UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 9, 2016

P.A.M. TRANSPORTATION SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

0-15057 |

71-0633135 |

|

(State or other jurisdiction of

incorporation) |

(Commission File

Number) |

(I.R.S. Employer Identification No.) |

297 West Henri De Tonti, Tontitown, Arkansas 72770

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (479) 361-9111

| |

N/A |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Item 2.02 |

Results of Operations and Financial Condition. |

On February 9, 2016, P.A.M. Transportation Services, Inc. issued a news release announcing its financial results for the fourth quarter ending December 31, 2015. A copy of the news release is attached hereto as Exhibit 99.1.

The information contained in this report and the exhibit hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information herein (including the exhibit hereto) may contain "forward-looking statements" that are made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995 and otherwise may be protected. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results may differ from those anticipated by forward-looking statements.

Please refer to the Company's Annual Report on Form 10-K and other filings with the Securities and Exchange Commission for information concerning risks, uncertainties and other factors that may affect future results.

|

Item 9.01 |

Financial Statements and Exhibits. |

|

(d) |

Exhibits. The following exhibits are furnished with this Report: |

|

|

|

99.1 News release issued by the Registrant on February 9, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

P.A.M. TRANSPORTATION SERVICES, INC. |

|

| |

|

(Registrant) |

|

|

|

|

|

|

|

Date: February 9, 2016 |

By: |

/s/ Allen W. West |

|

|

|

|

Allen W. West |

|

|

|

|

Vice President of Finance, Chief Financial Officer, |

|

| |

|

Secretary and Treasurer |

|

EXHIBIT INDEX

|

Exhibit

Number |

|

Exhibit Description |

|

|

|

|

|

|

99.1 |

|

News release issued by the Registrant on February 9, 2016 |

Exhibit 99.1

FROM: P.A.M. TRANSPORTATION SERVICES, INC.

P.O. BOX 188

Tontitown, AR 72770

Allen W. West

(479) 361-9111

P.A.M. TRANSPORTATION SERVICES, INC.

ANNOUNCES RECORD RESULTS FOR THE FOURTH QUARTER

AND YEAR ENDED DECEMBER 31, 2015

Tontitown, Arkansas, February 9, 2016...... P.A.M. Transportation Services, Inc. (NASDAQ: PTSI) today reported a 51.6% increase in net income and a 66.7% increase in diluted earnings per share for the fourth quarter of 2015 as net income increased to $3,232,616, or $0.45 per diluted share, for the fourth quarter of 2015 compared to net income of $2,132,541, or $0.27 per diluted share, for the fourth quarter of 2014. For the twelve months ended December 31, 2015, net income increased 58.9% and diluted earnings per share increased 74.4% as net income increased to $21,435,891, or $2.93 per diluted share, for the twelve months ended December 31, 2015 compared to net income of $13,491,430, or $1.68 per diluted share, for the twelve months ended December 31, 2014.

Base revenue, which excludes fuel surcharge revenue, increased 13.5% to $89,589,226 for the fourth quarter of 2015 compared to $78,923,809 for the fourth quarter of 2014, while fuel surcharge revenue decreased 43.7% to $12,835,181 for the fourth quarter of 2015 compared to $22,790,795 for the fourth quarter of 2014. As a result, total operating revenues increased to $102,424,407 for the fourth quarter of 2015 compared to $101,714,604 for the fourth quarter of 2014. For the twelve months ended December 31, 2015, base revenue, which excludes fuel surcharge revenue, increased 12.3% to $355,402,681 compared to $316,583,955 for the twelve months ended December 31, 2014, while fuel surcharge revenue decreased 34.7% to $61,647,740 for the twelve months ended December 31, 2015 compared to $94,353,274 for the twelve months ended December 31, 2014. As a result, total operating revenues increased 1.5% to $417,050,421 for the twelve months ended December 31, 2015 compared to $410,937,229 for the twelve months ended December 31, 2014. The decline in fuel surcharge revenue for each of the periods was due to the significant decline in retail fuel prices during the periods compared.

Daniel H. Cushman, President of the Company, commented, “We are very pleased to report record earnings for both the fourth quarter and for the year. We want to thank our committed employees and customers for our ongoing success. Our most profitable year on record, prior to this year, was 2006. What made 2015 especially satisfying was that we set a new record with significantly fewer assets. We did it by focusing on doing everything better.

