TIDMEMG

RNS Number : 2792V

Man Group plc

15 April 2016

Press Release

15 April 2016

TRADING STATEMENT for the quarter ended 31 March 2016

Key points

-- Funds under management (FUM) of $78.6 billion at 31 March

2016 (31 December 2015: $78.7 billion)

-- Net inflows in the quarter of $0.5 billion, comprising sales

of $5.1 billion and redemptions of $4.6 billion:

o Net inflows across quant alternative ($1.3 billion) and for

quant long only strategies ($0.4 billion), partially offset by;

o Net outflows from discretionary alternative ($0.6 billion),

discretionary long only ($0.5 billion), and guaranteed products

($0.1 billion);

o Net flows for fund of fund alternatives flat for the

quarter

-- Overall investment movement of negative $0.7 billion in the quarter:

o Positive investment performance across AHL's range of

strategies, adding $0.8 billion to FUM, more than offset by;

o Negative investment performance for GLG, mainly across their

long only strategies, reducing FUM by $1.5 billion;

o Investment performance for Numeric and FRM broadly flat for

the quarter

-- FX movements of positive $0.8 billion in the quarter,

primarily driven by the weakening of the US Dollar against the

Japanese Yen and Euro

-- Other negative movements of $0.7 billion in relation to

negative investment exposure adjustments ($0.4 billion) and CLO and

guaranteed product maturities ($0.3 billion)

Manny Roman, Chief Executive Officer of Man Group, said:

"Against the backdrop of challenging market conditions for the

global investment management industry, we have delivered results

for the first three months of the year that demonstrate the value

and benefits of a diversified business model. Investment

performance across our quantitative strategies and net inflows

meant that group funds under management remained stable over a

highly volatile quarter.

The ongoing uncertainty in the markets remains challenging and,

accordingly, the risk appetite of our clients has the potential to

impact flows. However, the ongoing diversification of our business

has enhanced our resilience as a firm, and positions us well to

navigate the current economic climate. As we have previously

indicated, we continue to explore new options for growth, both

organically and by acquisition, within our disciplined financial

framework."

FIRST QUARTER FUM COMMENTARY

FUM movements by product type

$bn FUM at Sales Redemptions Net inflows Investment FX Other FUM at

31 Dec / (outflows) movement 31 March

2015 2016

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Alternative 44.6 3.1 (2.4) 0.7 0.5 0.7 (0.6) 45.9

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Quant (AHL

/ Numeric) 16.4 1.9 (0.6) 1.3 0.8 0.3 (0.1) 18.7

Discretionary

(GLG) 16.3 0.4 (1.0) (0.6) (0.3) 0.2 (0.2) 15.4

Fund of funds

(FRM) 11.9 0.8 (0.8) - - 0.2 (0.3) 11.8

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Long only 32.8 2.0 (2.1) (0.1) (1.2) - - 31.5

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Quant (Numeric

/ AHL) 18.6 0.8 (0.4) 0.4 - - - 19.0

Discretionary

(GLG) 14.2 1.2 (1.7) (0.5) (1.2) - - 12.5

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Guaranteed 1.3 - (0.1) (0.1) - 0.1 (0.1) 1.2

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

Total 78.7 5.1 (4.6) 0.5 (0.7) 0.8 (0.7) 78.6

---------------- -------- ------ ------------ -------------- ----------- ---- ------ ----------

ALTERNATIVES

Quant

Quant alternative (AHL / Numeric) FUM increased by $2.3 billion

during the quarter driven by net inflows, positive investment

performance and positive FX movements. The net inflows of $1.3

billion included $0.3 billion into Dimension, $0.3 billion into

Alpha, $0.2 billion into Diversified and $0.5 billion into other

AHL styles, which included $0.4 billion into our US onshore 40-Act

strategy. Positive investment performance across the majority of

AHL strategies drove the $0.8 billion of investment movement, with

Evolution up 7.6%, Diversified up 5.4%, Dimension up 4.2%, and

Alpha up 3.9% in the quarter. Positive FX movements of $0.3 billion

were a result of the US Dollar weakening against the Euro, Japanese

Yen and Australian Dollar. As at 31 March 2016, 71% of AHL open

ended funds were at high watermark and 10% were within 5% of high

watermark.

