UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2016

Huntsman Corporation

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-32427 |

|

42-1648585 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

500 Huntsman Way |

|

|

|

Salt Lake City, Utah |

|

84108 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(801) 584-5700

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 11, 2016, we issued a press release announcing our results for the three months and year ended December 31, 2015. The press release is furnished herewith as Exhibit 99.1.

We will hold a telephone conference to discuss our 2015 fourth quarter and full year financial results on Thursday, February 11, 2016 at 9 a.m. Eastern Time.

|

Call-in number for U.S. participants: |

(888) 713 - 4199 |

|

International participants: |

(617) 213 - 4861 |

|

Passcode: |

810 262 68# |

The conference call will be available via webcast and can be accessed from the investor relations page of our website at http://www.huntsman.com.

The conference call will be available for replay beginning February 11, 2016 and ending February 18, 2016. The call-in numbers for the replay are as follows:

|

Within the U.S.: |

(888) 286 - 8010 |

|

International participants: |

(617) 801 - 6888 |

|

Replay code: |

29385180 |

Information with respect to the conference call, together with a copy of the press release furnished herewith as Exhibit 99.1, is available on the investor relations page of our website at http://www.huntsman.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Number |

|

Description of Exhibits |

|

|

|

|

|

99.1 |

|

Press Release dated February 11, 2016 regarding 2015 fourth quarter and full year earnings |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HUNTSMAN CORPORATION |

|

|

|

|

|

/s/ KURT D. OGDEN |

|

|

Vice President, Investor Relations and Finance |

Dated: February 11, 2016

3

EXHIBIT INDEX

|

Number |

|

Description of Exhibits |

|

|

|

|

|

99.1 |

|

Press Release dated February 11, 2016 regarding 2015 fourth quarter and full year earnings |

4

Exhibit 99.1

|

News Release |

|

|

FOR IMMEDIATE RELEASE |

Investor Relations: |

Media: |

|

February 11, 2016 |

Kurt Ogden |

Gary Chapman |

|

The Woodlands, TX |

(801) 584-5959 |

(281) 719-4324 |

|

NYSE: HUN |

|

|

HUNTSMAN REPORTS FOURTH QUARTER AND FULL YEAR 2015 RESULTS;

2015 ADJUSTED EPS IMPROVES TO $2.00 FROM $1.94 IN 2014

Fourth Quarter 2015 Highlights

· Adjusted EBITDA was $240 million compared to $292 million in the prior year period and $311 million in the prior quarter.

· Adjusted diluted income per share was $0.51 compared to $0.33 in the prior year period and $0.47 in the prior quarter.

· Net income attributable to Huntsman Corporation was $4 million compared to net loss of $38 million in the prior year period and net income of $55 million in the prior quarter.

· The stronger U.S. dollar reduced adjusted EBITDA by an estimated $24 million compared to the prior year period; a negative impact of approximately $0.07 loss per diluted share.

· The combination of effective tax planning, certain unusual tax benefits and regional mix of income created an approximate $0.25 per diluted share net tax benefit during the fourth quarter 2015.

· $100 million accelerated share repurchase program completed; $50 million authorization remaining.

Full Year 2015 Highlights

· Adjusted EBITDA was $1,221 million compared to $1,340 million in the prior year.

· Adjusted diluted income per share was $2.00 compared to $1.94 in the prior year.

· Net income attributable to Huntsman Corporation was $93 million compared to $323 million in the prior year.

· The stronger U.S. dollar reduced adjusted EBITDA by an estimated $136 million compared to the prior year; a negative impact of approximately $0.39 loss per diluted share.

· Planned PO/MTBE maintenance at our Port Neches, TX facility reduced adjusted EBITDA in 2015 by approximately $95 million. This maintenance occurs approximately once every five years.

|

|

|

Three months ended |

|

Twelve months ended |

|

|

|

|

December 31, |

|

September 30, |

|

December 31, |

|

|

In millions, except per share amounts, unaudited |

|

2015 |

|

2014 |

|

2015 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

2,332 |

|

$ |

2,951 |

|

$ |

2,638 |

|

$ |

10,299 |

|

$ |

11,578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Huntsman Corporation |

|

$ |

4 |

|

$ |

(38 |

) |

$ |

55 |

|

$ |

93 |

|

$ |

323 |

|

|

Adjusted net income(1) |

|

$ |

124 |

|

$ |

81 |

|

$ |

115 |

|

$ |

492 |

|

$ |

478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted income (loss) per share |

|

$ |

0.02 |

|

$ |

(0.16 |

) |

$ |

0.22 |

|

$ |

0.38 |

|

$ |

1.31 |

|

|

Adjusted diluted income per share(1) |

|

$ |

0.51 |

|

$ |

0.33 |

|

$ |

0.47 |

|

$ |

2.00 |

|

$ |

1.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA(1) |

|

$ |

111 |

|

$ |

141 |

|

$ |

255 |

|

$ |

741 |

|

$ |

1,022 |

|

|

Adjusted EBITDA(1) |

|

$ |

240 |

|

$ |

292 |

|

$ |

311 |

|

$ |

1,221 |

|

$ |

1,340 |

|

See end of press release for footnote explanations

The Woodlands, TX — Huntsman Corporation (NYSE: HUN) today reported fourth quarter 2015 results with revenues of $2,332 million and adjusted EBITDA of $240 million.

Peter R. Huntsman, our President and CEO, commented:

“During the fourth quarter this year, EBITDA from our cyclical businesses — which include our MTBE, ethylene and TiO2 products — decreased approximately $78 million compared to the prior year. This overshadowed the real strength of our portfolio which is in our downstream differentiated businesses. Excluding approximately $24 million of foreign currency headwind, the EBITDA from our differentiated businesses improved approximately $50 million compared to the prior year or 27%.

