UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 27, 2015

Altair Nanotechnologies Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

1-12497 |

33-1084375 |

|

(State or other jurisdiction of |

(Commission |

(IRS Employer |

|

incorporation or organization) |

File Number) |

Identification No.) |

|

204 Edison Way |

|

|

Reno, NV |

89502 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant's Telephone Number, Including Area Code:

(775) 856-2500

N/A

(Former name, former address, and formal fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Item 1.01 Entry into Material Definitive Agreement

On January 27, 2015, Altairnano, Inc. (the "Company"), an indirect subsidiary of Altair Nanotechnologies Inc., entered into a Client NNN Lease (the “Lease”) with Flagship Enterprise Center, Inc. Under the Lease, the Company will continue to lease the 70,000 square feet of space it currently occupies in Anderson, Indiana. The initial term of the Lease begins July 1, 2015 and expires June 30, 2017. Lease renewal options will be negotiated no less than six (6) months prior to the expiration of this lease. Annual rent under the two (2) year lease is $262,500 plus $1,680 in IT fees, plus utilities and maintenance.

Item 9.01 Financial Statements and Exhibits.

10 Building Lease dated January 27, 2015 between Altairnano, Inc. and Flagship Enterprise Center, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Altair Nanotechnologies Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

Dated: February 2, 2015 |

By: |

/s/ Karen Werner |

|

|

|

|

Karen Werner, Interim Chief Financial Officer |

|

|

|

|

|

|

3

Exhibit 10

BUILDING LEASE

THIS LEASE, is made and entered into this 27th day of January, 2015, by and between FLAGSHIP ENTERPRISE CENTER, INC. (hereinafter referred to as “Landlord”) and ALTAIRNANO (hereinafter referred to as “Tenant”).

Witnesseth That:

Article I.

Leased Premises & Equipment.

Section 1.01. Lease and Description of Leased Premises. Landlord, for and in consideration of the rent specified in section 3.01 below and the covenants, agreements and conditions stated herein, does hereby lease to Tenant and Tenant does hereby lease from Landlord the following described property, real and personal, located in Anderson, Madison County, Indiana:

|

Common Address: |

3019 Enterprise Drive, Anderson, Indiana 46013, being the entirety of the “A-1” Accelerator Building (hereinafter “Building”) |

| |

|

|

Physical Description of Leased Improvements: |

Approximately 70,000 square feet of the Building, as depicted on Exhibit 1 attached hereto (hereinafter “Leased Premises”), together with parking area and other leasehold improvements. |

Section 1.02. Examination and Inspection of Leased Premises. Tenant acknowledges that it has had the opportunity to examine and inspect and has examined and inspected the Leased Premises. Tenant accepts the Leased Premises in its current “as is” condition.

Article II.

Lease Term.

Section 2.01. Initial Term. Unless sooner terminated under the provisions hereof, the term of this Lease shall be for two (2) years (hereinafter “Term”), commencing on the 1st day of July , 2015 (hereinafter “Commencement Date”) and ending on the 30th day of June, 2017. Commencement Date was set on this date, as it is the expiration date of the one (1) year “Hold Over” extension on the original lease.

Section 2.02. Renewal(s) of Lease Term. Lease renewal options will be negotiated no less than six (6) months prior to the expiration of this lease.

Section 2.03. Holding Over. In the event Tenant remains in possession of the Leased Premises after the expiration of the Initial Term and/or expiration of a renewal term, without the execution of a lease extension agreement or exercise of a renewal option, the Lease shall automatically be extended for an additional period of one (1) year and all terms of the Lease shall continue unabated, except for the length of the term herein specified and Basic Rent amount, both of which may be negotiated. If such Lease is extended as provided above, either party may terminate the Lease upon one hundred and eighty (180) days written notice delivered to the other party.

Article III.

Rental Payments.

Section 3.01. Components of Rent. Tenant hereby agrees to pay Landlord as rent for the Leased Premises an amount comprised of the components of rent hereinafter identified and defined as “Basic Rent” and “Additional Rent.” Basic Rent shall consist of monetary payments by Tenant to Landlord intended to provide Landlord with a reasonable rate of return on the market value of the Building and Real Estate. Additional Rent shall consist of: (1) monetary payments by Tenant to Landlord intended to provide Landlord with full reimbursement of Landlord’s expenses on services or materials not contracted directly and independently by Tenant, (excluding those specific costs to be borne by Landlord as provided in Section 6.01 below), including but not limited to such costs as fire/safety inspection and maintenance costs, insurance costs, security costs, mowing/landscaping costs, and snow removal costs related to the Building and adjoining real estate upon which the Building is located; and (2) monetary payments by Tenant directly to contractors/payees for real estate taxes, utility costs, garbage/refuse removal and custodial services relating to the Leased Premises or the real estate upon which the Leased Premises is located.

