Johnson Controls CEO Molinaroli Pushes for Higher-Margin Businesses

January 25 2016 - 5:21PM

Dow Jones News

By Bob Tita

Alex Molinaroli spent nearly three decades working at Johnson

Controls Inc. as it built itself into a giant manufacturing

company. He's spent much of his two-plus-years as chief executive

working to pull it apart.

Mr. Molinaroli came in as CEO in October 2013 determined to

reduce the Milwaukee-based company's reliance on car seats,

dashboards, roof liners and other automotive components. Those

auto-related businesses--built up under his predecessors with a

series of acquisitions--accounted for more than two-thirds of the

company's annual revenue, which totaled $42.7 billion in fiscal

2013.

But Mr. Molinaroli argued that continued exposure to the auto

industry caused investors to discount its stock to account for

sharp swings in vehicle demand and typically low margins on sales

of auto parts.

Just the ninth CEO since the company's 1885 founding, Mr.

Molinaroli set out to recreate Johnson Controls with a focus on

higher-margin businesses mostly connected to providing

climate-control equipment and other systems for commercial

buildings, schools and hospitals. The deal announced Monday to

merge with Tyco International PLC doubles down on that strategy,

resulting in a much larger company but one focused on building

operations.

Johnson Controls already owned York-brand heating and air

conditioning gear and the systems to control it, giving Mr.

Molinaroli a base to build on. But the pivot from the automotive

industry also was risky given the size of that business: Johnson

Controls was the world's sixth-largest supplier of parts based on

sales . The previous CEO, Stephen Roell, had invested more than $1

billion in the auto-seating businesses just before retiring.

Mr. Molinaroli wasted little time . Even before officially

taking the CEO job, he began selling parts the automotive

electronics business. In 2014, when he couldn't find an outright

buyer for the company's low-margin auto-interiors business, he spun

it off into a joint venture with Chinese supplier Yanfeng

Automotive Trim Systems Co.

Last July came the biggest move, a plan to spin off the

auto-seating business to shareholders--a move that would slice off

more than half of Johnson Controls' annual sales and complete its

exit from supplying components for new vehicles. The new company,

which will be called Adient, is scheduled start trading this

fall.

Mr. Molinaroli, who joined Johnson Controls in 1983 as part of

its building-efficiency unit, has used the proceeds from the sales

to bolster the buildings business, buying ventilation-equipment

maker Air Distribution Technologies Inc. for $1.6 billion and

striking a deal for a 60% stake in Hitachi Ltd.'s commercial

air-conditioning business. Johnson Controls expects revenue of

about $32 billion in the current fiscal year.

Mr. Molinaroli's tenure hasn't been without hitches. In 2014,

the company's board fired a management consulting firm following

his disclosure of an extramarital affair with one of the firm's

principals. The company's board determined that no conflict of

interest had occurred but said he hadn't complied with the

company's ethics policy and reduced his 2014 performance incentive

bonus by 20% over the incident.

Once the merger with Tyco is complete, which is expected by the

end of 2016, Mr. Molinaroli will stay on as CEO and chairman for 18

months. After that, he'll be replaced as CEO by Tyco Chief

Executive George Oliver; Mr. Molinaroli will turn over the

chairman's title to Mr. Oliver 12 months after relinquishing the

CEO's job.

Mr. Molinaroli said in an interview, "Certainly we've got a lot

on our plate, [but] the time frame is right" for him to exit the

company.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

January 25, 2016 17:06 ET (22:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

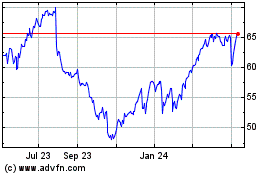

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

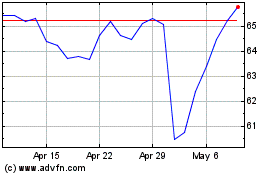

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024