TIDMMBH

RNS Number : 1088I

Michelmersh Brick Holdings PLC

23 March 2015

23 March 2015

Michelmersh Brick Holdings Plc

("MBH" or the "Group")

FINAL RESULTS

Improved trading, reduced borrowings,

and dividend reinstated

Michelmersh Brick Holdings (AIM:MBH) , the specialist brick

manufacturer and landfill company, is pleased to report its audited

final results for the year ended 31 December 2014, reflecting

another positive period for the Group as the industry continues to

progress.

Financial Highlights

-- Turnover up 10% to GBP28.5 million (2013: GBP25.9million);

-- Operating profit of GBP2.8 million (2013: 1.4 million), the

best result since the business floated in 2004;

-- Net debt further reduced from GBP4.2 million to GBP2.1 million;

-- Capital expenditure of just over GBP2 million for Freshfield

Lane expansion project and completion of Telford reorganisation;

and

-- Dividend reinstated - 0.5 pence per share payable for the period.

Operational Highlights

-- Strong progress in an improved market place;

-- 70 million bricks sold in the period and production of 67.5 million;

-- Average selling prices increased 13.5% on prior year prices;

-- January 2014 saw the commencement of the 20% expansion

project at Freshfield Lane which has now been completed, extending

capacity at the plant by 6 million bricks;

-- New products launched and awards won such as 'Best Public

building' for the East Ham Customer Service Centre & Library at

the BDA awards;

-- Application for 200 houses at the Charnwood site was submitted at the end of 2014; and

-- Planning consent confirmed for additional clay extraction at Michelmersh site.

Eric Gadsden, Chairman at Michelmersh Brick Holdings, commented:

"Michelmersh is the only UK owned brick manufacturer and places

itself in the top end of the market in terms of quality of products

and service to customers. With a strong financial footing, and in a

market that seems set for continued prosperity, we can be confident

of robust profitability and meaningful shareholder returns going

forward. We have had a strong start to 2015 and, with our

well-invested plants, feel well positioned for the year ahead."

Chairman's Statement

I am pleased to report a very good performance for the Group in

2014 having made continued strong progress, building on the

foundations laid in the previous period, and in a further improved

market place. In addition, I can report to shareholders that the

Group is well placed to make further advances in a very promising

market.

In the financial period, turnover increased by 10% to GBP28.5

million (2013: GBP25.9 million) as average brick selling prices

increased by 13.5%. These price increases translated into a

profitable outcome for the year and we can anticipate continued

progress with the recent completion of the investment at our

largest brickworks Freshfield Lane, as the long awaited improvement

in industry dynamics continues to play out favourably. I am

particularly pleased that our fortunes and prospects are positive

enough to be able to reinstate dividend payments.

Financial Highlights

2014 2013 +/-

---------------------- --------- --------- --------

GBP28.5 GBP25.9

Turnover m m +10%

---------------------- --------- --------- --------

GBP2.8 GBP1.4

Operating profit m m +100%

---------------------- --------- --------- --------

Basic EPS 2.72 0.18 +2.54

p p p

---------------------- --------- --------- --------

GBP46.7 GBP45.5

Net assets m m +3%

---------------------- --------- --------- --------

57.5 56.3

Net assets per share p p +2%

---------------------- --------- --------- --------

Net Debt GBP2.1 GBP4.2 -GBP2.1

m m m

---------------------- --------- --------- --------

The price recovery in the brick market positively impacted the

income statement in 2014 at all levels: as stated above, turnover

increased by 10% and improved gross profit by 30% as gross margin

increased by 5% to 31%. Operating profit from underlying business

amounted to GBP3.0 million, by far the best result since the

business floated in 2004. With low borrowings, the interest burden

for the Group is modest and the Profit before taxation of GBP2.6

million exceeded the equivalent figure in 2013 by 6.4 times.

These positive results were achieved despite a reduction in

contribution from the landfill operations, which halved to

GBP130,000 as a result of a combination of external economic

conditions and internal decisions to maximise the lifetime assets

and income at the Telford site.