“In 2016, primarily as a result of lower priced oil and a lower global economic growth environment, we expect continued EBITDA pressure on our cyclical businesses. Growth from our differentiated businesses will offset cyclical pressure and inflationary costs such that we expect our 2016 EBITDA to be a similar amount to 2015. Importantly however, we expect our free cash flow generation to improve by $350 million in 2016 through lower capital expenditures, restructuring and maintenance. In 2016 we will continue to pursue actively a separation of our TiO2 business through a spinoff to shareholders or other strategic transaction.”

Segment Analysis for 4Q15 Compared to 4Q14

Polyurethanes

The decrease in revenues in our Polyurethanes division for the three months ended December 31, 2015 compared to the same period in 2014 was due to lower average selling prices and lower MTBE sales volumes. MDI average selling prices decreased in response to lower raw material costs and the currency exchange impact of a stronger U.S. dollar primarily against the Euro. PO/MTBE average selling prices decreased in-line with lower pricing for high octane gasoline. MDI sales volumes increased due to higher demand as well as competitor outages in the Asian region. The decrease in adjusted EBITDA was primarily due to lower MTBE contribution margins and the foreign currency exchange impact of a stronger U.S. dollar primarily against the Euro partially offset by higher MDI contribution margins.

Performance Products

The decrease in revenues in our Performance Products division for the three months ended December 31, 2015 compared to the same period in 2014 was primarily due to lower average selling prices and lower sales

2

volumes. Average selling prices decreased primarily in response to lower raw material costs and the foreign currency exchange impact of a stronger U.S. dollar primarily against the Euro. Sales volumes decreased primarily due to customer destocking and competitive pressure. The decrease in adjusted EBITDA was primarily due to lower ethylene contribution margins partially offset by higher contribution margins in our amines business.

Advanced Materials

The decrease in revenues in our Advanced Materials division for the three months ended December 31, 2015 compared to the same period in 2014 was due to lower sales volumes and lower average selling prices. Sales volumes decreased primarily due to the de-selection of certain business, customer destocking and competitive pressure. Average selling prices increased on a local currency basis in the Americas primarily due to our focus on higher value markets but this was more than offset by the foreign currency exchange impact of a stronger U.S. dollar primarily against the Euro globally. The increase in adjusted EBITDA was primarily due to higher global contribution margins from lower raw material costs and higher selling prices in the Americas.

Textile Effects

The decrease in revenues in our Textile Effects division for the three months ended December 31, 2015 compared to the same period in 2014 was due to lower average selling prices and lower sales volumes. Average selling prices increased on a local currency basis due to certain price increase initiatives but this was more than offset by the foreign currency exchange impact of a stronger U.S. dollar primarily against the Euro. Sales volumes decreased primarily due to the de-selection of lower value business and challenging market conditions. The increase in adjusted EBITDA was primarily due to higher contribution margins from lower raw material costs and product mix improvements.

Pigments and Additives

The decrease in revenues in our Pigments and Additives division for the three months ended December 31, 2015 compared to the same period in 2014 was due to lower average selling prices and lower sales volumes. Average selling prices decreased primarily as a result of titanium dioxide over supply in the market place and the foreign currency exchange impact of a stronger U.S. dollar primarily against the Euro. Sales volumes decreased primarily as a result of lower end use demand. The decrease in adjusted EBITDA was primarily due to lower contribution margins for titanium dioxide.

Corporate, LIFO and Other

Adjusted EBITDA from Corporate, LIFO and Other increased by $10 million to a loss of $38 million for the three months ended December 31, 2015 compared to a loss of $48 million for the same period in 2014. The increase in adjusted EBITDA was primarily the result of an increase in income from benzene sales of $7 million.

Liquidity, Capital Resources and Outstanding Debt

As of December 31, 2015, we had $1,023 million of combined cash and unused borrowing capacity compared to $1,601 million on December 31, 2014.

On September 29, 2015, our Board of Directors authorized the repurchase of up to $150 million in shares of our common stock. On October 27, 2015 we entered into and funded an accelerated share repurchase agreement to repurchase $100 million of our common stock. The accelerated share repurchase was completed in January 2016 with 8.6 million shares repurchased.

During 2015 we spent $663 million on capital expenditures; we expect to spend approximately $450 million annually on capital expenditures in 2016 and 2017.

3

Income Taxes

During the three months ended December 31, 2015, we recorded an income tax benefit of $39 million as a result of the combination of effective tax planning, certain unusual tax benefits and the regional mix of income. During the same period we paid $45 million in cash for income taxes.

We expect our 2016 and long term adjusted effective tax rate to be approximately 30%.

Earnings Conference Call Information

We will hold a conference call to discuss our fourth quarter and full year 2015 financial results on Thursday, February 11, 2016 at 9:00 a.m. ET.

Call-in numbers for the conference call:

|

U.S. participants |

(888) 713 - 4199 |

|

International participants |

(617) 213 - 4861 |

|

Passcode |

810 262 68# |

In order to facilitate the registration process, you may use the following link to pre-register for the conference call. Callers who pre-register will be given a unique PIN to gain immediate access to the call and bypass the live operator. You may pre-register at any time, including up to and after the call start time. To pre-register, please go to: https://www.theconferencingservice.com/prereg/key.process?key=P8K7QH79L

Webcast Information

The conference call will be available via webcast and can be accessed from the company’s website at ir.huntsman.com.

