UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 21, 2015

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-26068 |

|

95-4405754 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 500 Newport Center Drive,

Newport Beach, California |

|

92660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Not applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, on January 21, 2015, Matthew

Vella, Chief Executive Officer of Acacia Research Corporation (the “Company”), hosted a conference call to discuss the ruling received by Adaptix, Inc., a subsidiary of the Company, in the United States District Court for the Northern

District of California on January 20th, 2015 relating to pending patent cases. The conference call was announced by a widely disseminated press release and was made available to the public via audio webcast. A transcript of the conference call

is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information herein, including Exhibit 99.1, is

furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Transcript of Conference Call held on January 21, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ACACIA RESEARCH CORPORATION |

|

|

|

| Date: January 26, 2015 |

|

|

|

/s/ Matthew Vella |

|

|

|

|

Matthew Vella |

|

|

|

|

Chief Executive Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Transcript of Conference Call held on January 21, 2015. |

Exhibit 99.1

ACACIA RESEARCH CORP

Moderator:

Matthew Vella

01-21-15/8:00 am CT

Confirmation # 6815326

Page 1

ACACIA RESEARCH CORP

Moderator: Matthew Vella

January 21, 2015

8:00 am CT

Operator: Please standby. We’re about to begin.

Good day and welcome to the Acacia Research Corporation Investor Update call. Today’s conference is being recorded.

At this time, I’d like to turn the conference over to Mr. Matthew Vella. Please go ahead sir.

Matthew Vella: Thanks. Good morning or good evening, depending on the part of the world you’re calling in from.

Yesterday there was a ruling in which Magistrate Judge Grewal entered a Summary Judgment of non-infringement against your Adaptix subsidiary in

its case against Apple, HTC, Verizon and AT&T in the Northern District of California.

I’m here with Jaime Siegel to discuss the

development and place it into perspective for the folks on this call.

Let me start by saying that we lost a round yesterday but we

certainly did not lose the fight.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

2

First off, the ruling yesterday from the California District Court has nothing to do with the

Adaptix base station cases in the Eastern District of Texas which are a very valuable component of the Adaptix portfolio.

We also

don’t think that the ruling will stop us from getting to trial on our handset cases scheduled for the next couple of months in the Eastern District of Texas as well.

This ruling pertains primarily to Apple and HTC on the handset portion of the case. The net effect of the ruling in our view will be to delay

any recovery against Apple. The Adaptix case to recover for infringement against Apple is not lost but more likely postponed perhaps 15 months and will be refiled, the case that is, to address the reason for the ruling.

We also have a new patent issued in the last couple of weeks which corrects the technical claims issue addressed by yesterday’s ruling and

in which we filed - and on this new patent we filed suit in it last week against all the defendants that were dismissed yesterday including Apple, HTC, Verizon and AT&T.

Without getting into too much detail about the reason for the ruling suffice it to say that it was due in part to a shift in the law around the

issue of whether or not a plaintiff like Adaptix can successfully sue a defendant like Apple or Verizon or AT&T for infringing a method patent claim that is practiced on the defendant’s device, in this case for example an iPhone, after the

defendant sells the device to a consumer.

We were basically counting on law as captured by the Federal Circuit in a case called SURF

Technology in which the court in a situation similar to this one found direct infringement based on the sale of accused devices because they were preprogrammed to automatically perform certain steps in that case.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

3

In this case as well the phone was preprogrammed to carry out those steps and so we relied on

that case to argue that our matter in California should proceed to trial.

The Federal Circuit counted on another case that basically said

that you have to perform the required steps. The actual defendant has to perform the required steps in order for there to be infringement.

And the judge was wrestling with this issue when on December 4th after oral arguments were made by both us and the defendants in the words

of the judge; a new case from the Federal Circuit fell into his lap. And he interpreted that case to stand for the proposition that if Verizon or Apple in this case were not actually performing the steps in the phone then effectively they should be

dismissed from this case.

We’ve addressed this matter in the new patents by adding apparatus claims which would not be impacted at

all by this line of cases.

