SEC FILE NUMBER 001-34746

CUSIP NUMBER 00438V103

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

|

| (Check one) |

|

¨ Form 10-K

¨ Form 20-F ¨ Form 11-K

x Form 10-Q ¨ Form

10-D ¨ Form N-SAR ¨ Form N-CSR |

|

|

|

|

For Period Ended: September 30, 2014 |

|

|

|

|

¨ Transition Report on Form 10-K |

|

|

¨ Transition Report on Form 20-F |

|

|

¨ Transition Report on Form 11-K |

|

|

¨ Transition Report on Form 10-Q |

|

|

¨ Transition Report on Form N-SAR |

|

|

|

|

For the Transition Period Ended: |

|

| Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the

notification relates:

PART I — REGISTRANT

INFORMATION

Accretive Health, Inc.

Full Name of Registrant

Former Name if Applicable

401 North Michigan Avenue, Suite 2700

Address of Principal Executive Office (Street and Number)

Chicago, IL 60611

City,

State and Zip Code

PART II — RULES 12B-25(b)

AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to

Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

| ¨ |

|

(a) |

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

| |

(b) |

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or

portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be

filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not

be filed within the prescribed time period.

Accretive Health, Inc. (the “Company”) is delaying the filing of its Quarterly

Report on Form 10-Q for the quarter ended September 30, 2014.

As previously announced on March 4, 2013, the Audit Committee of the

Company’s Board of Directors (the “Audit Committee”) determined that the Company will restate its financial statements. The Audit Committee made this determination following consultation with and upon the recommendation of management

and following consultation with Ernst & Young LLP.

The Company has concluded that the timing of revenue recognition under its

revenue cycle management agreements was incorrect. Accordingly, the Company will revise its financial statements to correct these errors. The Company believes, based on information available to date, that correcting the timing of revenue recognition

will (1) have no impact on the timing and magnitude of cash flows from operations, (2) reflect deferred timing of revenue recognition leading to an increase in deferred revenue or other liabilities reported in prior periods, and

(3) result in increases in revenue recognized in future periods. Furthermore, the Company believes, based on information available to date, that due to changes in timing of revenue recognition, certain amounts of bad debt expense related to its

revenue cycle management agreements may instead be accounted for as reduced revenue after restatement.

Moreover, the Company has

determined that the base fee revenues from its revenue cycle management agreements should have been presented in the Company’s previously reported financial statements net of associated operating costs rather than based on the gross amount of

base fees billed to customers. Accordingly, the Company will revise its financial statements to correct these errors. This change in financial statement presentation is not expected to impact either net income or the timing or magnitude of cash

flows from operations in any reporting period.

The Company has also reviewed its capitalization of internally developed software and has

determined that a portion should have been expensed as incurred rather than initially capitalized and subsequently amortized to expense in later periods. Accordingly, the Company will revise its financial statements to correct these errors. This

change is expected to decrease net income in earlier periods and increase net income in later periods, but have no cumulative impact to net income over time. This change will decrease cash provided by operations, decrease cash used by investing

activities and have no net impact on total cash flows in any reporting period.

Because the Company is in the process of restating its

financial statements as described above, the Company has not been able to complete its financial statements for the quarter ended September 30, 2014 or prior periods.

The Company remains committed to completing the restatement of its financial statements and its related audits as soon as possible. The

Company anticipates completing the restatement and the related audits by the middle of December 2014; however, the Company cannot provide any assurances that it will be able to do so.

The Company is in the process of preparing an Annual Report on Form 10-K (the “Comprehensive Form

10-K”) that includes the following financial information: (1) audited consolidated balance sheets as of December 31, 2011 (as restated), 2012 and 2013; (2) audited statements of operations, cash flows and stockholders’ equity (or deficit)

for the years ended December 31, 2011 (as restated), 2012 and 2013; (3) unaudited quarterly financial data for the eight quarterly periods ended December 31, 2013; and (4) selected annual financial data for the years ended December 31, 2009, 2010

and 2011 (each as restated), 2012 and 2013, of which 2011, 2012 and 2013 would be audited. The Company anticipates filing the Comprehensive Form 10-K by the middle of December 2014; however, the Company cannot provide any assurances that it will be

able to do so.

PART IV — OTHER INFORMATION

| (1) |

Name and telephone number of person to contact in regard to this notification |

|

|

|

|

|

|

|

|

|

| Peter Csapo |

|

|

|

(312) |

|

|

|

324-7820 |

| (Name) |

|

|

|

(Area Code) |

|

|

|

(Telephone Number) |

| (2) |

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period

that the registrant was required to file such report(s) been filed? If answer is no, identify

report(s). ¨ Yes x No |

The Company has not filed the Forms 10-K for its fiscal years ended December 31, 2012 and December 31, 2013, and the Forms 10-Q for

the quarters ended March 31, 2013, June 30, 2013, September 30, 2013, March 31, 2014 and June 30, 2014.

| (3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion

thereof? x Yes ¨ No |

If so: attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a

reasonable estimate of the results cannot be made.

As discussed in the Company’s press release filed with the SEC on

February 26, 2013 and as described above, the Company has been evaluating the manner in which it recognizes revenue for its revenue cycle management agreements. Moreover, as described above, the Company is currently evaluating, among other

things as described above, the manner in which it presents revenue for its revenue cycle management agreements. As described above, on March 4, 2013, the Audit Committee determined that the Company will restate its financial statements. The

Company is currently evaluating the impact of such restatement on its results of operations and financial position as well as total revenue recognized over the life of managed service contracts.

Safe Harbor Statement

This Form 12b-25 contains forward-looking statements, including the Company’s statements regarding the anticipated consequences of the

restatement of the Company’s financial statements described above, and the Company’s ability to complete the restatement and file the Comprehensive Form 10-K by the middle of December 2014. All forward-looking statements contained in this

Form 12b-25 involve risks and uncertainties. Our actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the possibility that any restatement that may

be required could have unanticipated consequences and the factors set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2012, filed with the SEC on November 8, 2012, under the heading “Risk Factors”.

The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “would,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements on our current expectations and projections about

future events. Although we believe that the expectations underlying any of our forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or

more of these risks and uncertainties materialize, or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated,

estimated, or expected.

All forward-looking statements included in this Form 12b-25 are expressly

qualified in their entirety by these cautionary statements. We wish to caution readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions

of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as

others that we may consider immaterial or do not anticipate at this time. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations may prove correct. Our

expectations reflected in our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not

exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition or relationships with customers and potential customers, may emerge from time to time.

We assume no, and we specifically disclaim any, obligation to update, amend, or clarify forward-looking statements to reflect actual

results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to consult any further disclosures we make on related subjects in our periodic reports that we file with or furnish to the SEC.

Accretive Health, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

| Date: |

|

November 12, 2014 |

|

|

|

By: |

|

/s/ Peter Csapo |

|

|

|

|

|

|

Name: |

|

Peter Csapo |

|

|

|

|

|

|

Title: |

|

Chief Financial Officer, Treasurer and Chief Accounting Officer |

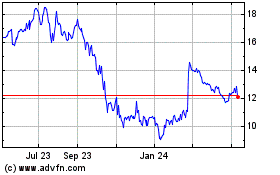

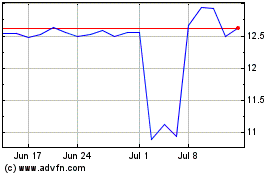

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Aug 2024 to Sep 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Sep 2023 to Sep 2024