Replay Information

The conference call will be available for replay beginning February 11, 2016 and ending February 18, 2016.

Call-in numbers for the replay:

|

U.S. participants |

(888) 286 - 8010 |

|

International participants |

(617) 801 - 6888 |

|

Replay code |

29385180 |

4

Table 1 — Results of Operations

|

|

|

Three months ended |

|

Twelve months ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

In millions, except per share amounts, unaudited |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

2,332 |

|

$ |

2,951 |

|

$ |

10,299 |

|

$ |

11,578 |

|

|

Cost of goods sold |

|

1,956 |

|

2,502 |

|

8,451 |

|

9,659 |

|

|

Gross profit |

|

376 |

|

449 |

|

1,848 |

|

1,919 |

|

|

Operating expenses |

|

282 |

|

317 |

|

1,141 |

|

1,128 |

|

|

Restructuring, impairment and plant closing costs |

|

81 |

|

67 |

|

302 |

|

158 |

|

|

Operating income |

|

13 |

|

65 |

|

405 |

|

633 |

|

|

Interest expense |

|

(47 |

) |

(57 |

) |

(205 |

) |

(205 |

) |

|

Equity in income of investment in unconsolidated affiliates |

|

1 |

|

— |

|

6 |

|

6 |

|

|

Loss on early extinguishment of debt |

|

— |

|

(28 |

) |

(31 |

) |

(28 |

) |

|

Other income (loss) |

|

3 |

|

(2 |

) |

1 |

|

(2 |

) |

|

(Loss) income before income taxes |

|

(30 |

) |

(22 |

) |

176 |

|

404 |

|

|

Income tax benefit (expense) |

|

39 |

|

(12 |

) |

(46 |

) |

(51 |

) |

|

Income (loss) from continuing operations |

|

9 |

|

(34 |

) |

130 |

|

353 |

|

|

Loss from discontinued operations, net of tax(3) |

|

— |

|

(1 |

) |

(4 |

) |

(8 |

) |

|

Net income (loss) |

|

9 |

|

(35 |

) |

126 |

|

345 |

|

|

Net income attributable to noncontrolling interests, net of tax |

|

(5 |

) |

(3 |

) |

(33 |

) |

(22 |

) |

|

Net income (loss) attributable to Huntsman Corporation |

|

$ |

4 |

|

$ |

(38 |

) |

$ |

93 |

|

$ |

323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

|

$ |

240 |

|

$ |

292 |

|

$ |

1,221 |

|

$ |

1,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income(1) |

|

$ |

124 |

|

$ |

81 |

|

$ |

492 |

|

$ |

478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income (loss) per share |

|

$ |

0.02 |

|

$ |

(0.16 |

) |

$ |

0.38 |

|

$ |

1.33 |

|

|

Diluted income (loss) per share |

|

$ |

0.02 |

|

$ |

(0.16 |

) |

$ |

0.38 |

|

$ |

1.31 |

|

|

Adjusted diluted income per share(1) |

|

$ |

0.51 |

|

$ |

0.33 |

|

$ |

2.00 |

|

$ |

1.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common share information: |

|

|

|

|

|

|

|

|

|

|

Basic shares outstanding |

|

239 |

|

243 |

|

243 |

|

242 |

|

|

Diluted shares |

|

241 |

|

243 |

|

245 |

|

246 |

|

|

Diluted shares for adjusted diluted income per share |

|

241 |

|

247 |

|

245 |

|

246 |

|

See end of press release for footnote explanations

5

Table 2 — Results of Operations by Segment

|

|

|

Three months ended |

|

|

|

Twelve months ended |

|

|

|

|

|

|

December 31, |

|

Better / |

|

December 31, |

|

Better / |

|

|

In millions, unaudited |

|

2015 |

|

2014 |

|

(Worse) |

|

2015 |

|

2014 |

|

(Worse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

$ |

909 |

|

$ |

1,201 |

|

(24 |

)% |

$ |

3,811 |

|

$ |

5,032 |

|

(24 |

)% |

|

Performance Products |

|

552 |

|

712 |

|

(22 |

)% |

2,501 |

|

3,072 |

|

(19 |

)% |

|

Advanced Materials |

|

256 |

|

295 |

|

(13 |

)% |

1,103 |

|

1,248 |

|

(12 |

)% |

|

Textile Effects |

|

186 |

|

203 |

|

(8 |

)% |

804 |

|

896 |

|

(10 |

)% |

|

Pigments & Additives |

|

453 |

|

573 |

|

(21 |

)% |

2,160 |

|

1,549 |

|

39 |

% |

|

Eliminations and other |

|

(24 |

) |

(33 |

) |

27 |

% |

(80 |

) |

(219 |

) |

63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

2,332 |

|

$ |

2,951 |

|

(21 |

)% |

$ |

10,299 |

|

$ |

11,578 |

|

(11 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Adjusted EBITDA(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