Section 3.02. Basic Rent during Lease Term. During the two (2) year term of the NNN Lease, from July 1, 2015, through June 30, 2017, Basic Rent, as described in “Exhibit 2 – Rent Calculation,” shall be Twenty-Two Thousand and Fifteen dollars and Zero cents ($22,015.00) per month, represented by annual rent in the sum of $262,500.00 [being the product of $3.75, the annual Basic Rent per square foot, and 70,000 square feet, the total square footage of the Leased Premises, divided by 12 months], plus $140.00 monthly IT fees.

Section 3.03. Additional Rent/Payment of Expenses or Reimbursement of Landlord’s Advancements for Tenant’s Operating Costs. In addition to the Basic Rent to be paid by Tenant to Landlord pursuant to Section 3.02 above, Tenant shall timely pay or reimburse to Landlord, as the case may be, during the Lease Term hereof, the following:

|

|

(a) |

Any and all real estate taxes and assessments levied against the Building (hereinafter “Real Estate Taxes”); |

|

|

(b) |

Insurance for the Building, including all applicable deductible payment obligations, obtained by Landlord in connection with the Building, including, but not limited to fire, casualty, with vandalism and malicious mischief endorsements, sprinkler leakage coverage, public liability and rent abatement insurance and workman’s compensation insurance solely for workers associated with the Leased Premises, and such other insurance as may, from time to time, be obtained by Landlord for the sole benefit of the Tenant (hereinafter “Insurance Costs”); |

|

|

(c) |

Charges for electricity, water, sewage service, heating, ventilation and air conditioning, and other utilities and/or services furnished to the Building (hereinafter “Utility Costs”); |

|

|

(d) |

Cost of removal of trash, rubbish, and garbage and other refuse from the Building (hereinafter “Trash Removal Costs”); |

|

|

(e) |

Cost of all supplies and materials/labor charges and other service agreements incurred in the operation, maintenance, and repair of the Building, which shall include, but not be limited to, costs related to alarm services, fire and safety inspection services, appropriate building and parking area signage, heating and air conditioning (excluding those specific expenses to be borne by Landlord in Section 6.01 below) and plumbing equipment, window cleaning, and extermination services (hereinafter “Maintenance Costs”); |

|

|

(f) |

The cost of security personnel and measures to protect the Building and inhabitants therein (hereinafter “Security Costs”); |

|

|

(g) |

Mowing and landscaping costs for grounds adjoining the Building (hereinafter “Landscaping Costs”); |

|

|

(h) |

The cost of snow/ice removal from parking lots and areas adjacent to the Building (hereinafter “Snow Removal Costs”); |

|

|

(i) |

The cost of routine/customary cleaning, janitorial and housekeeping services for the Leased Premises as required for Tenant’s use thereof by a Vendor selected or approved by Landlord (hereinafter “Custodial Services Costs). |

Section 3.06. Method of Computation and Payment of Additional Rent. During the Initial Term and any Renewal Term(s) of this Lease, Tenant, in addition to the Basic Rent, shall pay on or before the 30th day of each calendar month Additional Rent in the sum equal to billings received and paid by Landlord for insurance costs, maintenance costs, security costs, fire and safety costs, landscaping costs, snow removal costs (hereinafter “Operating Expenses”) during the preceding calendar month. As provided in paragraph 3.05 above, Tenant shall separately contract for and timely pay Real Estate taxes, utility costs, trash removal costs and custodial services.

Section 3.07. Monthly Statement of Operating Expenses Relating to Additional Rent. Within ten (10) business days of the close of each calendar month, Landlord will deliver to Tenant a written statement in reasonable detail of any and all amounts of Landlord’s Operating Expenses not directly contracted by Tenant. Such amounts shall be for the preceding calendar month or fractional calendar month, as the case may be.