“At the start of 2015, our goal was to continue to maintain our operating profit margins realized in 2014, but just as importantly, we wanted to grow. Throughout the year we explored multiple growth opportunities, but in the end, only realized growth organically. We continued to see strong demand in our Automotive, Mexico and Logistics Divisions which are among our most profitable divisions. Growth in our Logistics Division far exceeded our expectations and as a result, we were able to provide our customers with better than expected additional capacity. We were also able to stabilize our Expedited and Dedicated Divisions during the year. Overall, we achieved base revenue growth of 12.3% in a somewhat challenging year, particularly towards the end of the year. As previously mentioned, maintaining margins was our goal while growth was our focus, and we achieved base revenue growth of 12.3% year over year and increased operating profit margins by 55.1% year over year. We are very satisfied by those results.

“We enter 2016 with continued focus on our commitment to our driving professionals. We do that in a multitude of ways. We provide them with one of the newest and innovative fleets on the road as the average age of our truck fleet is 1.3 years old. During 2015, we also made significant investments in new trailers and expect to continue to do so throughout the coming year. As a result of our investments and efforts, we have seen our driver fleet grow by over 100 drivers during the fourth quarter of 2015 compared to the fourth quarter of 2014. Our selection of job opportunities and home time separates us from others.

“While 2015 represented a record year for the Company in many categories, we expect that the coming year won’t be without its challenges. However, we also believe that we have a diverse marketing plan that will allow us to adapt to various conditions and we look forward to the coming year.”

P.A.M. Transportation Services, Inc. is a leading truckload dry van carrier transporting general commodities throughout the continental United States, as well as in the Canadian provinces of Ontario and Quebec. The Company also provides transportation services in Mexico through its gateways in Laredo and El Paso, Texas under agreements with Mexican carriers.

Certain information included in this document contains or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may relate to expected future financial and operating results or events, and are thus prospective. Such forward-looking statements are subject to risks, uncertainties and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, excess capacity in the trucking industry; surplus inventories; recessionary economic cycles and downturns in customers' business cycles; increases or rapid fluctuations in fuel prices, interest rates, fuel taxes, tolls, license and registration fees; the resale value of the Company's used equipment and the price of new equipment; increases in compensation for and difficulty in attracting and retaining qualified drivers and owner-operators; increases in insurance premiums and deductible amounts relating to accident, cargo, workers' compensation, health, and other claims; unanticipated increases in the number or amount of claims for which the Company is self-insured; inability of the Company to continue to secure acceptable financing arrangements; seasonal factors such as harsh weather conditions that increase operating costs; competition from trucking, rail, and intermodal competitors including reductions in rates resulting from competitive bidding; the ability to identify acceptable acquisition candidates, consummate acquisitions, and integrate acquired operations; a significant reduction in or termination of the Company's trucking service by a key customer; and other factors, including risk factors, included from time to time in filings made by the Company with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking events and circumstances discussed above and in company filings might not transpire.

P.A.M. Transportation Services, Inc. and Subsidiaries

Key Financial and Operating Statistics

(unaudited)

| |

|

Quarter ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue, before fuel surcharge |

|

$ |

89,589,226 |

|

|

$ |

78,923,809 |

|

|

$ |

355,402,681 |

|

|

$ |

316,583,955 |

|

|

Fuel surcharge |

|

|

12,835,181 |

|

|

|

22,790,795 |

|

|

|

61,647,740 |

|

|

|

94,353,274 |

|

| |

|

|

102,424,407 |

|

|

|

101,714,604 |

|

|

|

417,050,421 |

|

|

|

410,937,229 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses and costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, wages and benefits |