And so to elaborate a little bit on our recently issued patents let me state that the technicality argued to

the court by Apple and Verizon to permit their continued use of Adaptix’s technology has in fact been addressed by the new patent we got last week.

Importantly this new patent was granted even though the Patent Office has received all the prior art that Apple, Verizon, HTC, AT&T

submitted in the California case during their attempt to invalidate Adaptix’s patents. This fact will make newly issued patents much stronger and more resistant to the same challenges and again we filed suit in this new patent last week against

all the parties that were dismissed yesterday.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

4

Also regardless of yesterday’s ruling as mentioned previously the Adaptix cases versus

Ericsson and Alcatel-Lucent are disconnected from this California case and are proceeding to trial next quarter.

In addition as also

mentioned previously we expect the cases against the handset defendants in Texas to also proceed to trial on indirect infringement claims which again would not be impacted by this ruling.

So there you have our overview of the impact in our opinion of yesterday’s ruling. With that Taylor, can you please open up the call for

any questions?

Operator: Thank you. If you’d like to ask a question, please signal by pressing star 1 on your

telephone keypad. If you’re using a speakerphone please make sure your mute function is turned off to allow your signal to reach our equipment. A voice prompt on the phone line will indicate when your line is open. Please state your name before

posing your question.

Again, press star 1 to ask a question and we’ll pause for just a moment to allow everyone an opportunity to

signal for questions.

And as a reminder again, that is star 1 if you’d like to ask a question.

Matthew Vella: Okay. Looks like we don’t have questions so…

Operator: We do have a question.

(Crosstalk)

Matthew Vella: …we’ll ((inaudible)). Oh okay.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

5

Operator: Caller your line is open.

Mike Latimore: Hi. It’s Mike Latimore, Northland Capital.

Matthew Vella: Hi Mike.

Mike Latimore: Good morning. So it sounds like you’re not going to appeal the ruling that came out yesterday.

You’re going to file - you’re basically going to rely on the…

Matthew Vella: Well no, we’ll…

Mike Latimore: …new filing.

Matthew Vella: We’ll appeal the ruling. And we’ll even refile the case in California to include indirect

infringement claims.

But we will in fact be appealing this ruling. I mean just to elaborate, I didn’t want to spend too much time

talking about it but the - we think that just because the steps in the method claim are not actually practiced by Apple or in this case let’s say, you know, the steps are practiced by their phone.

And more importantly and this is the part that surprised me personally, the steps we think are controlled by the operators. The operators

initiate the performance of those steps.

And so, you know, what surprised us was that the carriers were dismissed from this case.

So we’ll be appealing and exploring all of these issues. And we’ll go from there.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

6

Mike Latimore: And with regard to the other handset cases in Texas, you

don’t see this sort of summary judgment ruling having an influence there and, you know, wouldn’t they kind of look at the SURF case alone in those cases or can you explain why you don’t think it has an influence?

Matthew Vella: Well no, I think it’ll have an influence. We just expect that case to proceed to trial because in that

case unlike in this case we pled indirect infringement. And so we have an indirect infringement claim as a fallback in the Texas case which is something we didn’t have in the California case.

So the statement I made was on that basis.

Mike Latimore: Got it.

Matthew Vella: Now I’m not saying the Texas court is going to necessarily find the same outcome. But even if it did we

still have the indirect infringement claims to fall back on.

Mike Latimore: And does this ruling change any of your kind

of OPEX, you know, marketing G&A goals for the year or do those not change under this?

Matthew Vella: It, you know,

it will change not for this year I suspect because I think this is going to be a relatively inexpensive case to fight. Meaning the evidence is going to be practically identical. The claim construction issues are going to be practically identical.

The only thing that’s different is that we’ve got an issued patent that’s been sanctioned if you will by the Patent Office.

And notwithstanding all the prior art that’s been thrown at it by the defendants and we’re not going to have this SURF issue because

we’re going to have apparatus claims in place.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

7

So, you know, it’s obviously going to cost a little bit more but it shouldn’t be

that expensive because we’ll be able to reuse a lot of the evidence that we had used in the first case.