Discretionary

Discretionary alternatives (GLG) FUM decreased by $0.9 billion

during the period, primarily driven by net outflows and negative

investment performance. The net outflows of $0.6 billion were

mainly from our North American equity and convertibles strategies.

The negative investment movement of $0.3 billion in the quarter was

due to negative performance across the range of strategies. FX

movements were positive, increasing FUM by $0.2 billion in the

quarter. Other movements related to CLO maturities of $0.2 billion

in the period. As at 31 March 2016, 9% of GLG performance fee

eligible FUM was at high watermark and 55% was within 5% of high

watermark.

Fund of funds

Alternative fund of funds (FRM) FUM reduced by $0.1 billion

during the quarter as a result of negative other movements,

partially offset by positive FX movements. Net flows were flat for

the quarter. Sales included $0.7 billion from recently awarded

managed account mandates, and redemptions included $0.4 billion

from FRM Diversified strategies. Investment movement was flat for

the quarter. Positive FX movements increased FUM by $0.2 billion

due to the weakening of the US Dollar in the period against the

Japanese Yen and Euro. The negative other movements of $0.3 billion

related to investment exposure adjustments.

LONG ONLY

Quant

Quant long only (Numeric / AHL) FUM increased by $0.4 billion

during the quarter as a result of net inflows, mainly into Numeric

Emerging Markets. Investment movement was broadly flat across

Numeric's range of strategies. The asset weighted performance

relative to a blend of applicable benchmarks (net of fees) across

Numeric's product range was approximately -0.7%(1) for the

quarter.

Discretionary

Discretionary long only (GLG) FUM decreased by $1.7 billion due

to negative investment movement and net outflows in the period. Net

outflows of $0.5 billion were mainly in relation to Japan

CoreAlpha. The negative investment movement of $1.2 billion was

mainly driven by Japan CoreAlpha, which was down 16.3% for the

period (compared to the Topix which was down 12.0%).

GUARANTEED PRODUCTS

Guaranteed product FUM decreased by $0.1 billion in the quarter

to $1.2 billion. There were no guaranteed product launches and

redemptions were $0.1 billion. Positive FX movements increased FUM

by $0.1 billion due to the weakening of the US Dollar against the

Australian Dollar and Euro. Negative other movements of $0.1

billion related to maturities during the quarter.

(1) Numeric's asset weighted alpha YTD to 31 March 2016 is

calculated using the asset weighted average of the performance

relative to the benchmark for all non-restricted strategy

composites available net of the highest management fees and, as

applicable, performance fees that can be charged.

FUM by manager

$bn 31 Mar 31 Dec 30 Sep 30 Jun 31 Mar

2016 2015 2015 2015 2015

------------------------- ------- ------- ------- ------- -------

AHL 19.2 16.9 17.9 15.8 16.5

------------------------- ------- ------- ------- ------- -------

AHL Diversified (inc.

