Myriad Genetics Unveils Prolaris Data - Analyst Blog

February 19 2014 - 2:50PM

Zacks

Shares of Myriad Genetics

Inc. (MYGN) surged 11.4% at yesterday’s market close

following the company’s recent release of positive data on its

Prolaris test – a 46-gene molecular diagnostic test – in the

Journal of Urology. The Prolaris test correctly predicted those

prostrate cancer patients who had the risk of biochemical

recurrence (“BCR”) or metastatic disease following a radical

prostrate surgery. The predictions were made based on biopsies

conducted earlier on these patients. Notably, the Prolaris test has

been evaluated in more than 5,000 patients across 11 clinical

studies.

According to the company, this

test, that helps to detect patients who are likely to fail surgery,

is a great milestone in the field of prostate cancer treatment.

While patients with a low score may need active surveillance, the

ones with a high score signify aggressive cancer and may require

more intensive treatments.

Myriad is currently targeting

expansion of its pipeline with products for diverse indications

including oncology, women’s health, urology, dermatology,

autoimmune and inflammatory disease and neuroscience. To achieve

this objective, the company has decided to pursue internal

developments, in-licensing of technologies and acquisitions to

expand its business. We are sanguine about these developments as

some of the pipeline candidates look promising enough to cater to a

billion-dollar market size.

Earlier this month, the company

announced the acquisition of Crescendo Bioscience – an autoimmune

diagnostics company. The product line of Crescendo is expected to

complement Myriad’s portfolio by adding autoimmune and inflammatory

disease products. Crescendo’s novel offering, Vectra DA that Myriad

will gain from the takeover will allow the company to tap a

promising market opportunity of $2.5 billion worldwide.

The commercialization of the unique

myRisk test is another material upside as management expectations

from the pan-cancer test are sky high. Moving forward, we consider

Myriad’s HRD (Homologous Recombination Deficiency) test as a

valuable asset for top-line growth given its potential to tap a

widely unexplored market. The company’s increasing focus on the

companion diagnostic market should work reasonably well to fuel

growth. We look forward to the expansion of indications and derive

comfort from the company’s plan to foray into the dermatology,

autoimmune and neuroscience market in the future on the back of

portfolio development.

Currently, the stock carries a

Zacks Rank #3 (Hold). Better-placed stocks that are worth a look

include Affymetrix Inc. (AFFX),

Biogen Idec Inc. (BIIB) and Actelion

Ltd. (ALIOF). While Affymetrix and Biogen Idec sport

a Zacks Rank #1 (Strong Buy), Actelion bears a Zacks Rank #2

(Buy).

AFFYMETRIX INC (AFFX): Free Stock Analysis Report

ACTELION LTD (ALIOF): Get Free Report

BIOGEN IDEC INC (BIIB): Free Stock Analysis Report

MYRIAD GENETICS (MYGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

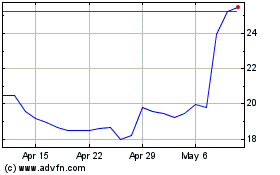

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

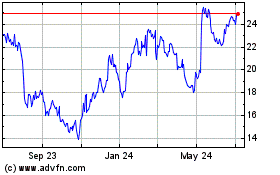

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024