TIDMOEX

RNS Number : 5130M

Oilex Ltd

31 July 2017

oilex ltd

JUNE 2017 QUARTERLY REPORT

HIGHLIGHTS

CAMBAY FIELD, ONSHORE GUJARAT, INDIA

>> During the quarter, the Joint Venture partner, GSPC,

paid the equivalent of US$1.43 million (gross) against outstanding

cash calls.

>> EP-IV core analysis and modelling of optimal drilling

and stimulation parameters is underway by Schlumberger and Baker

Hughes - results anticipated shortly.

>> During the quarter, gas production re-started from the C-77H well at the Cambay Field.

>> Preparation of the application for an extension of the

PSC is in its final stage. The application is required to be lodged

by late September 2017 ahead of PSC expiry date of September

2019.

>> The field programme involving the workover of wells

C-70 and C-23z was completed in June 2017 and did not return

commercial volumes of oil and or gas.

BHANDUT FIELD, ONSHORE GUJARAT, INDIA

>> During the quarter, the Joint Venture partner, GSPC,

paid the equivalent of US$109,000 (gross) against outstanding cash

calls.

>> Preparation of the application for an extension of the

PSC is in final stages. The application is required to be lodged by

September 2017.

>> In May 2017 gas production re-started at Bhandut-3

however the well was shut-in following increased water

production.

>> Potential opportunities for sale of the PSC continue to be explored.

CORPORATE

>> Shareholders approved Tranche 2 of the capital raising,

announced in March 2017, at a General Meeting held on 3 May

2017.

>> Mr Paul Haywood appointed as Non-Executive Director.

>> Cash resources at 30 June 2017 were $3.2 million.

>> Actively reviewing new opportunities to create value by

expanding the Company's project portfolio.

OPERATIONS REVIEW

OVERVIEW

The Company's primary objective is to maximise shareholder value

from its principal asset in the Cambay Basin, located onshore

Gujarat State in India, whilst also continuing to review other

opportunities to create value by adding new assets to the Company's

portfolio.

To that end, Oilex continues to evaluate and implement a range

of technical programme options to progress the main objective of

accessing the significant gas resource present in siltstones in the

EP-IV reservoir. North American unconventional drilling, completion

and stimulation technologies have been applied by the Joint Venture

over the last six years with positive but commercially modest

results and work is underway to optimise results for future work

programmes. The current technical work programmes are focused

on:

-- Extracting geological and engineering information from core

data analysis with associated studies to match advanced North

American drilling and completion technologies with the local basin

geology of the EP-IV;

-- The preparation of the application for an extension of the

Cambay PSC (incorporating a proposed Field Development Program).

The application for an extension of the PSC term beyond September

2019 is required to be lodged by September 2017; and

-- Resolution of outstanding cash calls payable by the Company's Joint Venture partner GSPC.

HEALTH, SAFETY, SECURITY AND ENVIRONMENT

No lost time incidents recorded during the quarter.

CAMBAY FIELD, GUJARAT, INDIA

(Oilex: Operator and 45% interest)

During the quarter gas production re-started from the C-77H well

at the Cambay Field. Production from the C-77H well averaged 209

mscfd with 13.8 bpd associated liquids (49.8 boepd; Oilex net 22.4

boepd) during the quarter. The current gas sales agreements were

renegotiated to take any additional produced volumes as and when

required. The Company plans to cycle production between C-77 and

C-73 as part of its reservoir management.

The preparation of the Field Development Plan, in support of the

application for an extension of the PSC, is in its final stages.

The application for an extension of the PSC term beyond September

2019 is required to be lodged by September 2017.

During the March 2017 quarter, historical core samples from

C-23z were provided to Schlumberger for detailed analysis and

testing with completion of the work and delivery of results

anticipated shortly. Baker Hughes is currently completing an

initial desk study on EP-IV wells in the PSC in advance of

undertaking evaluation work on the geomechanical model and to

provide direction on the optimal stimulation methodologies for

future drilling and testing. The results of the evaluation work by

Baker Hughes are anticipated in August.

The Company has a significant gas resource at the Cambay PSC in

the EP-IV tight siltstones that requires drilling optimisation and

stimulation technologies to achieve commercial flow rates. The

analysis of the core from C-23z is essential in the planning and

design of future wells and the stimulation process at the Cambay

PSC. Both Schlumberger and Baker Hughes are global leaders in the

stimulation of tight gas reservoirs.