The income statement has separated the costs of non-underlying

events so that the accounts demonstrate better the true performance

of the Group. These non-underlying items in 2014 included set-up

costs of the Freshfield Lane expansion project, which is expected

to yield benefits in 2015 and beyond.

Cash and Borrowings

The Group ended the year with net debt of GBP2.1 million (2013:

GBP4.2 million) representing gearing of under 5%. Cash generated by

operations of GBP2.6 million was supplemented by the second of

three tranches of the Bovis land sale proceeds of GBP1.5 million.

The Group undertook capital expenditure of just over GBP2 million

in respect of the Freshfield Lane expansion project and completion

of the Telford reorganisation.

The Group has used cash resources to repay all borrowings except

a Term Loan of GBP5 million with Barclays and a small residual hire

purchase contract and has ceased the ineffective interest rate cap

agreement. The Group generates a strong cash flow from operations

and along with the final GBP1.5 million deferred land sale

proceeds, is expected to be in a net positive cash position through

2015 which gives flexibility for capital projects and shareholder

distributions.

Assets and working Capital

The Group's balance sheet is strongly backed by substantial

fixed assets of GBP42 million. Opportunities afforded by surplus

land assets continue to be evaluated and their eventual realisation

is closer as time passes. No significant planning or operational

events have occurred in the year and prudent valuations have been

made by the Directors. Only one asset, the landfill void at

Telford, has been subject to a valuation adjustment as a result of

a change in the Board's intended timescale of landfill. As the

economic benefit has been deferred for some years, the net present

value has reduced and as a result, the carrying value has fallen by

GBP1 million. Net asset value at 31 December 2014 stands at 57.5

pence (2013: GBP56.3 pence) per share.

Working capital has increased marginally during 2014 as strong

late season sales kept debtors unusually high. Stock levels are now

at a level that cannot be reduced much further. Overdraft

facilities have been maintained and, alongside cash balances,

provide healthy headroom for security and allow investment in

capital projects.

Dividend

Improved trading, reduced borrowings, strong cash flow and the

realisation of revaluation gains have now put the Group in a

position where it can recommence dividend payments. The Board are

intent upon implementing a sustainable dividend policy that

reflects a balance between trading cashflow and long-term

reinvestment in capital assets. Accordingly, the Board is proposing

a dividend of 0.5 pence per share in respect of the financial year

ended 31 December 2014. Net debt is likely to be positive by the

end of 2015, and the Board will seek to make dividend payments out

of trading cash flow annually to establish and maintain a prudent

level of dividend cover.

Land Assets

We have received the second tranche of funds from the sale of

the former factory site at Telford with a further GBP1.5 million

due in October this year. We have undertaken a comprehensive review

of our clay reserves at this site and based on current production

levels believe these will extend in excess of 30 years. In the

light of the improved market for brick manufacture our priority is

to maximise this asset and we have therefore taken the decision to

cease landfill at this site for the foreseeable future.

We have now received detailed consent for an additional 20 years

of clay supplies at our Michelmersh site. Our scheme for 200 houses

has now been submitted at our quarry site at Charnwood and we

continue to progress our application for a landfill licence at our

Dunton site.

People

In the past year much work was done to strengthen the business

and I would like to thank all our employees for their hard work

over the period. We have successfully recruited for our increased

capacity at Freshfield Lane and it is satisfying to anticipate a

more stable outlook in the future.

Outlook

Two long anticipated events occurred during 2014: firstly brick

industry prices increased for the first time in six years and

secondly two of the major UK manufacturers have new overseas

owners.

A generational oversupply of bricks has come to an end and the

market is now reliant on increasing levels of imports. The last big

industry investments were in the 1980's and capital will need to be

directed to modernise existing works rather than increasing

capacity.

The current environment brings a new set of challenges with our

stocks, and industry stocks, at an all time low. Bricks are no

longer immediately available on demand but we have successfully

managed our customers' requirements and our hallmarks of quality

and service will continue to serve us well in the future.

