TIDMOEX

RNS Number : 5830E

Oilex Ltd

11 February 2015

OILEX LTD

ABN 50078652632

CONDENSED CONSOLIDATED INTERIM FINANCIAL REPORT

For the half-year ended 31 December 2014

CONTENTS

Directors' Report

Auditor's Independence Declaration

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

Condensed Consolidated Statement of Financial Position

Condensed Consolidated Statement of Changes in Equity

Condensed Consolidated Statement of Cash Flows

Notes to the Condensed Consolidated Interim Financial Report

Directors' Declaration

Independent Review Report

DIRECTORS REPORT

The Directors of Oilex Ltd present their report together with

the condensed consolidated interim financial report of the Group

comprising of Oilex Ltd (the "Company") and its subsidiaries for

the half-year ended 31 December 2014 and the auditor's review

report thereon.

Directors

The directors of the Company at any time during the interim

period and until the date of this report are detailed below. All

directors were in office for this entire period unless otherwise

stated.

Mr Max Dirk Jan Cozijn Non-Executive Chairman

Mr Sundeep Bhandari Non-Executive Vice Chairman

Mr Jeffrey Auld Non-Executive Director (Appointed 28 January 2015)

Mr Ronald Miller Managing Director

Dr Bruce Henry McCarthy Non-Executive Director (Resigned 18 November 2014)

Review of Operations

Oilex is continuing its transition to an early mover

unconventional energy producer, focusing on assets around the

Indian Ocean Rim. The Company is evaluating and commercialising the

extensive Eocene low permeability ("tight") reservoirs in its

onshore Cambay Field project located in the state of Gujarat,

India, where energy market fundamentals are attractive. Oilex is

applying tight reservoir evaluation, drilling and production

techniques which have been developed in recent years in the rapidly

expanding shale gas and tight oil ("SGTO") industry in North

America. Oilex also has a large acreage position in the onshore

Canning Basin, Western Australia, which is anticipated to be

prospective for conventional and SGTO resources. The interest in

the exploration asset offshore Timor Sea is currently under

temporary suspension of the PSC for a further 3 month period to

April 2015 to enable the completion of the ANP legal assessment and

continued discussion between the parties to address the way

forward. Oilex is pursuing enforcement of the Arbitration Award

with respect to its interest in the West Kampar PSC, onshore

Sumatra, Indonesia.

Cambay Field

Significant progress was achieved during the period on the

Cambay Field development. The Company successfully completed the

Cambay-77H production test. The test was focused on acquiring long

term performance data which is essential for assessment of

reservoir properties and will supplement surface data collected

during flowback. A 5 day shut-in period preceded the test to allow

the well to stabilise after 85 days of flowback production.

Cambay-77H produced 3,372 bbls (net to Oilex 1,517 bbls) of light

oil which was sold to a local refinery and 43 MMscf of gas which

was flared for the safety of personnel and equipment at site.

Delivering the Proof of Concept

Proof of Concept objectives are critical to demonstrating that

the Cambay Field can be commercially developed using multi-stage

fracture treatments (fracs) in horizontal wells. Key objectives

achieved include:

-- Efficient drilling operations demonstrating the repeatability of targeting the Y zone

-- Y zone reservoir properties are laterally consistent, having

variability within expectations

-- Successful completion of 8 fracture treatments

-- Successfully demonstrated "Plug and Perf" completion technique in India

-- First horizontal well in the Cambay Basin with multiple

fracture treatments to achieve flowback

-- Flowback data used to calibrate horizontal well model for the first time

-- Future well designs may have wider frac spacing, leading to significant cost savings

Gas sales agreements

Oilex has concluded two gas sale agreements ("GSA") to date.

GSAs are conducted via a bid system, with buyers submitting offers

to purchase via a tender process. Given the demand for gas by

nearby industrial users, strong pricing is secured, above the floor

price recently established by the Indian Government.

During the period Oilex received the endorsement from the

relevant Government of India authorities for the Gas Sales

Agreement for the sale of Cambay-73 gas, a critical milestone for

increasing production from the field and supplying gas to the local

market. With Cambay-73, gas production from the Cambay Field will

recommence for the first time since the early 1990's.

Bhandut Field

During the period Oilex received endorsement from the Government

of India for the sale of gas from the Bhandut-3 well, located

within the Bhandut Field. This is a critical milestone for

returning the field to production, supplying gas to the local

market and generating positive cash flow for the Company from a

previously idle asset.

Now that endorsement of the gas sales agreement has been

received, the Bhandut Joint Venture will proceed to establish the

appropriate production facilities for Bhandut-3. This will include

a compressed natural gas ("CNG") loading facility that will enable

CNG "bullet" trucks to be loaded at site for transportation of the

gas to end users. Bhandut-3 gas is "lean" and therefore no material

condensate production is expected.

Sabarmati Field

During the period the Joint Venture finalised cost estimates for

the plug and abandonment of the Sabarmati-1 well and commenced the

process to obtain Government of India approval to relinquish the

Sabarmati Field. Plug and abandonment activities are expected to be

completed during the remainder of Q1 2015. As part of the

relinquishment of the Sabarmati Field, Oilex plans to transfer

equipment from Sabarmati EPS facility for possible future use at

Cambay Field.