The recent field programme involving the workover of two older

wells C-70 and C-23z to test potential production flow rates from

the OS-II reservoir was completed in June. The results of these

wells did not return commercial volumes of oil and or gas. The

Company is considering whether further stimulation is warranted.

The workovers targeted potential production from the OS-II

reservoir whilst the Company's primary objective remains the

development of the potential of the EP-IV reservoir.

The Company is currently in discussions with several potential

partners who are undertaking data room reviews of the EP-IV tight

gas potential at Cambay. Should any change in the structure of the

joint venture eventuate, a restructure of the Company's ongoing

funding commitment to the Cambay Project may ensue.

In December 2016, Oilex participated in a formal tender process

initiated by Gujarat State Petroleum Corporation Limited (GSPC),

its Joint Venture partner, by submitting a conditional offer for a

possible additional 55% interest in the Cambay PSC (Cambay). The

Company has received informal advice that the sale process is

unlikely to proceed in the near term.

Joint Venture Management

During the quarter the Company made material progress in the

resolution of the outstanding cash calls owing to the Cambay Joint

Venture by GSPC. The Cambay joint venture have received the

equivalent of US$1.4 million in regards to outstanding cash calls

from its joint venture partner.

As at 30 June 2017, gross unpaid cash calls issued to GSPC

totalled approximately US$5.5 million. The Company continues to

maintain a constructive dialogue with its joint venture partner to

resolve the remaining outstanding cash call balances. Oilex as

Operator, has continued to bear the ongoing costs of the Joint

Venture. It is anticipated that GSPC will commence regular

contributions to ongoing operating cash calls going forward.

BHANDUT FIELD, GUJARAT, INDIA

(Oilex: Operator and 40% interest)

Oilex holds a 40% equity in the Bhandut Field, with GSPC holding

the remaining participating interest. Previous drilling in the

Bhandut Field intersected a number of hydrocarbon zones, some of

which have been produced and are now shut-in.

During the June 2017 quarter production recommenced from the

Bhandut Field having previously ceased on 6 October 2016.

Production from the Bhandut-3 well averaged 148 mscfd (25.2 boepd;

Oilex net 10.2 boepd) during the quarter. In June 2017, the

Bhandut-3 well was shut-in following increased water

production.

The preparation of the Field Development Plan, in support of the

application for an extension of the PSC, is underway. The

application for an extension of the PSC term beyond September 2019

is required to be lodged by late September 2017.

The field has ongoing production and exploration potential,

coupled with existing production facilities. The Company is

currently in discussion with several parties, seeking expressions

of interest in a possible sale of its participating interest in the

PSC.

During the quarter Oilex received gross US$109,000 from GSPC

against outstanding cash calls for Bhandut.

At the end of the quarter, total unpaid cash calls by GSPC had

been reduced to US$63,000 (gross).

Sabarmati FIELD, GUJARAT, INDIA

(Relinquished)

During the current quarter, Oilex received gross US$23,000 owing

by the Joint Venture partner, GSPC.

The Sabarmati PSC was relinquished in 2016.

WALLAL GRABEN, WESTERN AUSTRALIA (CANNING BASIN)

(Oilex: Operator and 100% interest)

The Wallal Graben asset is located adjacent to the Pilbara, a

global resource centre for iron ore and LNG in Western

Australia.

The Wallal Graben blocks are currently under application with

the Department of Mines and Petroleum (DMP). They are frontier

exploration blocks that represent a potential low cost entry to an

underexplored area.

Final award of the blocks requires signing of Heritage

Agreements with the Nyangumarta and Njamal People and is linked to

a request to the DMP that all three blocks be awarded

simultaneously. Consultations on the Heritage Agreements are nearly

complete following which it is anticipated that the DMP will make

an offer to grant a Petroleum Exploration Permit for each of the

three blocks to Oilex for its final acceptance. Oilex can review

its interest in pursuing these applications at any time.

JPDA 06-103, TIMOR SEA

(Oilex: Operator and 10% interest)

Oilex as operator, and on behalf of the JPDA 06-103 Joint

Venture participants, continues to seek a resolution to the dispute

with Autoridade Nacional do Petroleo e Minerais (ANPM) in relation

to matters associated with the termination of JPDA 06-103 PSC. In

July 2015, the ANPM rejected the Joint Venture request to terminate

the PSC by mutual agreement in good standing and without penalty,

and the ANPM sought to impose a penalty of approximately US$17

million upon the Joint Venture. The Joint Venture undertook

significantly more exploration expenditure than required during the

PSC term and believes the excess was not properly accounted for in

accordance with the terms of the PSC.