Guaranteed) 4.6 4.1 4.4 4.3 5.1

AHL Alpha 4.5 3.9 4.0 3.0 3.7

AHL Evolution 2.9 2.7 3.0 2.9 3.0

AHL Dimension 4.6 4.1 4.2 3.6 2.4

Europe and Asia Plus 0.9 1.2 1.1 1.2 1.7

Other specialist styles 1.7 0.9 1.2 0.8 0.6

------------------------- ------- ------- ------- ------- -------

Numeric 19.4 19.0 17.2 18.4 17.8

------------------------- ------- ------- ------- ------- -------

Global 10.6 10.8 9.3 9.7 9.6

Emerging markets 2.6 2.1 1.9 2.5 2.4

US 4.9 4.8 4.6 4.7 4.3

Alternatives 1.3 1.3 1.4 1.5 1.5

------------------------- ------- ------- ------- ------- -------

GLG 27.9 30.5 31.0 33.3 33.3

------------------------- ------- ------- ------- ------- -------

Alternatives 15.4 16.3 17.4 18.0 17.2

------------------------- ------- ------- ------- ------- -------

Europe equity 4.0 3.9 4.0 3.9 4.0

North America equity 1.1 1.3 2.2 2.5 2.2

Other equity 0.6 0.5 0.6 0.6 0.5

Convertibles 3.6 4.0 4.0 4.0 3.8

(MORE TO FOLLOW) Dow Jones Newswires

April 15, 2016 02:00 ET (06:00 GMT)

Market Neutral 0.5 0.6 0.6 0.7 0.7

CLO 5.0 5.1 5.2 5.5 5.3

Multi-strategy 0.6 0.9 0.8 0.8 0.7

Long only 12.5 14.2 13.6 15.3 16.1

------------------------- ------- ------- ------- ------- -------

Japan equity 7.0 8.6 7.7 8.7 10.3

Europe equity 2.2 2.0 1.7 1.6 1.2

UK equity 0.7 0.8 0.6 0.6 0.5

Other equity 1.0 1.1 1.4 1.7 1.3

Fixed income 1.6 1.7 2.2 2.7 2.8

------------------------- ------- ------- ------- ------- -------

FRM 12.1 12.3 10.7 11.3 10.5

------------------------- ------- ------- ------- ------- -------

Infrastructure and

direct access 3.9 3.2 1.5 2.1 2.3

Segregated 2.8 2.6 3.1 3.0 3.0

Diversified FoHF 4.2 4.6 4.2 4.6 3.2

Thematic FoHF 0.9 1.5 1.5 1.1 1.4

Guaranteed 0.3 0.4 0.4 0.5 0.6

------------------------- ------- ------- ------- ------- -------

Total 78.6 78.7 76.8 78.8 78.1

------------------------- ------- ------- ------- ------- -------

Investment performance

Total Return Annualised Return

---------------------------------------- ---------------------- --------------------------

3 years

3 months 12 months to 5 years

to to 31 Mar to 31

31 Mar 16 31 Mar 16 16 Mar 16

---------------------------------------- ---------- ---------- ----------------- -------

AHL

AHL Diversified(1) 5.4% -5.3% 8.6% 5.4%

AHL Alpha(2) 3.9% -0.7% 7.4% 5.3%

AHL Evolution(3) 7.6% 1.5% 15.0% 16.7%

AHL Dimension(4) 4.2% 8.6% 7.9% 5.9%

---------------------------------------- ---------- ---------- ----------------- -------

GLG ALTERNATIVES

Equity

Europe

GLG European Long Short(5) -2.4%* -0.1%* 1.4%* 3.1%*

Man GLG European Equity Alternative

UCITS(6) -2.6% -0.6% 0.7% n/a

Man GLG European Alpha Alternative

UCITS(7) -0.8% -1.6% 0.5% 1.1%

UK

Man GLG Alpha Select UCITS(8) -0.5% 1.6% 5.6% 1.3%

Global

Man GLG Cred-Eq Alternative Class(9) -5.5% -11.1% n/a n/a

Man GLG Value Opportunity (10) -4.8%* -11.3%* n/a n/a

Convertibles

GLG Global Convertible(11) -3.0% -4.4% 0.8% 1.1%

Man GLG Global Convertible UCITS(12) -2.8% -3.7% 2.7% 2.4%

Market neutral

GLG Market Neutral(13) -2.6%* -2.1%* -1.3%* 1.8%*

Man GLG European Distressed(14) -1.9%* 4.1%* 1.0%* 2.6%*

Multi-strategy

Man Multi-Strategy(15) -2.0%* 0.0%* 1.7%* 1.3%*

---------------------------------------- ---------- ---------- ----------------- -------

