UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 2, 2015

BLUE BIRD CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36267 |

|

46-3891989 |

| (State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 402 Blue Bird Boulevard

Fort Valley, Georgia 31030 |

|

31030 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (478) 822-2130

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On March 3, 2015, Blue Bird Corporation (the “Company”)

issued a press release announcing the results of its previously announced Public Warrant Exchange Offer, which expired at 12:00 midnight, New York City time, at the end of the day on March 2, 2015. A copy of the press release is attached as an

exhibit to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release of the Company, dated March 3, 2015. |

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| BLUE BIRD CORPORATION |

|

|

| By: |

|

/s/ Paul Yousif |

|

|

Name: Paul Yousif Title: Vice

President |

Dated: March 3, 2015

-3-

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release of the Company, dated March 3, 2015. |

-4-

Exhibit 99.1

Blue Bird Corporation Announces Results of

Public Warrant Exchange Offer

FORT

VALLEY, GEORGIA – March 3, 2015 – Blue Bird Corporation (“Blue Bird” or the “Company”) (Nasdaq: BLBD and BLBDW), formerly named Hennessy Capital Acquisition Corp., today announced the results of its previously

announced offer to exchange (the “Offer”) up to a maximum of 5,750,000 of its outstanding public warrants (the “Public Warrants”) for shares of Company common stock (the “Shares”) at an exchange ratio of 0.1 of a Share

for each Public Warrant validly tendered and not withdrawn (approximately one Share for every ten Public Warrants tendered). The Offer expired at 12:00 midnight, New York City time, at the end of the day on March 2, 2015. Based upon information

provided by Continental Stock Transfer & Trust Company, the depositary for the Offer, as of the expiration of the Offer, a total of 2,690,462 Public Warrants have been validly tendered and not properly withdrawn, for a total of

approximately 269,046 Shares to be issued by the Company.

As previously announced, Hennessy Capital Partners I LLC (the “Sponsor”) has agreed

to exchange (the “Sponsor Warrant Exchange”) that number of the outstanding warrants it obtained in a private placement in connection with the initial public offering of Hennessy Capital Acquisition Corp. (such warrants, the

“Placement Warrants”) equal to (i) 12,125,000 less (ii) the number of Public Warrants validly tendered and accepted for exchange pursuant to the Offer, in exchange for Shares at an exchange ratio of 0.1 of a Share for each

Placement Warrant. Accordingly, based on the results of the Offer, the Sponsor will exchange 9,434,538 of its Placement Warrants for a total of 943,453 Shares to be issued to the Sponsor by the Company. The closing of the Sponsor Warrant Exchange is

expected to occur on March 17, 2015.

After the Offer and the Sponsor Warrant Exchange, there will be a total of 11,500,000 Public Warrants and

Placement Warrants that remain outstanding. Such Public Warrants and Placement Warrants will be exercisable for a total of 5,750,000 Shares, subject to adjustment.

About Blue Bird Corporation

Blue Bird is the leading

independent designer and manufacturer of school buses, with more than 550,000 buses sold since its formation in 1927 and approximately 180,000 buses in operation today. Blue Bird’s longevity and reputation in the school bus industry have made

it an iconic American brand. Blue Bird distinguishes itself from its principal competitors by its singular focus on the design, engineering, manufacture and sale of school buses and related parts. As the only manufacturer of chassis and body

production specifically designed for school bus applications, Blue Bird is recognized as an industry leader for school bus innovation, safety, product quality/reliability/durability, operating costs and drivability. In addition, Blue Bird is the

market leader in alternative fuel applications with its propane-powered and compressed natural gas-powered school buses. Blue Bird manufactures school buses at two facilities in Fort Valley, Georgia. Its Micro Bird joint venture operates a

manufacturing facility in Drummondville, Quebec, Canada. Service and after-market parts are distributed from Blue Bird’s parts distribution center located in Delaware, Ohio.

Forward Looking Statements

This press release may include forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. Specifically, forward-looking statements may include statements relating to:

| |

• |

|

Inherent limitations of internal controls impacting financial statements |

| |

• |

|

Ability to expand market share |

| |

• |

|

Customer demand for certain products |

| |

• |

|

Economic conditions that could affect fuel costs, commodity costs, industry size and financial conditions of our dealers and suppliers |

| |

• |

|

Labor or other constraints on the Company’s ability to maintain a competitive cost structure |

| |

• |

|

Volatility in the tax base and other funding sources that support the purchase of buses by our end customers |

| |

• |

|

Lower or higher than anticipated market acceptance for our products |

| |

• |

|

Ability to be successful in the Company’s appeal of the delisting determination by the staff of the Listing Qualifications Department of the NASDAQ Stock Market and to meet NASDAQ’s listing standards,

including having the requisite number of stockholders |

| |

• |

|

Other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,”

“believe,” “seek,” “target” or similar expressions |

These forward-looking statements are based on information

available as of the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our

views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except

as may be required under applicable securities laws. The factors described above, as well as risk factors described in reports filed with the SEC by the Company (available at www.sec.gov), could cause our actual results to differ materially from

estimates or expectations reflected in such forward-looking statements.

Contact

Jeff Merten

Director, Investor Relations & New Business

Development

Blue Bird Corporation

(478) 822-2496

Jeff.Merten@blue-bird.com

2

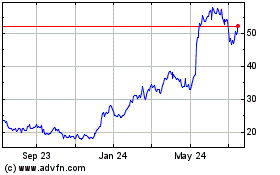

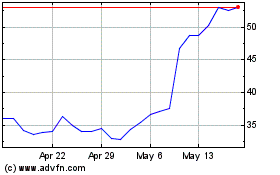

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Apr 2023 to Apr 2024