UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2015 (May 7, 2015)

Ryerson Holding Corporation

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

001-34735

(Commission

File Number)

26-1251524

(I.R.S. Employer Identification No.)

227 W. Monroe St., 27th Floor, Chicago, IL 60606

(Address of principal executive offices and zip code)

(312) 292-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Election of Edward Lehner as President and Chief Executive Officer; Retirement of Michael

C. Arnold

On May 7, 2015, Ryerson Holding Corporation (the “Company”) entered into an offer letter (the “Offer Letter”) with

Edward J. Lehner, pursuant to which he was appointed to the position of President and Chief Executive Officer of the Company, effective June 1, 2015. Mr. Lehner, 49, will replace Michael C. Arnold, who previously announced his plans to

retire as President and Chief Executive Officer.

Mr. Lehner is currently the Company’s Executive Vice President and Chief Financial Officer,

positions he has held since August 2012. Prior to that time, Mr. Lehner served from 2009 to 2012 as chief financial officer and chief administrative officer for PSC Metals, Inc., a North American ferrous and non-ferrous scrap processor.

Description of Offer Letter

Pursuant to the terms of the

Offer Letter, Mr. Lehner will be entitled to an annual base salary of $650,000 per year and will have a target annual bonus opportunity equal to 110% of his base salary, based on the achievement of targets established pursuant to the

Company’s Annual Incentive Plan. Mr. Lehner will also receive a grant of performance units (“PSUs”) and time-vesting restricted stock units (“RSUs”) in amounts such that the total number of RSUs and PSUs granted to him

will equal 90,000. The RSUs and PSUs will be granted to Mr. Lehner in conjunction with the grant of equity-based long-term incentive awards to Company executives during 2015 (the “2015 LTI Grants”) and their terms will be in

accordance with the terms established by the Company’s Board of Directors in connection with the 2015 LTI Grants.

Pursuant to the Offer Letter, the

Company will compensate Mr. Lehner for temporary living expenses in Chicago, including transportation costs for weekly travel between Chicago and his home in Cleveland, through August 31, 2016. It will also provide Mr. Lehner

financial support for his relocation to the Chicago area.

Mr. Lehner’s employment will be “at-will” and his appointment is subject to

his execution of a confidentiality, non-competition and non-solicitation agreement (“Non-Competition Agreement”) prior to the effective date of his appointment. In the event that the Company terminates his employment without cause, he

will, subject to his execution of a release in favor of the Company and its affiliates, be entitled to an amount equal to eighteen months of his then current base salary (the “Severance Payment”). The details and conditions relating to the

Severance Payment will be more fully set forth in the Non-Competition Agreement.

A copy of the Company’s press release announcing

Mr. Lehner’s appointment is attached hereto as Exhibit 99.1 and is incorporated by reference herein. A copy of the Offer Letter is attached hereto as Exhibit 10.1 and is incorporated by reference herein. This summary does not purport to be

complete and is subject to and qualified in its entirety by reference to the text of the Offer Letter.

Item 9.01. Financial Statements and

Exhibits.

The following exhibits are being filed with this Current Report on Form 8-K:

|

|

|

| 10.1 |

|

Offer Letter Agreement, dated May 7, 2015, by and between Ryerson Holding Corporation and Edward J. Lehner. |

|

|

| 99.1 |

|

Press Release, dated May 8, 2015. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: May 8, 2015

|

|

|

| RYERSON HOLDING CORPORATION |

|

|

| By: |

|

/s/ Mark S. Silver |

| Name: |

|

Mark S. Silver |

|

|

| Title: |

|

Vice President, Managing Counsel and Secretary |

3

Exhibit Index

|

|

|

| Exhibit

# |

|

Description |

|

|

| 10.1 |

|

Offer Letter Agreement, dated May 7, 2015, by and between Ryerson Holding Corporation and Edward J. Lehner. |

|

|

| 99.1 |

|

Press Release, dated May 8, 2015 |

4

Exhibit 10.1

|

|

|

|

|

|

|

May 7, 2015 |

|

|

|

|

|

|

|

Edward J. Lehner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Eddie: |

|

|

Further to your discussion with the Board of Directors of Ryerson

Holding Corporation (the “Company” or “Ryerson”), this letter will confirm the general terms and conditions of your appointment to the position of President and Chief Executive Officer of the Company.