Canning Basin

During the period the WA Department of Mines and Petroleum (DMP)

approved Oilex's application to convert the Special Prospecting

Authority (SPA) (SPA 17 AO) to Exploration Permit Application

(STP-EPA-0131).

The committed work program for SPA 17 AO was fulfilled by the

acquisition, processing and interpretation of a 4,060 line km

gravity gradiometry/magnetic survey ("Survey"). Under the terms of

the SPA, Oilex had exclusive rights to negotiate a formal

exploration permit with the Government of Western Australia. The

terms of the SPA state that the area retained as an exploration

permit from within the SPA is limited to 30-50% of the total

area.

The final report for SPA 17 AO incorporating the newly acquired

Survey data with 2D seismic, regional gravity, magnetic, surface

geological and well data, confirmed Oilex's structural model of the

Wallal Graben and its extension into SPA 17 AO.

The graben is present in Oilex's three, 100%-owned, exploration

areas encompassing approximately 11,900 km2 (3 million acres). The

acreage is in a unique position in the Canning Basin as it is

adjacent to many world class mining projects in the Pilbara region.

This activity has led to the development of a significant amount of

infrastructure in the area with the Great Northern Highway,

numerous sealed roads, good quality graded roads and multiple

airstrips being present within the Oilex acreage.

Oilex continues to negotiate Native Title agreements with

Traditional Owners. Upon finalisation of the agreements the

regulatory process of conversion of STP-EPA-0106 and STP-EPA-0107

to formal exploration permits will commence.

Financial

The Group incurred a consolidated loss after income tax of

$3,118,088 for the half-year (31 December 2013: loss of

$2,776,134). Revenue for the period has increased due to increased

production from the Cambay Field. The loss includes $1,040,131 (31

December 2013: $1,058,838) incurred on exploration expenditure and

$1,718,780 (31 December 2013: $1,637,860) incurred on employee and

administrative expenditure. The Company's focus on reducing costs,

which do not impact its technical and commercial capabilities, is

continuing. Cash and cash equivalents held by the Group as at 31

December 2014 totalled $5,426,328 (30 June 2014: cash and cash

equivalents $7,455,572).

Significant Events After Balance Date

Oilex received approval from the Government of India for the

grant of an extension of the Petroleum Mining Lease for the Cambay

Field to 22 September 2019.

The receipt of endorsement from the relevant authorities of the

Government of India for the sale of gas from Cambay Field,

specifically from the Cambay-77H well.

The Autoridade Nacional do Petroleo ("ANP") with prior consent

of the Joint Commission for the Joint Petroleum Development Area

under the Timor Sea Treaty, advised on 16 January 2015 that it had

further extended the expiry date of the PSC from 15 January 2015 to

15 April 2015 for the purpose of completing an assessment and to

continue discussions with the Joint Venture partners.

Significant Events After Balance Date (Continued)

On 28 January 2015 Oilex announced the appointment of Mr Jeffrey

D Auld as a Non-Executive Director. The appointment of a UK based

independent non-executive director, with significant experience in

the London Capital markets and upstream oil and gas industry is in

line with the Company's decision to appoint additional directors to

achieve the right mix of skills, experience and diversity which

reflects the Company's strategy and increase the balance of

independence on the Board.

There are no other significant subsequent events occurring after

balance date.

Lead Auditor's Independence Declaration

The lead auditor's independence declaration is set out on page 4

and forms part of the Directors' Report for the half-year ended

31 December 2014.

Signed in accordance with a resolution of the Board of

Directors.

Mr Max Cozijn Mr Ronald Miller

Chairman Managing Director

Leederville

Western Australia

10 February 2015

KPMG

Lead Auditor's Independence Declaration under Section 307C of

the Corporations Act 2001

To: the directors of Oilex Ltd

I declare that, to the best of my knowledge and belief, in

relation to the review for the half-year ended 31 December 2014

there have been:

(i) no contraventions of the auditor independence requirements

as set out in the Corporations Act 2001 in relation to the review;

and

(ii) no contraventions of any applicable code of professional

conduct in relation to the review.

KPMG

Brent Steedman

Partner

Perth

10 February 2015

KPMG, an Australian partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG

International Cooperative ("KPMG International"), a Swiss

entity

Liability limited by a scheme approved under Professional

Standards Legislation

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

FOR THE HALF-YEAR ENDED 31 DECEMBER 2014

31 December 31 December

2014 2013

Note $ $

-------------- --------------

Revenue 6(a) 232,992 121,927

Cost of sales 6(b) (272,005) (197,596)

-------------- --------------

Gross loss (39,013) (75,669)

Other income 6(c) 6,573 336,514

Exploration expenditure (1,040,131) (1,058,838)

Administration expense 6(d) (1,718,780) (1,637,860)

Share-based payments expense (407,152) (289,549)

Other expenses 6(e) (35,625) (42,920)

