FIFTH THIRD BANCORP

Profit, Revenue Rise

Fifth Third Bancorp said its profit and revenue increased as

loans and deposits grew.

Earnings beat Wall Street estimates as the company said results

were strong despite a "tepid economic environment."

The bank posted earnings of $516 million, compared with $381

million a year earlier. On a per-share basis, earnings rose to 65

cents from 45 cents. Revenue at the Cincinnati-based bank increased

8.3% to $1.75 billion. Analysts had expected 40 cents a share in

earnings and $1.52 billion in revenue, according to Thomson

Reuters.

Expenses grew by 3%, driven by increased salary and employee

benefits that were partially offset by cheaper occupancy costs and

equipment expenses. Total business loans grew by 1.5% as consumer

loans fell 1.9% due to increased residential mortgage and

commercial construction loans. Net interest margin, an important

measure of lending profitability, fell to 2.88% from 2.89% last

year.

--Austen Hufford

TRAVELERS

Premium Volume Increases to Record

Travelers Cos. said third-quarter operating earnings fell 24%,

as premium volume hit a record but the company was up against an

unusually strong year-earlier quarter.

Operating earnings of $701 million, or $2.40 a share, were down

from $918 million, or $2.93 a share, a year earlier. Operating

earnings are the industry benchmark because they exclude realized

capital gains and losses in investment portfolios. Analysts

expected operating profit of $2.38. Overall, Travelers reported a

profit of $716 million, or $2.45 a share, down from $928 million,

or $2.97 a share, a year earlier.

New York-based Travelers is one of the first big

property-casualty insurers to release third-quarter earnings, and

its results are watched closely as a bellwether for others that

follow. Travelers, part of the Dow Jones Industrial Average, is a

leading seller of insurance to U.S. businesses, and sells car and

home insurance to individuals and families.

Net premiums written increased 3.2% to $6.39 billion. Analysts

polled by Thomson Reuters expected net premiums written of $6.37

billion. The Travelers auto-insurance business delivered some of

the company's strongest premium growth, while the

business-insurance unit posted flat net written premiums.

Travelers cited hail storms in the western U.S. and flooding in

the southeast as a factor in results. But it and other

private-sector insurers largely were spared of major catastrophe

damage when Hurricane Hermine landed in Florida but quickly

weakened. The storm left extensive power outages over the Labor Day

weekend on the East Coast but relatively modest claims volume.

Analysts are expected to focus more on any comments during

Travelers' earnings call on Thursday regarding Hurricane Matthew, a

major storm that threatened to hit Florida in early October but

stayed offshore to then make landfall in South Carolina. Its damage

will show up in insurers' fourth-quarter earnings. Matthew caused

flooding and widespread power outages as it moved up the U.S.

Atlantic Coast and took a toll on North Carolina's agricultural

sector.

In the year-earlier period, catastrophe claims were at an

abnormally low level, contributing to the tough comparison

year-over-year.

More broadly, the insurance industry continues to face

challenges from low interest rates, which depress income earned

from investing customers' premium dollars until needed to pay

claims. Travelers said its investment income fell 5.2%, as its

investment team put maturing bonds and new money to work at lower

yields.

For the latest quarter, Travelers reported that its catastrophe

losses, net of reinsurance, reached $89 million, compared with $85

million a year earlier.

--Tess Stynes, Leslie Scism

CONSUMER TRENDS

Among Unbanked, Prepaid Cards Gain

More households that don't have bank accounts are using prepaid

cards for basic financial services, such as making purchases,

receiving deposits and saving for the future, a government survey

found.

Among U.S. households that have no access to the regular banking

system, 27% reported using prepaid cards in the 12 months before

June 2015, when the survey was taken, up from 22% in 2013. The

Federal Deposit Insurance Corp. survey, released Thursday, found

that 9.8% of all households reported using prepaid cards, up from

7.9% in 2013.

The survey, done in partnership with the U.S. Census Bureau,

collected responses from more than 36,000 households.

--Yuka Hayashi

(END) Dow Jones Newswires

October 21, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

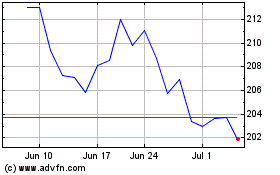

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024