PepsiCo Revenue Lifted by Healthier Products, But Forex Impacts Linger -- 2nd Update

February 15 2017 - 9:33AM

Dow Jones News

By Jennifer Maloney and Austen Hufford

PepsiCo Inc. said its push into healthier foods and drinks

helped lift revenue at a time that global demand for traditional

sodas has slowed.

Chief Executive Indra Nooyi said the maker of Frito Lay snacks,

Gatorade and its namesake cola expects global economic challenges

to continue this year but "we are making considerable progress" in

diversifying the company's portfolio.

Products that the company calls "guilt-free" accounted for 45%

of net revenue in 2016. Those products include diet sodas as well

as snacks with low levels of sodium and saturated fat. The

company's namesake cola accounted for 12% of net revenue in

2016.

PepsiCo's beverage volumes increased 1% during the fourth

quarter, beating rival Coca-Cola Co., whose volumes world-wide fell

1% in the same period.

Hugh Johnston, the company's finance chief, said in an interview

that to drive more growth "we're going to continue doing what we've

been doing, which is we'll want to innovate, particularly in the

area of lower sugar. We'll continue to invest behind interesting

brands."

Mr. Johnston pointed to the company's recent launch of premium

bottled-water brand LIFEWTR, intended to compete with Coke's

fast-growing smartwater brand. Mr. Johnston said research and

development spending was up about 45% since 2011 and advertising

and marketing was up 1.6% over the same period.

On an organic basis -- which takes out currency fluctuations,

acquisitions and an extra week of sales due to timing -- revenue

rose 3.7% in the quarter. Volumes rose across the company's units

but the strong dollar hurt foreign results and caused the price

paid for raw goods abroad to be higher. The Purchase, N.Y., company

generates a large chunk of its sales abroad with everyday staples

like soda, potato chips and juice.

Despite the currency headwinds, the company posted organic

growth of 9% in Latin America with a 4% increase in snack volumes

offsetting a 3% decline in beverage volumes. The company posted 5%

organic growth each in its Europe-Sub Saharan Africa unit and its

Asia, Middle East and North Africa division.

In North America, its Frito-Lay group posted 3% organic growth

as its Beverages unit posted 2% growth. Quaker Foods was flat.

In all, Snack organic volumes rose 3% as beverage volumes

increased 1%.

PepsiCo said it expects 2017 earnings per share to be $5.09 with

organic revenue growth of at least 3%. Analysts polled by Thomson

Reuters had expected earnings per share of $5.16 for the year.

In all for its fourth quarter, profit fell to $1.4 billion, or

97 cents a share, from $1.72 billion, or $1.17 a share, a year

earlier due to interest expenses and a income-tax provision. On an

adjusted basis, earnings per share were $1.20, or 4 cents above

analyst expectations.

Revenue rose 5% to $19.52 billion. Analysts had been looking for

$19.51 billion.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 15, 2017 09:18 ET (14:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

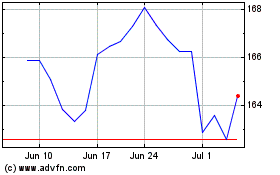

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Aug 2024 to Sep 2024

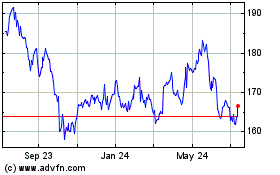

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Sep 2023 to Sep 2024