Michelmersh Brick Holdings is the only UK owned brick

manufacturer and places itself in the top end of the market in

terms of quality of products and service to customers. With a

strong financial footing, and in a market that seems set for

continued prosperity, we can look forward to increasing profits and

meaningful shareholder returns. We have had a strong start to 2015

and, with our well -invested plants, feel well positioned for the

year ahead.

Eric Gadsden

Chairman

Chief Executive Review

Clay Products

Demand for our product was strong during 2014. The Group

achieved record forward intake figures throughout the year,

ensuring robust deliveries into 2015, with some current products

currently on over 24 weeks availability. We sold 70 million bricks

in the period (2014 71.5 million) against production of 67.5

million (2014 65.4 million) and sales were constrained by capacity

for the first time in many years. Average selling prices increased

by 13.5% to GBP395 per '000 (2014: GBP348) against an industry

average increase for the year of 16%. This is a pleasing increase

in light of the premium price enjoyed by our products.

We worked hard with our customers to ensure that product

delivery schedules during the year were well balanced and in line

with production and stock management. The Group achieved a good mix

of 'Repair Maintenance and Improvement' ("RMI") projects,

specification and new housing work.

There was success for recently launched new products such as

Charnwood's I-Line range. The East Ham Customer Service Centre

& Library won the coveted 'Best Public Building' at the BDA

awards and the completion of the RFU Centre for Athletic

Development at Penny Hill Park sparked much positive praise for the

new high end product. During 2014 the Group also saw the

commencement of other notable schemes such as the contemporary

Grosvenor Estates Arts Complex in Southampton and the new junior

school complex for St. Swithuns, the leading girls' school in

Winchester. Many urban regeneration projects continued with new

phases being ordered well into 2015 by developers such as Crest

Nicholson's Oak Grove and the Lendlease Elephant & Castle

regeneration project. Our close relationship with developers such

as Berkeley Group Holdings Plc, Croudace Homes Ltd and Octagon

Developments Limited continues, with all delivering much needed

high quality housing stock using MBH Group products. The award

winning Hill, Ceres CB1 redevelopment in Cambridge also made an

impact this year, again delivering unique quality homes.

We continued to support key merchants and distributors with our

robust distribution and partnership policy.

Overall 2014 was a quieter period for the Hathern Terra Cotta

division, however it finished the year with a strong order intake

having completed some intricate high value restoration work for the

Jimmy Choo store refurbishment in New Bond St. London, along with

Brighton College's stunning new entrance and clock tower.

Exports were positive for both our high value specification

bricks and pavers with over 600,000 units going as far a field as

Singapore and New York, USA.

The drive for efficiency continued within our Central Sales

Office as we reviewed our haulage operations, IT and BIM data.

Furthermore, we increased our truck fleet capacity with our rolling

programme of vehicle replacement.

As with previous years, 2014 saw the Group continue it's policy

of supporting education through supply of free product, resource

and seminars to various colleges in the UK and contributing to the

CITB Skill build programme.

In January 2014 we commenced our 20% expansion project at

Freshfield Lane. The GBP2.2 million investment extends capacity at

the plant by 6 million bricks. We are pleased that the project was

completed within budget and on schedule and the plant now has a

capability of producing 36 million bricks per annum. The investment

encompassed a new clay preparation area, an additional brick making

machine, extending drier capacity and the erection of a new 'clamp'

for firing the bricks. The product output expansion at Freshfield

Lane has meant that we are now able to build upon and increase our

strong regional RMI and SME developer relationships, providing much

needed extra capacity to new sites.

We scheduled a tunnel kiln shutdown at our Blockleys plant

during December to carry out a major maintenance programme. This

consisted of lining and ductwork improvements and long-term

preventative maintenance of the mechanical systems. The kiln that

had been continuously firing bricks for five years was restarted

ahead of schedule delivering an increase over our budgeted output

for 2015.

