- Q4 sales of $70.7 million

- Q4 GAAP income per share of $0.08;

non-GAAP adjusted EPS of $0.24

- Strong order momentum in automotive,

mobility and IoT markets

- Completed the acquisition of Kita,

creating sales synergies opportunities

Cohu, Inc. (NASDAQ:COHU) today reported fiscal 2016 fourth

quarter net sales of $70.7 million and GAAP income of

$2.3 million or $0.08 per share. Net sales for the twelve

months ended 2016 were $282.1 million and GAAP income was

$3.3 million or $0.12 per share. (1)

The Company also reported non-GAAP results, with fourth quarter

2016 income of $6.6 million or $0.24 per share and income

of $18.8 million or $0.68 per share for the twelve months

ended 2016. (1)

GAAP Results (1) (in millions, except per share

amounts)

Q4 FY 2016

Q3 FY 2016 (2)

Q4 FY 2015 (4)

12 Months 2016

12 Months 2015

(4)

Net sales $ 70.7 $ 69.3 $ 63.5 $ 282.1 $ 269.7 Income $ 2.3 $ 0.1 $

2.3 $ 3.3 $ 5.8 Income per share $0.08 $0.01 $0.08 $0.12 $0.22

Non-GAAP Results

(1) (in millions, except per share amounts)

Q4 FY 2016

Q3 FY 2016 (2)

(3)

Q4 FY 2015

12 Months 2016 (2)

(3)

12 Months 2015

Income $ 6.6 $ 4.3 $ 2.4 $ 18.8 $ 15.7 Income per share $0.24 $0.16

$0.09 $0.68 $0.58

(1) In 2015 the Company announced the sale of

its mobile microwave communication equipment business, Broadcast

Microwave Services, Inc. (“BMS”). The operating results of BMS have

been presented as discontinued operations and all prior period

amounts have been reclassified accordingly. All amounts presented

are from continuing operations.(2) In the fourth quarter of 2016

the Company early adopted ASU 2016-09, Improvements to Employee

Share-Based Payment Accounting, (ASU 2016-09). As a result of the

adoption of ASU 2016-09 certain prior quarter amounts have been

restated. The impact of these 2016 restatements was not

significant.(3) Non-GAAP results for the third quarter of 2016 were

revised in the current period to exclude the impact of other

acquisition costs incurred in connection with the acquisition of

Kita Manufacturing Ltd. (“Kita”) on January 4, 2017.(4)

GAAP income for the fourth quarter and year ended December 26, 2015

included a $3.2 million, pretax gain on the sale-leaseback of

the Company’s Poway headquarters.

Total cash and investments at the end of the year were

$128.0 million.

Luis Müller, President and Chief Executive Officer of Cohu,

stated, “We delivered growth in fiscal 2016 with sales up 4.6%

year-on-year, a non-GAAP income increase of 20% and approximately

2-points market share gain in test handlers. We also grew our

contactor business and executed the acquisition of Kita, creating

sales synergy opportunities at Cohu’s large installed base of

handlers at automotive and mobile customers.”

Müller concluded, “We started 2017 with strong order momentum

and a plan to further expand sales and profitability. Customer and

end-market diversification as well as growing revenue contribution

from recurring, that includes test contactors, are driving improved

predictability in the business model.”

Cohu expects first quarter 2017 sales to be approximately

$78 million. Cohu's Board of Directors approved a quarterly

cash dividend of $0.06 per share payable on April 14, 2017 to

shareholders of record on February 28, 2017. Cohu has paid

consecutive quarterly cash dividends since 1977.

