Overall Postsecondary Enrollments up 18%;

Driven by International Diversification Strategy

DeVry Education Group (NYSE:DV), a global provider of

educational services, today reported academic, operational and

financial results for its fiscal 2015 third quarter ended March 31,

2015. DeVry Group also reported enrollment results at Chamberlain

College of Nursing, Carrington College, DeVry Brasil, and DeVry

University with its Keller Graduate School of Management.

Academic and operational accomplishments:

- DeVry University announced a

significant next phase in its transformation, relaunching its brand

and repositioning the institution for long-term growth

- Keller Graduate School of Management

ranked among best business schools for military service members and

veterans by Military Times

- Chamberlain College of Nursing opened

its fourth new campus in fiscal 2015 in North Brunswick, New

Jersey, with classes beginning in May

- DeVry Brasil continued its integrations

of recently acquired Faci and Damasio

- In 2015, Ross University School of

Medicine and American University of the Caribbean School of

Medicine current and prior graduates earned more than 1,050

residency positions at hospitals in the United States and

Canada

Selected financial data for the three months ended March 31,

2015:

- Total revenue decreased 1.3 percent to

$489.8 million

- Medical and Healthcare and

International and Professional Education segment revenue grew 10.2

percent and 20.3 percent, respectively, while Business, Technology

and Management revenue decreased 15.7 percent

- Reported net income of $47.1 million,

compared to $55.5 million last year; net income from continuing

operations and excluding special items was $45.4 million

- Reported diluted earnings per share of

$0.72, compared to earnings per share of $0.86 last year; earnings

per share from continuing operations and excluding special items

was $0.70

Selected financial data for the nine months ended March 31,

2015:

- Total revenue decreased 0.1 percent to

$1,436.8 million

- Medical and Healthcare and

International and Professional Education segment revenue grew 13.1

percent and 12.6 percent respectively, while Business, Technology

and Management revenue decreased 13.5 percent

- Reported net income of $110.0 million,

compared to $96.5 million last year; net income from continuing

operations and excluding special items was $125.3 million, up 2.5

percent from prior year

- Reported diluted earnings per share of

$1.68, compared to earnings per share of $1.49 last year; earnings

per share from continuing operations and excluding special items

was $1.92, as compared to $1.89 last year

- Operating cash flow of $209.4 million

compared to $263.2 million last year

- Cash and cash equivalents increased to

$402.1 million as of March 31, 2015, from $396.8 million as of

March 31, 2014

- Organization on track to achieve more

than $100 million in cost savings and value creation for fiscal

2015

The third quarter fiscal year 2015 results contained an

after-tax charge of $3.9 million related to workforce reductions

and real estate consolidations, primarily at DeVry University. In

addition, the results included $5.6 million in income from

discontinued operations related to Advanced Academics. (See “Use of

Non-GAAP Financial Information and Supplemental Reconciliation

Schedule”).

“Today we have announced the next phase of the significant

transformation strategy underway at DeVry University to improve its

competitive positioning and return the institution to growth,” said

Daniel Hamburger, DeVry Group’s president and chief executive

officer. “We are confident that this strategy, together with the

sustained expansion of our healthcare, professional and

international institutions will drive positive student outcomes and

DeVry Group’s future growth.”

Operating Highlights

Medical and Healthcare Segment

For the third quarter, segment revenue of $225.4 million

increased 10.2 percent compared to the prior year. For the

nine-month period, revenue increased 13.1 percent to $645.4 million

and segment operating income, excluding special charges, rose 11.9

percent to $122.3 million versus prior year.

DeVry Medical International

Revenue for the quarter at DeVry Medical International decreased

0.8 percent. In 2015, Ross University School of Medicine and

American University of the Caribbean School of Medicine current and

prior graduates earned more than 1,050 residency positions at

hospitals in the United States and Canada. These graduates will

continue their training in 47 U.S. states and three Canadian

provinces, including such prestigious institutions as Cleveland

Clinic Florida, Mt. Sinai Hospital in New York City, and Rush

University Medical Center in Chicago.

Chamberlain College of Nursing

For the third quarter, Chamberlain revenue increased 25.3

percent. For the March 2015 session, new students grew 3.5 percent

to 2,166 students versus 2,092 in the prior year. Total students

increased 27.1 percent to 23,108 versus 18,185 in the prior

year.