GLG LONG ONLY

Man GLG Europe Plus ETF(16) -6.1% -12.3% 6.4% 6.6%

Man GLG Japan Core Alpha Equity(17) -16.3% -15.8% 10.5% 9.9%

Man GLG Global Equity UCITS(18) -4.7% -9.2% 6.5% 5.4%

Man GLG Strategic Bond(19) 2.4% -4.2% 2.6% n/a

Man GLG Undervalued Assets(20) -4.4% -1.2% n/a n/a

Man GLG European Equity(21) -5.8% -9.1% 10.6% 7.5%

Man GLG UK Select(22) -2.4% -4.8% 8.0% 6.8%

Man GLG Continental European Growth(23) 1.5% 19.0% 18.1% 12.4%

---------------------------------------- ---------- ---------- ----------------- -------

Total Return Annualised Return

3 years 5 years

3 months 12 months to to

to to 31 Mar 31 Mar

31 Mar 16 31 Mar 16 16 16

FRM

FRM Diversified II(24) -3.4% -5.9% 1.0% 1.1%

Indices

World stocks(25) -1.8% -4.4% 8.8% 8.4%

World bonds(26) 3.8% 3.1% 4.2% 4.9%

Corporate bonds(27) 7.4% 3.0% 5.9% 8.9%

Hedge fund indices

HFRI Fund of Funds Composite Index(28) -2.5% -5.1% 2.0% 1.4%

HFRI Fund Weighted Composite Index(28) -0.8% -4.1% 2.1% 1.8%

HFRX Global Hedge Fund Index(28) -1.9% -7.4% -0.9% -1.2%

HFRI Fund of Funds Conservative

Index(28) -2.2% -3.7% 2.0% 1.6%

Style indices

Barclay BTOP 50 Index(29) 1.8% -3.8% 3.9% 1.8%

HFRI Equity Hedge (Total) Index(28) -1.7% -4.5% 2.6% 1.8%

HFRI EH: Equity Market Neutral

Index(28) 0.6% 3.3% 4.1% 2.7%

HFRI Macro (Total) Index(28) 1.2% -3.3% 1.2% 0.2%

HFRI Relative Value (Total) Index(28) 0.0% -2.0% 2.5% 3.7%

--------------------------------------- ---------- ---------- --------- --------

Total Return Annualised Return

------------------------------- ---------------------------- -------------------------------

NUMERIC LONG ONLY 3 months to 12 months to 3 years to 5 years to

31 Mar 16 31 Mar 16 31 Mar 16 31 Mar 16

------------------------------- ------------- ------------- ------------------ -----------

U.S. Large Cap Equity

------------------------------- ------------- ------------- ------------------ -----------

Numeric Core 0.1% -1.4% 13.5% 13.4%

Russell 1000(R)# 1.2% 0.5% 11.5% 11.4%

Relative Return -1.1% -1.9% 2.0% 2.0%

Numeric All Cap Core -0.1% -4.2% 11.5% 12.5%

Russell 3000(R)# 1.0% -0.3% 11.1% 11.0%

Relative Return -1.1% -3.9% 0.4% 1.5%

Numeric Large Cap Core -0.4% -1.4% 13.9% 13.6%

S&P 500(R)# 1.3% 1.8% 11.8% 11.6%

Relative Return -1.8% -3.2% 2.1% 2.1%

Numeric Value -0.2% -2.2% 11.9% 12.5%

Russell 1000 Value(R)# 1.6% -1.5% 9.4% 10.2%

Relative Return -1.9% -0.7% 2.5% 2.2%

Numeric Amplified Core

(130/30) -1.0% 1.5% 17.3% 16.9%

S&P 500(R)# 1.3% 1.8% 11.8% 11.6%

Relative Return -2.3% -0.2% 5.5% 5.3%

------------------------------- ------------- ------------- ------------------ -----------