Use of Non-GAAP Financial Information:

Included within this press release are non-GAAP financial

measures that supplement the Company's Condensed Consolidated

Statements of Income prepared under generally accepted accounting

principles (GAAP). These non-GAAP financial measures adjust the

Company's actual results prepared under GAAP to exclude charges and

the related income tax effect for share-based compensation, the

amortization of acquired intangible assets, manufacturing

transition costs, employee severance costs, asset impairments, the

reduction of an uncertain tax position liability and related

indemnification receivable and the gain generated by the

sale-leaseback of a facility. Reconciliations of GAAP to non-GAAP

amounts for the periods presented herein are provided in schedules

accompanying this release and should be considered together with

the Condensed Consolidated Statements of Income.

These non-GAAP measures are not meant as a substitute for GAAP,

but are included solely for informational and comparative purposes.

The Company's management believes that this information can assist

investors in evaluating the Company’s operational trends, financial

performance, and cash generating capacity. Management believes

these non-GAAP measures allow investors to evaluate Cohu’s

financial performance using some of the same measures as

management. However, the non-GAAP financial measures should not be

regarded as a replacement for (or superior to) corresponding,

similarly captioned, GAAP measures.

Forward Looking Statements:

Certain matters discussed in this release, including statements

regarding expectations of business, sales, revenue, business model

predictability and operating results are forward-looking statements

that are subject to risks and uncertainties that could cause actual

results to differ materially from those projected or forecasted.

Such risks and uncertainties include, but are not limited to, risks

associated with acquisitions, inventory, goodwill and other asset

write-downs; our ability to convert new products under development

into production on a timely basis, support product development and

meet customer delivery and acceptance requirements for next

generation equipment; our reliance on third-party contract

manufacturers; failure to obtain customer acceptance resulting in

the inability to recognize revenue and accounts receivable

collection problems; customer orders may be canceled or delayed;

the concentration of our revenues from a limited number of

customers; intense competition in the semiconductor test handler

industry; our reliance on patents and intellectual property;

compliance with U.S. export regulations; and the cyclical and

unpredictable nature of capital expenditures by semiconductor

manufacturers. These and other risks and uncertainties are

discussed more fully in Cohu's filings with the Securities and

Exchange Commission, including the most recently filed Form 10-K

and Form 10-Q. The forward-looking statements included in this

release speak only as of the date hereof, and Cohu does not

undertake any obligation to update these forward-looking statements

to reflect subsequent events or circumstances.

About Cohu:

Cohu is a leading supplier of semiconductor test and inspection

handlers, micro-electro mechanical system (MEMS) test modules, test

contactors and thermal sub-systems used by global semiconductor

manufacturers and test subcontractors.

Cohu will be conducting their conference call on Thursday,

February 16, 2017 at 1:30 p.m. Pacific Time/4:30 p.m. Eastern Time.

The call will be webcast at www.cohu.com. Replays of the call can

be accessed at www.cohu.com.

For press releases and other information of interest to

investors, please visit Cohu’s website at www.cohu.com. Contact:

Jeffrey D. Jones - Investor Relations (858) 848-8106

COHU, INC. CONSOLIDATED STATEMENT OF

INCOME (Unaudited) (in thousands, except per share amounts)

Three Months Ended (1) Twelve Months Ended (1)

December 31, December 26,

December 31, December 26,

2016 2015

2016

2015 Net sales

$ 70,694 $ 63,484

$ 282,084 $ 269,654 Cost and expenses: Cost of sales

45,167 43,087

187,256 180,616 Research and

development

10,143 8,206

34,841 33,107 Selling,

general and administrative

12,332 13,164

54,322

51,170 Gain on sale of facility (2)

-

(3,198 )

- (3,198 )

67,642 61,259

276,419

261,695 Income from operations

3,052

2,225

5,665 7,959 Interest and other, net

169

25

342 44

Income from continuing operations before taxes

3,221 2,250

6,007 8,003 Income tax provision (benefit)

915

(40 )

2,747 2,211

Income from continuing operations

2,306

2,290

3,260 5,792

Discontinued operations: Loss from discontinued operations before

taxes (3)

(217 ) (341 )

(221 ) (5,536 )

Income tax provision

- -

- 6 Loss from discontinued operations

(217 ) (341 )