During the quarter, Chamberlain opened locations in Troy,

Michigan, and Las Vegas. It also began accepting applications for

the May 2015 class at its new North Brunswick, New Jersey,

location, which is co-located with DeVry University.

Carrington College

Revenue at Carrington College grew 2.8 percent during the

quarter. For the three-month period ending March 31, 2015, new

student enrollment decreased 2.7 percent to 2,187 versus 2,247 in

the previous year. Total enrollment decreased 1.5 percent to 7,639

from 7,758 in the previous year. The declines were the result of

fewer class starts in the third quarter compared to the prior

year.

International and Professional Education Segment

Segment revenue increased 20.3 percent to $61.1 million in the

third quarter compared to the prior year. Segment operating income

decreased to $4.6 million versus $6.3 million in the previous year,

largely due to the impact upon Becker Professional Education of

fewer candidates taking this year’s CPA exam. For the nine-month

period, revenue increased 12.6 percent to $175.5 million, while

segment operating income decreased $2.5 million to $19.9 million

versus prior year.

Becker Professional Education

During the quarter, revenue decreased 0.7 percent, which

reflects a dip in demand for its CPA course. Year to date, Becker

experienced growth in the United States Medical Licensing Exam and

Continuing Professional Education markets.

DeVry Brasil

Revenue in the quarter grew 38.8 percent over the previous year.

DeVry Brasil’s new student enrollment in the March term increased

105.5 percent to 18,173 compared to 8,845 in the prior year. Total

student enrollment increased 77.9 percent to 58,724 students

compared to 33,013 last year.

Business, Technology, and Management Segment

DeVry University

DeVry University announced the next phase of its strategy to

return to growth and transform the institution through new,

student-focused innovations. Near-term, the university is taking

action to differentially invest in its strongest markets and

programs; reduce its cost structure; and establish a distinct voice

for its brand. In addition, DeVry University is implementing

strategies to place it on a path for growth by enhancing the

teaching and learning model, addressing affordability, and

strengthening employer workforce solutions. Taken together, these

actions are designed to maintain positive economics in fiscal

2016.

DeVry University recently relaunched its brand to emphasize what

it is best known for, careers and care. To view the campaign, which

illustrates how DeVry University is “Different. On Purpose” please

click on this web link: http://bit.ly/1EdBznH.

For the third quarter, segment revenue of $203.8 million

decreased 15.7 percent compared to the prior year. The segment

generated $5.6 million of operating income during the quarter,

excluding special items. For the nine-month period, revenue

decreased 13.5 percent to $617.8 million, and the segment reported

operating income of $16.8 million, excluding special items.

For the March session at DeVry University, new undergraduate

enrollments decreased 17.2 percent to 4,156 compared to 5,018 the

previous year. Total undergraduate students decreased 15.0 percent

to 36,188 versus 42,583 for the session a year ago.

At the graduate level, including Keller Graduate School of

Management, total coursetakers in the March session decreased 9.5

percent to 14,651 versus 16,192 for the same session a year

ago.

Balance Sheet/Cash Flow

For the nine months ended March 31, 2015, DeVry Group generated

$209.4 million of operating cash flow. As of March 31, 2015, cash

and cash equivalents totaled $402.1 million.

New Credit Agreement

DeVry Group recently entered into a new, secured revolving

credit agreement. The amount of borrowing capacity available under

the credit agreement is $400 million. Subject to certain conditions

set forth in the credit agreement, the aggregate commitment may be

increased up to $550 million. The credit agreement has a five-year

term ending May 2020 and replaces DeVry Group’s prior $400 million

agreement that was set to expire in May 2016.

Conference Call and Webcast Information

DeVry Group will hold a conference call to discuss its fiscal

2015 third-quarter financial results on April 23, 2015 at 4 p.m.

Central Time (5 p.m. Eastern Time). The conference call will be led

by Daniel Hamburger, president and chief executive officer, Tim

Wiggins, chief financial officer and Patrick Unzicker, chief

accounting officer and treasurer.

For those wishing to participate by telephone, dial 877-506-6380

(domestic) or 412-902-6690 (international). Please say “DeVry Group

Call”. DeVry Group will also broadcast the conference call via

webcast. Interested parties may access the webcast through the

Investor Relations section of DeVry Group's website, or

http://services.choruscall.com/links/dv150423.html.

