Euro Climbs Against Majors

August 17 2012 - 4:11AM

RTTF2

The euro climbed against other major currencies in the early

European session on Friday as shares rose following strong U.S.

building permits data and Merkel's support for ECB action.

Expectations remain high for strong European Central Bank action

to stem the continent's debt crisis after German Chancellor Angela

Merkel said late Thursday that Germany is committed to do

everything they can to preserve the euro and assist indebted

countries.

Merkel supported ECB President Mario Draghi's announcements in

the last ECB meet, saying the move to save the euro and the

prospects of ECB buying Spanish and Italian debt are "completely in

line" with the approach taken by European leaders. She also called

for swifter integration of fiscal policies among block members,

adding time was running short to resolve the crisis.

In economic news, German producer price inflation eased to 0.9

percent in July from 1.6 percent in June, the Federal Statistics

Office said today.

Economists expected the rate to eased to 1.2 percent. A year

ago, the rate of inflation was 2.1 percent.

The euro advanced to a 2-day high of 0.7872 against the British

currency and a 3-day high of 1.2375 against the U.S. dollar,

compared to Thursday's close of 0.7856 and 1.2358, respectively.

The next upside target level for the euro is seen at 1.24 against

the greenback and 0.79 against the pound.

Against the yen, the euro approached a 7-week high of 98.29 with

99.00 seen as the next resistance level. The euro-yen pair was

worth 98.07 at yesterday's close.

The European single currency advanced to a 3-week high of 1.1851

against the Australian dollar and a 2-day high of 1.5313 against

the NZ counterpart and the euro may break 1.19 and 1.54 levels,

respectively on the upside. The euro closed Thursday's trading at

1.1761 against the aussie and 1.5253 against the kiwi.

Prices received by New Zealand producers rebounded in the June

quarter amid a surge in electricity costs, data from Statistics New

Zealand showed.

The output producer price index (PPI) gained 0.3 percent

quarter-on-quarter in the June quarter following a 0.1 percent

decline in the March quarter. Economists had forecast a 0.2 percent

fall.

Against the Canadian dollar, the euro edged up to as high as

1.2222 from Thursday's American session close of 1.2195. The next

resistance level for the euro-loonie pair is seen at 1.225.

The euro moved in a tight range against the Swiss currency,

trading between 1.2012 and 1.2014. The pair closed yesterday's

deals at 1.2013.

Looking ahead, Eurozone trade data for June is due shortly.

The U.S. leading economic indicators index for July and the

preliminary report of the Reuters/University of Michigan's consumer

sentiment survey for August and Canada's CPI for July are due in

the New York morning session.

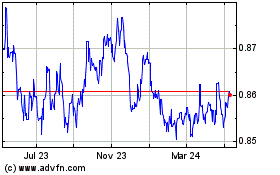

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

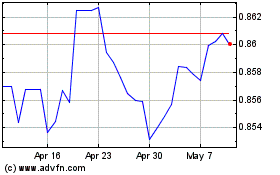

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024