U.S. Small Cap Equity

------------------------------- ------------- ------------- ------------------ -----------

Numeric Small Cap Core -2.1% -9.5% 8.7% 9.8%

Russell 2000(R)# -1.5% -9.8% 6.8% 7.2%

Relative Return -0.5% 0.2% 1.8% 2.6%

Numeric Small Cap Growth -4.5% -12.4% 9.0% 9.9%

Russell 2000 Growth(R)# -4.7% -11.8% 7.9% 7.7%

Relative Return 0.1% -0.6% 1.1% 2.2%

Numeric Small Cap Value 0.3% -7.6% 8.7% 9.7%

Russell 2000 Value(R)# 1.7% -7.7% 5.7% 6.7%

Relative Return -1.4% 0.1% 2.9% 3.1%

Numeric SMID Growth -2.6% -10.6% 10.8% 10.3%

Russell 2500 Growth(R)# -2.7% -9.6% 9.2% 8.8%

Relative Return 0.0% -1.0% 1.6% 1.6%

------------------------------- ------------- ------------- ------------------ -----------

Global / Non-U.S. Equity

------------------------------- ------------- ------------- ------------------ -----------

(MORE TO FOLLOW) Dow Jones Newswires

April 15, 2016 02:00 ET (06:00 GMT)

Numeric Global Core -1.5% -2.0% 10.7% n/a

MSCI World(R)# -0.3% -3.5% 6.8% n/a

Relative Return -1.2% 1.4% 3.9% n/a

Numeric Global Small Cap -0.2% -2.6% n/a n/a

MSCI World Small Cap(R)# 0.7% -3.9% n/a n/a

Relative Return -0.9% 1.3% n/a n/a

Numeric EAFE Core -1.3% -0.8% n/a n/a

MSCI EAFE(R)# -3.0% -8.3% n/a n/a

Relative Return 1.7% 7.5% n/a n/a

Numeric International Small

Cap -0.4% 6.0% 9.2% 9.5%

MSCI World ex U.S. Small

Cap(R)# 0.6% 2.0% 5.9% 4.7%

Relative Return -1.0% 4.0% 3.3% 4.8%

Numeric Europe Core (EUR) -6.3% -10.1% 11.4% 10.8%

MSCI Europe(R)# (EUR) -7.1% -13.7% 6.9% 6.6%

Relative Return 0.7% 3.6% 4.5% 4.1%

Numeric Japan Core (YEN) -12.9% -9.6% 12.0% 13.2%

MSCI Japan(R)# (YEN) -12.7% -12.9% 10.2% 10.6%

Relative Return -0.3% 3.3% 1.8% 2.6%

Numeric Asia Pacific ex Japan 0.8% -8.6% n/a n/a

Russell Asia Pacific ex

Japan(R)# 1.4% -10.4% n/a n/a

Relative Return -0.6% 1.8% n/a n/a

------------------------------- ------------- ------------- ------------------ -----------

Emerging Markets

------------------------------- ------------- ------------- ------------------ -----------

Numeric Emerging Markets Alpha 5.1% -11.5% 1.5% 2.1%

MSCI Emerging Markets(R)# 5.7% -12.0% -4.5% -4.1%

Relative Return -0.7% 0.5% 6.0% 6.3%

Numeric Emerging Markets Core 4.5% -11.3% n/a n/a

MSCI Emerging Markets(R)# 5.7% -12.0% n/a n/a

Relative Return -1.2% 0.7% n/a n/a

NUMERIC LONG/SHORT

Numeric US Market Neutral -0.9% 3.2% 2.8% 4.5%

Numeric World Market Neutral -3.4% 0.7% 3.2% 4.3%

Numeric Alternative Market

Neutral -0.2% 2.2% 5.2% 5.6%

Numeric Absolute Return 2.0% 2.5% 4.7% 4.5%

ML 91-Day T-Bill(R) 0.1% 0.1% 0.1% 0.1%

------------------------------- ------------- ------------- ------------------ -----------

Source: Man database, Bloomberg, MSCI and Source. There is no guarantee of trading

performance

and past or projected performance is not a reliable indicator of future performance. Returns

may increase or decrease as a result of currency fluctuations.

