Canadian Pacific Abandons Threat of Proxy Fight for Norfolk Southern -- Update

February 09 2016 - 7:06PM

Dow Jones News

By Jacquie McNish and Laura Stevens

Canadian Pacific Railway Ltd. backed away from a threatened

proxy battle to unseat Norfolk Southern Corp. directors, opting to

enlist the Virginia rail operator's shareholders to press the board

for friendly merger talks.

Canadian Pacific said it would submit a nonbinding resolution to

the company's coming shareholders' meeting calling for the board to

start negotiations. The Calgary, Alberta-based railway has been

surprised by the force of opposition to the deal, according to a

person familiar with its plans.

"We believe this shareholder resolution is the clearest, fairest

approach to a process that will result in an outcome beneficial to

all stakeholders," Canadian Pacific said in a statement on

Tuesday.

Norfolk Southern said it wouldn't support further discussions

barring a new offer with "compelling value" and that addresses

regulatory issues.

The Norfolk, Va., company's stock rose 1%, or 93 cents, to

$71.42, and Canadian Pacific gained nearly 2% to $124.10, both in 4

p.m. New York trading on Tuesday.

Canadian Pacific's retreat from pursuing a hostile takeover

reflects its dwindling options after a three-month campaign that

has failed to draw wider support. Its bid is backed by activist

investor William Ackman, who sits on the Canadian railroad's board

and whose hedge fund owns about 9% of its shares.

Norfolk Southern's board has dismissed the hostile bid as

inadequate and unlikely to win approval of regulators in a process

that is expected to last years.

Since Canadian Pacific first announced a cash-and-stock merger

offer in November, Norfolk Southern has refused to engage in

discussions. A number of shippers, other large rail operators and

politicians have lined up against the proposal.

Canadian Pacific's move for shareholder support was seen by

analysts as an acknowledgment that a combination with Norfolk is

unlikely unless negotiated on friendly terms with Norfolk. Its

complex merger proposed includes an interim trust structure that

would operate during a lengthy regulatory review.

"I think it speaks to CP realizing the importance of a

transaction being as friendly as possible," said Justin Long, an

analyst for investment bank Stephens Inc.

The continuing pursuit of a merger reflects a belief that it can

wring greater support from some Norfolk Southern's holders that

have expressed disappointment with its high ratio of operating

costs to revenue, and revive the struggling business.

"Shareholders and analysts will be watching NS closely

throughout 2016 and if they continue to underperform, the pressure

to work with CP will only grow," Canadian Pacific Chief Executive

Hunter Harrison said in a statement.

Canadian Pacific has filed a complaint with the U.S. Department

of Justice alleging that some of its competitors have colluded to

block its bid that would create the country's first

transcontinental railway.

The bid initially was valued at $30 billion and has since

declined in value to about $27.7 billion amid a commodity slump

that has depressed railway stocks.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and Laura

Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

February 09, 2016 18:51 ET (23:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

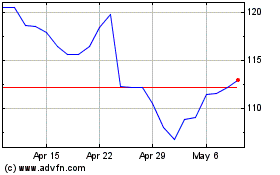

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Sep 2023 to Sep 2024