CIBC Revenue and Profit Rise

August 25 2016 - 7:50AM

Dow Jones News

Canadian Imperial Bank of Commerce said revenue and profit rose

in its latest quarter.

Chief Executive Victor Dodig said results in the quarter were

"broad based," driven by the Toronto-based bank's three units.

CIBC posted a net profit of 1.44 billion Canadian dollars ($1.1

billion), or C$3.61 a share, in its latest quarter. That is up from

C$962 million, or C$2.42 a share, a year prior.

In December, CIBC agreed to sell its stake in mutual-fund

manager American Century Investments to Nomura Holdings Inc. for

around $1 billion. That move added C$428 million in the

quarter.

Adjusted to exclude the gain and other items, CIBC said earnings

were C$2.67 a share, handily beating analyst views.

Revenue rose 18% to $4.14 billion.

Analysts polled by Thomson Reuters had expected profit of C$2.36

a share on revenue of $3.72 billion.

The bank's provision for credit losses totaled C$243 million,

down from C$324 million in the prior quarter but up from the C$189

in the prior year.

Net interest income rose 4.6% to $2.11 billion as fee-based

income jumped 35% to $2.02 billion.

Noninterest expenses rose 1.8% to $2.22.

In June, CIBC said it would acquire Chicago-based lender

PrivateBancorp Inc. for about $3.8 billion in cash and stock, in

the latest move by a big Canadian bank to bet on the U.S. market

for growth. The deal is expected to close in early 2017.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 25, 2016 07:35 ET (11:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

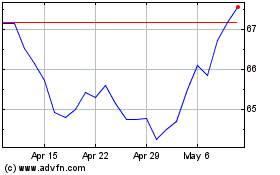

Canadian Imperial Bank o... (TSX:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

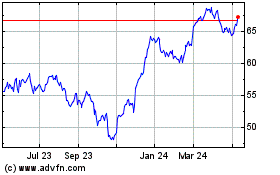

Canadian Imperial Bank o... (TSX:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024