1) Represented by Man AHL Diversified plc from 26 March 1996 to 29 October 2012, and by Man

AHL Diversified (Guernsey) USD Shares - Class A from 30 October 2012 to date. The

representative

product was changed at the end of October 2012 due to legal and/or regulatory restrictions

on Man AHL Diversified plc preventing the product from accessing the Programme's revised

target

allocations. Both funds are valued weekly; however, for comparative purposes, statistics

have

been calculated using the best quality price that is available at each calendar month end,

using estimates where a final price is unavailable. Where a price, either estimate or final

is unavailable on a calendar month end, the price on the closest date prior to the calendar

month end has been used.

2) Represented by AHL Alpha plc from 17 October 1995 to 30 September 2012, and by AHL

Strategies

PCC Limited: Class Y AHL Alpha USD Shares from 1 October 2012 to 30 September 2013. The

representative

product was changed at the end of September 2012 due to the provisioning of fund liquidation

costs in October 2012 for AHL Alpha plc, which resulted in tracking error compared with

other

Alpha Programme funds. Both funds are valued weekly; however, for comparative purposes,

statistics

have been calculated using the best quality price that is available at each calendar month

end, using estimates where a final price is unavailable. Where a price, either estimate or

final is unavailable on a calendar month end, the price on the closest date prior to the

calendar

month end has been used. Both of the track records have been adjusted to reflect the fee

structure

of AHL Alpha (Cayman) Limited - USD Shares. From 30 September 2013, the actual performance

of AHL Alpha (Cayman) Limited - USD Shares is displayed.

3) Represented by AHL Strategies PCC: Class G AHL Evolution USD from 1 November 2006 to 30

November 2011; and by the performance track record of AHL Investment Strategies SPC: Class

E AHL Evolution USD Notes from 1 December 2011 to 30 November 2012. From 1 December 2012,

the track record of AHL (Cayman) SPC: Class A1 Evolution USD Shares has been shown. All

returns

shown are net of fees.

4) Represented by AHL Strategies PCC Limited: Class B AHL Dimension USD Shares from 3 July

2006 to 31 May 2014, and by AHL Dimension (Cayman) Ltd - F USD Shares Class from 1 June 2014

until 28 February 2015 when AHL Dimension (Cayman) Ltd - A USD Shares Class is used.

Representative

fees of 1.5% Management Fee and 20% Performance Fee have been applied.

5) Represented by GLG European Long Short Fund - Class D Unrestricted - EUR.

6) Represented by Man GLG European Equity Alternative IN EUR.

7) Represented by Man GLG European Alpha Alternative IN EUR.

8) Represented by Man GLG Alpha Select Alternative IN H EUR.

9) Represented by Man GLG Cred-Eq Alternative Class IN EUR

10) Represented by Man GLG Value Opportunity Class B USD Unrestricted

11) Represented by GLG Global Convertible Fund - Class A - USD.

12) Represented by Man GLG Global Convertible UCITS Fund - Class IM USD.

13) Represented by GLG Market Neutral Fund - Class Z Unrestricted - USD.

14) Represented by Man GLG European Distressed Fund - Class A - USD.

15) Represented by the gross return of Man GLG Multi-Strategy Fund - Class A - USD Shares

until 31 December 2012. From 1 January 2013 the performance of Man Multi-Strategy Fund -

Class

G - USD Shares is displayed.

16) Represented by the official performance of Man GLG Europe Plus Source ETF net of a 0.75%

p.a. management fee and no performance fee. Provided by Source.

17) Represented by Man GLG Japan CoreAlpha Equity Fund - Class I JPY.

18) Represented by Man GLG Global Equity Fund - Class I T USD to Class I USD (13/05/2011).