The Joint Venture continues its discussions with the ANPM and

remains hopeful an amicable settlement will be reached. If the

parties are unable to reach an amicable settlement, any party may

refer the matter to arbitration. If this occurs, the obligations

and liabilities of the Joint Venture participants under the PSC are

joint and several, with parent company guarantees provided by all

Joint Venture participants. Oilex has a 10% participating interest

in the Joint Venture.

WEST KAMPAR PSC, CENTRAL SUMATRA, INDONESIA

(Oilex: 45% interest and further 22.5% secured (1) )

At the end of 2016 the Indonesian Operator applied to the

Indonesian courts for a debt payment obligation suspension. This

was denied and the operating company, PT Sumatera Persada Energi

(SPE) was declared bankrupt. A number of creditors meetings were

held during the quarter. Oilex has instructed its Indonesian based

lawyers to pursue its claim in the courts covering refund of monies

provided by Oilex to the Operator, accrued interest, arbitration

and legal costs and loss of profits.

During the March 2017 quarter, Oilex received confirmation from

the Indonesian Government regulator, SKK Migas that Oilex continues

to retain a 45% participating interest in the PSC. In the absence

of a commercial settlement, the Company intends to preserve its

rights. Oilex continues to pursue enforcement of the Arbitration

Award and a commercial settlement.

CORPORATE

At the end of the quarter Oilex retained cash resources of $3.2

million.

New Non-Executive Director Appointed

During the quarter the Company appointed Mr Paul Haywood as a

Non-Executive Director. Mr Haywood has a wealth of experience in

capital markets, investment advisory, corporate affairs and the

operational management of early stage and growth companies

including six years in the Middle East. More recently, Mr Haywood

has held senior management positions with UK and Australian public

companies in the natural resource and energy sectors, with

International experience in the UK, Middle East and Eurasia. Mr

Haywood is currently Executive Director of Block Energy Plc and

resource focussed advisory firm, Plutus Strategies Ltd and resides

in the United Kingdom.

General Meeting of Shareholders

On 3 May 2017, the Company held a General Meeting of

Shareholders. All resolutions put to Shareholders, including the

approval of the issue of the shares and options pursuant to the

March 2017 Placement, were passed by a show of hands.

Placement to Fund Cambay Work Programme

On 16 March 2017, the Company agreed to a capital raising

(Placement) to secure funding of approximately GBP1.1 million

(A$1.78 million) to support its 2017 work programme and working

capital requirements. The Placement, part of which required

shareholder approval, secured approximately GBP1.1 million before

expenses through the issue of 488,888,888 new fully paid ordinary

shares at an average price of 0.225 pence (A$0.0036) per share and

190,353,386 options in the issued capital of the Company.

The Placement was in two tranches with the issue of the first

tranche of 298,353,502 shares issued for GBP0.67 million

(approximately A$1.07 million) completed during the March 2017

quarter. Following shareholder approval, on 10 May 2017 the Company

issued the second tranche of 190,535,386 shares for GBP0.43 million

(approximately A$0.76 million).

On 22 May 2017, pursuant to the second tranche, the Company also

issued 190,535,386 unlisted options exercisable at 0.35 pence

(A$0.0062) per share on or before 22 November 2017. In addition,

pursuant to the capital raising mandate with Cornhill Capital

Limited, the Company issued 88,888,888 unlisted options exercisable

at 0.225 pence (A$0.0040) per share exercisable within 3 years of

grant.

Capital Structure as

at 30 June 2017

Ordinary Shares 1,684,302,899

Unlisted Options 286,974,273

Qualified Petroleum Reserves and Resources Evaluator

Statement

Pursuant to the requirements of Chapter 5 of the ASX Listing

Rules, the information in this report relating to petroleum

reserves and resources is based on and fairly represents

information and supporting documentation prepared by or under the

supervision of Mr Jonathan Salomon, Managing Director employed by

Oilex Ltd. Mr Salomon has over 30 years' experience in petroleum

geology and is a member of the Society of Petroleum Engineers and

AAPG. Mr Salomon meets the requirements of a qualified petroleum

reserve and resource evaluator under Chapter 5 of the ASX Listing

Rules and consents to the inclusion of this information in this

report in the form and context in which it appears. Mr Salomon also

meets the requirements of a qualified person under the AIM Note for

Mining, Oil and Gas Companies and consents to the inclusion of this

information in this report in the form and context in which it

appears.