$ |

141 |

|

$ |

171 |

|

(18 |

)% |

$ |

573 |

|

$ |

722 |

|

(21 |

)% |

|

Performance Products |

|

76 |

|

111 |

|

(32 |

)% |

460 |

|

473 |

|

(3 |

)% |

|

Advanced Materials |

|

48 |

|

43 |

|

12 |

% |

220 |

|

199 |

|

11 |

% |

|

Textile Effects |

|

13 |

|

6 |

|

117 |

% |

63 |

|

58 |

|

9 |

% |

|

Pigments & Additives |

|

— |

|

9 |

|

(100 |

)% |

61 |

|

76 |

|

(20 |

)% |

|

Corporate, LIFO and other |

|

(38 |

) |

(48 |

) |

21 |

% |

(156 |

) |

(188 |

) |

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

240 |

|

$ |

292 |

|

(18 |

)% |

$ |

1,221 |

|

$ |

1,340 |

|

(9 |

)% |

See end of press release for footnote explanations

Table 3 — Pro Forma (2) Results of Operations by Segment

|

|

|

Three months ended |

|

|

|

Twelve months ended |

|

|

|

|

|

|

December 31, |

|

Better / |

|

December 31, |

|

Better / |

|

|

In millions, unaudited, pro forma |

|

2015 |

|

2014 |

|

(Worse) |

|

2015 |

|

2014 |

|

(Worse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

$ |

909 |

|

$ |

1,201 |

|

(24 |

)% |

$ |

3,811 |

|

$ |

5,053 |

|

(25 |

)% |

|

Performance Products |

|

552 |

|

712 |

|

(22 |

)% |

2,501 |

|

3,072 |

|

(19 |

)% |

|

Advanced Materials |

|

256 |

|

295 |

|

(13 |

)% |

1,103 |

|

1,248 |

|

(12 |

)% |

|

Textile Effects |

|

186 |

|

203 |

|

(8 |

)% |

804 |

|

896 |

|

(10 |

)% |

|

Pigments & Additives |

|

453 |

|

559 |

|

(19 |

)% |

2,160 |

|

2,673 |

|

(19 |

)% |

|

Eliminations and other |

|

(24 |

) |

(33 |

) |

27 |

% |

(80 |

) |

(219 |

) |

63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma total |

|

$ |

2,332 |

|

$ |

2,937 |

|

(21 |

)% |

$ |

10,299 |

|

$ |

12,723 |

|

(19 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Adjusted EBITDA(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

$ |

141 |

|

$ |

171 |

|

(18 |

)% |

$ |

573 |

|

$ |

728 |

|

(21 |

)% |

|

Performance Products |

|

76 |

|

111 |

|

(32 |

)% |

460 |

|

473 |

|

(3 |

)% |

|

Advanced Materials |

|

48 |

|

43 |

|

12 |

% |

220 |

|

199 |

|

11 |

% |

|

Textile Effects |

|

13 |

|

6 |

|

117 |

% |

63 |

|

58 |

|

9 |

% |

|

Pigments & Additives |

|

— |

|

17 |

|

(100 |

)% |

61 |

|

225 |

|

(73 |

)% |

|

Corporate, LIFO and other |

|

(38 |

) |

(48 |

) |

21 |

% |

(156 |

) |

(188 |

) |

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma total |

|

$ |

240 |

|

$ |

300 |

|

(20 |

)% |

$ |

1,221 |

|

$ |

1,495 |

|

(18 |

)% |

See end of press release for footnote explanations

6

Table 4 — Factors Impacting Sales Revenues

|

|

|

Three months ended |

|

|

|

|

December 31, 2015 vs. 2014 |

|

|

|

|

Average Selling Price(a) |

|

|

|

|

|

|

|

|

|

|

Local |

|

Exchange |

|

Sales Mix |

|

Sales |

|

|

|

|

Unaudited |

|

Currency |

|

Rate |

|

& Other |

|

Volume(b) |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

(19 |

)% |

(4 |

)% |

2 |

% |

(3 |

)% |

(24 |

)% |

|

Performance Products |

|

(11 |

)% |

(4 |

)% |

(1 |

)% |

(6 |

)% |

(22 |

)% |

|

Advanced Materials |

|

2 |

% |

(8 |

)% |

1 |

% |

(8 |

)% |

(13 |

)% |

|

Textile Effects |

|

2 |

% |

(7 |

)% |

0 |

% |

(3 |

)% |

(8 |

)% |

|

Pigments & Additives |

|

(9 |

)% |

(7 |

)% |

(2 |

)% |

(3 |

)% |

(21 |

)% |

|

Total Company |

|

(14 |

)% |

(5 |

)% |

2 |

% |

(4 |

)% |

(21 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended |

|

|

|

|

December 31, 2015 vs. 2014 |

|

|

|

|

Average Selling Price(a) |

|

|

|

|

|

|

|

|

|

|

Local |

|

Exchange |

|

Sales Mix |

|

Sales |

|

|

|

|

Unaudited |

|

Currency |

|

Rate |

|

& Other(c) |

|

Volume(b) |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

(12 |

)% |

(5 |

)% |

3 |

% |

(10 |

)% |

(24 |

)% |

|

Performance Products |

|

(7 |

)% |

(5 |

)% |

(3 |

)% |

(4 |

)% |

(19 |

)% |

|

Advanced Materials |

|

2 |

% |

(8 |

)% |

(1 |

)% |

(5 |

)% |

(12 |

)% |

|

Textile Effects |

|

1 |

% |

(6 |

)% |

2 |

% |

(7 |

)% |

(10 |

)% |

|

Pigments & Additives |

|

(10 |

)% |

(8 |

)% |

62 |

% |

(5 |

)% |

39 |

% |

|

Total Company |

|

(8 |

)% |

(6 |

)% |

10 |

% |

(7 |

)% |

(11 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma |

|

|

|

|

|

|

Twelve months ended |

|

|

|

|

|

|

December 31, 2015 vs. 2014 |

|

|

|

|

|

|

Average |

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

Sales Mix |

|

Sales |

|

|

|

|

|

|

Unaudited, pro forma |

|

Price(a) |

|

& Other |

|

Volume(b) |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polyurethanes |

|

(17 |

)% |

2 |

% |

(2 |

)% |

(17 |

)%(d) |

|

|

|

Performance Products |

|

(12 |

)% |

(3 |

)% |

(2 |

)% |

(17 |

)%(e) |

|

|

|

Advanced Materials |

|

(6 |

)% |

(1 |

)% |

(5 |

)% |

(12 |

)% |

|

|

|

Textile Effects |

|

(5 |

)% |

2 |

% |

(7 |

)% |

(10 |

)% |

|

|

|

Pigments & Additives |

|

(19 |

)% |

2 |

% |

(2 |

)% |

(19 |

)%(f) |

|

|

|

Total Company |

|

(15 |

)% |

2 |

% |

(2 |

)% |

(15 |

)% |

|

|

(a) Excludes sales from tolling arrangements, by-products and raw materials.

