GE to Acquire Metem

December 28 2015 - 9:50AM

Dow Jones News

General Electric Co. agreed to acquire privately-held Metem

Corp., in a deal that aims to bolster GE's competitiveness in

heavy-duty gas turbine engines.

Financial terms of the deal, expected to close in the first

quarter of 2016, weren't provided.

Metem is a provider of precision cooling hole manufacturing

technologies that enable turbine engines to function more

efficiently. GE, which has had a relationship with the New Jersey

company since the 1970s, is Metem's largest customer.

During November, GE completed its acquisition of Alstom SA's

power business, expanding GE's power business. The Metem deal aims

to help lower the overall cost base of products made by GE's power

unit.

GE is in the midst of a multiyear effort to return its focus

back toward heavy industrial manufacturing and away from financial

services.

It took more than 18 months and significant concessions for GE

to complete its $10.3 billion purchase of the energy assets of

Alstom SA, the company's largest acquisition ever and a huge bet on

the business of coal- and gas-fueled electricity-generating

turbines.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

December 28, 2015 09:35 ET (14:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

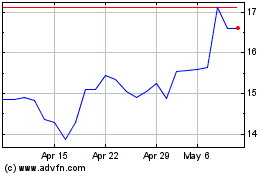

Alstom (EU:ALO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Alstom (EU:ALO)

Historical Stock Chart

From Sep 2023 to Sep 2024