Board of Directors

Brad Lingo Non-Executive Chairman

Max Cozijn Non-Executive Director

Paul Haywood Non-Executive Director

Joe Salomon Managing Director

Company Secretary

Mark Bolton CFO & Company Secretary

Stock Exchange

Listing

Australian Securities Code: OEX

Exchange

AIM London Stock Code: OEX

Exchange

AIM Nomad AIM Broker

Strand Hanson Limited Cornhill Capital Limited

Share Registry

Australia United Kingdom

Link Market Services Limited Computershare Investor

Level 12 Services PLC

250 St. Georges Terrace The Pavilions

Perth WA 6000 Australia Bridgwater Road

Telephone: 1300 554 474 Bristol BS13 8AE United

Website: Kingdom

http://investorcentre.linkmarketservices.com.au Telephone: +44 (0) 870

703 6149

Website:

www.computershare.com

PERMIT SCHEDULE

PERMIT SCHEDULE - 30 JUNE 2017

----------------------------------------------------------------------------

ASSET LOCATION ENTITY EQUITY OPERATOR

%

--------------- ------------------ -------------- -------- -------------

Cambay Field Gujarat, Oilex Ltd 30.0 Oilex Ltd

PSC India

--------------- ------------------ -------------

Oilex N.L.

Holdings

(India)

Limited 15.0

------------------------------------------------- -------- -------------

Bhandut Gujarat, Oilex N.L. 40.0 Oilex N.L.

Field PSC India Holdings Holdings

(India) (India)

Limited Limited

--------------- ------------------ -------------- -------- -------------

West Kampar Sumatra, Oilex (West 67.5 PT Sumatera

PSC Indonesia Kampar) (1) Persada

Limited Energi

--------------- ------------------ -------------- -------- -------------

JPDA 06-103 Joint Petroleum Oilex (JPDA 10.0 Oilex (JPDA

PSC (2) Development 06-103) 06-103)

Area Ltd Ltd

Timor Leste

and Australia

--------------- ------------------ -------------- -------- -------------

STP-EPA-0131 Western Admiral 100.0 Admiral

Australia Oil Pty Oil Pty

Ltd (3) Ltd (3)

--------------- ------------------ -------------- -------- -------------

STP-EPA-0106 Western Admiral 100.0 Admiral

Australia Oil and (4) Oil and

Gas (106) Gas (106)

Pty Ltd Pty Ltd

(3) (3)

--------------- ------------------ -------------- -------- -------------

STP-EPA-0107 Western Admiral 100.0 Admiral

Australia Oil and (4) Oil and

Gas (107) Gas (107)

Pty Ltd Pty Ltd

(3) (3)

--------------- ------------------ -------------- -------- -------------

(1) Oilex (West Kampar) Limited is entitled to have assigned an

additional 22.5% to its holding through the exercise of its rights

under a Power of Attorney granted by PT Sumatera Persada Energi

(SPE) following the failure of SPE to repay funds due. The

assignment request has been provided to BPMigas (now SKK Migas) but

has not yet been approved or rejected. If Oilex is paid the funds

due it will not be entitled to pursue this assignment.

(2) PSC terminated 15 July 2015

(3) Ultimate parent entity is Oilex Ltd.

(4) Current status is a Preferred Applicant

LIST OF ABBREVIATIONS AND DEFINITIONS

Barrel/bbl Standard unit of measurement for all

oil and condensate production. One barrel

is equal to 159 litres or 35 imperial

gallons.

------------- ------------------------------------------------

MMBO Million standard barrels of oil or condensate

------------- ------------------------------------------------

SCFD Standard cubic feet (of gas) per day

------------- ------------------------------------------------

MSCFD Thousand standard cubic feet (of gas)

per day

------------- ------------------------------------------------

MMSCFD Million standard cubic feet (of gas)

per day

------------- ------------------------------------------------

BBO Billion standard barrels of oil or condensate

------------- ------------------------------------------------

BCF Billion Cubic Feet of gas at standard

temperature and pressure conditions

------------- ------------------------------------------------

TCF Trillion Cubic Feet of gas at standard

temperature and pressure conditions

------------- ------------------------------------------------

Discovered Is that quantity of petroleum that is

in place estimated, as of a given date, to be

volume contained in known accumulations prior

to production

------------- ------------------------------------------------

Undiscovered Is that quantity of petroleum estimated,

in place as of a given date, to be contained

volume within accumulations yet to be discovered

------------- ------------------------------------------------

PSC Production Sharing Contract

------------- ------------------------------------------------

Prospective Those quantities of petroleum which

Resources are estimated, as of a given date, to

be potentially recoverable from undiscovered

accumulations.