(221

) (5,542 ) Net Income

$ 2,089 $

1,949

$ 3,039 $ 250

Income per share: Basic: Income from continuing operations

$ 0.09 $ 0.09

$ 0.12 $ 0.22 Loss from

discontinued operations

(0.01 ) (0.02 )

(0.01 ) (0.21 )

$ 0.08

$ 0.07

$ 0.11 $ 0.01

Diluted: Income from continuing operations

$

0.08 $ 0.08

$ 0.12 $ 0.22 Loss from

discontinued operations

0.00 (0.01 )

(0.01 ) (0.21 )

$ 0.08

$ 0.07

$ 0.11 $ 0.01

Weighted average shares used in computing income per share:

(4) Basic

26,848 26,241

26,659 26,057 Diluted

27,774 27,115

27,480

26,788

(1) The three- and twelve-month periods ended

December 31, 2016 were comprised of 14 weeks and 53 weeks,

respectively. The three- and twelve-month periods ended December

26, 2015 were comprised of 13 weeks and 52 weeks,

respectively.(2) Gain on sale of facility resulted from the

sale-leaseback of the Company’s Poway headquarters completed on

December 4, 2015.(3) Prior year amounts include the loss generated

by the sale of our mobile microwave communication equipment

business totaling $0.3 million and $3.6 million in the

three- and twelve-month periods ended December 26, 2015,

respectively.(4) The Company has utilized the "control number"

concept in the computation of diluted earnings per share to

determine whether a potential common stock instrument is dilutive.

The control number used is income from continuing operations. The

control number concept requires that the same number of potentially

dilutive securities applied in computing diluted earnings per share

from continuing operations be applied to all other categories of

income or loss, regardless of their anti-dilutive effect on such

categories.

COHU, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) (Unaudited)

December 31, December 26,

2016 2015

Assets:

Current assets: Cash and investments

$ 128,035 $

117,022 Accounts receivable

63,019 59,832 Inventories

45,502 51,348 Other current assets

8,593

6,261 Total current assets

245,149 234,463 Property,

plant & equipment, net

18,234 19,000 Goodwill

58,849 60,264 Intangible assets, net

17,835 25,297

Other assets

5,445 6,322 Total assets

$

345,512 $ 345,346

Liabilities & Stockholders’

Equity: Current liabilities: Deferred profit

$

6,886 $ 3,730 Other current liabilities

61,803

59,461 Total current liabilities

68,689 63,191 Other

noncurrent liabilities

41,354 44,018 Stockholders’ equity

235,469 238,137 Total liabilities &

stockholders’ equity

$ 345,512 $ 345,346

COHU, INC. Supplemental Reconciliation of GAAP

Results to Non-GAAP Financial Measures (Unaudited) (in

thousands, except per share amounts) Three Months

Ended December 31, September 24, December 26, 2016 2016

2015 Income from operations - GAAP basis (a) $

3,052 $ 906 $ 2,225 Non-GAAP adjustments: Share-based

compensation included in (b): Cost of goods sold 89 101 153

Research and development 337 327 251 Selling, general and

administrative (SG&A) 1,426 1,329

1,270 1,852 1,757 1,674 Amortization of intangible

assets included in (c): Cost of goods sold 1,138 1,355 1,310

SG&A 400 450 454

1,538 1,805 1,764 Manufacturing transition and severance

costs included in SG&A (d) 496 586 436 Acquisition costs

included in SG&A (e) 896 474 - Reduction of

indemnification receivable included in SG&A (f) 588 - -

Gain on sale of facility (g) - -

(3,198 ) Income from operations - non-GAAP basis (h) $ 8,422

$ 5,528 $ 2,901 Income from continuing

operations - GAAP basis $ 2,306 $ 128 $ 2,290 Non-GAAP adjustments

(as scheduled above) 5,370 4,622 676 Tax effect of non-GAAP

adjustments (f) (i) (1,031 ) (463 ) (569 )