-------------- --------------

Results from operating activities (3,234,128) (2,768,322)

-------------- --------------

Finance income 33,959 21,447

Finance costs (41) (5)

Foreign exchange gain/(loss) 6(f) 82,122 (19,254)

-------------- --------------

Net finance income 116,040 2,188

-------------- --------------

Loss before income tax (3,118,088) (2,766,134)

Tax expense - -

-------------- --------------

Loss for the period (3,118,088) (2,766,134)

-------------- --------------

Other comprehensive income/(loss)

Items that may be reclassified

subsequently to profit or loss

Foreign currency translation

difference 4,250,375 507,701

-------------- --------------

Other comprehensive (loss)/income

for the period, net of income

tax 4,250,375 507,701

-------------- --------------

Total comprehensive income/(loss)

for the period 1,132,287 (2,258,433)

-------------- --------------

Earnings per share

Basic loss per share (cents per

share) 0.48 0.66

Diluted loss per share (cents

per share) 0.48 0.66

The above Condensed Consolidated Statement of Profit or Loss and

Other Comprehensive Income is to be read in conjunction with the

accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

Note 31 December 30 June 2014

2014

$ $

-------------- --------------

Assets

Cash and cash equivalents 5,426,328 7,455,572

Trade and other receivables 5,987,480 3,684,488

Prepayments 576,259 733,654

Inventories 1,200,540 1,047,630

-------------- --------------

Total current assets 13,190,607 12,921,344

-------------- --------------

Trade and other receivables 92,887 80,585

Exploration and evaluation 7 33,841,997 26,320,952

Property, plant and equipment 265,414 254,741

Total non-current assets 34,200,298 26,656,278

-------------- --------------

Total assets 47,390,905 39,577,622

-------------- --------------

Liabilities

Trade and other payables 3,474,923 2,776,075

Employee benefits 442,422 386,198

Provisions 153,263 132,966

Total current liabilities 4,070,608 3,295,239

-------------- --------------

Provisions 3,375,128 2,928,141

Total non-current liabilities 3,375,128 2,928,141

-------------- --------------

Total liabilities 7,445,736 6,223,380

-------------- --------------

Net assets 39,945,169 33,354,242

-------------- --------------

Equity

Issued capital 9 154,154,028 149,250,072

Reserves 7,624,280 5,179,638

Accumulated losses (121,833,139) (121,075,468)

-------------- --------------

Total equity 39,945,169 33,354,242

-------------- --------------

The above Condensed Consolidated Statement of Financial Position

is to be read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED 31 DECEMBER 2014

Attributable to Owners of the Company

Foreign

Currency

Issued Option Translation Accumulated

Capital Reserve Reserve Losses Total Equity

$ $ $ $ $

------------ ------------ ------------- -------------- -------------

Balance at 1 July

2013 135,371,619 3,663,824 2,644,735 (117,416,789) 24,263,389

------------ ------------ ------------- -------------- -------------

Total Comprehensive

(loss)/income for

the period

Loss - - - (2,766,134) (2,766,134)

------------ ------------ ------------- -------------- -------------

Other comprehensive

income

Foreign currency

translation differences - - 507,701 - 507,701

------------ ------------

Total other comprehensive

income - - 507,701 - 507,701

------------ ------------ ------------- -------------- -------------

Total comprehensive

(loss)/ income

for the period - - 507,701 (2,766,134) (2,258,433)

------------ ------------ ------------- -------------- -------------

Transactions with owners

of the Company

Contributions and

distributions

Shares issued 3,394,957 - - - 3,394,957

Capital raising

costs (357,765) - - - (357,765)

Shares issued on

exercise of listed

options 120 - - - 120

Transfers on forfeited

options - (93,932) - 93,932 -

Share-based payment

transactions - 289,549 - - 289,549

------------ ------------ ------------- -------------- -------------

Total transactions

with owners of

the Company 3,037,312 195,617 - 93,932 3,326,861

------------ ------------ ------------- -------------- -------------

Balance at 31 December

2013 138,408,931 3,859,441 3,152,436 (120,088,991) 25,331,817

------------ ------------ ------------- -------------- -------------

Balance at 1 July

2014 149,250,072 4,089,004 1,090,634 (121,075,468) 33,354,242

------------ ------------ ------------- -------------- -------------

Total Comprehensive

(loss)/income for

the period

Loss - - - (3,118,088) (3,118,088)

------------ ------------ ------------- -------------- -------------

Other comprehensive

income

Foreign currency

translation differences - - 4,250,375 - 4,250,375

Total other comprehensive

income - - 4,250,375 - 4,250,375

------------ ------------ ------------- -------------- -------------

Total comprehensive

(loss)/ income

for the period - - 4,250,375 (3,118,088) 1,132,287

------------ ------------ ------------- -------------- -------------

Transactions with owners

of the Company

Contributions and

distributions

Shares issued 4,362,379 - - - 4,362,379

Capital raising

costs(1) (552,676) 147,532 - - (405,144)

Shares issued on

exercise of listed

options 1,094,253 - - - 1,094,253

Transfers on forfeited

options - (2,360,417) - 2,360,417 -

Share-based payment

transactions - 407,152 - - 407,152

------------ ------------ ------------- -------------- -------------

Total transactions

with owners of

the Company 4,903,956 (1,805,733) - 2,360,417 5,458,640

------------ ------------ ------------- -------------- -------------

Balance at 31 December

2014 154,154,028 2,283,271 5,341,009 (121,833,139) 39,945,169

------------ ------------ ------------- -------------- -------------

(1) Capital raising costs include unlisted options granted to

the underwriter and sub-underwriters.