Please access the website at least 15 minutes prior to the start

of the call to register, download and install any necessary audio

software.

DeVry Group will archive a telephone replay of the call until

May 9, 2015. To access the replay, dial 877-344-7529 (domestic) or

412-317-0088 (international), passcode 10062321. To access the

webcast replay, please visit DeVry Group's website, or

http://services.choruscall.com/links/dv150423.html.

About DeVry Education Group

The purpose of DeVry Education Group is to empower its students

to achieve their educational and career goals. DeVry Education

Group Inc. (NYSE: DV; member S&P MidCap 400 Index) is a global

provider of educational services and the parent organization of

American University of the Caribbean School of Medicine, Becker

Professional Education, Carrington College, Chamberlain College of

Nursing, DeVry Brasil, DeVry University and its Keller Graduate

School of Management, Ross University School of Medicine and Ross

University School of Veterinary Medicine. These institutions offer

a wide array of programs in healthcare, business, technology,

accounting, finance, and law. For more information, please visit

www.devryeducationgroup.com.

Certain statements contained in this release concerning DeVry

Group's future performance, including those statements concerning

DeVry Group's expectations or plans, may constitute forward-looking

statements subject to the Safe Harbor Provision of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements generally can be identified by phrases such as DeVry

Group or its management "believes," "expects," "anticipates,"

"foresees," "forecasts," "estimates" or other words or phrases of

similar import. Actual results may differ materially from those

projected or implied by these forward-looking statements. Potential

risks, uncertainties and other factors that could cause results to

differ are described more fully in Item 1A, "Risk Factors," in

DeVry Group's most recent Annual Report on Form 10-K for the year

ending June 30, 2014 and filed with the Securities and Exchange

Commission (SEC) on August 27, 2014 and its most recent Form 10-Q

for the quarter ending December 31, 2014 and filed with the SEC on

February 5, 2015.

Selected Operating Data (in

thousands, except per share data)

Third Quarter FY 2015

FY 2014

Change Revenue $489,830 $496,117 -1.3% Net Income $47,120

$55,525 -15.1% Earnings per Share (diluted) $0.72 $0.86 -16.3%

Number of common shares (diluted) 65,265 64,841 +0.7%

Nine Months FY 2015 FY 2014 Change

Revenue $1,436,754 $1,438,298 -0.1% Net Income $109,973 $96,548

+13.9% Earnings per Share (diluted) $1.68

$1.49

+12.8% Number of common shares (diluted) 65,402 64,747 +1.0%

Use of Non-GAAP Financial Information and Supplemental

Reconciliation Schedule

During the third quarter and first nine months of fiscal year

2015, DeVry Group recorded restructuring charges related to real

estate consolidations and workforce reductions at DeVry University

and real estate consolidations at Chamberlain College of Nursing

and Carrington College in order to align its cost structure with

enrollments. DeVry Group also recorded during the third quarter and

first nine month of fiscal 2014, restructuring charges primarily

related to workforce reductions and real estate consolidations at

DeVry University, Carrington College and the DeVry Group home

office. DeVry Group also recorded the operating results of its

Advanced Academics reporting unit as discontinued operations. DeVry

Group recorded a gain from the sale of a former DeVry University

campus in Decatur, Georgia, during the first quarter of fiscal year

2014. The following table illustrates the effects of restructuring

charges and gain on the sale of assets on DeVry Group’s operating

income. Management believes that the non-GAAP disclosure of

operating income excluding these special items provides investors

with useful supplemental information regarding the underlying

business trends and performance of DeVry Group’s ongoing operations

and is useful for period-over-period comparisons of such operations

given the special nature of the restructuring charges and gain on

the sale of assets. DeVry Group uses these supplemental financial

measures internally in its management and budgeting process.

