Man Group plc Holding(s) in Company (2184A)

December 18 2014 - 11:00AM

UK Regulatory

TIDMEMG

RNS Number : 2184A

Man Group plc

18 December 2014

TR-1: NOTIFICATION OF MAJOR INTEREST IN SHARES

1. Identity of the issuer or the

underlying issuer of existing shares Man Group plc

to which voting rights are attached:

2 Reason for the notification (please tick the appropriate box

or boxes):

An acquisition or disposal of voting rights

------

An acquisition or disposal of qualifying financial instruments

which may result in the acquisition of shares already

issued to which voting rights are attached

------

An acquisition or disposal of instruments with similar

economic effect to qualifying financial instruments

------

An event changing the breakdown of voting rights

------

Other (please Delta variation on listed warrants and

specify): OTC options X

------------------- ---------------------------------------------- ------

3. Full name of person(s) subject Société Générale

to the notification obligation: SA (SG SA)

4. Full name of shareholder(s) (if

different from 3.):

-------------------------------------

5. Date of the transaction and date 16 December 2014

on which the threshold is crossed

or reached:

-------------------------------------

6. Date on which issuer notified: 18 December 2014

-------------------------------------

7. Threshold(s) that is/are crossed

or reached: Above 9%

-------------------------------------

8. Notified details:

A: Voting rights attached to shares

Class/type Situation previous Resulting situation after the triggering

of to the triggering transaction

shares transaction

if possible

using

the ISIN

CODE

---------------------- ---------------------------------------------------------

Number Number Number Number of voting % of voting rights

of of of shares rights

Shares Voting

Rights

---------- ---------- ----------- --------------------- ---------------------

Direct Direct Indirect Direct Indirect

---------- ---------- ----------- ---------- --------- --------- ----------

GB00B83VD954 2,093,497 2,093,497 1,487,736 1,487,736 374,535 0.08% 0.02%

---------- ---------- ----------- ---------- --------- --------- ----------

Ordinary

shares

---------- ---------- ----------- ---------- --------- --------- ----------

B: Qualifying Financial Instruments

Resulting situation after the triggering transaction

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date Conversion rights that rights

Period may be

acquired if

the

instrument is

exercised/ converted.

----------- ------------ ----------------------- ------------

C: Financial Instruments with similar economic effect to Qualifying

Financial Instruments

Resulting situation after the triggering transaction

Type of financial Exercise Expiration Exercise/ Number of voting % of voting

instrument price date Conversion rights instrument rights

period refers to

---------- ----------- ------------ ------------------- -----------------

Nominal Delta

-------- -------

OTC call option 1.00 18.12.2015 18.12.2015 8,631,657 0.57% 0.49%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.25 18.12.2015 18.12.2015 6,809,931 0.57% 0.39%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 18.12.2015 18.12.2015 4,528,613 0.57% 0.26%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 2.00 21.12.2018 21.12.2018 3,652,217 0.57% 0.21%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.30 19.12.2014 19.12.2014 4,818,573 0.28% 0.27%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.00 19.12.2014 19.12.2014 4,999,326 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.15 19.12.2014 19.12.2014 4,999,125 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 21.12.2018 21.12.2018 2,740,041 0.28% 0.16%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.00 19.06.2015 19.06.2015 4,625,957 0.28% 0.26%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.25 19.06.2015 19.06.2015 3,610,383 0.28% 0.21%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 19.06.2015 19.06.2015 2,053,634 0.28% 0.12%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.00 18.12.2015 18.12.2015 8,810,291 0.57% 0.50%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.25 18.12.2015 18.12.2015 7,125,541 0.57% 0.41%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 18.12.2015 18.12.2015 4,904,217 0.57% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 2.00 21.12.2018 21.12.2018 3,806,335 0.57% 0.22%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.30 19.12.2014 19.12.2014 4,986,180 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.00 19.12.2014 19.12.2014 4,999,631 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.15 19.12.2014 19.12.2014 4,999,630 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 21.12.2018 21.12.2018 2,814,747 0.28% 0.16%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.00 19.06.2015 19.06.2015 4,703,856 0.28% 0.27%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.25 19.06.2015 19.06.2015 3,813,081 0.28% 0.22%

--------- ----------- ------------ ------------------- -------- -------

OTC call option 1.50 19.06.2015 19.06.2015 2,307,848 0.28% 0.13%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.00 18.12.2015 18.12.2015 8,490,028 0.55% 0.48%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.25 18.12.2015 18.12.2015 7,125,541 0.57% 0.41%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.50 18.12.2015 18.12.2015 4,895,684 0.57% 0.28%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 2.00 21.12.2018 21.12.2018 3,803,450 0.57% 0.22%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.30 19.12.2014 19.12.2014 4,986,180 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.00 19.12.2014 19.12.2014 4,999,631 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.15 19.12.2014 19.12.2014 4,999,630 0.28% 0.28%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.50 21.12.2018 21.12.2018 2,814,747 0.28% 0.16%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.00 19.06.2015 19.06.2015 4,703,856 0.28% 0.27%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.25 19.06.2015 19.06.2015 3,813,081 0.28% 0.22%

--------- ----------- ------------ ------------------- -------- -------

Listed call

warrant 1.50 19.06.2015 19.06.2015 2,281,668 0.28% 0.13%

--------- ----------- ------------ ------------------- -------- -------

Total (A+B+C)

Number of voting rights Percentage of voting rights

----------------------------

159,516,581 9.08%

----------------------------

9. Chain of controlled undertakings through which the voting

rights and/or the

financial instruments are effectively held, if applicable:

Société Générale Acceptance (SGA)

As Société Générale Option Europe (SGOE)

individually holds more that 3%, please find below the details

of its holding:

* Voting rights attached to shares: 374,535

representing 0.02%;

* Voting rights attached to derivatives (listed call

warrants): 52,913,496 representing 3.01%;

Total: 53,288,031 voting rights representing 3.03%.

Proxy Voting:

10. Name of the proxy holder:

11. Number of voting rights proxy

holder will cease to hold:

12. Date on which proxy holder will

cease to hold voting rights:

13. Additional information:

14. Contact name: Rachel Rowson

--------------

15. Contact telephone number: 020 7144 1732

--------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

HOLLLFSSFVLTLIS

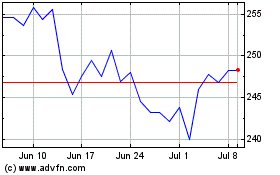

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

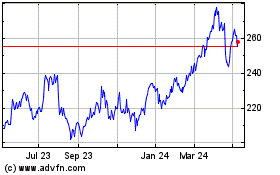

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024