The above Condensed Consolidated Statement of Changes in Equity

is to be read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2014

31 December 31 December

2014 2013

$ $

------------ ------------

Cash flows from operating activities

Cash receipts from customers 241,668 89,084

Payments to suppliers and employees (1,995,279) (1,745,293)

------------ ------------

Cash outflows from operations (1,753,611) (1,656,209)

Payments for exploration and evaluation

expenses (879,195) (1,827,686)

Cash receipts from government grants 358,517 198,148

Interest received 33,925 20,855

Interest paid (41) (5)

Net cash used in operating activities (2,240,405) (3,264,897)

------------ ------------

Cash flows from investing activities

Advances (to)/from joint ventures (25,202) 33,071

Advance from sale of petroleum interests

(refer Note 10) - 4,272,013

Payments for capitalised exploration and

evaluation (5,204,371) (565,611)

Proceeds from sale of assets 600 -

Acquisition of property, plant and equipment (30,900) (44,557)

------------ ------------

Net cash (used in)/from investing activities (5,259,873) 3,694,916

------------ ------------

Cash flows from financing activities

Proceeds from issue of share capital 5,725,960 3,395,077

Payment for share issue costs (323,261) (357,765)

Net cash from financing activities 5,402,699 3,037,312

------------ ------------

Net (decrease)/increase in cash held (2,097,579) 3,467,331

Cash and cash equivalents at 1 July 7,455,572 3,598,640

Effect of exchange rate fluctuations 68,335 118,776

------------ ------------

Cash and cash equivalents at 31 December 5,426,328 7,184,747

------------ ------------

The above Condensed Consolidated Statement of Cash Flows is to

be read in conjunction with the accompanying notes.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL REPORT

FOR THE HALF-YEAR ENDED 31 DECEMBER 2014

1. REPORTING ENTITY

Oilex Ltd (the "Company") is domiciled in Australia. The

condensed consolidated interim financial report of the Group as at

and for the half-year ended 31 December 2014 comprise the Company

and its subsidiaries (collectively the "Group" and individually

"Group Entities"). Oilex Ltd is a company limited by shares

incorporated in Australia whose shares are publicly traded on the

Australian Securities Exchange ("ASX") and on the Alternative

Investment Market ("AIM") of the London Stock Exchange. The Group

is a for-profit entity and is primarily involved in the

exploration, evaluation, development and production of

hydrocarbons.

The consolidated annual financial report of the Group as at and

for the year ended 30 June 2014 is available upon request from the

Company's registered office at Level One, 660 Newcastle Street,

Leederville, Western Australia 6007 or at www.oilex.com.au.

2. BASIS OF PREPARATION

(a) Statement of Compliance

The condensed consolidated interim financial report is a general

purpose condensed financial report which has been prepared in

accordance with Accounting Standard AASB 134 Interim Financial

Reporting and the Corporations Act 2001, and IAS 34 Interim

Financial Reporting. The condensed consolidated interim financial

report does not include all of the notes and information included

in an annual financial report and accordingly this report should be

read in conjunction with the consolidated annual financial report

of the Group as at and for the year ended 30 June 2014.

This condensed consolidated interim financial report was

authorised for issue by the Board of Directors on 10 February

2015.

(b) Going Concern

The Directors believe it is appropriate to prepare the

consolidated financial report on a going concern basis, which

contemplates realisation of assets and settlement of liabilities in

the normal course of business. The Group has incurred a loss of

$3,118,088, and had cash outflows from operating and investing

activities of $2,240,405 and $5,259,873 respectively. As at 31

December 2014, the Group's current assets exceeded current

liabilities by $9,119,999 and the Group had cash and cash

equivalents of $5,426,328.

The Company has in place a GBP7,500,000 three year equity

financing facility with a UK company, Darwin Strategic Limited

("Darwin"). Under the terms of the facility, the Company may (at

its discretion) issue placement shares to Darwin at any time until

December 2016. Any drawdown of the facility and resultant issue of

shares on the AIM of the London Stock Exchange is limited to the

Company's equity placement capacity under ASX Listing Rules.

GBP6,300,000 is available in financing as at 31 December 2014.

The Group will continue to manage its expenditure to ensure that

it has sufficient cash reserves for at least the next twelve

months. The Group will require funds within the next twelve months

in order to meet planned expenditures for its projects, noting that

the timing and amount of discretionary expenditures may be able to

be varied if required although some commitments exist in the medium

term as per note 14.