(b) Excludes sales from by-products and raw materials.

(c) Includes impact from the acquisition of the Performance Additives and Titanium Dioxide businesses of Rockwood Holdings, Inc. on October 1, 2014.

(d) Excludes volume impact from planned maintenance at our PO/MTBE facility in 1H15.

(e) Excludes volume impact from closure of our European surfactants plant in 2Q14.

(f) Excludes volume impact from nitrogen tank incident at our Uerdingen, Germany facility in 3Q15.

7

Table 5 — Reconciliation of U.S. GAAP to Non-GAAP Measures

|

|

|

|

|

|

|

Income Tax |

|

Net Income (Loss) |

|

Diluted Income |

|

|

|

|

EBITDA |

|

Benefit (Expense) |

|

Attrib. to HUN Corp. |

|

Per Share |

|

|

|

|

Three months ended |

|

Three months ended |

|

Three months ended |

|

Three months ended |

|

|

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

In millions, except per share amounts, unaudited |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

111 |

|

$ |

141 |

|

$ |

39 |

|

$ |

(12 |

) |

$ |

4 |

|

$ |

(38 |

) |

$ |

0.02 |

|

$ |

(0.16 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

22 |

|

40 |

|

(6 |

) |

(4 |

) |

16 |

|

36 |

|

0.07 |

|

0.15 |

|

|

Loss from discontinued operations, net of tax(3) |

|

3 |

|

1 |

|

N/A |

|

N/A |

|

— |

|

1 |

|

— |

|

— |

|

|

Loss (gain) on disposition of businesses/assets |

|

1 |

|

(1 |

) |

— |

|

— |

|

1 |

|

(1) |

|

— |

|

— |

|

|

Loss on early extinguishment of debt |

|

— |

|

28 |

|

— |

|

(10 |

) |

— |

|

18 |

|

— |

|

0.07 |

|

|

Certain legal settlements and related expenses |

|

1 |

|

— |

|

— |

|

— |

|

1 |

|

— |

|

— |

|

— |

|

|

Plant incident remediation costs |

|

1 |

|

— |

|

— |

|

— |

|

1 |

|

— |

|

— |

|

— |

|

|

Amortization of pension and postretirement actuarial losses |

|

18 |

|

14 |

|

(3 |

) |

— |

|

15 |

|

14 |

|

0.06 |

|

0.06 |

|

|

Restructuring, impairment, plant closing and transition costs |

|

83 |

|

69 |

|

3 |

|

(18 |

) |

86 |

|

51 |

|

0.36 |

|

0.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted(1) |

|

$ |

240 |

|

$ |

292 |

|

$ |

33 |

|

$ |

(44 |

) |

$ |

124 |

|

$ |

81 |

|

$ |

0.51 |

|

$ |

0.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income tax (benefit) expense |

|

|

|

|

|

|

|

|

|

(33 |

) |

44 |

|

|

|

|

|

|

Net income attributable to noncontrolling interests, net of tax |

|

|

|

|

|

|

|

|

|

5 |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted pre-tax income(1) |

|

|

|

|

|

|

|

|

|

$ |

96 |

|

$ |

128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted effective tax rate |

|

|

|

|

|

|

|

|

|

-34 |

% |

34 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax |

|

Net Income |

|

Diluted Income |

|

|

|

|

EBITDA |

|

(Expense) Benefit |

|

Attrib. to HUN Corp. |

|

Per Share |

|

|

|

|

Three months ended |

|

Three months ended |

|

Three months ended |

|

Three months ended |

|

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

In millions, except per share amounts, unaudited |

|

2015 |

|

2015 |

|

2015 |

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

255 |

|

|

|

$ |

(49 |

) |

|

|

$ |

55 |

|

|

|

$ |

0.22 |

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

10 |

|

|

|

(2 |

) |

|

|

8 |

|

|

|

0.03 |

|

|

|

|

Loss from discontinued operations, net of tax(3) |

|

1 |

|

|

|

N/A |

|

|

|

— |

|

|

|

— |

|

|

|

|

Loss on early extinguishment of debt |

|

8 |

|

|

|

(3 |

) |

|

|

5 |

|

|

|

0.02 |

|

|

|

|

Certain legal settlements and related expenses |

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

|

Plant incident remediation costs |

|

3 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

0.01 |

|

|

|

|

Amortization of pension and postretirement actuarial losses |

|

19 |

|

|

|

(4 |

) |

|

|

15 |

|

|

|

0.06 |

|

|

|

|

Restructuring, impairment, plant closing and transition costs |

|

14 |

|

|

|

15 |

|

|

|

29 |

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted(1) |

|

$ |

311 |

|

|

|

$ |

(44 |

) |

|

|

$ |

115 |

|

|

|

$ |

0.47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income tax expense |

|

|

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interests, net of tax |

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted pre-tax income(1) |

|

|

|

|

|

|

|

|

|

$ |

167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted effective tax rate |

|

|

|

|

|

|

|

|

|

26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax |

|

Net Income |

|

Diluted Income |

|

|

|

|

EBITDA |

|

Expense (Benefit) |

|

Attrib. to HUN Corp. |

|

Per Share |

|

|

|

|

Twelve months ended |

|

Twelve months ended |

|

Twelve months ended |

|

Twelve months ended |

|

|

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

In millions, except per share amounts, unaudited |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