Upon your acceptance, the effective date of your appointment shall be June 1, 2015

(“Effective Date”) and is contingent on the execution prior to the Effective Date by you of the Company’s standard Confidentiality, Non-Competition and Non-Solicitation Agreement, with such adjustments as are mutually agreed by the

Company and you (the “Non-Competition Agreement”).

COMPENSATION

Your base annual salary will be $650,000, to be paid in accordance with the Company’s regular payroll process and procedures during your employment and

will be subject to all applicable withholdings. Additionally, your target incentive percentage for the Company’s Annual Incentive Plan (“AIP”) shall be 110%, commencing with the Effective Date. Any 2015 plan year payout will be

prorated for the time you were employed in each of your positions during 2015. In

conjunction with the granting of equity-based long-term incentive awards to Company executives during 2015 (the “2015 LTI Grants”) under the 2014 Ryerson Holding Corporation Omnibus Incentive Plan, you will receive a grant of performance

units (“PSUs”) and time-vesting restricted stock units (“RSU”) in amounts such that the total number of RSUs and PSUs granted to you will equal 90,000. The terms and vesting rules for the RSUs and PSUs granted to you will be in

accordance with the terms established by the Company’s Board of Directors in connection with the 2015 LTI Grants.

VACATION

You will continue to be entitled to four (4) weeks of paid vacation annually. |

|

|

|

|

|

Mr. Edward Lehner |

|

|

Page

2

|

|

|

May 7, 2015 |

|

|

|

|

|

BENEFITS

You and your qualified dependents will continue to be eligible for the benefit programs generally available to the Company’s office employees, including

medical, dental and vision and life insurance; short-term and long-term disability benefits, voluntary life and accidental death and dismemberment insurance, and the Company’s 401(k) plan.

TEMPORARY LIVING

It is also confirmed that the Company will continue to provide you with

support to cover your temporary living expenses in Chicago through August 31, 2016. These expenses will include the rent, utilities and upkeep of a studio apartment in the Loop area of Chicago and weekly transportation costs between Cleveland

and Chicago, and will include tax gross-up to cover any personal income taxes associated with these covered expenses. All other expenses will be a cost to you.

RELOCATION ASSISTANCE

It is anticipated that at some time prior to the 31st August 2016 you will relocate your family to

the Chicago area. The Company will provide support broadly in line with that outlined in the Company’s relocation policy. The precise terms will be discussed and agreed between you and the Company’s Board of Directors closer to the

event. AT-WILL EMPLOYMENT

Your employment with the Company is at-will, and either you or the Company

may terminate your employment at any time, with or without cause. We ask that you provide at least 30 days’ notice if you wish to terminate your employment.

SEVERANCE

In the event that the Company terminates your employment without cause, then the Company shall pay you an amount equal to eighteen (18) months of your

then current base salary, which payment shall be subject to and reduced by all necessary and appropriate statutory payroll and benefit-related withholdings and deductions (the “Severance Payment”). The details and conditions relating to

the Severance Payment will be more fully set forth in the Non-Competition Agreement, and for the avoidance of doubt, any Severance Payment will be contingent on (i) your conformance with the provisions of the Non-Competition Agreement, and

(ii) your execution of a mutually acceptable release of the Company and its affiliates. |

|

|

|

|

|

Mr. Edward Lehner |

|

|

Page

3

|

|

|

May 7, 2015 |

|

|

|

|

|

|

|

GENERAL

You agree that the provisions of this letter are severable; and if any portion thereof shall be declared unenforceable, the same shall not affect the

enforceability of all other provisions hereof. It is the intent of the parties to this letter that if any portion of this letter contains provisions which are held to be unreasonable then, in such event, a court shall fix the terms of this agreement

or shall enforce the terms and provisions hereof to the extent deemed reasonable by the court.

This letter, in conjunction with the Non-Competition Agreement, constitutes the sole and complete agreement between the Company and you and supersedes all

other agreements, both oral and written, between the Company or any of its direct and indirect subsidiaries and you with respect to your employment by the Company or any of its direct and indirect subsidiaries or the matters contained herein.

