UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 17, 2014

PANGAEA LOGISTICS SOLUTIONS, LTD.

(Exact Name of Registrant as Specified in Charter)

Bermuda

|

|

001-36139

|

|

N/A

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

109 Long Wharf, Newport, Rhode Island 02840

(Address of Principal Executive Offices) (Zip

Code)

(401) 846-7790

(Registrant’s Telephone Number, Including

Area Code)

_____________________________________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

Item 2.02 Results of Operations and

Financial Condition.

On November 17, 2014, Registrant issued a press

release announcing financial results for the quarter ended September 30, 2014. The full text of this press release is included

as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report,

including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Current

Report shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933.

Item 9.01 Financial

Statements, Pro Forma Financial Information and Exhibits.

(d) Exhibits

| | Exhibit

| Description

|

| | | |

| 99.1 | Press Release of Pangaea Logistics Solutions, Ltd. dated November 17, 2014 announcing financial results for the quarter ended

September 30, 2014. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: November 17, 2014

PANGAEA LOGISTICS SOLUTIONS, LTD.

By: /s/ Anthony Laura

| | Title: Chief Financial Officer |

EXHIBIT 99.1

Pangaea Logistics Solutions Ltd. Reports

Financial Results for the Third Quarter Ended September 30, 2014

NEWPORT, RI – November 17,

2014 – Pangaea Logistics Solutions, Ltd. (“Pangaea” or the “Company”) (NASDAQ: PANL), a global provider

of comprehensive maritime logistics solutions, announced today the results for Bulk Partners (Bermuda) Ltd., (“Bulk Partners”)

for the third quarter ended September 30, 2014. Future reporting will be from Pangaea, the 100% parent of Bulk Partners as

of October 1, 2014.

Third Quarter 2014 Highlights & Recent Developments

- Revenue of $91.2 million for the third quarter of 2014

- 25% increase in voyage days, demonstrating increasing demand for services

- Completed public listing; began trading under NASDAQ: PANL

- Took delivery of m/v Nordic Oshima, a 76,180 dwt ice-class 1A panamax

dry bulk carrier

- Signed two new long-term contracts of affreightment (“COAs”) to support

its ice-class fleet

Edward Coll, Chairman and Chief Executive Officer of Pangaea

Logistics Solutions, stated, “The third quarter of 2014 presented a challenging rate environment, continuing what we experienced

during the second quarter. Despite these headwinds, we were able to effectively leverage our relationships in the industry

and create revenue opportunities where others could not. Further, we are incredibly pleased to have begun publicly trading and

look forward to building increased shareholder value.”

Third Quarter and Nine-Months 2014 Financial Results

For the quarter ended September 30, 2014, total revenue was $91.2

million. Total revenue was $295.2 million for the nine months ended September 30, 2014.

Bulk Partners reported a loss from operations of $1.9 million

for the third quarter of 2014, and income from operations of $11.5 million for the nine months ended September 30, 2014.

Bulk Partners reported a net loss after non-controlling interests

of $2.9 million for the third quarter, and net income after non-controlling interests of $4.9 million for the nine months

ended September 30, 2014.

“Our voyage days increased 25% in the quarter over the

same period last year, demonstrating strong demand for our services,” Coll added. “That said, operating margins were

under significant pressure due to weakened market rates in the vast majority of the dry shipping segments.”

Assuming the merger had been consummated as of January 1, 2014,

the Company’s pro forma earnings per share for the nine months ended September 30, 2014 was $0.11 basic and diluted, which

were calculated based on 34,696,997 shares.

Cash Flows

For the nine months ended September 30, 2014, Bulk Partners’

net cash provided by operating activities was $16.4 million, compared to $18.9 million for the nine months ended September

30, 2013.

For the nine months ended September 30, 2014 and 2013,

net cash used in investing activities was $30.1 million and $75.7 million, respectively. Net cash provided by financing

activities was $14.9 million and $60.9 million for the nine months ended September 30, 2014 and 2013, respectively. This reflects

increased borrowing to finance the purchase of additional vessels and take delivery of the m/v Nordic Oshima.

“We continue to invest operating cash flow in newbuilding

vessels in the ice-class trade, a market that is well-protected from the newbuilding backlog and where we have distinct strategic

advantages,” Coll said.

Recent Developments

The following events took place after the close of the third

quarter:

| · | On October 1, 2014, Bulk Partners completed its merger with Quartet. The combined company is a wholly owned subsidiary of Pangaea

Logistics Solutions. On October 3, 2014, the Company’s common shares commenced trading on NASDAQ under the ticker symbol

PANL. |

| · | On October 8, 2014, Pangaea announced that ASO 2020 Maritime, an affiliate of the Alexander S. Onassis Public Benefit Foundation,

executed a letter of intent to acquire a stake in Pangaea. |

| · | On October 28, 2014, the Company announced the delivery of the m/v Nordic

Oshima, a 76,180 dwt ice-class 1A panamax dry bulk carrier. Pangaea took delivery of the vessel on September 25, 2014 from

Oshima Shipbuilding Co., Ltd. |

| · | On November 14, 2014, the Company announced long-term COAs that will help support the activities of its specialized ice-class

1A panamax vessels. |

o

The first contract is a new agreement with an existing client to carry cargo in the Baltic region through 2017. Beginning

in 2015, the contract will provide an estimated 240 cargo days of coverage and

will contribute revenue of approximately $10 million per year.

o

The second contract is with a new, blue-chip client to carry cargo from 2015 to 2018. Pangaea’s ice-hardened fleet

is contracted to transport cargo for an estimated 600 days each summer in the far northern latitudes, contributing revenue of approximately

$22 million per year.

About Pangaea Logistics Solutions, Ltd.

Pangaea Logistics Solutions, Ltd. (NASDAQ: PANL) provides

logistics services to a broad base of industrial customers who require the transportation of a wide variety of dry bulk cargoes,

including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. The Company addresses

the transportation needs of its customers with a comprehensive set of services and activities, including cargo loading, cargo

discharge, vessel chartering, and voyage planning. Learn more at www.pangaeals.com.

Forward-Looking Statements

Certain statements in this press release are "forward-looking

statements" within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are based

on our current expectations and beliefs and are subject to a number of risk factors and uncertainties that could cause actual

results to differ materially from those described in the forward-looking statements. Such risks and uncertainties include, without

limitation, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates

and vessel values, changes in demand for drybulk shipping capacity, changes in our operating expenses, including bunker prices,

dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance,

ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations

or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international

political conditions, potential disruption of

shipping routes due to accidents or political events, vessels breakdowns and instances

of off-hires and other factors, as well as other risks that have been included in filings with the Securities and Exchange Commission,

all of which are available at www.sec.gov.

Contacts:

Investor Relations

Thomas Rozycki

Prosek Partners

Managing Director

212-279-3115 x208

trozycki@prosek.com

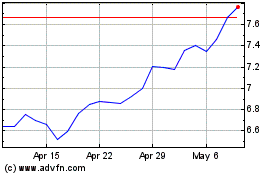

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

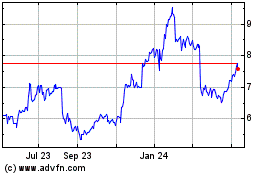

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024