Credit Agricole CIB Names Seasoned Latin American Banker Leonardo Osorio as a Managing Director in the New York Structured Fi...

January 25 2016 - 10:00AM

Business Wire

Crédit Agricole Corporate & Investment Bank (“CACIB”) -- the

corporate and investment banking arm of the Crédit Agricole Group,

the world’s ninth largest bank by total assets – announced today

that Leonardo Osorio, a 17-year senior Latin American bank

executive, has joined its Structured Finance Advisory Group for the

Americas as a Managing Director.

Mr. Osorio will be the primary lead in Latin America of a

recently launched New York-based CACIB advisory group focused on

financial advisory mandates in the Americas, in addition to being

involved in specific energy related transactions in North

America.

“Leonardo brings to us a wealth of experience originating,

structuring and executing project financings in the international

and local markets,” said Jaya Viswanadha, who heads up the newly

formed Americas advisory group and to whom Mr. Osorio will

report.

“With our new Americas advisory group, our aim is to utilize our

versatility and know-how to even more broadly serve markets in the

Americas. Leonardo’s deep knowledge and background will be of

immense value as we move forward,” Ms. Viswanadha added.

CACIB, a Global Player in Energy and

Infrastructure Financing

CACIB, a leading global player in Energy and Infrastructure

financing, has the distinction of being the only bank to receive

Project Finance Bond House of the Year, Global Bank of the Year and

Global Adviser of the Year awards from Project Finance

International, in addition to being named its 2015 Americas Bank of

the Year for Project Financing.

As a leading advisor globally, CACIB has been actively involved

in several recent transactions, including, among others, a $20

billion debt financing for the Ichthys LNG project offshore

Australia, the world’s largest project financing; refinancing of

the $1.1 billion Singapore SportsHub, the largest public private

partnership to date in South East Asia; and the 765 million Euro

refinancing of Copenhagen Airport in the U.S. and Euro private

placement and bank markets, together with associated cross currency

swaps. In the Americas, CACIB has recently advised on a 500kV

Charrua Ancoa 196.5km transmission line financing, owned by Grupo

Elecnor S.A. and APG; and on the debt and equity financing of the

Tres Mesas’ 148.5 MW wind farm in Mexico.

Leonardo Osorio’s Latin American

Banking Expertise

Prior to joining CACIB, Mr. Osorio was a founder and Managing

Director of L2 Energy Capital LLC, which in 2012 was launched as a

financial advisory firm focused in the energy and infrastructure

sectors in Latin America. Serving top Latin American clients, the

firm grew to having six professionals – three based in the U.S. and

the others in Colombia – providing advice on strategic financing,

raising debt and equity, project finance, and mergers and

acquisitions.

Mr. Osorio previously was Director – Project Finance Latin

America for BNP Paribas, where he served for approximately 14

years, starting as an associate in project financing and utilities.

After graduating from the Universidad Simón Bolívar, in Caracas,

Venezuela, he was for three years project manager-global technical

services with Rockwell International. Thereafter, he attended MIT

Sloan School of Management, where in June 1998 he received an

MBA.

About Crédit Agricole Corporate and

Investment Bank

Crédit Agricole CIB is the corporate and investment banking arm

of the Crédit Agricole Group, the world’s ninth largest bank by

total assets. Crédit Agricole CIB offers its clients a

comprehensive range of products and services in structured finance,

capital markets, brokerage, investment banking, corporate banking,

and international private banking.

The Bank provides support to clients in large international

markets through its network with a presence in major countries in

Europe, the Americas, Asia and the Middle East.

For more information: www.ca-cib.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160125005962/en/

For media inquiries:Crédit Agricole CIB AmericasMs. Mary

Guzman, +1 212-261-7129mary.guzman@ca-cib.comorAnreder &

CompanySteven S. AnrederMichael

Wichman+1-212-532-3232steven.anreder@anreder.commichael.wichman@anreder.com

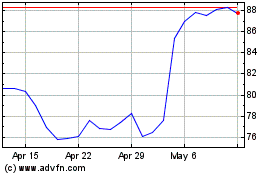

Arcosa (NYSE:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

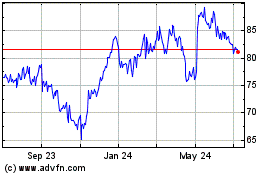

Arcosa (NYSE:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024