Mike

Latimore: Okay. All right. Thanks.

Operator: And we’ll take our next question.

Bryan Prohm: Hello?

Matthew Vella: Hi.

Bryan Prohm: Hey Matt. It’s Bryan Prohm from Cowen. I’m sorry. I didn’t hear myself get…

Matthew Vella: Hey Bryan.

Bryan Prohm: …introduced. Hey a couple questions just following up here on some of the things you talked about into the

Q&A so far.

First beer question is what was your expectation for the best case outcome here? You know pretrial settlement with, you

know, eight figure revenue type of agreement recognizing in Q1 based on some precedent in Adaptix that we’ve seen with other Smartphone OEMs.

Matthew Vella: Yes. I mean I - you know I can’t talk about amounts because the - I’m sure this call is going to be

evidence in a case.

But having said that you always hope for a settlement prior to trial, right and so that’s always certainly a

hope.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

8

But the nice thing about our business is that if that hope doesn’t materialize you have

several other trials that are going to potentially drive several other settlements, several other revenue events on the Adaptix matter.

And then besides the other trials on the Adaptix matter that, you know, hopefully also will drive settlements. You have several other

portfolios like VoiceAge, like Rambus that are also going to trial in the next four or five months. That should also drive revenue events.

So you hope for each of these individual revenue events, these trials that are coming up. But if any of them don’t materialize,

that’s why you’ve got 15, 20, 25, so that you don’t have to count on one too much.

And that’s especially heartening

when you haven’t lost a revenue opportunity as in this case because in effect it’s not like someone saying the patent’s invalid or that the actual method or the actual apparatus is not being done by someone. This is a dispute about

who to blame for the particular claims that were at issue. And by getting new claims we sidetrack that dispute and render it irrelevant.

Bryan Prohm: Okay. Thanks for the clarification. Hey so you sort of touched on my next question which is you’ve

previously spoken to, you know, roughly two dozen First Half of ’15 marquis trial dates that we know historically can correspond to major revenue events.

How many of those go away in the summary judgment ruling from yesterday? Is it one encompassing all the ((inaudible))?

(Crosstalk)

Matthew Vella: I think we treat that as two. There’s an Apple and HTC.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

9

Bryan Prohm: Okay. So you would consider two, you know, a net loss of two

but basically they get pushed into ’16 and from ’15.

Matthew Vella: Yes.

Bryan Prohm: Okay. No. That helps a lot.

And then so to - talk to me a little bit about the portfolio itself. It sounds like if - once you’ve corrected the technical claims issue,

do you think that the portfolio becomes stronger in the long run or, and I think you touched on this a little bit already, or that the trials in Texas are substantially different or different enough that the ruling yesterday won’t impact them

in as comprehensive of a way as to, you know, just get a summary judgment for infringement or not infringement rather, and move on?

Matthew Vella: Well let me take that in two parts. I think I detected two questions in there. You know this ruling because

it’s a postponement it is, you know, a setback. I’d say it’s temporarily a big setback. I think overall it’s a minor setback because we expect to collect on those revenues nonetheless.

Having said that the way I judge the strength of the portfolio overall is I look at how it’s been doing vis-à-vis the prior art.

And I look at how the infringement cases are going and what claims we have to make those infringement cases go forward.

And on those bases

I’m very happy with the portfolio. We don’t think there’s any anticipatory art out there. And we think that with the claims we’re getting which have been making little fixes and adjustments to these sorts of technical defenses we

like our infringement case even more than we did before.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

10

I’m also heartened by the fact that we’re talking about relatively technical type

defenses. You know so overall I’m quite happy with the progress of the portfolio.

Coming to your question about Texas, you know,

it’s hard to tell what the judges in Texas are going to do. They might look at the same fact pattern. And they might decide that - well someone has to control the method practiced by the phone. You know there isn’t - to me I just - I

can’t imagine a method that’s not controlled by someone when it’s being done a lot, lots and lots and lots of times on all of our phones every hour.

And so someone has to control the method. So if it’s not for example Apple, and it’s not the carrier, it’s certainly not me, the

consumer of the phone or you the consumer of the phone. Someone’s got to control it.