Section 3.08. Tenant Verification. In the event Tenant is not satisfied with the statement submitted by Landlord pursuant to Section 3.07 hereof in connection with Additional Rent, for a period of thirty (30) days following delivery of such statement, Tenant or its accountant shall have the right to inspect, at reasonable times and in reasonable manner, such of Landlord’s books and records as pertain to and contain information concerning the costs and expenses referred to herein as Landlord’s Operating Expenses in order to verify the amounts thereof. Any such inspection of Landlord’s books and records shall be performed at Tenant’s sole cost and expense. If such an inspection shall show an overpayment by Tenant in connection with its payment of Landlord’s Operating Expenses, the amount of such overpayment shall be promptly paid by Landlord to Tenant, and if such inspection shall show such variable expense adjustment to have been underpaid, then such deficiency shall be promptly paid by Tenant to Landlord. If such audit shall show that Landlord has overstated Landlord’s Operating Expenses for any relevant period by more than seven percent (7%) of the total of Landlord’s Operating Expenses as determined by such audit, then such fees and expenses charged by Tenant’s independent accountant making such audit shall be paid by Landlord.

Section 3.09. No Security Deposit Required by Landlord. Tenant shall not be obligated to pay Landlord a security deposit at the inception or during the Initial Term or any Renewal Term.

Section 3.10. Past Due Payments. In the event any rental payment or other payment owing from Tenant to Landlord pursuant to this Lease shall become overdue for a period in excess of ten (10) days, a late charge in the amount of five percent (5%) of such overdue payment shall be paid by Tenant to Landlord, which late charge shall be payable upon demand. Said late charge shall be in addition to and not in lieu of any other remedy Landlord may have and any fee, charge, payment and advancements landlord may be entitled to hereunder or by law. In the event any rental payment or other payment owing from Tenant to Landlord pursuant to this Lease shall become overdue for a period in excess of twenty-five (25) days, such unpaid amounts shall bear interest from the due date thereof to the date of payment at the rate of one and one-half percent (1½ %) per month.

Section 3.11. Place of Payments. All payments required to be paid, and all statements required to be rendered by Tenant to Landlord shall be delivered to Landlord at its address set forth in Section 15.01 hereof or to such other address as Landlord specifies to tenant in accordance with such Section.

Article IV.

Use and Occupancy.

Section 4.01. Use as Executive/ General Purpose Offices, Research/Testing Facilities and Other Legally Permitted Uses. The Leased Premises shall be used and occupied by Tenant solely for the purpose of executive and general purpose offices. Subject to the restrictions recited in Section 4.02 and 4.03 below, Tenant may also conduct research and testing in the Building in areas compatible with such research and testing. Finally, Tenant shall be permitted to use the Leased Premises for other legally permitted uses.

Section 4.02. Prohibition against Waste and Unlawful Uses. Tenant shall not commit or allow any waste or damage to be committed on any portion of the Leased Premises. Tenant shall not occupy or use or permit any portion of the Leased Premises to be occupied or used for any business or purpose which is unlawful, disreputable or deemed to be hazardous, or permit anything to be done which would in any way significantly increase the cost of insurance coverage on the Leased Premises or its contents.

Section 4.03. Prohibition against Use or Storage of Hazardous Materials. Tenant shall not maintain, store or use any other hazardous materials upon the Leased Premises without Landlord’s written consent. Hazardous materials shall mean any hazardous, toxic or radioactive substance, matter, material or waste which is or becomes regulated by any federal, state or local law, ordinance, order, rule, regulations, code or other governmental restriction or requirement and includes, without limitation, asbestos, petroleum products and the terms hazardous substance and hazardous waste as defined in CERCLA and RCRA, as each may be amended. If any hazardous materials are necessary for the carrying on of tenant’s business operations, notice of existence of such materials must be given to Landlord, and Tenant shall retain such licenses as may be required to handle, transport and dispose of such materials in accordance with local, state and federal rules, regulations and laws.

Section 4.04. Condition, Alterations and Additions. Tenant’s acceptance of the Leased Premises on the Commencement Date shall be as is, where is and without warranty of any kind as to zoning, condition, fitness for Tenant’s business purpose or otherwise. Tenant assumes sole responsibility for examining the Leased Premises prior to the Commencement Date to assure itself of the Leased Premises’ compliance with this Lease and Tenant’s business purpose. Tenant shall make no leasehold improvements, alterations or additions to any part of the Leased Premises without the prior written consent of Landlord. All such improvements, alterations and additions, excepting only unattached and movable trade fixtures, shall be the sole property of Landlord.

