Lloyds Banking 1Q Net Profit Falls 44%

April 28 2016 - 2:50AM

Dow Jones News

By Max Colchester

LONDON--Lloyds Banking Group PLC said first-quarter net profit

fell 44% in to 531 million pounds ($773.72 million) after it was

hit by a series of restructuring charges.

The British retail bank, which is about 9% owned by the U.K.

government, said income dropped 1% to GBP4.4 billion in the

quarter. Underlying profit, which strips out a series of one off

charges, came to GBP2.1 billion, down 6% compared to the same

period a year earlier.

As with other lenders, Lloyds has been struggling with low

interest rates which have eaten into profitability. The bank was

also hit with the cost of splitting out and selling around 600

branches to form a new standalone bank.

The bank also took a GBP790 million loss on high interest paying

bonds it issued to investors during the financial crisis and which

have been redeemed.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

April 28, 2016 02:35 ET (06:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

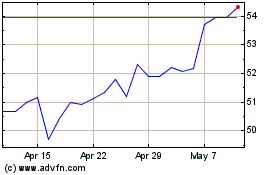

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024