The Directors believe it is appropriate to prepare the

consolidated financial report on a going concern basis as, and in

the opinion of the Directors, the Company has adequate plans in

place to meet its minimum administrative, evaluation and

development expenditures for at least twelve months from the date

of this report. If further funds are not able to be raised or

realised, possible funding options available to the Group include

the sale of interests in the Group's assets, farm out opportunities

or a future capital raising, including but not limited to the

Darwin facility.

3. SIGNIFICANT ACCOUNTING POLICIES

Except as disclosed below, the accounting policies applied by

the Group in this condensed consolidated interim financial report

are the same as those applied by the Group in its consolidated

financial report as at and for the year ended 30 June 2014.

The Group has adopted the following new and revised accounting

standards that are mandatory for entities with an annual reporting

period beginning on 1 July 2014:

Offsetting Financial Assets and Financial Liabilities

(Amendments to AASB 132);

Recoverable Amount Disclosures for Non-Financial Assets

(Amendments to AASB 136);

Annual Improvements to Australian Accounting Standards 2010-2012

and 2011-2013 Cycles: and

IFRIC 21 Levies.

The adoption of these newly effective standards have no material

effect on the financial position or the consolidated financial

statements of the Group.

4. ESTIMATES AND JUDGEMENTS

The preparation of an interim financial report requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this condensed consolidated interim financial

report, the significant judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial report as at and for the year ended 30 June 2014.

5. OPERATING SEGMENTS

The Group has identified its operating segments based upon the

internal reports that are reviewed and used by the executive

management team (the chief operating decision makers) in assessing

performance and that are used to allocate the Group's resources.

There has been no change in the basis of segmentation from the

Group's 30 June 2014 annual consolidate financial report.

India Australia JPDA (1) Indonesia Corporate (2) Consolidated

Six months 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

ended 31

December

--------------- ----------- ----------- ---------- ---------- --------- -------- --------- --------- ------------ ------------ ------------ ------------

$ $ $ $ $ $ $ $ $ $ $ $

Revenue

Revenue - Oil

Sales 232,992 121,927 - - - - - - - - 232,992 121,927

--------------- ----------- ----------- ---------- ---------- --------- -------- --------- --------- ------------ ------------ ------------ ------------

Reportable

segment

profit/(loss)

before income

tax (733,220) (790,642) (398,316) (432,361) (40,141) 90,279 (25,399) (59,668) (2,037,052) (1,575,930) (3,234,128) (2,768,322)

--------------- ----------- ----------- ---------- ---------- --------- -------- --------- --------- ------------ ------------ ------------ ------------

Net finance

income 33,918 21,442

Foreign

exchange

gain/(loss) 82,122 (19,254)

Loss for the

period (3,118,088) (2,766,134)

------------ ------------

India Australia JPDA (1) Indonesia Corporate (2) Consolidated

31 Dec 30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 30 June

2014 2014 2014 2014 2014 2014 2014 2014 2014 2014 2014 2014

--------------- ----------- ----------- ---------- ---------- --------- -------- --------- --------- ------------ ------------ ------------ ------------

$ $ $ $ $ $ $ $ $ $ $ $

Segment assets 40,879,333 29,837,428 384,302 431,174 310,950 305,703 - - 5,816,320 9,003,317 47,390,905 39,577,622

Segment

liabilities 6,154,574 5,023,492 - 203,880 9,133 5,522 270,747 157,996 1,011,282 832,490 7,445,736 6,223,380

--------------- ----------- ----------- ---------- ---------- --------- -------- --------- --------- ------------ ------------ ------------ ------------

There were no significant inter-segment transactions during the

year.

(1) Joint Petroleum Development Area.

(2) Corporate represents a reconciliation of reportable segment

revenues, profit or loss and assets to the consolidated figure.

6. REVENUE AND EXPENSES

31 December 31 December

2013

2014 $

$

------------ ------------

(a) Revenue

Oil sales 232,992 121,927

------------ ------------

(b) Cost of Sales

Production costs (251,731) (211,134)

Movement in oil stocks inventory (20,274) 13,538

------------ ------------

(272,005) (197,596)

------------ ------------

(c) Other Income

Government Grants - research and development - 336,514

Insurance proceeds 6,573 -

------------ ------------

6,573 336,514

------------ ------------

(d) Administrative Expenses

Employee benefits expense (662,875) (489,886)

Administration expense (1,055,905) (1,147,974)

------------ ------------

(1,718,780) (1,637,860)

------------ ------------

(e) Other Expenses

Depreciation expense (33,500) (42,285)

Loss on disposal of assets (2,125) (635)

------------ ------------

(35,625) (42,920)

------------ ------------

(f) Foreign Exchange Gain/(Loss)

Foreign exchange gain/(loss) - realised 3,473 (28,446)

Foreign exchange gain - unrealised 78,649 9,192

------------ ------------

82,122 (19,254)

------------ ------------

7. EXPLORATION AND EVALUATION

31 December Year Ended

2014 30 June

2014

$ $

------------ -----------

Opening balance 26,320,952 22,553,085

Expenditure capitalised 3,188,884 4,521,508

Effect of movements in foreign exchange rates 4,332,161 (753,641)

------------ -----------

Closing balance 33,841,997 26,320,952

------------ -----------

Exploration and evaluation assets are reviewed at each reporting

date to determine whether there is any indication of impairment or

reversal of impairment. When a well does not result in the

successful discovery of potentially economically recoverable

reserves, or if sufficient data exists to indicate the carrying

amount of the exploration and evaluation asset is unlikely to be

recovered in full, either by development or sale, it is

impaired.