Section 4.05. Signage. Tenant shall have the right to install a sign on the face of the Building, at Tenant’s expense, so long as the sign complies with applicable zoning ordinances and meets with the approval of Landlord’s architect.

Article V.

Maintenance and Repairs.

Section 5.01. Maintenance and Repairs by Tenant. Tenant shall at all times, at its sole cost and expense, keep and maintain the interior, non-structural elements of the Leased Premises and the electrical, exterior lighting, plumbing, heating and ventilating and air conditioning and sprinkler systems servicing the Leased premises in good order and repair throughout the term of this Lease, and shall deliver same to Landlord at the termination of the Lease in good order and condition, normal wear and tear and damage by fire and other insured casualty excepted. Tenant acknowledges that it will maintain the HVAC systems and Sprinkler Systems servicing the Leased Premises. Tenant will directly contract with, or Landlord will contract with, at Tenant’s expense, a licensed HVAC Contractor and licensed Sprinkler Contractor to provide routine maintenance and repairs of such HVAC and Sprinkler Systems.

Section 5.02. Maintenance and Repairs by Landlord. Landlord shall keep and maintain the other building systems not specified in Section 5.01 (which shall be Tenant’s responsibility) that serve and are located on the Leased Premises, and the roof and exterior roof membrane, parking lot (seal coating and full replacement only), foundations, concrete floor slabs, columns, exterior walls and wall footings, electrical wiring, underground utilities, truck court gutters, down spouts and subfloors, and all other structural elements of the Leased Premises (except those specifically delineated above as being Tenant’s obligation) in good order and repair throughout the term of this Lease and at Landlord’s sole cost and expense; provided, however, that if any such repairs are caused by Tenant or it’s invitees, licensees, employees, agents or representatives, Tenant shall be obligated to make such repairs. In addition, Landlord shall be responsible to replace the HVAC units and/or Sprinkling system servicing the Leased Premises if necessitated due to age or end of useful life, or in the event such HVAC unit or Sprinkling system is beyond the cost to reasonably repair the same.

Section 5.03. Notice. Tenant shall give Landlord prompt written notice of the need for any maintenance, replacement or repairs of any items specified in Section 5.01 required to be maintained, replaced or repaired by Landlord.

Section 5.04. Access to Leased Premises. Tenant shall permit Landlord and its agents to enter upon the Leased Premises at reasonable times and upon reasonable notice (except in the event of any emergency as to which such time and notice requirements shall not apply) to inspect and examine the Leased Premises. Also, Tenant shall permit Landlord and its agents to enter upon the Leased Premises at reasonable times and upon reasonable notice (except in the event of an emergency as to which such time and notice requirements shall not apply) to make such repairs (including the bringing of materials that may be required therefore into or upon the Leased Premises) as Landlord may reasonably deem necessary without any such act constituting an eviction of Tenant in whole or in part, without Rent in any manner abating while such repairs are being made by reason of loss or interruption of Tenant’s business in the Lease Premises, and without responsibility for any loss or damage to Tenant’s business or property other than such loss or damage resulting from the negligence of Landlord, its agents, employees or contractors, and Landlord shall use due diligence to minimize the extent and duration of any such interruption. Landlord’s foregoing right of entry shall not be construed to impose upon Landlord any obligation or liability whatsoever for the maintenance or repair of the Leased Premises, except as expressly provided in this Lease.

Article VI.

Non-Liability, Insurance and Indemnification.

Section 6.01. General Liability Insurance. Landlord, utilizing payment by Tenant of Tenant’s proportionate share of such insurance, shall maintain in full force and effect throughout the Lease Term a policy of commercial general liability insurance naming Tenant as an additional insured, which shall include bodily injury, property damage and personal liability insurance with respect to the Leased Premises and all operations in which the limits of liability shall not be less than a combined single limit of Two Million Dollars ($2,000,000.00).

Section 6.02. Insurance on Tenant’s Property. All of Tenant’s fixtures, equipment, merchandise or other personal property shall be kept at Tenant’s sole risk and expense, and Tenant, at Tenant’s expense, shall maintain in full force and effect throughout the Lease Term fire and extended coverage insurance on its fixtures, equipment, merchandise and other personal property in or upon the Leased Premises for its full insurable value on a replacement cost basis, if obtainable, and if not obtainable, for the full amount of the estimated cash value for such property.

