Indian Rupee Off 5-day High Vs U.S. Dollar After RBI Rate Cut

March 04 2015 - 1:13AM

RTTF2

The Indian rupee retreated from its early high against the U.S.

dollar in late morning deals on Thursday, after the Reserve Bank of

India slashed rates unexpectedly on the back of soft inflation.

The central bank cut its repo rate by 25 basis points to 7.50

percent with immediate effect. Consequently, the reverse repo rate

was adjusted to 6.50 percent. The bank last reduced its key rates

by 25 basis points in January.

The cash reserve ratio was kept unchanged at 4.00 percent.

Given low capacity utilisation and still-weak indicators of

production and credit off-take, it is appropriate for the Reserve

Bank to be pre-emptive in its policy action to utilize available

space for monetary accommodation, the bank said.

The rupee reversed from an early 5-day high of 61.56 against the

greenback and edged down to 61.92. The rupee may possibly find

support around the 62.5 zone.

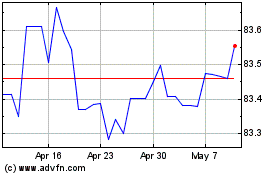

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

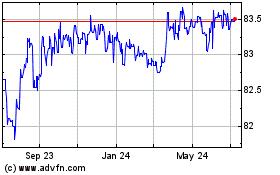

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024