However, these non-GAAP financial measures should be viewed in

addition to, and not as a substitute for, DeVry Group’s reported

results prepared in accordance with GAAP. The following table

reconciles these non-GAAP measures to the most directly comparable

GAAP information (in thousands, except per share data):

Non-GAAP Earnings Disclosure PRELIMINARY

For The Three

Months For The Nine Months Ended March 31,

Ended March 31, 2015 2014 2015

2014 Net Income $ 47,120 $ 55,525 $ 109,973 $ 96,548

Earnings per Share (Diluted) $ 0.72 $ 0.86 $ 1.68 $ 1.49

Discontinued Operations (net of tax) $ (5,576 ) $ 607 $ (5,576 ) $

16,855 Effect on Earnings per Share (Diluted) $ (0.08 ) $ 0.01 $

(0.08 ) $ 0.26 Restructuring Expenses (net of tax) $ 3,879 $

- $ 20,868 $ 10,057 Effect on Earnings per Share (Diluted) $ 0.06 $

- $ 0.32 $ 0.16 Gain on Sale of Assets (net of tax) $ - $ -

$ - $ (1,167 ) Effect on Earnings per Share (Diluted) $ - $ - $ - $

(0.02 ) Net Income from Continuing Operations Excluding the

Restructuring Expense and Gain on Sale of Assets (Diluted) $ 45,423

$ 56,132 $ 125,265 $ 122,293 Earnings per Share from

Continuing Operations Excluding the Restructuring Expense and Gain

on Sale of Assets (Diluted) $ 0.70 $ 0.87 $ 1.92 $ 1.89

Shares used in Diluted EPS Calculation 65,265 64,841 65,402 64,747

Enrollment

Results

2015 2014

% Change DeVry Education Group

Postsecondary Enrollments(1) New students 28,719 20,738

+40.9% Total students 143,935 121,643 +18.3%

Chamberlain College of Nursing March Session New students

(2) 2,166 2,092 +3.5% Total students 23,108 18,185 +27.1%

Carrington College 3 months ending March 31, 2015 New

students 2,187 2,247 -2.7% Total students 7,639 7,758 -1.5%

DeVry Brasil (3) March Term New students 18,173 8,845

+105.5% Total students 58,724 33,013 +77.9%

DeVry

University Undergraduate – March Session New students 4,156

5,018 -17.2% Total students 36,188 42,583 -15.0% Graduate – March

Session Coursetakers(4) 14,651 16,192 -9.5% 1)

Includes the most recently reported enrollments at DeVry Group’s

degree-granting institutions; excluding the acquisitions of FMF,

Faci and Damasio, new and total student enrollments increased 0.9%

and 1.2%, respectively. 2) Post-licensure online programs only;

pre-licensure campus-based programs start in September, January and

May. 3) Excluding the acquisitions of FMF, Faci and Damasio, new

and total student enrollments increased 13.3% and 14.7%,

respectively. 4) The term “coursetaker” refers to the number of

courses taken by a student. Thus one student taking two courses

equals two coursetakers.

Chart 1: DeVry Education Group 2015

Announcements & Events

August 18, 2015 Fiscal 2015 Fourth

Quarter/Year-End October 22, 2015 Fiscal 2016 First Quarter

Results and September Enrollment November 5, 2015 Annual

Shareholders’ Meeting

DEVRY EDUCATION GROUP INC.

CONSOLIDATED

BALANCE SHEETS

(Unaudited) PRELIMINARY

March 31, June 30,

March 31, 2015 2014 2014 (Dollars in

thousands, except for share and par value amounts)

ASSETS

Current

Assets

Cash and Cash Equivalents $ 402,115 $ 358,188 $ 396,815 Marketable

Securities and Investments 3,577 3,448 3,333 Restricted Cash 9,658

8,347 8,023 Accounts Receivable, Net 149,586 132,621 161,202

Deferred Income Taxes, Net 45,163 39,679 29,458 Prepaid Expenses

and Other 57,822 34,808 39,665

Total Current Assets 667,921 577,091 638,496

Land, Buildings

and Equipment

Land 63,282 68,185 66,775 Buildings 470,706 464,944 454,099

Equipment 500,902 488,322 476,688 Construction In Progress

32,292 17,405 19,957 1,067,182

1,038,856 1,017,519 Accumulated Depreciation (522,559 )