------------- ------------------------------------------------

Contingent Those quantities of petroleum estimated,

Resources as of a given date, to be potentially

recoverable from known accumulations

by application of development projects,

but which are not currently considered

to be commercially recoverable due to

one or more contingencies.

Contingent Resources may include, for

example, projects for which there are

currently no viable markets, or where

commercial recovery is dependent on

technology under development, or where

evaluation of the accumulation is insufficient

to clearly assess commerciality. Contingent

Resources are further categorized in

accordance with the level of certainty

associated with the estimates and may

be sub-classified based on project maturity

and/or characterised by their economic

status.

------------- ------------------------------------------------

Reserves Reserves are those quantities of petroleum

anticipated to be commercially recoverable

by application of development projects

to known accumulations from a given

date forward under defined conditions.

Proved Reserves are those quantities

of petroleum, which by analysis of geoscience

and engineering data, can be estimated

with reasonable certainty to be commercially

recoverable, from a given date forward,

from known reservoirs and under defined

economic conditions, operating methods

and government regulations.

Probable Reserves are those additional

Reserves which analysis of geoscience

and engineering data indicate are less

likely to be recovered than Proved Reserves

but more certain to be recovered than

Possible Reserves.

Possible Reserves are those additional

reserves which analysis of geoscience

and engineering data indicate are less

likely to be recoverable than Probable

Reserves.

Reserves are designated as 1P (Proved),

2P (Proved plus Probable) and 3P (Proved

plus Probable plus Possible).

Probabilistic methods

P90 refers to the quantity for which

it is estimated there is at least a

90% probability the actual quantity

recovered will equal or exceed. P50

refers to the quantity for which it

is estimated there is at least a 50%

probability the actual quantity recovered

will equal or exceed. P10 refers to

the quantity for which it is estimated

there is at least a 10% probability

the actual quantity recovered will equal

or exceed.

------------- ------------------------------------------------

Rule 5.5

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

------------------------------------------

OILEX LTD

------------------------------------------

ABN Quarter ended (current

quarter)

--------------- -----------------------

50 078 652 632 30 JUNE 2017

--------------- -----------------------

Consolidated statement Current quarter Year to date

of cash flows $A'000 (12 months)

$A'000

----------------------------------- ---------------- -------------

1. Cash flows from operating

activities

1.1 Receipts from customers 26 131

1.2 Payments for

(a) exploration & evaluation (242) (1,113)

(b) development - (2)

(c) production (336) (666)

(d) staff costs (262) (1,185)

(e) administration

and corporate costs (321) (1,604)

1.3 Dividends received

(see note 3) - -

1.4 Interest received 2 56

1.5 Interest and other

costs of finance paid - -

1.6 Income taxes paid - -

1.7 Research and development

refunds - -

1.8 Other (provide details

if material)

Litigation legal fees - (726)

Recovery of prior year

outstanding cash calls 1,856 1,856

Recovery of prior year

Indian tax refunds - 348

Redundancy and entitlement

costs - (464)

Net cash from / (used

1.9 in) operating activities 723 (3,369)

---- ----------------------------- ---------------- -------------

Consolidated statement Current quarter Year to date

of cash flows $A'000 (12 months)

$A'000

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) property, plant

and equipment - (24)

(b) tenements (see - -

item 10)

(c) investments - -

(d) other non-current - -

assets

2.2 Proceeds from the disposal

of:

(a) property, plant

and equipment - -

(b) tenements (see - -

item 10)

(c) investments - -

(d) other non-current - -

assets

2.3 Cash flows from loans - -

to other entities

2.4 Dividends received - -

(see note 3)

2.5 Other (provide details - -

if material)

----- --------------------------- ---------------- -------------

Net cash from / (used

2.6 in) investing activities - (24)