8. SHARE-BASED PAYMENTS

The Company has an established share option program that

entitles directors, key management personnel and advisors to

purchase shares in the Company. The terms and conditions of the

share option program are disclosed in the consolidated financial

report as at and for the year ended 30 June 2014. During the

half-year ended 31 December 2014 further grants on similar terms

were made to key management personnel, employees and financiers and

advisors. All options are to be settled by the physical delivery of

shares.

The basis of measuring fair value of options is consistent with

that disclosed in the consolidated financial report as at and for

the year ended 30 June 2014. The terms and conditions of the grants

made during the half-year ended 31 December 2014 are as

follows:

Option Grant Date Number of Vesting Conditions Exercise Contractual Life

Instruments Price of Options

-------------------------- ------------- -------------------- --------- -----------------

Key Management Personnel

5 August 2014 500,000 Vest immediately $0.25 3 years

5 August 2014 500,000 One year of service $0.35 4 years

25 August 2014 1,500,000 Vest immediately $0.25 3 years

25 August 2014 1,500,000 One year of service $0.35 5 years

Employees

5 August 2014 825,000 Vest immediately $0.25 3 years

5 August 2014 825,000 One year of service $0.35 4 years

Financiers and Advisors

22 December 2014 5,000,000 Vest immediately $0.10 3 years

Total Options 10,650,000

-------------

During the half-year ended 31 December 2014, the following

options lapsed unexercised:

Option Grant Date Number of Expiry Date Exercise

Instruments Price

-------------------------- ------------- ----------------- ---------

Key Management Personnel

17 August 2009 300,000 1 July 2014 $0.30

26 November 2009 750,000 1 July 2014 $0.30

10 November 2010 3,250,000 10 November 2014 $0.37

7 February 2011 2,000,000 10 November 2014 $0.37

Employees

17 August 2009 1,500,000 1 July 2014 $0.30

24 August 2009 100,000 1 July 2014 $0.30

26 November 2009 1,500,000 1 July 2014 $0.30

10 November 2010 3,162,500 10 November 2014 $0.37

16 November 2010 325,000 10 November 2014 $0.37

Total Options 12,887,500

-------------

Fair value of options granted during the half-year ended 31

December 2014 has been determined using the following

assumptions:

Option Grant Date 5/8/2014 5/8/2014 25/08/2014 25/08/2014 22/12/2014

------------------------------------------- --------- --------- ----------- ----------- -----------

Assumptions

Fair value per option at measurement date $0.10 $0.11 $0.10 $0.12 $0.03

Share price at grant date $0.18 $0.18 $0.17 $0.17 $0.05

Exercise price $0.25 $0.35 $0.25 $0.35 $0.10

Expected volatility 106.59% 106.59% 108.62% 108.62% 114.71%

Option life 3 years 4 years 3 years 5 years 3 years

Expected dividends - - - - -

Risk-free interest rate 2.50% 2.50% 2.50% 2.50% 2.50%

The fair value of the options is calculated at the date of grant

using the Black-Scholes Model.

As at 31 December 2014 Oilex Ltd had 35,225,000 unlisted options

on issue exercisable at prices of between $0.10 and $0.63.

9. ISSUED CAPITAL

31 December 31 December 30 June 30 June

2014 2014 2014 2014

Number $ Number $

of Shares Issued Capital of Shares Issued Capital

------------ ---------------- ------------ ----------------

Shares

On issue 1 July - fully paid 591,034,789 148,980,743 354,778,499 135,371,619

Shares contracted to be issued - not fully paid(1) 2,350,000 269,329 - -

------------ ---------------- ------------ ----------------

Balance at the start of the period 593,384,789 149,250,072 354,778,499 135,371,619

Issue of share capital

Shares issued for cash - - 236,255,090 14,646,441

Shares issued for cash(1) 16,250,000 1,862,379 - -

Shares issued for cash(2) 60,975,610 2,500,000 - -

Exercise of listed options(3) 7,295,020 1,094,253 1,200 180

Capital raising costs (405,144) (917,497)

Underwriter and sub-underwriter options (147,532) (120,000)

------------ ---------------- ------------ ----------------

On issue at the end of the period - fully paid 677,905,419 591,034,789

Issued Capital as at the end of the period 154,154,028 148,980,743

Shares contracted to be issued - not fully paid(1) - - 2,350,000 269,329

------------ ---------------- ------------ ----------------

Balance at the end of the period 677,905,419 154,154,028 593,384,789 149,250,072

------------ ---------------- ------------ ----------------

Number of Listed Options

Listed Options (ASX) 31 December 30 June 2014

2014

------------ -------------

On issue at 1 July 195,892,111 151,893,311

Issue of listed options - 34,000,000

Issue of listed underwriter and sub-underwriter

options - 10,000,000

Exercise of listed options(3) (7,295,020) (1,200)

