By Theo Francis and Joann S. Lublin

A critical factor in how much chief executives are paid isn't

how well their share price performs or how long they run their

company. It is who sits at the head of the boardroom table.

CEOs that report to a board run by an independent chairman are

paid about 20% less than their peers, according to a new study by

proxy advisory firm Institutional Shareholder Services.

Such executives made $2.9 million less a year on average than

leaders of S&P 500 companies that also serve as chairman or

report to a board run by a founder or other company insider,

according to the ISS report, which is expected to be released this

week.

Variations in board chairmanship account for about 88% of that

amount, ISS's analyses of the data show. "It's accounting for

almost all of the difference," said Carol Bowie, ISS's head of

research for the Americas.

Shareholder advocacy groups have spent years pushing companies

to separate the jobs of chairman and CEO, reasoning that a

company's top manager shouldn't also lead the board that oversees

his or her performance and compensation. ISS has supported some of

those campaigns but opposed others.

Shareholders have proven largely comfortable with the combined

role: They have voted on 372 proposals to separate the roles at

S&P 500 companies over the past decade, but approved only about

6%, ISS says.

In one high-profile recent fight, Bank of America Corp.'s

shareholders last year voted to allow Chairman and CEO Brian

Moynihan to keep both titles, in the face of opposition from some

shareholders and proxy advisory firms, including ISS. Bank of

America had no immediate comment.

In the new study, ISS analyzed three years of pay for 484

S&P 500 companies that maintained the same board structure for

at least two of the latest three fiscal years.

ISS found that a company's chairman was a bigger factor in CEO

pay than the top executive's tenure or the company's recent

shareholder return relative to competitors. Only annual revenue, a

reflection of company size and complexity, better predicts the

scale of CEO pay, the report concludes.

CEOs that also serve as chairmen were paid an average of $13.8

million a year over the three-year period, while those reporting to

an independent chairman were paid an average of $11 million a year,

according to ISS.

The highest-paid leaders were CEOs reporting to a controlling

shareholder, founder or other insider. ISS found this group was

paid an average of $15.6 million a year.

One is CBS Corp., where founder Sumner Redstone was executive

chairman, and which paid CEO Leslie Moonves an average of $62.1

million a year in the three years ending in 2014, according to the

company's SEC filings. Mr. Moonves was named chairman in early

February after Mr. Redstone retired from the position.

Oracle Corp., where founder and former CEO Larry Ellison is

chairman and a major shareholder, paid its CEO an average of $66.7

million a year in the three years ended May 31, according to the

company's latest proxy filing; during most of that time, Mr.

Ellison also served as CEO.

CBS and Oracle declined to comment.

CEOs at companies with an inside chairman typically get paid

more based on the belief "they bring greater shareholder returns,"

said George Davis Jr., head of the global CEO practice for

recruiters Egon Zehnder. As more companies split the top two roles,

he said, "the gap is going to narrow" between pay for CEOs with and

without independent chairmen.

Among the highly paid chairman-CEOs in the S&P 500 in recent

years, based on pay disclosed in their securities filings are

Coca-Cola Co.'s Muhtar Kent, who earned an average of $25.4 million

in the three years ending in 2014, and AT&T Inc.'s Randall

Stephenson, who averaged $23.2 million in compensation in the three

years ending in 2014.

A Coca-Cola spokesman said the board's lead independent

director, former U.S. Sen. Sam Nunn, leads Mr. Kent's performance

evaluation. In its proxy filing, Coca-Cola says the complexity and

global scope of the business mean Mr. Kent "is in the best position

to focus directors' attention on critical business matters and to

speak for and lead both the company and the board."

An AT&T spokesman said the company is "committed to paying

for performance, and Mr. Stephenson's compensation reflects this."

Over the three years, 92% of Mr. Stephenson's target compensation

was tied to performance, including stock price, he added.

Combining the top two roles remains highly popular. About 51% of

S&P 500 companies combined the CEO and chairman positions as of

last year, down from about 54% in 2014, ISS said.

In comparison, companies with independent chairmen include

Automatic Data Processing Inc., which paid CEO Carlos Rodriguez an

average of $7.6 million over the three years ended June 30, and

ConAgra Foods Inc., which paid former CEO Gary Rodkin an average of

$9.4 million over the three years ended May 31, the companies'

securities filings show.

ADP declined to comment. ConAgra didn't immediately respond.

Write to Theo Francis at theo.francis@wsj.com and Joann S.

Lublin at joann.lublin@wsj.com

(END) Dow Jones Newswires

March 09, 2016 12:48 ET (17:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

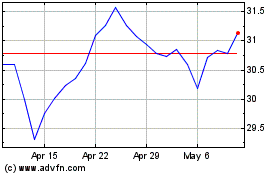

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024