Section 6.03. Insurance on Leased Premises. Landlord, utilizing payment by Tenant of Tenant’s proportionate share of such insurance, shall maintain in full force and effect throughout the Lease Term a Special Form (all-risk) insurance policy, insuring the Leased Premises and improvements to the extent of one hundred percent (100%) of their replacement value. Tenant shall be furnished a certificate of insurance with respect to the Special Form (all-risk) insurance provided by Landlord and shall be named as an additional insured therein, and the insurers thereof shall agree to furnish Tenant and Landlord at least thirty (30) days advanced notice of any cancellation of coverage. The insurance policy shall include a standard mortgage clause in favor of any person or entity having a mortgage interest in the Leased Premises.

Section 6.04. Tenant’s Indemnification. Unless caused or contributed to by the gross negligence or willful misconduct of Landlord, its agents or employees, Tenant assumes all risks and responsibilities for accidents, injuries or damages to person or property and agrees to indemnify and hold Landlord harmless from any and all claims, liabilities, losses, costs and expenses (including attorneys’ fees) arising from or in connection with its, use or control of the Leased Premises and any improvements thereon during the Lease Term or Tenant’s breach of any term, covenant, condition or agreement to be observed by Tenant under this Lease. Tenant shall be liable to Landlord for any damages caused by gross negligence or willful misconduct to the Leased Premises and for gross negligence or willful misconduct done by Tenant or any person coming on the Leased Premises by the license or invitation of Tenant, express or implied (except Landlord, its agents or employees).

Section 6.05. Tenant’s Waiver of Claims. Landlord shall not be liable for, and Tenant waives all claims against Landlord for, any injuries, damages (including, but not limited to, consequential damages) or losses of or to person, property or otherwise, sustained by Tenant and not covered by insurance, unless resulting from Landlord’s gross negligence or willful misconduct. All property of Tenant kept or stored in, upon or about the Leased Premises shall be so kept or stored at the sole risk of Tenant; and Tenant shall hold Landlord harmless from any claims, costs or expenses, including attorneys’ fees, arising out of damage thereto, unless such claim arises out of grossly negligent or willful misconduct on the part of Landlord, its agents and employees.

Section 6.06. Certificates of Insurance. For each type of insurance which Landlord or Tenant are required to maintain under this Lease, each shall furnish the other an endorsed copy of such insurance policy showing that each such type of insurance is in full force and effect and not cancelable without thirty (30) days prior written notice to the other party. Renewal certificates shall be supplied at least thirty (30) days prior to the expiration of the current certificate. The insurance carrier shall be reasonably acceptable to both parties.

Article VII.

Eminent Domain.

Section 7.01. Legal Effect. If the whole or any part of the Leased Premises is taken for public or quasi-public use by a governmental or other authority having the power of eminent domain, or shall be conveyed to any such authority in lieu of such taking, and if such taking or conveyance shall cause the remaining part of the Leased Premises to be untenantable and inadequate for Tenant’s business purpose, then Landlord or Tenant may, at their option, terminate this Lease as of the date Tenant is required to surrender possession of the Leased Premises by giving the other party notice of such termination. If a part of the Leased Premises shall be taken or conveyed, but the remaining part is tenantable and adequate for Tenant’s business purpose (as reasonably determined by Tenant, and with notice of such determination given to Landlord within fifteen (15) days of any such taking), then this Lease shall be terminated as to the part taken or conveyed as of the date Tenant surrenders possession thereof; Landlord shall make such repairs, alterations and improvements as may be necessary to render the part not taken or conveyed tenantable; and the rent shall be reduced in proportion to the part of the Leased Premises so taken or conveyed.

Section 7.02. Payment of Award. All compensation awarded for such taking or conveyance shall be the sole property of Landlord, without deduction therefrom for any present or future estate of Tenant, and Tenant hereby assigns to Landlord all its right, title and interest in and to any such award; provided Tenant shall have the right to recover from such taking authority, but not from Landlord, such compensation as may be awarded to Tenant on account of moving and relocation expenses and depreciation to and removal of Tenant’s property.

Article VIII.

Destruction and Damage.