(483,019 ) (466,008 ) Land, Buildings and Equipment,

Net 544,623 555,837 551,511

Other

Assets

Intangible Assets, Net 325,000 294,932 294,497 Goodwill 561,406

519,879 517,065 Perkins Program Fund, Net 13,450 13,450 13,450

Other Assets 36,277 36,447

33,846 Total Other Assets 936,133

864,708 858,858

TOTAL ASSETS $

2,148,677 $ 1,997,636 $ 2,048,865

LIABILITIES

Current

Liabilities

Accounts Payable $ 58,531 $ 52,260 $ 54,594 Accrued Salaries, Wages

and Benefits 90,503 94,501 91,811 Accrued Expenses 74,073 70,891

64,723 Deferred and Advance Tuition 176,451

99,160 194,560 Total Current Liabilities

399,558 316,812 405,688

Other

Liabilities

Deferred Income Taxes, Net 71,153 47,921 54,574 Deferred Rent and

Other 103,920 93,117 89,095

Total Other Liabilities 175,073 141,038

143,669

TOTAL LIABILITIES

574,631 457,850 549,357

NONCONTROLLING INTEREST 9,100 6,393 6,189

SHAREHOLDERS'

EQUITY

Common Stock, $0.01 par value, 200,000,000 Shares Authorized;

63,701,000, 63,624,000 and 63,465,000 Shares issued and outstanding

at March 31, 2015, June 30, 2014 and March 31, 2014, respectively.

769 753 754 Additional Paid-in Capital 343,339 320,703 311,851

Retained Earnings 1,778,239 1,682,071 1,655,283 Accumulated Other

Comprehensive Loss (78,876 ) (15,394 ) (19,604 ) Treasury Stock, at

Cost (12,208,000, 11,655,000 and 11,661,000 Shares, Respectively)

(478,525 ) (454,740 ) (454,965 )

TOTAL

SHAREHOLDERS' EQUITY 1,564,946 1,533,393

1,493,319

TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 2,148,677 $ 1,997,636 $

2,048,865

DEVRY EDUCATION GROUP INC.

CONSOLIDATED

STATEMENTS OF INCOME

(Dollars in Thousands Except for Per Share Amounts)

(Unaudited) PRELIMINARY

For The Three

Months For The Nine Months Ended March 31,

Ended March 31, 2015 2014 2015

2014 REVENUE: Tuition $ 444,715 $ 455,422 $

1,320,197 $ 1,332,627 Other Educational 45,115

40,695 116,557 105,671

Total Revenue 489,830 496,117 1,436,754 1,438,298

OPERATING COST

AND EXPENSE: Cost of Educational Services 253,186 242,631

750,326 727,363 Student Services and Administrative Expense 180,212

183,949 532,878 558,154 Loss on Sale of Assets - - - (1,918 )

Restructuring Expense 6,982 -

30,487 16,329 Total Operating Cost and

Expense 440,380 426,580

1,313,691 1,299,928

Operating

Income 49,450 69,537 123,063 138,370

INTEREST: Interest

Income 1,318 605 2,015 1,498 Interest Expense (2,813 )

(1,073 ) (3,558 ) (3,125 ) Net Interest

Expense (1,495 ) (468 ) (1,543 ) (1,627

)

Income from Continuing Operations Before Income

Taxes 47,955 69,069 121,520 136,743

Income Tax Provision

(6,327 ) (12,918 ) (16,653 ) (23,113 )

Income from Continuing Operations 41,628 56,151

104,867 113,630

DISCONTINUED OPERATIONS: Income (Loss)

from Operations of Divested Component 1,011 (934 ) 1,011

(18,645 )

Income Tax Benefit 4,565 327

4,565 1,790

Income (Loss) on

Discontinued Operations 5,576 (607 )

5,576 (16,855 )

NET INCOME

47,204 55,544 110,443 96,775 Net Income Attributable to

Noncontrolling Interest (84 ) (19 ) (470 )

(227 )

NET INCOME ATTRIBUTABLE TO DEVRY EDUCATION

GROUP $ 47,120 $ 55,525 $ 109,973 $ 96,548

AMOUNTS ATTRIBUTABLE TO DEVRY EDUCATION GROUP:

Income from Continuing Operations, Net of Income Taxes 41,544

56,132 104,397 113,403 Income (Loss) from Discontinued Operations,

Net of Income Taxes 5,576 (607 ) 5,576

(16,855 )

