European Shares Advance on Strong Earnings, Confident Fed -- Update

May 04 2017 - 6:12AM

Dow Jones News

By Riva Gold and Ese Erheriene

European stocks and S&P 500 futures climbed Thursday on

upbeat corporate results and signs of a firming economy, brushing

off a steep drop in commodity prices.

The Stoxx Europe 600 was up 0.4% in morning trading while

Germany's DAX index rose 0.7% from a record high as earnings

reports pushed up the oil and gas and banking sectors.

Shares of Royal Dutch Shell PLC climbed 2.9% after the energy

giant said first-quarter profit more than quadrupled from a year

ago, while HSBC Holdings PLC rose 2.2% after reporting

better-than-expected first quarter profit.

Investors also drew encouragement from fresh signs of health in

the eurozone economy. IHS Markit raised its estimate for the

eurozone's composite purchasing managers indexes in April after a

six-year high in March. while data showed eurozone retail sales

rose for the third straight month.

A gauge of Italy's services sector meanwhile surpassed

expectations to reach its highest since 2007, sending Italy's FTSE

MIB index up 1.3%.

The euro climbed 0.3% against the dollar to $1.0923, not far off

its high of the year, while the British pound rose 0.1% to $1.2886

after the U.K.'s services index for April beat forecasts.

Futures pointed to a 0.2% opening gain for the S&P 500, as

investors also digested earnings from Facebook Inc. and Kraft Heinz

Co.

In government bonds, the gap between French and German bonds

narrowed to around its lowest since November in morning trading

following a live head-to-head debate between French presidential

candidates Emmanuel Macron and Marine Le Pen late Wednesday, which

analysts said kept Mr. Macron in the lead.

"The tone of the last French presidential debate was at times

aggressive but failed to produce the sort of slip-up that could

materially alter Macron's roughly 20 points lead," strategists at

Mizuho wrote. The final vote takes place May 7.

Yields on 10-year German government bonds rose to 0.365% from

0.327% on Wednesday while French yields edged up a bit less to

0.756% from 0.737%. Investors had sold French debt and bought

German debt earlier in the year to protect against the chance that

the country could elect a euroskeptic candidate and ultimately

leave the currency union. Yields move inversely to prices.

France's CAC-40 index was up 0.7%, while the wider Euro Stoxx 50

index of blue-chip eurozone companies climbed 0.6%, bringing this

year's gains close to 10%.

The WSJ Dollar Index, which tracks the dollar against a basket

of currencies, was last down 0.1% after rising 0.5% on Wednesday.

U.S. 10-year Treasury yields rose to 2.335% Thursday from

2.309%.

The dollar and government bond yields had inched higher

Wednesday after the Fed left interest rates unchanged but said it

expected the economy to rebound from a soft first quarter,

signaling it is likely to continue gradually raising rates this

year if the data hold up.

"The key over the coming weeks will be the economic data from

the U.S.," said Lee Ferridge, head of multiasset strategy for North

America at State Street Global Markets.

Investors now price a 74% chance of a rate rise at the June

meeting, according to fed-funds futures tracked by CME Group, a

touch higher than before the meeting.

Gains in stocks on Thursday came despite a steep drop in

commodities prices that weighed on the basic resources sector, with

Brent crude oil last down 0.6% at $50.51 a barrel and metals prices

lower across the board amid concerns about Chinese demand for

commodities such as steel and iron.

A global fall in metals prices gained speed in Asian trading

Thursday as China's iron-ore futures opened at the 8% limit drop,

while copper futures in London were last down 0.4%, building on

Wednesday's steep declines. Gold fell 1% to $1,236 an ounce.

A Caixin reading on China's service-sector activity hit its

lowest level in nearly a year for April on Thursday, adding to

concerns about the country's economic health, though it remained in

expansion territory.

"China has been gradually but appreciably tightening credit,"

said Tina Byles Williams, chief investment officer at FIS Group,

noting that is slowly showing up in economic data and metal prices.

"I don't see catastrophe, but I do think there's a lot of

complacency in emerging market assets around China," she said.

The Shanghai Composite Index fell 0.3% while markets across Asia

mostly moved lower. Benchmarks in Hong Kong and Singapore fell 0.1%

and 0.3% respectively, while Australian stocks shed 0.3% amid

worries about banks' earnings and weakness in the mining

sector.

South Korean equities powered to record highs, however, adding

1% Thursday as index heavyweight Samsung advanced.

Japan's markets were closed for a holiday Thursday.

Paul Hannon and Yifan Xie contributed to this article.

Write to Riva Gold at riva.gold@wsj.com and Ese Erheriene at

ese.erheriene@wsj.com

(END) Dow Jones Newswires

May 04, 2017 05:57 ET (09:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

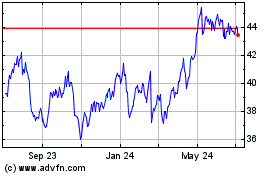

HSBC (NYSE:HSBC)

Historical Stock Chart

From Aug 2024 to Sep 2024

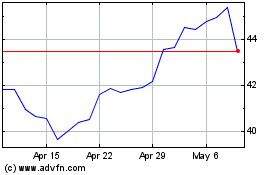

HSBC (NYSE:HSBC)

Historical Stock Chart

From Sep 2023 to Sep 2024