|

|

26,910,459 |

|

|

|

26,971,358 |

|

|

|

105,942,384 |

|

|

|

108,370,974 |

|

|

Operating supplies and expenses |

|

|

20,675,425 |

|

|

|

28,314,741 |

|

|

|

89,877,843 |

|

|

|

126,874,439 |

|

|

Rent and purchased transportation |

|

|

36,304,819 |

|

|

|

25,075,271 |

|

|

|

134,187,353 |

|

|

|

90,831,124 |

|

|

Depreciation |

|

|

8,593,580 |

|

|

|

8,966,884 |

|

|

|

32,346,438 |

|

|

|

36,296,221 |

|

|

Insurance and claims |

|

|

4,069,103 |

|

|

|

8,148,524 |

|

|

|

15,314,863 |

|

|

|

20,273,664 |

|

|

Other |

|

|

2,037,512 |

|

|

|

2,289,316 |

|

|

|

8,904,921 |

|

|

|

9,871,459 |

|

|

Gain on disposition of equipment |

|

|

(1,142,149 |

) |

|

|

(1,177,467 |

) |

|

|

(5,753,529 |

) |

|

|

(4,591,185 |

) |

|

Total operating expenses and costs |

|

|

97,448,749 |

|

|

|

98,588,627 |

|

|

|

380,820,273 |

|

|

|

387,926,696 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

4,975,658 |

|

|

|

3,125,977 |

|

|

|

36,230,148 |

|

|

|

23,010,533 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(825,113 |

) |

|

|

(659,535 |

) |

|

|

(2,817,951 |

) |

|

|

(2,897,272 |

) |

|

Non-operating income |

|

|

1,130,400 |

|

|

|

974,262 |

|

|

|

1,515,772 |

|

|

|

2,099,362 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

5,280,945 |

|

|

|

3,440,704 |

|

|

|

34,927,969 |

|

|

|

22,212,623 |

|

|

Income tax expense |

|

|

2,048,329 |

|

|

|

1,308,163 |

|

|

|

13,492,078 |

|

|

|

8,721,193 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,232,616 |

|

|

$ |

2,132,541 |

|

|

$ |

21,435,891 |

|

|

$ |

13,491,430 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.45 |

|

|

$ |

0.27 |

|

|

$ |

2.93 |

|

|

$ |

1.68 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average shares outstanding – Diluted |

|

|

7,144,142 |

|

|

|

8,026,979 |

|

|

|

7,324,962 |

|

|

|

8,034,376 |

|

| |

|

Quarter ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

Truckload Operations |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total miles |

|

|

54,717,397 |

|

|

|

51,176,203 |

|

|

|

218,418,033 |

|

|

|

209,990,358 |

|

|

Operating ratio (1) |

|

|

93.96 |

% |

|

|

95.91 |

% |

|

|

88.69 |

% |

|

|

92.42 |

% |

|

Empty miles factor |

|

|

7.10 |

% |

|

|

7.01 |

% |

|

|

6.78 |

% |

|

|

6.80 |

% |

|

Revenue per total mile, before fuel surcharge |

|

$ |

1.44 |

|

|

$ |

1.40 |

|

|

$ |

1.43 |

|

|

$ |

1.39 |

|

|

Total loads |

|

|

76,650 |

|

|

|

69,651 |

|

|

|

306,553 |

|

|

|

282,446 |

|

|

Revenue per truck per work day |

|

$ |

669 |

|

|

$ |

644 |

|

|

$ |

670 |

|

|

$ |

647 |

|

|

Revenue per truck per week |

|

$ |

3,345 |

|

|

$ |

3,220 |

|

|

$ |

3,350 |

|

|

$ |

3,235 |

|

|

Average company-driver trucks |

|

|

1,405 |

|

|

|

1,437 |

|

|

|

1,415 |

|

|

|

1,442 |

|

|

Average owner operator trucks |

|

|

470 |

|

|

|

333 |

|

|

|

414 |

|

|

|

340 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Logistics Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

10,608,963 |

|

|

$ |

7,062,430 |

|

|

$ |

44,161,507 |

|

|

$ |

23,862,708 |

|

|

Operating ratio |

|

|

98.08 |

% |

|

|

97.37 |

% |

|

|

97.68 |

% |

|

|

96.53 |

% |

|

1) |

Operating ratio has been calculated based upon total operating expenses, net of fuel surcharge, as a percentage of revenue, before fuel surcharge. We used revenue, before fuel surcharge, and operating expenses, net of fuel surcharge, because we believe that eliminating this sometimes volatile source of revenue affords a more consistent basis for comparing our results of operations from period to period. |

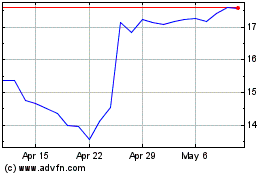

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

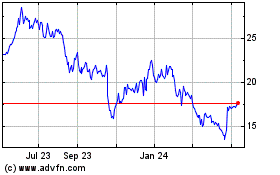

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024