Income from continuing operations - non-GAAP basis $ 6,645 $

4,287 $ 2,397 GAAP income from continuing

operations per share - diluted $ 0.08 $ 0.01 $ 0.08 Non-GAAP

income from continuing operations per share - diluted (j) $ 0.24

$ 0.16 $ 0.09

Management believes the presentation of these non-GAAP financial

measures, when taken together with the corresponding GAAP financial

measures, provides meaningful supplemental information regarding

the Company's operating performance. Our management uses these

non-GAAP financial measures in assessing the Company's operating

results, as well as when planning, forecasting and analyzing future

periods and these non-GAAP measures allow investors to evaluate the

Company’s financial performance using some of the same measures as

management. Management views share-based compensation as an expense

that is unrelated to the Company’s operational performance as it

does not require cash payments and can vary in amount from period

to period and the elimination of amortization charges provides

better comparability of pre and post-acquisition operating results

and to results of businesses utilizing internally developed

intangible assets. Manufacturing transition costs relate

principally to employee severance expenses incurred as a

result of moving certain manufacturing activities to

Asia as part of our cost reduction efforts and employee

severance are costs incurred in conjunction with the termination of

certain employees to streamline our operations and reduce costs.

Management has excluded these costs primarily because they are not

reflective of the ongoing operating results and they are not used

to assess ongoing operational performance. Acquisition costs have

been excluded by management as they are unrelated to the core

operating activities of the Company and the frequency and

variability in the nature of the charges can vary significantly

from period to period. Management believes the reduction of an

uncertain tax position liability and related indemnification

receivable is better reflected within income tax expense rather

than a charge to SG&A and credit to the income tax provision.

Excluding this data provides investors with a basis to compare

Cohu’s performance against the performance of other companies

without this variability. However, the non-GAAP financial measures

should not be regarded as a replacement for corresponding,

similarly captioned, GAAP measures. The presentation of non-GAAP

financial measures above may not be comparable to similarly titled

measures reported by other companies and investors should be

careful when comparing our non-GAAP financial measures to those of

other companies.

(a) 4.3%, 1.3% and 3.5% of net sales,

respectively.(b) To eliminate compensation expense for employee

stock options, stock units and our employee stock purchase plan.(c)

To eliminate the amortization of acquired intangible assets.(d) To

eliminate manufacturing transition and employee severance costs.(e)

To eliminate professional fees and other direct incremental

expenses incurred related to the acquisition of Kita.(f) To

eliminate the impact of the reduction of an uncertain tax position

liability and related indemnification receivable.(g) To eliminate

the gain recognized on the sale-leaseback of the Company’s Poway

facility.(h) 11.9%, 8.0% and 4.6% of net sales, respectively.(i) To

adjust the provision for income taxes related to the adjustments

described above based on applicable tax rates.(j) All periods

presented were computed using the number of GAAP diluted shares

outstanding for the period.

COHU, INC. Supplemental Reconciliation of GAAP

Results to Non-GAAP Financial Measures (Unaudited) (in

thousands, except per share amounts) Twelve Months

Ended December 31, December 26, 2016 2015

Income from operations - GAAP basis (a) $ 5,665 $ 7,959

Non-GAAP adjustments: Share-based compensation included in (b):

Cost of goods sold 398 566 Research and development 1,292 1,092

Selling, general and administrative (SG&A) 5,453

5,097 7,143 6,755 Amortization of intangible assets

included in (c): Cost of goods sold 5,170 5,420 SG&A

1,732 1,612 6,902 7,032 Manufacturing

transition and severance costs included in (d): Cost of goods sold

75 - SG&A 1,423 970 1,498 970

Acquisition costs included in SG&A (e) 1,777 -

Reduction of indemnification receivable included in SG&A (f)