741 |

|

$ |

1,022 |

|

$ |

(46 |

) |

$ |

(51 |

) |

$ |

93 |

|

$ |

323 |

|

$ |

0.38 |

|

$ |

1.31 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

53 |

|

67 |

|

(13 |

) |

(10 |

) |

40 |

|

57 |

|

0.16 |

|

0.23 |

|

|

Impact of certain foreign tax credit elections |

|

N/A |

|

N/A |

|

— |

|

(94 |

) |

— |

|

(94 |

) |

— |

|

(0.38 |

) |

|

Loss from discontinued operations, net of tax(3) |

|

6 |

|

10 |

|

N/A |

|

N/A |

|

4 |

|

8 |

|

0.02 |

|

0.03 |

|

|

Loss (gain) on disposition of businesses/assets |

|

2 |

|

(3 |

) |

— |

|

1 |

|

2 |

|

(2 |

) |

0.01 |

|

(0.01 |

) |

|

Loss on early extinguishment of debt |

|

31 |

|

28 |

|

(11 |

) |

(10 |

) |

20 |

|

18 |

|

0.08 |

|

0.07 |

|

|

Certain legal settlements and related expenses |

|

4 |

|

3 |

|

(1 |

) |

— |

|

3 |

|

3 |

|

0.01 |

|

0.01 |

|

|

Plant incident remediation costs |

|

4 |

|

— |

|

(1 |

) |

— |

|

3 |

|

— |

|

0.01 |

|

— |

|

|

Amortization of pension and postretirement actuarial losses |

|

74 |

|

51 |

|

(17 |

) |

(10 |

) |

57 |

|

41 |

|

0.23 |

|

0.17 |

|

|

Restructuring, impairment, plant closing and transition costs |

|

306 |

|

162 |

|

(36 |

) |

(38 |

) |

270 |

|

124 |

|

1.10 |

|

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted(1) |

|

$ |

1,221 |

|

$ |

1,340 |

|

$ |

(125 |

) |

$ |

(212 |

) |

$ |

492 |

|

$ |

478 |

|

$ |

2.00 |

|

$ |

1.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income tax expense |

|

|

|

|

|

|

|

|

|

125 |

|

212 |

|

|

|

|

|

|

Net income attributable to noncontrolling interests, net of tax |

|

|

|

|

|

|

|

|

|

33 |

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted pre-tax income(1) |

|

|

|

|

|

|

|

|

|

$ |

650 |

|

$ |

712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted effective tax rate |

|

|

|

|

|

|

|

|

|

19 |

% |

30 |

% |

|

|

|

|

See end of press release for footnote explanations

8

Table 6 — Pro Forma (2) Reconciliation of U.S. GAAP to Non-GAAP Measures

|

|

|

Pro Forma EBITDA |

|

|

|

|

Three months ended |

|

|

|

|

December 31, |

|

|

In millions, except per share amounts, unaudited, pro forma |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

111 |

|

$ |

191 |

|

|

Adjustments: |

|

|

|

|

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

22 |

|

(2 |

) |

|

Loss from discontinued operations, net of tax(3) |

|

3 |

|

1 |

|

|

Loss (gain) on disposition of businesses/assets |

|

1 |

|

(1 |

) |

|

Loss on early extinguishment of debt |

|

— |

|

28 |

|

|

Certain legal settlements and related expenses |

|

1 |

|

— |

|

|

Plant incident remediation costs |

|

1 |

|

— |

|

|

Amortization of pension and postretirement actuarial losses |

|

18 |

|

14 |

|

|

Restructuring, impairment, plant closing and transition costs |

|

83 |

|

69 |

|

|

|

|

|

|

|

|

|

Pro forma adjusted(2) |

|

$ |

240 |

|

$ |

300 |

|

|

|

|

Pro Forma EBITDA |

|

|

|

|

Three months ended |

|

|

|

|

September 30, |

|

|

In millions, except per share amounts, unaudited pro forma |

|

2015 |

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

255 |

|

|

Adjustments: |

|

|

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

10 |

|

|

Loss from discontinued operations, net of tax(3) |

|

1 |

|

|

Loss on early extinguishment of debt |

|

8 |

|

|

Certain legal settlements and related expenses |

|

1 |

|

|

Plant incident remediation costs |

|

3 |

|

|

Amortization of pension and postretirement actuarial losses |

|

19 |

|

|

Restructuring, impairment, plant closing and transition costs |

|

14 |

|

|

|

|

|

|

|

Pro forma adjusted(2) |

|

$ |

311 |

|

|

|

|

Pro Forma EBITDA |

|

|

|

|

Twelve months ended |

|

|

|

|

December 31, |

|

|

In millions, except per share amounts, unaudited pro forma |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