------------ -------------

Total listed options 188,597,091 195,892,111

------------ -------------

All listed options are exercisable at $0.15 per share and expire

7 September 2015.

(1) On 15 July 2014, the Company issued 18,600,000 shares at an

issue price of 6.3 pence per share (AUD$0.1146) via a draw down on

its Equity Financing Facility with Darwin Strategic Limited raising

GBP1,171,800 (AUD$2,131,708) before expenses. Of the total issued

shares, 2,350,000 shares were contracted to be issued prior to 30

June 2014. All shares were issued and fully paid in July 2014.

(2) On 22 December 2014, the Company issued 60,975,610 new

ordinary shares under the fully underwritten Share Purchase Plan

announced 26 November 2014. This placement was priced at $0.041 per

share.

(3) 7,295,020 listed options with an exercise price of $0.15

were exercised during the period.

10. ADVANCES RECEIVED FROM FARMOUT

On 9 August 2013 the Company announced that it had entered into

a Sale and Purchase Agreement ("SPA") to sell up to a 15%

participating interest in the Cambay Production Sharing Contract

("PSC") to Magna. Under the terms of the transaction, the Company

had agreed to sell a 10% participating interest (gross) in the

Cambay PSC for US$4 million, ("sale interest"), and an additional

5% participating interest, if Magna exercised an option to acquire

an additional 5% participating interest (gross) for US$2 million,

("option interest"). The sale of the Cambay asset was conditional

upon a number of conditions, including obtaining a waiver of the

pre-emptive rights from GSPC, the Company's non-operating joint

venture partner, and the consent of the Government of India. In the

event that certain conditions, including the approval of the

Government of India, had not been satisfied or, waived prior to 1

May 2014, the parties agreed that any payments made by Magna to the

Company, to the extent practicable, would be converted into shares

in the Company. The issue of shares, under the unwind provisions,

was limited to 19.9% of the enlarged issued capital of the Company

at the time of issue, with any balance of the investment not

satisfied in shares repayable in cash. Shareholders approved the

unwind provisions at the General Meeting held 4 October 2013. The

consent of the Government of India was not received by the cut-off

date, and Magna on 1 May 2014 requested that the Company issue US$4

million unwind shares in accordance with the SPA. The number of

unwind shares was determined in accordance with the SPA formula at

the contracted foreign exchange rate of US$0.91 to AUD$1.00.

Funds for the 10% sale interest were received from Magna during

the half year ended 31 December 2013. As the transaction could not

be completed until the Government of India advised of the approval

or rejection of the potential sale of the Cambay asset, the funds

were classified as an advance received from the farmout.

On 2 May 2014 the Company announced the issue of 73,505,090 new

ordinary shares to Magna Energy Limited ("Magna") under the terms

of the unwind provisions approved by shareholders on 4 October 2013

at a deemed price of $0.0598 per share and the funds received were

subsequently disclosed as proceeds from issue of share capital as

at 30 June 2014.

11. CONTINGENCIES

On 12 July 2013 Oilex (JPDA 06-103) Ltd, on behalf of the Joint

Venture participants, submitted to the Autoridade Nacional do

Petroleo ("ANP"), a request to terminate the PSC by mutual

agreement in accordance with its terms and without penalty or claim

due to the ongoing uncertainty in relation to security of tenure.

This request requires the consent of the Timor Sea Designated

Authority. Should this consent not be forthcoming, then the Company

would need to assess the consequences. Refer note 15 for details of

the extension by the ANP with prior consent of the Joint Commission

for the Joint Petroleum Development Area under the Timor Sea

Treaty, of the extension of the expiry date of the PSC to 15 April

2015.

12. RELATED PARTIES

Arrangements with related parties continue to be in place. For

details of these arrangements, refer to the consolidated annual

financial report of the Group as at and for the year ended 30 June

2014.

13. CHANGE IN THE COMPOSITION OF THE GROUP

Since the last annual reporting date, there have been no

significant changes in the composition of the Group.

14. EXPENDITURE COMMITMENTS

Exploration and Evaluation Expenditure Commitments

In order to maintain rights of tenure to exploration permits,

the Group is required to perform minimum exploration work to meet

the minimum expenditure requirements specified by various state and

national governments. These obligations are subject to

renegotiation when application for an exploration permit is made

and at other times. These obligations are not provided for in the

financial report. The expenditure commitments are currently

estimated to be payable as follows:

31 December

2014 30 June 2014

$ $

------------ --------------

Within one year 2,206,821 4,094,433

One year or later and no later than five

years 12,930,000 10,250,000

15,136,821 14,344,433

------------ --------------

The commitments include the Canning Basin Exploration Permit

Applications. The formal exploration permit period commences once

Native Title is granted.