Section 8.01. Damage by Casualty. In the event of a fire or other casualty in the Leased Premises, Tenant shall give prompt notice thereof to Landlord. If the Leased Premises shall be partially destroyed by fire or other casualty so as to render the Leased Premises partially or wholly untenantable, the Rent shall be abated on the basis of leasable square footage remaining and occupied thereafter, until such time as the Leased Premises are made fully fit for use by Tenant; provided, however, that if any act or neglect of Tenant, or its agents, employees or invitees shall have contributed to the cause of such fire or other casualty, the Rental shall not be abated during the period of restoration of the Leased Premises.

Section 8.02. Restoration; Partial or Total Destruction of Building. In the event the Building shall be partially or totally destroyed by fire or other casualty, unless Landlord shall elect to terminate this Lease as hereinafter provided, the same shall be repaired as soon as is reasonably possible, at the expense of Landlord, except if the act of such fire or casualty was caused by any act of neglect of Tenant or its agencies, employees or invitees,. If damage to the Leased Premises is to such extent that the cost of restoration, as estimated by Landlord will exceed fifty percent (50%) of the replacement value of the Leased Premises (including the building standard improvements) or thirty percent (30%) of the replacement value of the Building (exclusive of the foundation) in its condition just prior to the occurrence of the damage, Landlord may, no later than the sixtieth (60th) day following such damage, give Tenant notice that it elects to terminate this Lease. If such notice shall be given:

|

|

(a) |

This Lease shall terminate on the twentieth (20th ) day following the giving of said notice; |

|

|

(b) |

Tenant shall surrender possession of the Leased Premises on or before such termination date; and |

|

|

(c) |

The rental provided hereunder shall be apportioned as of the date of such termination and any Rental paid for any period beyond said date shall be refunded to Tenant. |

Unless Landlord so elects to terminate this Lease, Landlord shall proceed with the restoration of the Leased Premises and/or the Building as soon as reasonably possible. If the damage to the Building as the result of any casualty is such that the Leased Premises cannot be used by Tenant for Tenant’s business purposes for a period of three (3) or more months, as estimated by Landlord, either Landlord or Tenant may cancel and terminate this Lease by giving notice of such termination to the other party within thirty (30) days after the date of such casualty. Notwithstanding the foregoing, Landlord may at any time after such damage request that Tenant notify Landlord of whether it intends to terminate this Lease, and if Tenant does not exercise its option to terminate this Lease within ten (10) days after receipt of such notice, then the option shall be deemed waived. In such event of termination, all Rental shall be apportioned as of the date of such termination and any Rental paid for any period beyond said date shall be refunded to Tenant. In no event, however, shall Tenant have the right to cancel or terminate this Lease if any act or neglect of Tenant, or its agents, employees or invitees shall have contributed to the cause of such casualty.

Article IX.

Events of Default and Remedies.

Section 9.01. Events of Default. The occurrence of any one (1) or more of the following events shall be deemed to be an “Event of Default”:

|

|

(a) |

The failure of Tenant to pay any installment of rent within thirty (30) days after its due date; |

|

|

(b) |

The failure of Tenant to perform any other of its covenants under this Lease within thirty (30) days after written notice or demand therefor is served upon Tenant by Landlord; |

|

|

(c) |

The making by Tenant of an assignment for the benefit of creditors; |

|

|

(d) |

The levying of a writ of execution or attachment on or against the Leased Premises or Tenant’s interest therein as the property of Tenant, and the same not being released or discharged within sixty (60) days thereafter; |

|

|

(e) |

The institution of proceedings in a court of competent jurisdiction for the reorganization, liquidation, voluntary or involuntary dissolution of Tenant, or for its adjudication as a bankrupt or insolvent, or for the appointment of a receiver of the property of Tenant, and said proceedings are not dismissed within sixty (60) days after the institution of said proceedings; or |

|

|

(f) |

A mechanic’s lien or similar lien upon the Leased Premises or the building is asserted of record in connection with work allegedly done in or about the Leased Premises at the request or instance of Tenant, and the same is not removed by Tenant, or adequate security for the satisfaction thereof deposited with Landlord, within forty-five (45) days from the date any such lien was filed in the office of the Recorder of Madison County, Indiana. |