GAAP(1) |

|

$ |

741 |

|

$ |

1,214 |

|

|

Adjustments: |

|

|

|

|

|

|

Allocation of general corporate overhead |

|

— |

|

20 |

|

|

Acquisition and integration expenses, purchase accounting adjustments |

|

53 |

|

7 |

|

|

Loss from discontinued operations, net of tax(3) |

|

6 |

|

10 |

|

|

Loss (gain) on disposition of businesses/assets |

|

2 |

|

(3 |

) |

|

Loss on early extinguishment of debt |

|

31 |

|

28 |

|

|

Certain legal settlements and related expenses |

|

4 |

|

3 |

|

|

Plant incident remediation costs |

|

4 |

|

— |

|

|

Amortization of pension and postretirement actuarial losses |

|

74 |

|

54 |

|

|

Restructuring, impairment, plant closing and transition costs |

|

306 |

|

162 |

|

|

|

|

|

|

|

|

|

Pro forma adjusted(2) |

|

$ |

1,221 |

|

$ |

1,495 |

|

See end of press release for footnote explanations

9

Table 7 — Reconciliation of Net Income to EBITDA

|

|

|

Three months ended |

|

Twelve months ended |

|

|

|

|

December 31, |

|

September 30, |

|

December 31, |

|

|

In millions, unaudited |

|

2015 |

|

2014 |

|

2015 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Huntsman Corporation |

|

$ |

4 |

|

$ |

(38 |

) |

$ |

55 |

|

$ |

93 |

|

$ |

323 |

|

|

Interest expense |

|

47 |

|

57 |

|

49 |

|

205 |

|

205 |

|

|

Income tax (benefit) expense from continuing operations |

|

(39 |

) |

12 |

|

49 |

|

46 |

|

51 |

|

|

Income tax benefit from discontinued operations(3) |

|

(3 |

) |

— |

|

(1 |

) |

(2 |

) |

(2 |

) |

|

Depreciation and amortization |

|

102 |

|

110 |

|

103 |

|

399 |

|

445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA(1) |

|

111 |

|

141 |

|

255 |

|

741 |

|

1,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma adjustments to: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Huntsman Corporation |