19) Represented by Man GLG

Strategic Bond Fund Class A.

20) Represented by Man GLG Undervalued Assets

Fund - C Accumulation Shares.

21) Represented by Man GLG

European Equity Class I EUR

22) Represented by Man GLG UK

Select Fund Class A

23) Represented by Man GLG Continental European Growth Fund Class A Accumulation Shares

24) Represented by FRM

Diversified II USD A

25) Represented by MSCI World

Net Total Return Index hedged

to USD.

26) Represented by Citigroup World Government Bond Index hedged to USD (total return).

27) Represented by Citigroup

High Grade Corp Bond TR.

28) HFRI and HFRX index performance over the past 4 months is subject to change.

29) The historic Barclay BTOP

50 Index data is subject to

change.

Please note that the dates in brackets represent the date of the join in the linked track

records.

*Estimated.

Unless otherwise stated, returns are based on the performance of

unrestricted accounts or share classes within each strategy, as

applicable. Performance is net-of-fees unless otherwise stated.

Returns of accounts with client restrictions may differ.

#The reference index listed by Numeric is intended to best represent the

strategy's universe. Investors may choose to compare returns for their

accounts to different reference indices, resulting in differences in relative

return information. Comparison to an index is for informational purposes

only, as the holdings of an account managed by Numeric will differ from

the securities which comprise the index and may have greater volatility

than the holdings of an index.

Past or projected performance is no indication of future results. Returns

may increase or decrease as a result of currency fluctuations.

The information herein is being provided solely in connection with this

press release and is not intended to be, nor should it be construed or

used as, investment, tax or legal advice, any recommendation or opinion

regarding the appropriateness or suitability of any investment or strategy,

or an offer to sell, or a solicitation of an offer to buy, an interest

in any security, including an interest in any fund or pool described herein.

Enquiries

Andrea Waters

Head of Investor Relations

+44 20 7144 3508

andrea.waters@man.com

Rosanna Konarzewski

Global Head of Communications & Marketing

+44 20 7144 2072

rosanna.konarzewski@man.com

Finsbury

Michael Turner

+44 20 7251 3801

About Man Group

(MORE TO FOLLOW) Dow Jones Newswires

April 15, 2016 02:00 ET (06:00 GMT)

Man Group is one of the world's largest independent alternative

investment managers, and a leader in liquid investment strategies.

Across its four investment managers (Man AHL, Man FRM, Man GLG and

Man Numeric), Man Group has diverse hedge funds strategies and long

only products across equity, credit, managed futures, convertibles,

emerging markets and multi-manager solutions. At 31 March 2016, Man

Group's funds under management were $78.6 billion.

The original business was founded in 1783. Today, Man Group plc

is listed on the London Stock Exchange under the ticker EMG.L and

is a constituent of the FTSE 250 Index.

Man Group also supports many awards, charities and initiatives

around the world, including sponsorship of the Man Booker literary

prizes. Further information can be found at www.man.com.

Forward looking statements and other important information

This document contains forward-looking statements with respect

to the financial condition, results and business of Man Group plc.

By their nature, forward-looking statements involve risk and

uncertainty and there may be subsequent variations to estimates.

Man Group plc's actual future results may differ materially from

the results expressed or implied in these forward-looking

statements.

The content of the websites referred to in this announcement is

not incorporated into and does not form part of this announcement.

Nothing in this announcement should be construed as or is intended

to be a solicitation for or an offer to provide investment advisory

services.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTAKQDBABKDOQD

(END) Dow Jones Newswires

April 15, 2016 02:00 ET (06:00 GMT)

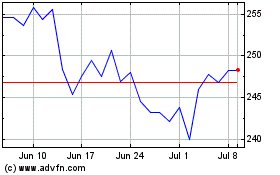

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

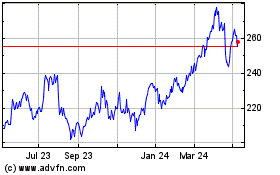

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024