And whoever’s controlling that method,

right, then effectively, you know, a judge might look at that fact pattern and say you know something it’s the carriers. It’s AT&T. It’s Verizon that controls the method. They should stay in the case.

So a Texas judge could do that. But my point is that even if he declines to do that as Magistrate Judge Grewal declined to do that then we have

the indirect infringement claims to fall back on and so we still think we get to a jury.

Bryan Prohm: All right. So net,

Adaptix you would still consider it a marquis portfolio after this ruling and that you ((inaudible)).

(Crosstalk)

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

11

Matthew Vella: Oh no, without a shadow of a doubt. Yes. And again, you know,

we think the handset cases are going to go forward. We think that the - even the actual defendants that were dismissed yesterday we think that all that’s happened is that the day of trial has been postponed, has not been cancelled by any

stretch of the imagination.

And we also don’t think this in any way impacts the base station side of the portfolio which we’ve

always said we’ve liked a lot because of the large number of patents we can bring to bear in that case.

Bryan

Prohm: Okay. Last question for me then. Of the Adaptix settlements to date, Motorola, NEC and some others come to mind, how many of those are on the handset side and how many of those are on the base station side or is that something you can speak

to?

Matthew Vella: Yes, I can. The - we look at the license fees, you know, I think there’s about four maybe five

on the handset side and there’s two if you include Samsung which would be both sides obviously. There’s two if you include Samsung on the base station side.

Bryan Prohm: Okay, so there are - there’s some precedent and some deals in place for us to look at. Okay, great.

That’s all my questions. Thanks, Matt, for your time.

Matthew Vella: Thanks Bryan.

Operator: And we’ll take our next question from Paul Coster with JPMorgan.

Paul Coster: Thanks. Matt a few questions, first up, the - okay so you’re going to reconstruct this claim against Apple

and HTC and come back at them in ’16 however you’re going to be using a newly file - a newly granted patent.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

12

Doesn’t that mean though that your - that’s something sort of you can only settle

with them or claim against them for future violations, infringements against that new patent? You don’t get the same magnitude of settlement because, you know, there’s no arrears associated with that patent.

Matthew Vella: Well two things. One, even if it’s true and it isn’t for a reason I’ll explain in a second, you

know, you’re talking about a couple of years out of a ten year life because, you know, LTE has just gotten started. So mathematically again you’re talking about a small portion.

But even in terms of what’s happened in the past, I disagree with that because we on these patents one, we’re going to appeal; and

two, we have to contribute to our infringement claims. The indirect infringement claims that is that we can bring.

So we’ll refile

the case, you know, as related. It will have those indirect infringement claims in it. And they’ve been on notice under those patents since day one.

So, you know, I think overall we’re going to be able to capture the entire economic value. That’s our view based on what I just said.

Paul Coster: So the indirect infringement claims they are not again - the ones that are pending are not in the - in

Texas they’re not versus Apple and HTC though. Is that correct?

Matthew Vella: That’s correct.

Paul Coster: All right. You know so just from a sort of generalist perspective, an indirect infringement doesn’t seem

quite as bad as a direct infringement. And so I suppose the assumption is that the magnitude of the settlement would be less.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

13

Matthew Vella: Well if you were dealing with indirect infringement in a

vacuum which you’re not it’s not so much that it sounds less bad or more bad, the evidentiary test required to make out a case are different.

And so you have to assess the probability of success based on different evidentiary tests.

And no two cases are alike. So it definitely, you know, is going to impact logically what the evidentiary probabilities look like.

Having said that we think we have a strong indirect infringement case. But more importantly, you know, these cases they’re not going to -

the settlement amounts are not going to turn dramatically on the basis of whether or not I’ve got full notice on, you know, these patents and I’m collecting a full amount or full royalty on these patents sort of speak up to the point of

time that you’re negotiating when it’s indisputable that the patents will continue to be infringed for many, many, many years to come, eight, nine, ten years. And that we’re really only talking about a couple of years of past damages

at worse.

