and losses 1,082

Net finance

costs (589)

Profit before

taxation 24,965

--------

Assets

Segment assets 7,162 4,089 3,501 100,622 115,374

Equity accounted

investments - - - 6,547 6,547

Unallocated

assets 52,783

Total assets 7,162 4,089 3,501 107,169 174,704

------------ -------- -------- --------- --------

Liabilities

Segment liabilities 1,464 3,057 1,010 46,074 51,605

Unallocated

liabilities 56,543

------------ -------- -------- --------- --------

Total liabilities 1,464 3,057 1,010 46,074 108,148

------------ -------- -------- --------- --------

Operating Segments

52 weeks ended 28 December

2014

Switzerland Germany Ireland United Total

Kingdom

GBP000 GBP000 GBP000 GBP000 GBP000

Segment revenue

Sales to external

customers 9,590 5,687 21,461 257,640 294,378

------------ ------------ -------- --------- --------

Results

Segment result (1,019) (7,348) 5,034 57,738 54,405

Non-underlying

items - (957) (863) 394 (1,426)

Share of profit

of associates - - - 1,047 1,047

------------ ------------ -------- --------- --------

Group operating

profit (1,019) (8,305) 4,171 59,179 54,026

Other gains and

losses 949 - - 198 1,147

------------ ------------ -------- --------- --------

(70) (8,305) 4,171 59,377 55,173

Net finance costs (1,376)

Profit before

taxation 53,797

--------

Assets

Segment assets 8,077 1,940 3,395 103,157 116,569

Equity accounted

investments - - - 7,170 7,170

Unallocated assets 42,250

Total assets 8,077 1,940 3,395 110,327 165,989

------------ ------------ -------- --------- --------

Liabilities

Segment liabilities 1,532 4,692 1,706 52,723 60,653

Unallocated liabilities 31,938

------------ ------------ -------- --------- --------

Total liabilities 1,532 4,692 1,706 52,723 92,591

------------ ------------ -------- --------- --------

5. ITEMS EXCLUDED FROM NON-GAAP MEASURE: UNDERLYING PROFIT BEFORE TAX

(a) Included within operating profit

26 weeks 26 weeks 52 weeks

Ended ended ended

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Onerous leases - (126) 492

Corporate stores 302 -

Property, plant and

equipment 439 1,036

Impairments - 741 1,036

Restructuring and reorganisation

costs (162) (102)

Other restructuring

and one-off items - (162) (102)

---- ---- ----

- 453 1,426

---- ---- ----

Onerous Lease Provision

The credit in H1 2014 related to a net release of UK and Irish

rent obligations.

Impairments

Impairments in H1 2014 related to store assets in Germany

following restructuring activities that carried on into the first

half of the year, and an unsuccessful new format (Extra stores) in

the UK.

Other Restructuring and one-off items

The credit in H1 2014 related to the release of the unused part

of the provision for German restructuring costs recognised in

2013.

(b) Included below operating profit

Other gains and losses

In H1 2014, this included a GBP1.1m credit in relation to the

release of contingent consideration in respect of Domino's Pizza

Switzerland following final settlement with the vendor and a

GBP0.2m credit in respect of the sale of store assets.

Discount unwind on items included in finance expense

GBPnil net charge has been recognised in respect of discount

unwind on items included in finance expense (29 June 2014:

GBP0.4m).

6. CASH AND CASH EQUIVALENTS

(Unaudited) (Unaudited)

At At At

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Cash at bank and in

hand 10,228 8,364 16,229

Short term deposits 19,906 35,247 17,514

------------ ------------ ------------

30,134 43,611 33,743

------------ ------------ ------------

7. INCOME TAX

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Current income tax

Current income tax charge 5,616 5,033 10,043

Deferred income tax

Origination and reversal

of temporary differences 952 234 1,802

Adjustments in respect

of prior periods (786)

------------ ------------ ------------

Income tax expense 6,568 5,267 11,059

------------ ------------ ------------

The calculation of the Group's tax position necessarily involves

a degree of estimation and judgement in respect of certain items

whose tax treatment cannot be finally determined until resolution

has been reached with the relevant tax authority. The final

resolution of certain these items may give rise to material income

statement and or cash flow variances.

8. DIVIDENDS PAID AND PROPOSED

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Declared and paid during

the period:

Final dividend for 2013

8.80p (2012: 7.90p) - - 14,551

Interim dividend for

2014 7.81p (2013: 7.10p) - - 12,929

Final dividend for 2014

9.69p (2013: 8.80) 16,039 14,551 -

------------ ------------ ------------

16,039 14,551 27,480

------------ ------------ ------------

The directors declare an interim dividend of 9p per share of

GBP14,924,000 (29 June 2014: 7.81p GBP12,855,000).

9. EARNINGS PER SHARE

Basic earnings per share amounts are calculated by dividing

profit for the period attributable to ordinary equity holders of

the parent by the weighted average number of ordinary shares

outstanding during the period.

Diluted earnings per share are calculated by dividing the profit

attributable to owners of the parent by the weighted average number

of ordinary shares outstanding during the period plus the weighted

average number of ordinary shares that would have been issued on

the conversion of all dilutive potential ordinary shares into

ordinary shares.

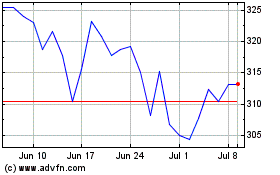

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Apr 2023 to Apr 2024