Also at Blockleys we have this year commenced a GBP500,000

capital project to upgrade our fired brick packaging facility. This

builds on our kiln unloading investment in 2013 and involves the

replacement of the originalequipment with a new robotic system and

the latest control software. The project will deliver operational

cost savings, increased capacity and reduced downtime risk.

Management Systems

Following our successful quality and environmental system review

in 2013 we achieved full accreditation to ISO 9001 and ISO 14001

during the period meaning that all of our manufacturing sites

operate to these standards. We are now focusing our efforts on

expanding our sustainability and energy management systems to

achieve BES 6001 and ISO 50,001.

Staff Development

During the year we restructured our operations functions

following retirement and succession planning. Our Group is now

fully integrated with a highly skilled and focused team that are

industry leading with succession and development in place to

address the future needs of the business.

Following on from our successful apprenticeship programmes at

Charnwood and Freshfield Lane we set up a technical engineering

programme that started in September 2014 with The Manufactures'

Organisation "EEF". The two apprentices spend their first year at

residential college followed by three years at Blockleys and

Michelmersh. We are currently recruiting two further apprentices to

start the programme in September 2015 for Charnwood and Freshfield

Lane.

In February this year we added a sustainability manager to our

operations team and expanded the existing team roles to include a

specific focus on training needs and staff development.

Landfill and Land Assets

Activity at our Telford operations was reduced with turnover of

GBP400,000 (2014: GBP632,000) on a tonnage of 63,000 (2014:

200,000) at significantly higher rates. However we have undertaken

a comprehensive review of our reserves and now have a robust plan

to maximise these. During this process it became apparent that it

would not be possible to continue landfilling at previous rates

during the life of the quarry. In these circumstances and in light

of improved brick trading it was decided to shut the landfill at

this site for the foreseeable future.

We are planning limited landfill at our Charnwood site to

restore the quarry to a land form suitable for development later

this year. Our application for 200 houses was submitted at the end

of 2014 and is now being considered by the Planning Authority.

We are close to finalising all documentation for a landfill

licence in discussion with the Environment Agency at our Dunton

site and will consider options to maximise this asset during the

course of the year.

Finally we have received detailed planning consent for

additional clay extraction at our Michelmersh site which secures

many years of reserves at the site and allows us to consider

investment in plant and processes to increase efficiency and reduce

risks of breakdown.

Outlook

With house building recovering from low levels and a continued

need for new housing the business is now set to make further

progress.

Over the course of the next few months we will start to see the

benefit of improved production, pricing structures and market

dynamics benefit our business.

Although we are well invested there will be opportunities to

further enhance and future proof our facilities and with our strong

cash position we are looking to continue to make marginal

improvements wherever possible.

We continue to strengthen our market position in a highly

capital intensive industry with huge barriers to entry. Increased

reliance on imports underlines brick as the material of choice for

owners, developers and lenders.

It is to be hoped that we are now in a period where the true

worth of this product for its appearance, longevity,

sustainability, flexibility in use and low maintenance requirement

will be properly valued.

Martin Warner

Chief Executive

Consolidated Income Statement

For the year ended 31 December 2014

Underlying Non-underlying Underlying Non-underlying

2014 2014 2014 2013 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 28,476 - 28,476 25,929 - 25,929

Cost of sales (19,631) (119) (19,750) (19,205) - (19,205)

----------- --------------- ---------- ----------- --------------- ----------

Gross profit 8,845 (119) 8,726 6,724 - 6,724

Administration

expenses (5,946) (140) (6,086) (5,656) (443) (6,099)

Other income 161 - 161 65 694 759

----------- --------------- ---------- ----------- --------------- ----------

Operating profit/(loss) 3,060 (259) 2,801 1,133 251 1,384

Finance costs (199) - (199) (977) - (977)

----------- --------------- ---------- ----------- --------------- ----------

Profit/(loss)

before taxation 2,861 (259) 2,602 156 251 407

Taxation (457) 56 (401) (86) (216) (302)