So it definitely changes the calculation logic. But we don’t think it changes the calculation in a way that takes away our

claim for past damages. And just as importantly it has no impact on the future exposure which in this case on these facts dwarfs the past exposure.

Paul Coster: All right, so my overall conclusion from this call is that this is a material setback for one of your marquis

portfolios. You - will you be conducting calls of this nature every time we have a material setback or good thing happen with respect to marquis portfolios in general? I’m just - this is a process question because I’m trying to understand

why this call is being, you know, brought about.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

14

Matthew Vella: Yes. Well I mean I - well first off, I’m not sure. It

depends what your perspective is in terms of material. It’s material in terms of the timing of revenue collection. I don’t think it’s material in terms of the overall revenue opportunity. You know so we can I guess quibble about that

one.

But in terms of the process we, you know, we debated this and we asked ourselves if we should have the call.

And we had it primarily because we had a sense that people were under the impression that the entire Adaptix portfolio was somehow impaired or

destroyed and that effectively our entire Adaptix portfolio was hinging on this one outcome. And we wanted to make that clarification in a public manner.

Any time we think that our shareholders are operating under a false set of assumptions about a recently issued ruling we’re obviously

going to try and clarify things as best we can. That’s what we’re doing today. And so that’s the - that’s why we’re having this call.

Paul Coster: All right, thank you.

Operator: And we’ll take our next question from Zach Pancratz with DePrince, Race & Zollo.

Zach Pancratz: Good morning guys. You know…

Matthew Vella: Hi.

Zach Pancratz: …question I have for you, you know, if we look at the Adaptix portfolio as a whole and the revenue

opportunity that it presents, you know, what this one trial with these patents is kind of a, you know, I don’t need an amount but just a percentage of the overall revenue opportunity that you see with the Adaptix portfolio.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

15

Matthew Vella: Well the - there’s two parts to the Adaptix portfolio.

There’s the bay station part and there’s the handset part.

And on the base station part that’s completely separate. So

I’m not going to comment on that. We think very highly of it. And we like those cases very much. But again that’s completely separate, different patents.

On the handset part there’s a number of geographies in play. And if you look at the U.S. geography Apple is the - you know by in terms of

unit sales, the largest remaining unlicensed company as of right now.

Now in two, three, four years’ time that could change. A

Chinese handset vendor could come along and take market share. But as of right now Apple is the number two player overall in the market. We’ve licensed Samsung and so we’re talking about postponing a revenue deal with the number two

player, the largest remaining unlicensed player.

And so, you know, that’s the impact. And we’re - you know in terms of the -

quantifying the impact you look at the Apple market share on LTE handsets and you calculate it that way. I don’t know what the latest percentages are.

But again it’s a postponement in our mind. It’s not a cancellation.

Zach Pancratz: Right. But what I’m trying to get at is, you know, with you saying that contagion across the portfolio is

minimal, you know this isn’t going to impact, you know, other trials down the road. You know are we looking at this revenue opportunity with this current trial, you know, is this 5%, 10%, 20% of the overall Adaptix portfolio of revenue

opportunity?

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

16

Matthew Vella: Well again and I don’t like to mention specific numbers

on these things because of the evidentiary impact of what I’m saying.

But, you know, one thing we do look at when we assess the

overall opportunity for any one prospective licensee, we look at their market share.

And so, you know, if the market share is 10% then a

lot of times, you know, that’s going to be something like 10% of the opportunity, right. Not always but a lot of the times.

So in

this case I guess I’m telling you that, you know, as a hint to take a look at Apple’s market share and that would answer the question about the impact of the postponement.

The second thing I want to say just again, to clarify something you said that was baked into your question about the no impact, again it might

impact the Texas case on the handset. It’s not the one on the newly issued patents but the ones on these existing patents. But to the extent that it might impact that case, we have a fallback path to get to trial.

Zach Pancratz: Right, okay. And then, you know, looking at the base station versus the handset, I mean how do we look at

those in terms of size? Is base station a bigger opportunity than the handset opportunity in your opinion?