Section 9.02. Remedies. Upon the occurrence of an Event of Default, Landlord shall have the option to:

|

|

(a) |

Terminate all rights of Tenant hereunder without terminating Tenant’s obligations hereunder; |

|

|

(b) |

Re-enter the Leased Premises with or without process of law, using such means as may be necessary to remove all persons and property therefrom; and/or |

|

|

(c) |

Exercise any other right or remedy available to Landlord at law or in equity in addition to or as an alternative to any of the other rights and remedies of Landlord herein specified upon the occasion of any such Event of Default. |

In the event that subsequent to an Event of Default, Landlord should relet the Leased Premises or a portion thereof during the balance of the Term of this Lease, the proceeds of such reletting, after deduction of all reasonable costs incurred by Landlord in connection with repossession and reletting of the Leased Premises (including without limitation, all legal fees, leasing commissions, remodeling costs and similar expenses) shall be applied to satisfaction of Tenant’s obligations hereunder. Landlord shall have the right to file suit to recover any sums which have fallen due under this Lease from time to time on one (1) or more occasions without being obligated to wait until the expiration of the Term of this Lease. Alternatively, in the event Landlord should elect to terminate this Lease, Landlord shall be entitled to recover forthwith as damages from Tenant a sum of money equal to: (i) the cost of recovering possession of the Leased Premises, (ii) the unpaid Rent owed at the time of such termination; (iii) the balance of the Rent for the remainder of the term; and (iv) any other sum of money or damages owed by Tenant to Landlord, less the fair market rental value of the Leased Premises for the remainder of the term of this Lease.

Article X.

Subordination.

Section 10.01. Subordination. Upon request by Landlord, this Lease shall become subordinate to the lien of a mortgage given by Landlord, if such mortgage provides that Tenant’s rights under this Lease and possession of the Leased Premises shall not be disturbed as long as it performs its duties hereunder. Tenant shall enter into any confirming subordination and non-disturbance agreement such mortgagee may reasonably require.

Article XI.

Assignment and Subletting.

Section 11.01. Assignment and Subletting. Tenant shall not assign or encumber this Lease or any interest herein, or sublet the Leased Premises or any part thereof, or permit the use of the Leased Premises or any part thereof by any party other than Tenant, without the prior written consent of Landlord, which cannot be unreasonably withheld. Provided, however, this prohibition shall not operate to prevent Tenant from assigning or transferring its interest in the Lease to Tenant’s affiliates, subsidiaries or parent company.

Article XII.

Covenant of Quiet Enjoyment.

Section 12.01. Covenant of Quiet Enjoyment. Landlord covenants and warrants that it has all necessary right, title and interest in the Leased Premises to enter into this Lease and grant tenant the rights herein. Landlord agrees that if Tenant performs all the covenants and agreements herein provided to be performed by Tenant, Tenant shall, at all times during the Lease Term, have the peaceable and quiet enjoyment of possession of the Leased Premises without any manner of hindrance from Landlord or any persons claiming under Landlord subject to the terms of any mortgage to which this Lease is subordinate or subordinated to.

Article XIII.

Termination of Lease and Surrender of Leased Premises.

Section 13.01. Termination. This Lease shall terminate upon any one (1) of the following occurrences:

|

|

(a) |

Upon issuance of written notice by Landlord to Tenant following Tenant’s default in the performance of obligations required to be performed by it; |

|

|

(b) |

Upon expiration of the Initial Term or any Renewal Term where no extension of the Initial Term or Renewal Term has been executed; |

|

|

(c) |

Upon expiration of ninety (90) days following written notice by one party to the other during any holdover period; |

Section 13.02. Surrender. Tenant agrees to and shall, on expiration or earlier termination of the Lease Term, as the case may be, surrender and deliver the Leased Premises to Landlord without demand therefor in as good condition as at the inception of this Lease, ordinary wear and tear excepted.

Article XIV.

Enforcement Expenses.

Section 14.01. Enforcement Expenses. In the event that either party hereto shall be successful in enforcing against the other any remedy, legal or equitable, for a breach of any of the provisions of this lease, there shall be included in the judgment or any decree the reasonable expenses and attorney fees of the successful party against the unsuccessful party.

Article XV.

Notices.

