GOL Announces its 4Q14 Results

March 30 2015 - 10:05PM

PR Newswire (US)

SAO PAULO, March 30, 2015 /PRNewswire/ -- GOL Linhas

Aereas Inteligentes S.A. (NYSE: GOL and BM&FBOVESPA: GOLL4),

(S&P: B, Fitch: B-, Moody's: B3), the largest low-cost and

best-fare airline in Latin

America, announces its 4Q14 Results.

Highlights

- Operating income (EBIT) of R$505 million in

2014, with an operating margin of 5.0%, up

89.8% compared to R$266 million

recorded in 2013. In 4Q14, EBIT came to

R$170.7 million, a 4.8% improvement

over 4Q13, with a margin of 6.3%, up by 0.3 percentage point.

- Net revenue reached R$10 billion in the year, 12.4% more than in

2013, being R$9.0 billion in

passenger revenue and R$1 billion in ancillary

revenues, increasing its share of total revenue from 9.3%, in

2013, to 10.1%. International

revenue amounted to R$1.2 billion, equivalent to 12% of the total. In

4Q14, net revenue totaled R$2.7 billion, in line with 4Q13.

- EBITDAR came to R$1.813 billion, with a margin of 18.0%, 18.8% up

vs. 2013 and the Company's highest ever annual figure. In 4Q14,

EBITDAR amounted to R$482.2 million,

with a margin of 17.7%.

- The consolidated load factor increased by 7 percentage points in the year,

reaching 76.9%, with the domestic up by 7

percentage points to 77.8%, and international load factors up by

8.3 percentage points to 71%. In 4Q14, the consolidated load factor was 78.7%, 3.9 percentage points

higher than 4Q13.

- Net RASK came to R$20.33 cents in 2014, 12.7% more than 2013 and

total CASK wasR$19.31 cents, up by 10,3%. CASK ex-fuel increased by 12.8% for the same period.

- In 2014, GOL obtained neutral operating

cash flow and closed the year with a cash position of

R$2.5 billion, representing 25% of

its last 12 months net revenue.

- The financial leverage ratio (adjusted gross debt/EBITDAR) was 6.7x,

versus 6.9x at the end of 2013, benefited by improved EBITDAR and

partially affected by the 13.4% depreciation of the real.

- In 2014, GOL continued with its Liability

Management initiatives. Dollar-denominated debt fell by 5% or

US$97 million over 2013 , while debt

in Reais (ex-Smiles) remained flat.

For further information visit

www.voegol.com.br/ir

CONTACTS

INVESTOR RELATIONS

Phone: +55 (11) 2128-4700

E-mail: ri@golnaweb.com.br

CORPORATE COMMUNICATIONS

Phone: +55 (11) 2128-4183

E-mail: comcorp@golnaweb.com.br

SOURCE GOL Linhas Aéreas Inteligentes S.A.

Copyright 2015 PR Newswire

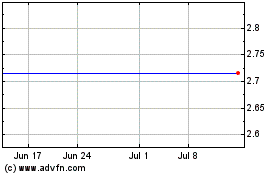

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

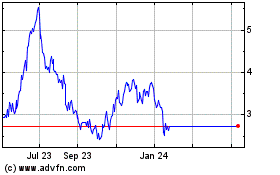

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024