Matthew

Vella: The base station again, and again I don’t want to get into numbers because we’ve got all these trials coming up. And anything I say especially numerically could be construed as evidence.

But the base station portfolio was undeniably deeper. There’s more patents. Our continuation patents practice is working just as well on

the base station side as the handset side. We’ve been talking for example about a newly issued patent on the handset side that addresses all the technicality issues we run into in the Apple suit. We also got one on the base station side that we

filed suit on against the base station vendors last week.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

17

So overall, you know, we like the base station case. We like the handset case. The - maybe

I’ll have to sort of qualitatively compare them. The base station case has a greater number of patents, a greater number of inventions at stake. And so it’s definitely more resilient.

In terms of the economic opportunity again, you know, I can’t comment on the specific numbers. But given, you know, you can kind of assess

that by looking at the dollar values of the markets. But then realize as well that we can command higher royalty rates on the base station side because we’ve just got more patents and plan - and because of some other factors as well that I

won’t get into right now.

Zach Pancratz: Okay. And then when can we expect the next base station case or ruling?

Matthew Vella: The trials are going to be in I think in the April to June timeframe on the base station side.

Zach Pancratz: Okay. All right. And then just lastly, you know, looking where your stock’s trading at this morning and

on the surface it looked like you guys had a very strong fourth quarter.

Have you given any thought in pre-releasing your fourth quarter

numbers rather than waiting till February 20 to do so?

Matthew Vella: No. We have a process we have to follow

because its yearend and we have to dot our Is and cross our Ts. And we’ll release our numbers when the auditors have checked them over and checked over our yearend numbers. And that’ll be February 18 kind of timeframe, somewhere

around that date.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

18

Zach Pancratz: Okay. That’s it for me. Thanks guys and best of luck

going forward.

Matthew Vella: Thank you.

Operator: And we’ll take our next question from Daniel Katz with Apex Capital.

Daniel Katz: Good morning. Sounds like…

Matthew Vella: Hey.

Daniel Katz: …you’re expecting a lot from the apparatus claim and patent that you just referred to on the base

station side.

Can you discuss how long ago did you file with the Patent Office on these patents and, you know, what did you learn along

the way? You know you’ve been an owner of Adaptix for a decent amount of time now.

Matthew Vella: Thanks. Well we

actually got two patents Dan and so there’s a base station patent we just got and there’s a handset patent we just got.

So

I’ll answer the question for both of those. And you can actually look at these patents because we filed suit on them last week.

But

one thing we learned is what’s apparent from just looking at the patents in which we filed suit last week, the ones that just issued which is that we think the patents are valid. You know normally when you look at a patent and you look at the -

on page 1 and page 2 it’s got all the prior art references the Patent Office considered before allowing the patent to issue. And those are only usually a page or two. In our case they’re 22 pages long or maybe even 25 pages long. And, you

know, that’s 20 to 25 pages, two columns, you know, a reference every three, four lines and there’s about 64 lines a column.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

19

So I haven’t done the math in terms of the number of references that the Patent Office

considered.

But suffice it to say that we’ve been putting all the references that the defendants say and validate those patents

before the Patent Office and the Patent Office still issued the patent.

And so, you know, what - the main thing we’re learning is

that the - there is no anticipatory reference out there. And we’re learning that in our view these patents are valid. And that gives us a lot of confidence going forward because we’ve always known the patents are infringed. These sort of

technicality type defenses notwithstanding, there’s no real in my mind question that people aren’t practicing the - what’s in the - what’s covered by the claims.

Daniel Katz: Okay. So I mean the discussion around the revenue opportunity for Adaptix was questioned by many of the analysts

along the way. Based on what you just said, you know, you feel like you’re still going to get what you had originally hoped for in total. Is that fair to say?

Matthew Vella: Yes. Yes.

Daniel Katz: Okay. Thank you.

Operator: And we’ll take our next question from Brett Reiss with Janney Montgomery Scott.

Brett Reiss: Morning, gentlemen.

Matthew Vella: Hi.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

20

Brett Reiss: If the market in your view unduly punishes you for this

temporary setback, do you think the Board will reconsider the priority of buying back some stock in this area?