Section 15.01. Notices. All notices and demands which may or are required to be given by either party to the other hereunder shall be in writing and shall be deemed to have been fully given two (2) days after being deposited with the United States Postal Service, or its successor, as certified or registered mail, postage prepaid, and addressed as follows:

|

To Tenant: |

Altairnano Inc. |

| |

3019 Enterprise Drive |

| |

Anderson, IN 46013 |

|

|

|

|

To Landlord: |

Flagship Enterprise Center, Inc. |

| |

2705 Enterprise Drive, Suite 150 |

| |

Anderson, IN 46013 |

or to such other address as either party may designate from time to time for itself by notice similarly given. Any notice to be given to Tenant may also be given by personal delivery of the written notice to tenant’s office manager, or the person in charge of the business operations of Tenant at the Leased Premises at the time of such notice, and shall be deemed effective as of the date such personal delivery is made.

Article XVI.

General Provisions.

Section 16.01. Relationship of the Parties. Nothing herein contained shall be deemed or construed by the parties hereto, nor by any third party, as creating a relationship of principal and agent, partnership or joint venture between the parties hereof, it being understood and agreed that nothing herein, nor any acts of the parties hereto, shall be deemed to create any relationship between the parties hereto other than the relationship of Landlord and Tenant.

Section 16.02. Provision for Non-Waiver. No delay or omission of the right to exercise any power by either party shall impair any such right or power, or shall be construed as a waiver of any default or as an acquiescence thereon. One or more waivers of any covenant, term or condition of this Lease by either party shall not be construed by the other party as a waiver of subsequent breach of the same covenant, term or condition. Consent or approval by either party to or of any act by the other party of a nature requiring consent or approval shall not be deemed to waive or render unnecessary consent to or approval shall not be deemed to waive or render unnecessary consent to or approval of any subsequent similar act.

Section 16.03. Recording Memorandum of Lease. Either party hereto, upon written request of the other, shall join in the execution of a Memorandum of Lease in proper form for recording or filing in the office of the Recorder of Madison County, Indiana, which Memorandum shall set forth the existence of terms of this Lease, with subordination of the leasehold interest to any mortgage by the Landlord and such other terms as the parties may mutually agree upon.

Section 16.04. Law of Indiana Governs. The laws of the State of Indiana shall govern the validity, performance and enforcement of this Lease. The invalidity or unenforceability of any provision of this Lease shall not affect or impair any other provision.

Section 16.05. Complete Agreement. The headings of the several articles of sections contained herein are for convenience only and do not define, limit or construe the contents of such articles and sections. All negotiations, considerations, representations and understandings between the parties are incorporated herein and may be modified or altered only by memorandum in writing signed by the parties hereto.

Section 16.06. Agreement on Successor and Assigns. The covenants, agreements and obligations herein contained shall extend to, bind and inure to the benefit not only of the parties hereto, but their respective personal representatives, heirs, successors and assigns.

Section 16.07. Tenant’s Compliance with Rules and Regulations. Tenant agrees to conduct its business and operations so as to comply with the Rules and Regulations adopted by the Landlord.

IN WITNESS WHEREOF, the said parties have hereunto set their hands and seals this _____ day of January, 2015.

|

Altairnano Inc. |

Flagship Enterprise Center, Inc. |

|

Tenant |

Landlord |

| |

|

|

|

|

| |

|

|

|

|

|

BY: |

/s/ Thomas Reddington |

|

BY: |

/s/ Charles E. Staley |

| |

Thomas Reddington |

|

|

Charles E. Staley |

| |

its COO and GM Global Operations |

|

|

its President and CEO |

Exhibit 1

Physical Description of Leased Improvements

Exhibit 2

Rent Calculation

Tenant shall pay to Landlord, with respect to each calendar year or fractional calendar year, as the case may be, total rental payments in the monthly sums as follows:

|

Initial Term: |

Rate PSF |

Total SF |

Rent/Yr |

Rent/Mo |

Mo IT Chg |

Total Mo Payment |

|

7/1/15 – 6/30/17 |

$3.75 |

70,000 |

$262,500.00 |

$21,875.00 |

$140.00 |

$22,015.00 |

15 of 15 Pages

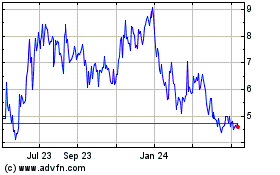

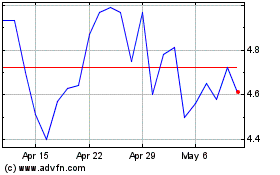

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Apr 2023 to Apr 2024