NET INCOME ATTRIBUTABLE TO DEVRY

EDUCATION GROUP $ 47,120 $ 55,525 $ 109,973

$ 96,548

EARNINGS (LOSS) PER COMMON SHARE

ATTRIBUTABLE TO DEVRY EDUCATION GROUP SHAREHOLDERS

Basic Continuing Operations $ 0.65 $ 0.87 $ 1.62 $ 1.77

Discontinued Operations $ 0.08 (0.01 ) $ 0.08

(0.26 ) $ 0.73 $ 0.86 $ 1.70 $ 1.51

Diluted Continuing Operations $ 0.64 $ 0.87 $ 1.60 $

1.75 Discontinued Operations $ 0.08 (0.01 ) $ 0.08

(0.26 ) $ 0.72 $ 0.86 $ 1.68 $

1.49

Cash Dividend Declared per Common Share $

- $ - $ 0.18 $ 0.17

DEVRY

EDUCATION GROUP INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited) PRELIMINARY

For The Nine Months Ended March

31, 2015 2014 (Dollars in

Thousands) CASH FLOWS FROM OPERATING ACTIVITIES: Net

Income $ 110,443 $ 96,775 (Income) Loss from Discontinued

Operations (5,576 ) 16,855 Adjustments to Reconcile Net Income to

Net

Cash Provided by Operating Activities:

Stock-Based Compensation Expense 13,435 13,672 Depreciation

62,126 61,541 Amortization 3,818 5,349 Provision for Refunds and

Uncollectible Accounts 68,479 58,923 Deferred Income Taxes 3,476

(1,385 ) Loss on Disposals of Land, Buildings and Equipment 6,312

3,261 Unrealized Loss on Assets Held for Sale - 244 Realized Gain

on Sale of Assets - (1,918 ) Changes in Assets and Liabilities, Net

of Effects from

Acquisitions and Divestitures of

Businesses:

Restricted Cash (1,311 ) (1,004 ) Accounts Receivable (85,994 )

(81,588 ) Prepaid Expenses And Other (20,725 ) 10,103 Accounts

Payable 6,278 (533 ) Accrued Salaries, Wages, Expenses and Benefits

(28,178 ) (12,383 ) Deferred and Advance Tuition 76,944

96,101 Net Cash Provided by Operating

Activities-Continuing Operations 209,527 264,013 Net Cash Provided

by Operating Activities-Discontinued Operations (160 )

(804 )

NET CASH PROVIDED BY OPERATING ACTIVITIES

209,367 263,209

CASH FLOWS

FROM INVESTING ACTIVITIES: Capital Expenditures (64,301 )

(47,609 ) Payment for Purchase of Business, Net of Cash Acquired

(73,117 ) (12,343 ) Marketable Securities Purchased (147 ) (189 )

Cash Received from Sale of Assets 6,100 8,727

NET CASH USED IN INVESTING ACTIVITIES

(131,465 ) (51,414 )

CASH FLOWS FROM FINANCING

ACTIVITIES: Proceeds from Exercise of Stock Options 6,014 6,236

Proceeds from Stock issued Under Employee Stock Purchase Plan 866

1,009 Repurchase of Common Stock for Treasury (18,672 ) - Cash

Dividends Paid (11,639 ) (10,941 ) Payments of Seller Financed

Obligations (5,978 ) (6,457 ) Payments of Debt Refinancing Fees

(3,472 ) -

NET CASH USED IN

FINANCING ACTIVITIES (32,881 ) (10,153 )

Effects of Exchange Rate Differences (1,094 ) (1,971

)

NET INCREASE IN CASH AND CASH EQUIVALENTS 43,927

199,671

Cash and Cash Equivalents at Beginning of

Period 358,188 197,144

Cash and

Cash Equivalents at End of Period $ 402,115 $ 396,815

DEVRY EDUCATION GROUP INC.

SEGMENT

INFORMATION

(Dollars in Thousands) (Unaudited) PRELIMINARY

For The

Three Months For The Nine Months Ended March 31,

Ended March 31, Increase Increase 2015

2014 (Decrease) 2015 2014

(Decrease) REVENUE: Medical and Healthcare $ 225,427

$ 204,610 10.2 % $ 645,424 $ 570,913 13.1 % International and

Professional Education 61,112 50,782 20.3 % 175,539 155,933 12.6 %

Business, Technology and Management 203,832 241,896 -15.7 % 617,810

714,118 -13.5 % Intersegment Elimination and Other (541 )

