NZ Dollar Slides As New Zealand Trade Deficit Rises

September 25 2016 - 9:53PM

RTTF2

The New Zealand dollar continued to be weak against other major

currencies in the Asian session on Monday, after data showed that

New Zealand trade deficit rose more than expected in August.

Meanwhile, speculation triggered that the Reserve Bank is likely to

cut the official cash rate in November.

Data from Statistics New Zealand showed that New Zealand had a

merchandise trade deficit of NZ$1.265 billion in August. This

missed forecasts for a shortfall of NZ$735 million following the

NZ$433 million deficit in July.

Exports were worth NZ$3.39 billion, shy of forecasts for NZ$3.60

billion, and down from NZ$3.96 billion in the previous month.

Imports came in at NZ$4.65 billion versus expectations for NZ$4.30

billion and up from NZ$4.40 billion a month earlier.

The currency weakness continued after the Reserve Bank of New

Zealand (RBNZ) reinforced last Thursday that further easing would

be necessary despite rapid growth in the economy. RBNZ governor

Graeme Wheeler maintained the OCR at a record low 2 percent at the

last week's policy meeting.

Last Friday, the NZ dollar fell 0.98 percent against the U.S.

dollar, 0.71 percent against the yen, 1.08 percent against the

euro, and 0.73 percent against the aussie.

In the Asian trading, the NZ dollar fell to a 5-week low of

72.83 against the yen, nearly a 5-week low of 1.5552 against the

euro, and nearly a 4-week low of 0.7220 against the U.S. dollar,

from Friday's closing quotes of 73.11, 1.5486 and 0.7239,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 71.00 against the yen, 1.57 against the euro,

and 0.71 against the greenback.

Against the Australian dollar, the kiwi dropped to 1.0538 from

Friday's closing value of 1.0516. The kiwi is likely to find

support around the 1.07 region. Looking ahead, the German Ifo

business climate index for September and U.K. BBA mortgage

approvals for August are due to be released later in the day.

At 4:30 am ET, European Central Bank's executive board member

Yves Mersch and Swiss National Bank Governing Board Chairman Thomas

Jordan are expected to speak at Sibos 2016 financial industry

conference, in Geneva.

In the New York session, U.S. new home sales data for August is

slated for release.

At 8:30 am ET, European Central Bank's member of the supervisory

board, Ignazio Angeloni, speaks at a conference "Strengths and

Weaknesses of European Banking" organized by Brevan Howard Centre

and Imperial College Business School, in London.

At 9:00 am ET, European Central Bank President Mario Draghi will

testify before the Committee on Economic and Monetary Affairs of

European Parliament, in Brussels.

At 9:30 am ET, Minneapolis Fed President Neel Kashkari

participates in a fireside chat moderated by Harry Melander,

president of the Minnesota Building and Construction Trades Council

and board member of the Federal Reserve Bank of Minneapolis, in

Minneapolis, U.S.

Fifteen minutes later, European Central Bank Vice President

Vitor Constancio is expected to speak at a conference, in

Frankfurt.

At 11:45 am ET, Federal Reserve Governor Daniel Tarullo will

deliver a speech titled "Next Steps in the Evolution of Stress

Testing" at the Yale School of Management Leaders Forum, in New

Haven.

At 12:00 pm ET, Austrian National Bank Governor and ECB

Governing Council member Ewald Nowotny is expected to speak on the

future of banks, in Vienna.

At 1:30 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan will participate in moderated Q&A before the Independent

Bankers Association of Texas Annual Convention, in Dan Antonio.

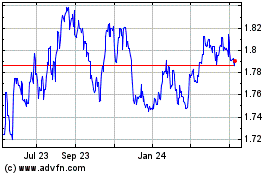

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

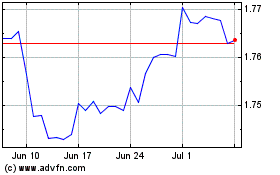

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024