Canadian Dollar Falls Ahead Of BoC Rate Decision

March 04 2015 - 7:30AM

RTTF2

The Canadian dollar declined against its most major counterparts

in European deals on Wednesday, as traders await the Bank of

Canada's interest rate decision, scheduled later today.

Economists expect the bank to retain benchmark rate unchanged at

0.75 percent, after a rate cut in January. Traders keenly await

accompanying statement for more hints about chances of further rate

cut, as recent plunge in oil prices is negative for economy.

In a speech last week, the BoC chief Stephen Poloz hinted that

the January rate cut "buys us some time to see how the economy

actually responds." But he also left the door open for further rate

cuts, if needed.

Oil prices edged up ahead of central bank decisions in Europe

and U.K. on Thursday, as well as U.S. jobs data on Friday.

Official inventory data from the U.S. Energy Information

Administration, due later in the day, will be watched for

indication on oil supplies. Data from the American Petroleum

Institute showed late Tuesday that U.S. crude inventories rose by

2.9 million barrels for the week ended February 27.

The loonie, which ended yesterday's trading at 1.2494 per

greenback, slipped to 1.2532. The loonie may possibly find support

around the 1.26 zone.

The loonie fell to a 2-day low of 95.41 against the yen, down

from Tuesday's closing quote of 95.80. Next key support for the

loonie may be located around the 94.00 mark.

Japan's service sector contracted in February after expanding in

the previous month, results of a survey by Markit Economics

showed.

The services purchasing managers' index, or PMI, fell to 48.5 in

February from 51.3 in January. This marked a moderate rate of

decline in service sector activity.

The loonie hit 0.9819 against the aussie, its lowest since

February 26. If the loonie continues its downward trading, it may

target support near the 0.99 area.

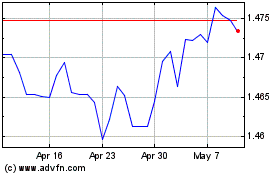

On the flip side, the loonie firmed to 1.3909 against the euro

in early deals and has been steady since then. The pair was valued

at 1.3963 at yesterday's close.

Eurozone retail sales growth accelerated unexpectedly in January

on both food and non-food turnover, according to data from the

Eurostat.

Retail sales were up 1.1 percent on a monthly basis, faster than

a revised 0.4 percent growth in December.

Looking ahead, Markit's U.S. PMI, ISM U.S. non-manufacturing PMI

and private sector employment report - all for February are slated

for release in the New York session.

At 9:00 am ET, U.S. Federal Reserve Bank of Chicago President

Charles Evans will deliver a speech about the economic outlook and

monetary policy at the Lake Forest-Lake Bluff Rotary Club 2015

Economic Breakfast in Lake Forest.

At 2:00 pm ET, U.S. Federal Reserve releases Beige Book

report.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024