Matthew

Vella: Yes. Under that assumption it certainly would reconsider it.

Brett Reiss: You know the stock’s down 3.5

points. You know do you have the logistical flexibility for the Board to kind of expeditiously meet and, you know, make a decision in this area?

Matthew Vella: Yes. The expeditiously flexibility is there.

Brett Reiss: Great. All right, and thanks for the call.

Operator: And we’ll take our next question from Rupal Bhansali with Aerial Investments.

Rupal Bhansali: Hi Matt. First of all, thank you for doing this call. It’s always important to interact with

shareholders if there is something that is being materially misunderstood so I actually appreciate the opportunity you took however out of normal course of events that might appear to some.

My question has to do with, you know, some of what’s been covered before but if you can handicap again, in the best case scenario what can

be expected in 2016 and in the worst case scenario how should we as investors try to handicap the loss of revenues? I know you gave orders of magnitude with respect to market share and I understand you can’t give numerical outcomes.

But perhaps you can put this into larger perspective in terms of, you know, other portfolios and revenue opportunities that you have so that

people can again appropriately value the company.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

21

Matthew Vella: Well, you know I’ll season in the last part of the

question and if it doesn’t fully answer the question then feel free to follow-up with another question.

But the company has, you

know, over ten marquis portfolios and Adaptix is one of them.

And so first of all, you know, this has nothing to do with the other nine.

Secondly, when you look at the Adaptix portfolio itself you have valuation on the base station side. You have valuation on the handset side. You know, I’d argue that our base station portfolio is even deeper. When you think about it the patents

cover both sides of a connection, the handset side and the base station side.

So, you know, we think there’s obviously a great, great

deal of value on the base station side. Yesterday’s ruling doesn’t touch the base station side.

And then when we get to the

handset side, you know, we’ve got valid patents as we think the Patent Office has been showing in the last - by issuing the patents last week. We think the patents are infringed.

And so yes, there’s this issue around the method claim and the SURF issue but it’s an issue that we can correct and that we have

corrected past tense with the issuance of a patent that covers an apparatus claim.

So overall, you know, we’re talking about a

fraction of the overall valuation of this company.

And of course I’m not even talking about - I’m just talking about the book

value of what we have on our books right now. Forget the enterprise value.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

22

So again even if I just look at that we’re talking about a fraction of the overall

valuation of the company.

And even on that fraction we don’t think we’ve lost it. We think it’s been merely postponed.

Rupal Bhansali: Fair point. Perhaps just on the other nine if there’s any developments that you can talk about positive

or negative or perhaps you’d like to withhold those comments till your February call.

Matthew Vella: Well I’ll

withhold them till the February call. But I’ll say what I will say on the February call and I’ve said on the past calls, which is to say that we like the way they’re unfolding. We’ve got trial dates on many of them coming up. And

we’re looking forward to monetizing those portfolios in the coming months.

Rupal Bhansali: Understood. And I would

echo the sentiment expressed by the prior caller which has to do with trying to take advantage of the situation on behalf of long term shareholders and engaging in buybacks when there are temporary, you know, temporary problems that cause some big

damage to the stock price in the short term.

Matthew Vella: Understood. Thank you.

Rupal Bhansali: Thank you.

Operator: And we’ll take our next question from Greg Lewin with Lewin Capital.

Greg Lewin: Oh hi Matt. Well you, you know, you got to the point that I was hoping you would get to on the last call so just

to reiterate or reframe, you know if you are - and this is obviously the process you’re going through. You know exactly what you think each portfolio is worth.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

23

But if we use rudimentary sort of guidelines you have over ten marquis. You have value in the

company. This is one of ten even if it’s a large one that you’ve already modeled. But the handset is possibly less than half of the value of the portfolio. So even if it were 15% of your perspective, you know, of your prospects the handset

is maybe worth whatever, 5% to 10%, 5% to 7, some number like that.

My only point is you did a job. There’s no basis. I understand

the sensitivity that you used in dealing with numbers because courts can hold you accountable and, you know, and counterparties can hold you accountable.

