Current Report Filing (8-k)

January 14 2015 - 8:34AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported): January 14, 2015 (January 9, 2015)

TYCO INTERNATIONAL PLC

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Ireland | | 98-0390500 |

(Jurisdiction of Incorporation) | | (IRS Employer Identification Number) |

001-13836

(Commission File Number)

Unit 1202, Building 1000, City Gate

Mahon, Cork, Ireland

(Address of Principal Executive Offices, including Zip Code)

353-21-423-5000

(Registrant’s Telephone Number, including Area Code)

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

______________________________________________________________________________________________________

As previously disclosed, during the fourth quarter of fiscal 2014, Tyco International plc (the “Company”), recorded a net charge of $465 million related to asbestos liabilities, of which $225 million related to Yarway Corporation liabilities and $240 million related primarily to Grinnell. The Company also disclosed that, in connection with claims primarily related to Grinnell, the Company had resolved disputes with certain of its historical insurers and agreed that certain insurance proceeds would be used to establish and fund a qualified settlement fund (“QSF”), within the meaning of the Internal Revenue Code, which would be used for the resolution of certain of these liabilities. On January 9, 2015, the Company completed a series of restructuring transactions related to the establishment and funding of a dedicated structure pursuant to which the Company acquired the assets of Grinnell and transferred cash and other assets totaling approximately $278 million (not including $22 million received by the QSF from historic third-party insurers in settlement of coverage disputes) to the structure. As part of the restructuring, subsidiaries in the structure assumed certain liabilities related to historic Grinnell, Scott and Figgie operations, including all historical Grinnell asbestos liabilities, and such subsidiaries purchased additional insurance by, through or from a wholly-owned subsidiary in the structure in order to supplement and enhance existing insurance assets. The structure and the QSF fully fund all historic Grinnell asbestos liabilities and provide for the efficient and streamlined management of claims related thereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| TYCO INTERNATIONAL PLC |

| (Registrant) |

| | |

| By: | /s/ Andrea Goodrich |

| | Andrea Goodrich |

| | Vice President and Corporate Secretary |

| |

| |

Date: January 13, 2015 | |

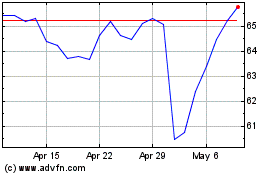

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

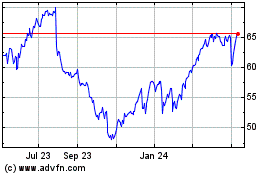

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024