----------- --------------- ---------- ----------- --------------- ----------

Profit/(loss)

for the financial

year from continuing

operations 2,404 (203) 2,201 70 35 105

Loss for the financial

year from discontinued

operations - - - (117) (1,536) (1,653)

----------- --------------- ---------- ----------- --------------- ----------

Profit/(loss)

for the financial

year 2,404 (203) 2,201 (47) (1,501) (1,548)

Basic earnings

per share from 2.72 0.18

continuing operations p p

Diluted earnings

per share from 2.72 0.17

continuing operations p p

2014 2013

GBP'000 GBP'000

Consolidated Statement of Comprehensive

Income

for the year ended 31 December

2014

Profit/(loss) for the financial

year 2,201 (1,548)

--------------------- -------------------------

Other comprehensive income:

Items which will not subsequently be reclassified

to profit or loss

Revaluation surplus of property,

plant and equipment - 3,500

Revaluation of property,

plant and equipment (1,000) (2,000)

Deferred tax on revaluation

movement (128) 415

(1,128) 1,915

--------------------- -------------------------

Total comprehensive profit

for the year 1,073 367

--------------------- -------------------------

2014 2013

Consolidated Balance

Sheet GBP'000 GBP'000

as at 31 December

2014

Assets

Non-current assets

Intangible assets 2,476 2,438

Property, plant

and equipment 41,899 41,831

-------------- -----------------

44,375 44,269

Amounts falling

due after one year

Derivatives - 91

Other receivables - 1,267

-------------- -----------------

Total non-current assets 44,375 45,627

Current assets

Inventories 6,084 6,307

Trade and other

receivables 7,346 6,361

Investments 30 46

Cash and cash equivalents 2,809 2,170

-------------- -----------------

Total current assets 16,269 14,884

Total assets 60,644 60,511

-------------- -----------------

Liabilities

Current liabilities

Trade and other

payables 3,940 3,900

Provisions 112 337

Corporation tax

payable 370 -

Interest bearing

borrowings 19 1,212

-------------- -----------------

Total current liabilities 4,441 5,449

Non-current liabilities

Deferred tax liabilities 4,593 4,434

Interest bearing

borrowings 4,916 5,125

-------------- -----------------

9,509 9,559

Total liabilities 13,950 15,008

Net assets 46,694 45,503

-------------- -----------------

Equity attributable to equity

holders

Share capital 16,247 16,162

Share premium account 11,495 11,495

Reserves 17,530 20,930

Retained earnings 1,422 (3,084)

Total equity 46,694 45,503

-------------- -----------------

Consolidated Share Share Merger Share Revaluation Retained Total

Statement of capital option reserve premium reserve earnings

Changes in Equity reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at January

2013 11,645 216 979 6,440 17,908 (1,654) 35,534

Loss for the

year - - - - - (1,548) (1,548)

Revaluation surplus - - - - 3,500 - 3,500

Revaluation deficit - - - - (2,000) - (2,000)

Deferred taxation

on revaluation - - - - 415 - 415

------------------------- --------------------------- --------------- --------------- ------------------ --------------- ---------------

Total comprehensive

income - - - - 1,915 (1,548) 367

Share based payment - 30 - - - - 30

Shares issued

during the year 4,517 - - 5,055 - - 9,572

Transfer to retained

earnings - - - - (134) 134 -

------------------------- --------------------------- --------------- --------------- ------------------ --------------- ---------------

As at 31 December

2013 16,162 246 979 11,495 19,705 (3,084) 45,503

Profit for the

year - - - - - 2,201 2,201

Revaluation deficit - - - - (1,000) - (2,000)

Deferred taxation

on revaluation - - - - (128) - (128)

Total comprehensive

income - - - - (1,128) 2,201 1,073

Share based payment - 33 - - - - 33

Shares issued

during the year 85 - - - - - 85

Transfer to retained

earnings - (231) - - (42) 273 -

Reclassification* - - - - (2,032) 2032 -

As at 31 December

2014 16,247 48 979 11,495 16,503 1,422 46,694

------------------------- --------------------------- --------------- --------------- ------------------ --------------- ---------------

* Reclassification relates to the revalued element of land sold

in October 2013 which is deemed to have completed in 2014 and is

now transferred to realised reserves.