588 - Asset impairment included in SG&A (g) - 273

Gain on sale of facility (h) - (3,198 ) Income

from operations - non-GAAP basis (i) $ 23,573 $ 19,791

Income from continuing operations - GAAP basis $

3,260 $ 5,792 Non-GAAP adjustments (as scheduled above) 17,908

11,832 Tax effect of non-GAAP adjustments (f) (j) (2,408 )

(1,961 ) Income from continuing operations - non-GAAP basis

$ 18,760 $ 15,663 GAAP income per share -

diluted $ 0.12 $ 0.22 Non-GAAP income per share - diluted

(k) $ 0.68 $ 0.58

Management believes the presentation of these non-GAAP financial

measures, when taken together with the corresponding GAAP financial

measures, provides meaningful supplemental information regarding

the Company's operating performance. Our management uses these

non-GAAP financial measures in assessing the Company's operating

results, as well as when planning, forecasting and analyzing future

periods and these non-GAAP measures allow investors to evaluate the

Company’s financial performance using some of the same measures as

management. Management views share-based compensation as an expense

that is unrelated to the Company’s operational performance as it

does not require cash payments and can vary in amount from period

to period and the elimination of amortization charges provides

better comparability of pre and post-acquisition operating results

and to results of businesses utilizing internally developed

intangible assets. Manufacturing transition costs relate

principally to employee severance expenses incurred as a

result of moving certain manufacturing activities to

Asia as part of our cost reduction efforts and employee

severance are costs incurred in conjunction with the termination of

certain employees to streamline our operations and reduce costs.

Management has excluded these costs primarily because they are not

reflective of the ongoing operating results and they are not used

to assess ongoing operational performance. Acquisition costs have

been excluded by management as they are unrelated to the core

operating activities of the Company and the frequency and

variability in the nature of the charges can vary significantly

from period to period. Management believes the reduction of an

uncertain tax position liability and related indemnification

receivable is better reflected within income tax expense rather

than a charge to SG&A and credit to the income tax provision.

Impairments are incurred when specific assets carrying value

exceeds its fair value. Management has excluded this item

because it is not reflective of the ongoing operating results and

because of the infrequent and non-cash nature of this activity.

Excluding this data provides investors with a basis to compare

Cohu’s performance against the performance of other companies

without this variability. However, the non-GAAP financial measures

should not be regarded as a replacement for corresponding,

similarly captioned, GAAP measures. The presentation of non-GAAP

financial measures above may not be comparable to similarly titled

measures reported by other companies and investors should be

careful when comparing our non-GAAP financial measures to those of

other companies.

(a) 2.0% and 3.0% of net sales,

respectively.(b) To eliminate compensation expense for employee

stock options, stock units and our employee stock purchase plan.(c)

To eliminate the amortization of acquired intangible assets.(d) To

eliminate manufacturing transition and employee severance costs.(e)

To eliminate professional fees and other direct incremental

expenses incurred related to the acquisition of Kita.(f) To

eliminate the impact of the reduction of an uncertain tax position

liability and related indemnification receivable.(g) To eliminate

the asset impairment charge recorded in the first quarter of

2015.(h) To eliminate the gain recognized on the sale-leaseback of

the Company’s Poway facility.(i) 8.4% and 7.3% of net sales,

respectively.(j) To adjust the provision for income taxes related

to the adjustments described above based on applicable tax

rates.(k) All periods presented were computed using the number of

GAAP diluted shares outstanding for each period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170216006242/en/

Cohu, Inc.Jeffrey D. Jones - Investor Relations(858)

848-8106

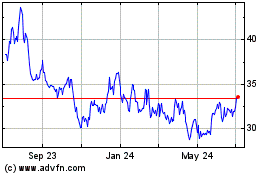

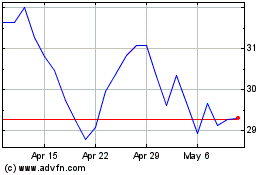

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Apr 2023 to Apr 2024