Euro Weakens As German ZEW Economic Sentiment Drops To 1-Year Low

October 13 2015 - 2:41AM

RTTF2

The euro slipped against most major rivals in European deals on

Tuesday, as Germany's economic confidence dropped to a one-year low

in October, reflecting the weak growth in emerging markets and the

fallout of the Volkswagen diesel emissions scandal.

Survey data from the Mannheim-based Centre for European Economic

Research or ZEW showed that the investor confidence index fell to

1.9 in October from 12.1 in September. This was the lowest score

since October 2014, when it stood at -3.6.

At the same time, current assessment deteriorated in October.

The corresponding index fell to 55.2 from 67.5 in September. The

reading was the lowest since March 2015, when the score was

55.1.

The European markets are trading in red, further undermining the

euro.

Investors treaded cautiously as Chinese imports fell a

more-than-expected 17.7 percent in yuan-denominated terms,

underscoring the fragile state of the world's second-largest

economy.

The euro was broadly higher in the Asian session, on dimming

hopes for a Fed rate hike this year.

In European trades, the euro fell back to 1.1365 against the

greenback, after climbing to nearly a 4-week high of 1.1411 at 3:45

am ET. The euro is on course to pierce its early 4-day low of

1.1344. The next likely support for the euro-greenback pair is seen

around the 1.125 level.

Extending early slide, the euro depreciated by 0.21 percent to

hit a 4-day low of 136.01 against the Japanese yen. At Monday's

close, the pair was valued at 136.30. The euro is seen finding

support around the 135.00 region.

The 19-nation currency was trading lower at 1.0930 against the

Swiss franc, following a 2-week high of 1.0950 hit at 1:15 am ET.

If the euro-franc pair continues slide, it may challenge support

around the 1.085 area.

On the flip side, the single currency stayed firm around an

early 5-month high of 0.7475 against the pound, as the latter was

weighed by falling consumer prices in the U.K. The pair closed

Monday's trading at 0.7399.

Data from the Office for National Statistics showed that U.K.

inflation turned negative again in September and factory gate

prices continued to decline.

Consumer prices dropped 0.1 percent year-on-year in September,

after staying flat in August. Economists had expected prices to

remain flat. Consumer prices last declined in April, when it was

down 0.1 percent.

Looking ahead, at 8:00 am ET, Federal Reserve Bank of St. Louis

President James Bullard is expected to speak on the U.S. economy

and monetary policy before the National Association for Business

Economics 57th annual meeting, "North America's Place in a Changing

World Economy", in Washington.

Subsequently, Federal Reserve Bank of New York President William

Dudley presides over an Economic Club of New York luncheon meeting

in New York at 11:45 am ET.

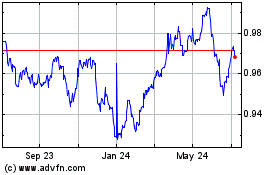

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

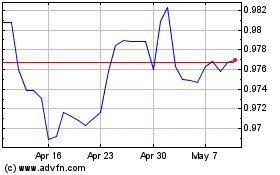

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024