Nestlé Reports Subdued Sales Growth, Sees Pricing Recovery -- 2nd Update

August 18 2016 - 4:17AM

Dow Jones News

By Brian Blackstone

Nestlé SA fell short of a longstanding sales growth objective

during the first half of the year in the face of weak pricing and

slack demand in important markets for the Swiss consumer-goods

company such as China.

The owner of Kit Kat candy bars, Perrier mineral water and

DiGiorno frozen pizza reported first-half net profit of 4.1 billion

francs, down 8.9% from 4.5 billion francs over the same period in

2015.

Nestlé notched up revenue of 43.2 billion Swiss francs ($45

billion) in the six months to end-June, equivalent to organic

growth--which strips out the effects of currencies changes,

acquisitions and divestments--of 3.5%, aided by strong sales in

North America.

Organic sales growth weakened during the second quarter compared

with the first, noted analysts at Baader Helvea Equity Research,

adding that the result was "weak, especially as it is not only

driven by low pricing."

The company has missed its sales target of organic growth of 5%

to 6%--dubbed the "Nestlé Model"--for three years running, raising

questions about its long-term growth prospects.

Analysts polled by Dow Jones Newswires had expected first-half

sales of 43.2 billion francs, net profit of 4.6 billion francs and

organic sales growth of 3.6%.

"While we continued to address challenges in China, we enjoyed

good performances across the U.S., Europe, South East Asia and

Latin America and expect this to continue in the second half,"

Chief Executive Paul Bulcke said in a statement.

"We also expect pricing, which reached historically low levels

in the first half, to recover somewhat in the coming months."

The company reaffirmed its outlook that organic growth for 2016

will match the rate of 2015, when it grew 4.2%.

Nestle's shares fell slightly in early trading, down 0.3%.

In the first half, organic sales growth was 4.7% in the

Americas, offsetting weaker growth in Asia, Europe and Africa. "In

China, growth in the food and beverage market slowed down

significantly," Nestlé said.

Like other major consumer products companies, Nestlé faces

challenges from changing global demographics--with populations

growing in emerging markets and aging in wealthier advanced

economies. It also confronts new consumer tastes that include an

increasing emphasis on nutrition and locally-grown products.

Nestlé's sales have also been hurt in recent years by the strong

Swiss franc, slowdowns in major markets like China and Europe and

ultralow inflation in many parts of the world that makes it hard to

increase prices.

"Pricing has reached a historically low level owing to

deflationary environments across a number of developed markets and

low commodity prices," Nestlé said.

When inflation is unusually subdued, or when consumer prices

fall, consumers get a boost in the nutrition-and-health-sciences

next chief executiveshape of higher disposable incomes. The flip

side is that companies such as Nestlé rely in part on being able to

lift their own prices to generate growth, and when they can't, it

affects revenues.

Nestlé has faced specific problems of its own, having had to

recall its Maggi noodles in India last year.

To stimulate sales growth, the company has expanded its

nutrition-and-health-sciences business. Reflecting that emphasis,

the company in late June tapped Ulf Mark Schneider--the head of

German health-care company Fresenius SE--to be its next chief

executive.

It was a surprise move, given the Mr. Schneider will be the

first outsider to run Nestlé in over a century and lacks a food and

beverage background. But investors seem to like the move, with

Nestlé shares up about 10% since he was announced as the next

CEO.

Nestlé's board has proposed that current CEO Mr. Bulcke become

the company's next chairman after Peter Brabeck-Letmathe retires

from that position next year.

Analysts said second-half sales growth should benefit from an

unwinding of the effect of the Maggi noodle recall.

--John Letzing contributed to this article

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

August 18, 2016 04:02 ET (08:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

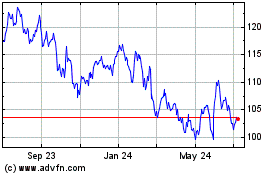

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024