When obligations expire, are re-negotiated or cease to be

contractually or practically enforceable, they are no longer

considered to be a commitment.

Further expenditure commitments for subsequent permit periods

are contingent upon future exploration results. These cannot be

estimated and are subject to renegotiation upon expiry of the

exploration leases.

Capital Expenditure Commitments

The Group had no capital expenditure commitments as at 31

December 2014 (30 June 2014: Nil).

15. SUBSEQUENT EVENTS

Oilex received approval from the Government of India for the

grant of an extension of the Petroleum Mining Lease for the Cambay

Field to 22 September 2019.

The receipt of endorsement from the relevant authorities of the

Government of India for the sale of gas from Cambay Field,

specifically from the Cambay-77H well.

The Autoridade Nacional do Petroleo with prior consent of the

Joint Commission for the Joint Petroleum Development Area under the

Timor Sea Treaty, advised on 16 January 2015 that it had further

extended the expiry date of the PSC from 15 January 2015 to 15

April 2015 for the purpose of completing an assessment and to

continue discussions with the Joint Venture partners.

On 28 January 2015 Oilex announced the appointment of Mr Jeffrey

D Auld as a Non-Executive Director. The appointment of a UK based

independent non-executive director, with significant experience in

the London capital markets and upstream oil and gas industry is in

line with the Company's decision to appoint additional directors to

achieve the right mix of skills, experience and diversity which

reflects the Company's strategy and increase the balance of

independence on the Board.

There are no other significant subsequent events occurring after

balance date.

DIRECTORS' DECLARATION

In the opinion of the Directors of Oilex Ltd (the

"Company"):

1. the condensed consolidated financial statements and notes set

out on pages 5 to 16, are in accordance with the Corporations Act

2001 including:

(a) giving a true and fair view of the Group's financial

position as at 31 December 2014 and of its performance for the

half-year ended on that date; and

(b) complying with Australian Accounting Standard AASB 134

Interim Financial Reporting and the Corporations Regulations 2001;

and

2. there are reasonable grounds to believe that the Company will

be able to pay its debts as and when they become due and

payable.

Signed in accordance with a resolution of the Directors.

Mr Max Cozijn Mr Ronald Miller

Chairman Managing Director

Leederville

Western Australia

10 February 2015

KPMG

Independent auditor's review report to the members of Oilex

Ltd

Report on the financial report

We have reviewed the accompanying interim financial report of

Oilex Ltd, which comprises the condensed consolidated statement of

financial position as at 31 December 2014, condensed consolidated

statement of profit or loss and other comprehensive income,

condensed consolidated statement of changes in equity and condensed

consolidated statement of cash flows for the half-year ended on

that date, notes 1 to 15 comprising a summary of significant

accounting policies and other explanatory information and the

directors' declaration of the Group comprising the company and the

entities it controlled at the half-year's end or from time to time

during the half-year.

Directors' responsibility for the interim financial report

The directors of the company are responsible for the preparation

of the interim financial report that gives a true and fair view in

accordance with Australian Accounting Standards and the

Corporations Act 2001 and for such internal control as the

directors determine is necessary to enable the preparation of the

interim financial report that is free from material misstatement,

whether due to fraud or error.

Auditor's responsibility

Our responsibility is to express a conclusion on the interim

financial report based on our review. We conducted our review in

accordance with Auditing Standard on Review Engagements ASRE 2410

Review of a Financial Report Performed by the Independent Auditor

of the Entity, in order to state whether, on the basis of the

procedures described, we have become aware of any matter that makes

us believe that the interim financial report is not in accordance

with the Corporations Act 2001 including: giving a true and fair

view of the Group's financial position as at 31 December 2014 and

its performance for the half-year ended on that date; and complying

with Australian Accounting Standard AASB 134 Interim Financial

Reporting and the Corporations Regulations 2001. As auditor of

Oilex Ltd, ASRE 2410 requires that we comply with the ethical

requirements relevant to the audit of the annual financial

report.

A review of an interim financial report consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with Australian Auditing Standards and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Independence

In conducting our review, we have complied with the independence

requirements of the Corporations Act 2001.

Conclusion

Based on our review, which is not an audit, we have not become

aware of any matter that makes us believe that the interim

financial report of Oilex Ltd is not in accordance with the

Corporations Act 2001, including:

(a) giving a true and fair view of the Group's financial

position as at 31 December 2014 and of its performance for the

half-year ended on that date; and

(b) complying with Australian Accounting Standard AASB 134

Interim Financial Reporting and the Corporations Regulations

2001.

KPMG

Brent Steedman

Partner

Perth

10 February 2015

KPMG, an Australian partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG

International Cooperative ("KPMG International"), a Swiss

entity

Liability limited by a scheme approved under Professional

Standards Legislation

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EFLBFELFLBBE

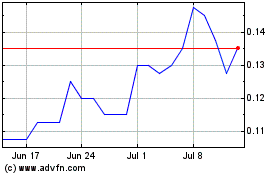

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Apr 2023 to Apr 2024