----- --------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues

3.1 of shares 762 1,836

3.2 Proceeds from issue - -

of convertible notes

3.3 Proceeds from exercise - -

of share options

Transaction costs related

to issues of shares,

convertible notes or

3.4 options (108) (250)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related

to loans and borrowings - -

3.8 Dividends paid - -

3.9 Other (provide details - -

if material)

----- --------------------------- ---------------- -------------

Net cash from / (used

3.10 in) financing activities 654 1,586

----- --------------------------- ---------------- -------------

Consolidated statement Current quarter Year to date

of cash flows $A'000 (12 months)

$A'000

4. Net increase / (decrease)

in cash and cash equivalents

for the period

---- ------------------------------ ---------------- -------------

Cash and cash equivalents

4.1 at beginning of period 1,834 5,158

Net cash from / (used

in) operating activities

4.2 (item 1.9 above) 723 (3,369)

Net cash from / (used

in) investing activities

4.3 (item 2.6 above) - (24)

Net cash from / (used

in) financing activities

4.4 (item 3.10 above) 654 1,586

Effect of movement

in exchange rates on

4.5 cash held 5 (135)

---- ------------------------------ ---------------- -------------

Cash and cash equivalents

4.6 at end of period 3,216 3,216

---- ------------------------------ ---------------- -------------

5. Reconciliation of cash

and cash equivalents

at the end of the

quarter (as shown in

the consolidated statement

of cash flows) to the Previous

related items in the Current quarter quarter

accounts $A'000 $A'000

---- ---------------------------- ---------------- ---------

5.1 Bank balances 3,216 1,834

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---- ---------------------------- ---------------- ---------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 3,216 1,834

---- ---------------------------- ---------------- ---------

Payments to directors of the entity Current quarter

6. and their associates $A'000

----------------

Aggregate amount of payments to

these parties included in item

6.1 1.2 103

----------------

6.2 Aggregate amount of cash flow

from loans to these parties included

in item 2.3 -

----------------

6.3 Include below any explanation necessary

to understand the transactions included

in items 6.1 and 6.2

---- --------------------------------------------------------

Payments to related entities of Current quarter

7. the entity and their associates $A'000

----------------

7.1 Aggregate amount of payments to

these parties included in item

1.2 -

----------------

7.2 Aggregate amount of cash flow

from loans to these parties included

in item 2.3 -

----------------

7.3 Include below any explanation necessary

to understand the transactions included

in items 7.1 and 7.2

---- --------------------------------------------------------

8. Financing facilities Total facility Amount drawn

available amount at at quarter

Add notes as necessary quarter end end

for an understanding $A'000 $A'000

of the position

--------------- -------------

8.1 Loan facilities - -

--------------- -------------

8.2 Credit standby arrangements - -

--------------- -------------

8.3 Other (please specify) - -

--------------- -------------

8.4 Include below a description of each facility

above, including the lender, interest rate

and whether it is secured or unsecured.

If any additional facilities have been entered

into or are proposed to be entered into

after quarter end, include details of those

facilities as well.

---- ------------------------------------------------------------

9. Estimated cash outflows $A'000

for next quarter

---- ------------------------------ -------

9.1 Exploration and evaluation 300

9.2 Development -

9.3 Production 191

9.4 Staff costs 314

Administration and corporate

9.5 costs 350

Other (provide details if

9.6 material) 265

---- ------------------------------ -------

9.7 Total estimated cash outflows 1,420

---- ------------------------------ -------

10. Changes in

tenements

(items 2.1(b) Tenement Interest Interest

and 2.2(b) reference at beginning at end

above) and location Nature of interest of quarter of quarter

----- ---------------------- -------------- ------------------- -------------- ------------

10.1 Interests Refer to Permit

in mining Schedule in

tenements Quarterly Report

and petroleum

tenements

lapsed, relinquished

or reduced

----- ---------------------- -------------- ------------------- -------------- ------------

10.2 Interests Refer to Permit

in mining Schedule in

tenements Quarterly Report

and petroleum

tenements

acquired

or increased

----- ---------------------- -------------- ------------------- -------------- ------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here: Date: 31 July 2017

CFO & Company Secretary

Print name: Mark Bolton

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCWGUCAMUPMUCG

(END) Dow Jones Newswires

July 31, 2017 02:00 ET (06:00 GMT)

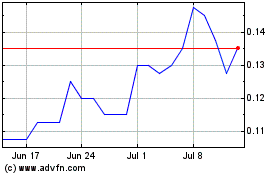

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Apr 2023 to Apr 2024