(1,171 ) NM (2,019 ) (2,666 ) NM Total

Consolidated Revenue 489,830 496,117

-1.3 % 1,436,754 1,438,298 -0.1 %

OPERATING INCOME (LOSS) (NOTE 1): Medical and Healthcare

43,302 44,703 -3.1 % 117,807 103,687 13.6 % International and

Professional Education 4,629 6,330 -26.9 % 19,859 22,401 -11.3 %

Business, Technology and Management 1,146 22,517 -94.9 % (9,155 )

21,403 NM Reconciling Items: Home Office and Other 373

(4,013 ) NM (5,448 ) (9,121 ) NM Total

Consolidated Operating Income 49,450 69,537 -28.9 % 123,063 138,370

-11.1 %

INTEREST: Interest Income 1,318 605 117.9 % 2,015

1,498 34.5 % Interest Expense (2,813 ) (1,073 ) 162.2

% (3,558 ) (3,125 ) 13.9 % Net Interest Expense

(1,495 ) (468 ) 219.4 % (1,543 ) (1,627

) -5.2 % Total Consolidated Income before Income Taxes and

Noncontrolling Interest $ 47,955 $ 69,069 -30.6 % $

121,520 $ 136,743 -11.1 %

Note 1 -

Segment Operating Income (Loss) has been adjusted in both periods

to reflect intangible asset amortization expense at the segment

level. This amortization expense had previously been disclosed as a

Reconciling Item.

During the third quarter and first nine

months of fiscal year 2015, DeVry Group recorded restructuring

charges related to workforce reductions and real estate

consolidations at DeVry University which is part of the Business,

Technology and Management segment and real estate consolidations at

Chamberlain College of Nursing and Carrington College which are

part of the Medical and Healthcare segment in order to align its

cost structure with enrollments. During the third quarter and first

nine months of fiscal year 2014, DeVry Group recorded restructuring

charges primarily related to workforce reductions and real estate

consolidations at DeVry University, Carrington College and the

DeVry Group home office in order to align its cost structure with

enrollments. DeVry Group recorded a gain from the sale of a former

DeVry University campus in Decatur, Georgia, during the first nine

months of fiscal year 2014. The following table illustrates the

effects of restructuring charges and gain on the sale of assets on

DeVry Group’s operating income. Management believes that the

non-GAAP disclosure of operating income excluding these special

items provides investors with useful supplemental information

regarding the underlying business trends and performance of DeVry

Group’s ongoing operations and is useful for period-over-period

comparisons of such operations given the special nature of the

restructuring charges and gain on the sale of assets. DeVry Group

uses these supplemental financial measures internally in its

management and budgeting process. However, these non-GAAP financial

measures should be viewed in addition to, and not as a substitute

for, DeVry Group’s reported results prepared in accordance with

GAAP. The following table reconciles these non-GAAP measures to the

most directly comparable GAAP information (in thousands):

For The Three Months For The Nine Months

Ended March 31, Ended March 31, Increase

Increase 2015 2014 (Decrease)

2015 2014 (Decrease) Medical and

Healthcare Operating Income $ 43,302 $ 44,703 -3.1 % $ 117,807 $

103,687 13.6 % Restructuring Charge 2,531 -

NM 4,448 5,522 -19.4 % Medical

and Healthcare Operating Income Excluding Restructuring Charge $

45,833 $ 44,703 2.5 % $ 122,255 $ 109,209

11.9 % Business, Technology and Management Operating

Income $ 1,146 $ 22,517 -94.9 % $ (9,155 ) $ 21,403 NM

Restructuring Charge 4,456 - NM 25,974 7,910 228.4 % Gain on Sale

of Assets - - - -

(1,918 ) NM Business, Technology and Management Operating Income

Excluding Restructuring Charge and Gain on Sale of Assets $ 5,602

$ 22,517 -75.1 % $ 16,819 $ 27,395

-38.6 %

DeVry Education GroupInvestor Contact:Joan Walter,

630-353-3800jwalter@devrygroup.comorMedia Contact:Ernie Gibble,

630-353-9920egibble@devrygroup.com

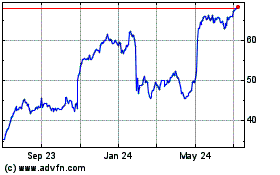

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Apr 2023 to Apr 2024