|

— |

|

26 |

|

— |

|

— |

|

75 |

|

|

Interest expense |

|

— |

|

1 |

|

— |

|

— |

|

34 |

|

|

Income tax (benefit) expense from continuing operations |

|

— |

|

13 |

|

— |

|

— |

|

43 |

|

|

Depreciation and amortization |

|

— |

|

10 |

|

— |

|

— |

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma EBITDA(2) |

|

$ |

111 |

|

$ |

191 |

|

$ |

255 |

|

$ |

741 |

|

$ |

1,214 |

|

See end of press release for footnote explanations

Table 8 — Selected Balance Sheet Items

|

|

|

December 31, |

|

September 30, |

|

December 31, |

|

|

In millions |

|

2015 |

|

2015 |

|

2014 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

269 |

|

$ |

437 |

|

$ |

870 |

|

|

Accounts and notes receivable, net |

|

1,449 |

|

1,632 |

|

1,707 |

|

|

Inventories |

|

1,692 |

|

1,850 |

|

2,025 |

|

|

Other current assets |

|

424 |

|

332 |

|

437 |

|

|

Property, plant and equipment, net |

|

4,446 |

|

4,380 |

|

4,423 |

|

|

Other assets |

|

1,540 |

|

1,535 |

|

1,461 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

9,820 |

|

$ |

10,166 |

|

$ |

10,923 |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,061 |

|

$ |

1,068 |

|

$ |

1,275 |

|

|

Other current liabilities |

|

686 |

|

839 |

|

790 |

|

|

Current portion of debt |

|

170 |

|

158 |

|

267 |

|

|

Long-term debt |

|

4,625 |

|

4,639 |

|

4,854 |

|

|

Other liabilities |

|

1,649 |

|

1,671 |

|

1,786 |

|

|

Total equity |

|

1,629 |

|

1,791 |

|

1,951 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

9,820 |

|

$ |

10,166 |

|

$ |

10,923 |

|

10

Table 9 — Outstanding Debt

|

|

|

December 31, |

|

September 30, |

|

December 31, |

|

|

In millions |

|

2015 |

|

2015 |

|

2014 |

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt: |

|

|

|

|

|

|

|

|

Senior credit facilities |

|

$ |

2,454 |

|

$ |

2,453 |

|

$ |

2,468 |

|

|

Accounts receivable programs |

|

215 |

|

217 |

|

229 |

|

|

Senior notes |

|

1,850 |

|

1,867 |

|

1,582 |

|

|

Senior subordinated notes |

|

— |

|

— |

|

526 |

|

|

Variable interest entities |

|

151 |

|

158 |

|

207 |

|

|

Other debt |

|

125 |

|

102 |

|

109 |

|

|

|

|

|

|

|

|

|

|

|

Total debt - excluding affiliates |

|

4,795 |

|

4,797 |

|

5,121 |

|

|

|

|

|

|

|

|

|

|

|

Total cash |

|

269 |

|

437 |

|

870 |

|

|

|

|

|

|

|

|

|

|

|

Net debt- excluding affiliates |

|

$ |

4,526 |

|

$ |

4,360 |

|

$ |

4,251 |

|

Table 10 — Summarized Statement of Cash Flows

|

|

|

Three months ended |

|

Year ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

In millions, unaudited |

|

2015 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

Total cash at beginning of period(a) |

|

$ |

437 |

|

$ |

870 |

|

$ |

529 |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

188 |

|

575 |

|

760 |

|

|

Net cash used in investing activities |

|

(217 |

) |

(600 |

) |

(1,606 |

) |

|

Net cash (used in) provided by financing activities |

|

(144 |

) |

(562 |

) |

1,197 |

|

|

Effect of exchange rate changes on cash |

|

(3 |

) |

(16 |

) |

(11 |

) |

|

Change in restricted cash |

|

8 |

|

2 |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

Total cash at end of period(a) |

|

$ |

269 |

|

$ |

269 |

|

$ |

870 |

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

(67 |

) |

$ |

(225 |

) |

$ |

(208 |

) |

|

Cash paid for income taxes |

|

(45 |

) |

(126 |

) |

(165 |

) |

|

Cash paid for capital expenditures |

|

(209 |

) |

(663 |

) |

(601 |

) |

|

Depreciation and amortization |

|

102 |

|

399 |

|

445 |

|

|

|

|

|

|

|

|

|

|

|

Changes in primary working capital: |

|

|

|

|

|

|

|

|

Accounts and notes receivable |

|

$ |

174 |

|

$ |

121 |

|

$ |

2 |

|

|

Inventories |

|

133 |

|

179 |

|

(20 |

) |

|

Accounts payable |

|

(46 |

) |

(157 |

) |

86 |

|

|

|

|

|

|

|

|

|

|

|

Total cash provided by primary working capital |

|

$ |

261 |

|

$ |

143 |

|

$ |

68 |

|

(a) Includes restricted cash.

11

Footnotes

(1) We use EBITDA and adjusted EBITDA to measure the operating performance of our business. We provide adjusted net income because we feel it provides meaningful insight for the investment community into the performance of our business. We believe that net income (loss) attributable to Huntsman Corporation is the performance measure calculated and presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”) that is most directly comparable to EBITDA, adjusted EBITDA and adjusted net income. Additional information with respect to our use of each of these financial measures follows:

EBITDA is defined as net income (loss) attributable to Huntsman Corporation before interest, income taxes, and depreciation and amortization. EBITDA as used herein is not necessarily comparable to other similarly titled measures of other companies. The reconciliation of EBITDA to net income (loss) attributable to Huntsman Corporation is set forth in Table 7 above.

Adjusted EBITDA is computed by eliminating the following from EBITDA: (a) acquisition and integration expenses, purchase accounting adjustments; (b) loss (gain) on initial consolidation of subsidiaries; (c) EBITDA from discontinued operations; (d) loss (gain) on disposition of businesses/assets; (e) loss on early extinguishment of debt; (f) extraordinary loss (gain) on the acquisition of a business; (g) certain legal settlements and related expenses; (h) plant incident remediation costs; (i) amortization of pension and postretirement actuarial losses (gains); and (j) restructuring, impairment, plant closing and transition costs (credits). The reconciliation of adjusted EBITDA to EBITDA is set forth in Table 5 above.

Adjusted net income (loss) is computed by eliminating the after tax impact of the following items from net income (loss) attributable to Huntsman Corporation: (a) acquisition and integration expenses, purchase accounting adjustments; (b) impact of certain foreign tax credit elections; (c) loss (gain) on initial consolidation of subsidiaries; (d) loss (income) from discontinued operations; (e) discount amortization on settlement financing associated with the terminated merger; (f) loss (gain) on disposition of businesses/assets; (g) loss on early extinguishment of debt; (h) extraordinary loss (gain) on the acquisition of a business; (i) certain legal settlements and related expenses; (j) plant incident remediation costs; (k) amortization of pension and postretirement actuarial losses (gains); and (l) restructuring, impairment, plant closing and transition costs (credits). We do not adjust for changes in tax valuation allowances because we do not believe it provides more meaningful information than is provided under GAAP. The reconciliation of adjusted net income (loss) to net income (loss) attributable to Huntsman Corporation common stockholders is set forth in Table 5 above.

(2) Pro forma adjusted as if it had occurred at the beginning of the relevant period to (a) include the October 1, 2014 acquisition of the Performance Additives and Titanium Dioxide businesses of Rockwood Holdings, Inc.; (b) to exclude the related sale of our TR52 product line — used in printing inks — to Henan Billions Chemicals Co., Ltd. in December 2014; and (c) to exclude the allocation of general corporate overhead by Rockwood.

(3) During the first quarter 2010 we closed our Australian styrenics operations; results from this business are treated as discontinued operations.

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated chemicals with 2015 revenues of approximately $10 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 100 manufacturing and R&D facilities in approximately 30 countries and employ approximately 15,000 associates within our 5 distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com.

Social Media:

Twitter: twitter.com/Huntsman_Corp

Facebook: www.facebook.com/huntsmancorp

LinkedIn: www.linkedin.com/company/huntsman

Forward-Looking Statements:

Statements in this release that are not historical are forward-looking statements. These statements are based on management’s current beliefs and expectations. The forward-looking statements in this release are subject to uncertainty and changes in circumstances and involve risks and uncertainties that may affect the company’s operations, markets, products, services, prices and other factors as discussed in the Huntsman companies’ filings with the U.S. Securities and Exchange Commission. Significant risks and uncertainties may relate to, but are not limited to, financial, economic, competitive, environmental, political, legal, regulatory and technological factors. The company assumes no obligation to provide revisions to any forward-looking statements should circumstances change, except as otherwise required by applicable laws.

12

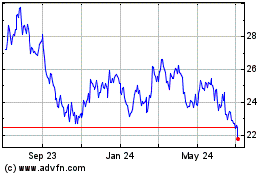

Huntsman (NYSE:HUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

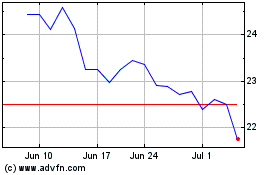

Huntsman (NYSE:HUN)

Historical Stock Chart

From Apr 2023 to Apr 2024