This letter and the terms and conditions hereof are to be construed, governed and

interpreted in accordance with the laws of the State of Illinois, without giving effect to its conflict of law principles.

*****

Should you have any questions about this letter, please contact Roger Lindsay at 905-454-6801. Two copies of this letter are enclosed. Please sign both copies

and return one to me. |

|

|

|

|

|

Very Truly Yours, |

|

|

|

|

|

|

|

/s/ Roger W. Lindsay |

|

|

|

|

|

|

|

Roger W. Lindsay |

|

|

|

|

Chief Human Resources Officer |

|

|

|

|

|

|

|

|

|

|

|

AGREED TO AND ACCEPTED: |

|

|

|

|

|

|

|

|

By: |

|

/s/ Edward J. Lehner |

|

|

|

|

|

|

|

|

Date: |

|

May 7, 2015 |

|

|

Exhibit 99.1

Media contact:

Chris Bona

Head of Communications

312.292.5052

mediainfo@ryerson.com

RYERSON APPOINTS EDWARD

J. LEHNER, EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER, AS PRESIDENT AND CHIEF EXECUTIVE OFFICER

(Chicago – May 8, 2015)

– Ryerson Holding Corporation (NYSE: RYI), a leading processor and distributor of metals, today announced that its Board of Directors has appointed Edward J. Lehner as the Company’s President and Chief Executive Officer,

effective June 1, 2015. He will succeed Michael C. Arnold who will retire at the end of the month.

Edward Lehner, 49, has served as the

Company’s Executive Vice President and Chief Financial Officer since 2012. In this role he has been responsible for leading several functions including Finance & Accounting, Supply Chain, Corporate Development and Information

Technology.

“The Board conducted an extensive internal and external search to find the right candidate to lead the business forward,” said

Philip E. Norment, a member of Ryerson’s Board of Directors who led the CEO search process. “Eddie‘s proven leadership in the metals industry and his excellent knowledge of our business make him ideally suited to leading

Ryerson’s future success,” added Mr. Norment.

“Our Board of Directors would like to thank Mike Arnold for his leadership and vision

over the past four years helping to guide the transformation of our business, and we wish him the very best in retirement,” Mr. Norment added.

-more-

Prior to joining Ryerson, Mr. Lehner was The Chief Financial Officer and Chief Administrative Officer of PSC

Metals, Inc., a diversified metals company and a Founder, Executive Vice President and Chief Financial Officer of SeverCorr, LLC. His career also includes several senior financial and general management roles for Nucor, Birmingham Steel, Inc., and

Laurel Steel. Mr. Lehner’s career began in 1989 with Deloitte Touche Tohmatsu Ltd. in the audit, tax and IT practice in Cincinnati, Ohio. Mr. Lehner serves on the board of directors of Modumetal. He is a member of the Financial

Executives International (FEI). He holds a bachelor of arts degree in Accounting from the University of Cincinnati and is also a Certified Public Accountant.

Lehner said, “I have been proud to be a part of the Ryerson story for the past three years, and look forward to continuing to work with the Ryerson Board

of Directors, leadership team and my colleagues to build on the solid foundation Mike developed. The next leg of our transformation demands that we advance our work to deliver results with great energy, passion, intelligence and skill that further

Ryerson’s purpose as an indispensable partner to our customers’ success, an excellent place to work and an engine for creating shareholder value.”

About Ryerson

Ryerson is a processor and distributor of

metals with operations in the United States, Mexico, Canada, China and Brazil. The company serves a variety of industries, including customers making products or equipment for construction, packaging, oil and gas and truck trailers. Founded in 1842,

Ryerson is headquartered in the United States and employs approximately 3,600 employees in more than 100 locations.

Visit Ryerson at

www.ryerson.com

###

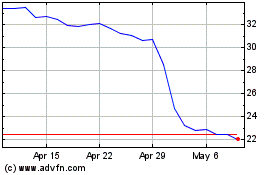

Ryerson (NYSE:RYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

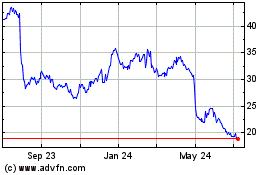

Ryerson (NYSE:RYI)

Historical Stock Chart

From Apr 2023 to Apr 2024