But you have to frame these things, these valuation ideas because these are the same ideas that I know you’re processing when thinking

about share repurchase. So the stock is down 20%. And easily the way you’re framing it for the last question and if I ask you to go further, we’d get more specific, we’re dealing with a potential loss of value of 5% that one could

then argue is postponed, not lost. You got to frame it for people.

You got to - when you say you want to give people perspective, just

don’t give people perspective on the court case. Give people perspective on the company because that’s what they’re really searching for when the stock’s down 20%.

Matthew Vella: You know and I think you summarized it quite well. I mean to be perfectly candid, yes, you’re right. I

think you frankly stated our case a little bit more succinctly from a business perspective than I just did.

Greg Lewin:

Yes. And I mean I understand you want to frame what the event was. But going forward you want to frame the impact because what every caller on this call when they’re done with all the research and all the nonsense, all they’re trying to do

is to decide should they be buying the stock right now or selling the stock right now. And that’s relative to the change in the stock price.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

24

Stock price is down 20.

Matthew Vella: Understood.

Greg Lewin: You’re sitting on the call arguing that this value - that the diminishment of value on this - from this

event in your opinion relative to the size of your company is possibly less than 5%. And that’s the thing that we’re looking for and then we’ll make bets on it.

But that’s what I want you to just think through as you go forward. And again I would also echo the sentiment of the woman who just

preceded me. There is no basis for you ever being hesitating relative to giving transparency. The guy who questioned that was dead wrong.

You’ll make some right judgments.

Matthew Vella: Understood.

Greg Lewin: And wrong judgments but always error on the side of transparency.

Matthew Vella: Understood. And again the only break if you will on my wanting to be transparent with you is the fact that if

- you know, that we might throw a number out there. I got to live with it in court.

Greg Lewin: Yes. But this is - if

you walk this back just the way we talked about it relative to the portfolio, relative to the real question at hand for investors ((inaudible)).

(Crosstalk)

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

25

Matthew Vella: Well understood. And I think you summarized it correctly.

Greg Lewin: Right. So you can always ((inaudible)).

(Crosstalk)

Matthew Vella: You know and we quibble about the numbers at the edges. But I think more or less you should be in the right

ballpark and that is the perspective.

Greg Lewin: Right. And so what I want you to just - I’m just suggesting is

that when you have an opportunity there are ways of framing these things that can help investors without putting you at risk relative to your, you know, court considerations which always take precedence.

Matthew Vella: Understood.

Greg Lewin: So I appreciate the call and it’s the right thing to do. Thank you.

Matthew Vella: Thank you.

Operator: And we have no further questions. And this concludes the question and answer session. I would now like to turn the

conference back over to Mr. Matthew Vella for any additional or closing remarks.

Matthew Vella: I think the last

caller did a pretty good job summarizing the overall situation we find ourselves in. Again just to then tunnel in and cast what happened yesterday into a larger perspective, it’s a postponement, not a cancellation of a portion of one of our

marquis.

ACACIA RESEARCH CORP

Moderator: Matthew Vella

01-21-15/8:00 am CT

Confirmation #

6815326

Page

26

And so with that we thank you for your continued support of this stock, your continued

interest. And we’re looking forward to continuing our emergence from the revenue trough we found ourselves in last year as we start to come across trial dates as mentioned in other calls over the next four to five months.

Thanks very much. And in my case it’s good night. I’m in China but for everybody else, good morning and thank you.

Operator: This concludes today’s conference. If you’d like to listen to today’s replay, that will begin

January 21, 2015 at 11:00 am and will end February 20, 2015 at 11:00 am. The phone numbers to be able to listen to the replays are 719-457-0820 or 888-203-1112. All parties may now disconnect.

END

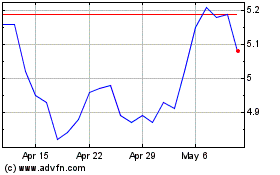

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

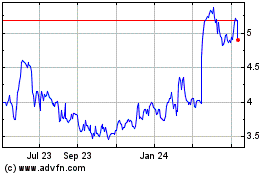

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024