Consolidated Statement of Cash

Flows 2014 2013

for the year ended 31 December

2013 GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 2,602 407

Loss from discontinued activities - (152)

Loss on disposal plant and machinery - -

Profit on sale of fixed assets (2) (724)

Profit on sale of

investments (15) -

Finance costs 199 977

Depreciation 973 916

Amortisation 2 2

Provision for impairment of investments - 28

Market value adjustment of Intangible

assets (40) 28

Share based payment charge 33 30

Cash flows from operations before

changes in working capital 3,752 1,512

Decrease in inventories 250 2,151

Increase in receivables (1,219) (232)

(Decrease)/increase in payables (177) 1,340

-------------- -----------------

Net cash generated by operations 2,606 4,771

Taxation paid - (35)

Interest paid (206) (986)

Net cash generated by operating

activities 2,400 3,750

-------------- -----------------

Cash flows from investing activities

Purchase of property, plant and

equipment (2,069) (927)

Proceeds of sale

of investments 31 -

Proceeds of sale

of land 1,500 1,600

Proceeds of disposal of property,

plant and equipment 4 145

Net cash (used in)/generated

by investing activities (534) 818

-------------- -----------------

Cash flows from financing activities

Repayment of interest bearing

borrowings (155) (10,348)

Proceeds of share

issue 85 9,572

Repayment of hire purchase and

finance lease obligations (5) (19)

Net cash used in financing activities (75) (795)

-------------- -----------------

Net increase in cash and cash

equivalents 1,791 3,773

Cash and cash equivalents at

the beginning of the year 1,004 (2,769)

Cash and cash equivalents at

the end of the year 2,795 1,004

-------------- -----------------

Cash and cash equivalents comprise:

Cash at bank and in hand 2,809 2,170

Bank overdraft (14) (1,166)

2,795 (1,004)

-------------- -----------------

NOTES TO THE FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union ("IFRSs as adopted by the EU"), IFRS

Interpretations Committee interpretations and with those parts of

the Companies Act 2006 applicable to companies reporting under

IFRS. There have been no changes to the accounting policies adopted

since the last consolidated financial statements were

published.

2. FINANCIAL INFORMATION

The financial information set out in this Preliminary

Announcement does not constitute the Group's statutory financial

statements for the years ended 31 December 2014 or 2013. The

financial information has been extracted from the Group's statutory

financial statements for the years ended 31 December 2014 and 2013.

The auditors have reported on those financial statements; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis and did not

contain a statement under Section 498(2) or (3) of the Companies

Act 2006.

The statutory accounts for the year ended 31 December 2013 have

been delivered to the Registrar of Companies, whereas those for the

year ended 31 December 2014 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

The financial information is presented in sterling and all

values are rounded to the nearest thousand pounds (GBP000) except

when otherwise indicated.

3. EARNINGS PER SHARE

Basic

The calculation of earnings per share from continuing operations

based upon the profit for the year of GBP2,201,000 (2013:

GBP105,000) and 80,861,273 (2013: 59,098,895) weighted average

number of ordinary shares.

Diluted

The calculation of diluted earnings per share from continuing

operations based upon the profit for the year of GBP2,201,000

(2013: GBP105,000) and 81,053,889 (2013: 59,4583,396) weighted

average number of ordinary shares.

4. REPORT & ACCOUNTS

Copies of this announcement are available and the Annual Report

will be available in due course on the Group's website

www.mbhplc.co.uk and from the Company's registered office at

Freshfield Lane, Danehill, Haywards Heath, West Sussex RH17

7HH.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JMMPTMBMTBIA

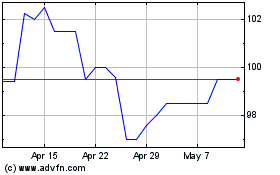

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Sep 2023 to Sep 2024