Bull of the Day: Myriad Genetics (MYGN) - Bull of the Day

April 29 2014 - 3:22AM

Zacks

Make no mistake about

it, Biotech has been hot. More specifically, the

Biomedical/Genetics industry is in the top 32% of our Zacks

Industry Rank. The industry has 38 stocks that are Zacks Rank #1

(Strong Buy) or Zacks Rank #2 (Buy). Among the top ranked stocks in

this highly ranked industry is our Bull of the Day, Myriad Genetics

(MYGN).

Myriad is a Zacks Rank

#1 (Strong Buy) with earnings coming up after the close on May

6th. Myriad uses a gene-based medicine to develop

therapeutic and molecular diagnostic products. Think medicine that

is programmed specifically to your personal gene mix. That's what

the long term goal is of Myriad. MYGN hopes that gene-specific

medication will lead to more effective treatment of illness and

disease.

The more you think about

potential of these drugs the more excited you get about the stock.

But this company is much more than just the story. MYGN has the

numbers behind it as well. Not only has the company surprised

earnings to the upside four quarters in a row, it’s also had

substantial upside revisions over the last 90 days. Current year

consensus has risen from $1.98 to $2.21 and next year’s numbers

have risen from $1.71 to $1.92.

So the fundamental story

is there, the feel good story is there, now what about the

technical picture? I’m just as confident. Since late last year,

MYGN has been locked in an upward trajectory. The stock has had a

few pullbacks to support which served as temporary rest along the

lines of a longer term bull run. The first major resistance MYGN

ran into was just above the $38 level in late February and early

March. Following the resistance, MYGN pulled all the way back to

$32, below its 25 day moving average shifted by 5 days

(25x5).

For a few days it looked

as if Myriad had run out of gas. But in late March we caught a bid

on confirmed strength out an oversold stochastic coupled with a

bullish cross. The last run of strength took us all the way up to

$42 before a recent sell-off put us on the North side of

$38.

It’s this $38 level that

is most important for MYGN and the reason why I’m bullish on it

today. You have a few very positive technical developments. First,

$38 had been resistance in the past prior to being broken by the

gap up in early April. What was once a ceiling now becomes a floor

to support the stock. So you have a stock that has been higher,

pulled back, is still above support and above its

25x5.

One worry I have from a

technical aspect is that the slope of the 25x5 is essential zero

right now which lends itself to a range bound stock. Settling into

a range wouldn’t be the worst thing in the world as the top of the

range looks to be $42 for a stock in the $38 handle. Ten percent

upside potential without a breakout versus a downside at about $36

gives a good risk versus reward scenario. Earnings around the

corner are a wildcard and I’d avoid having unidirectional exposure

ahead of the report. Those looking to roll the dice on a breakout

can use options as MYGN is optionable.

MYRIAD GENETICS (MYGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

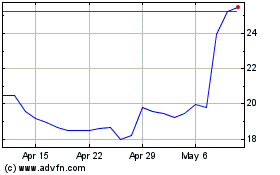

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

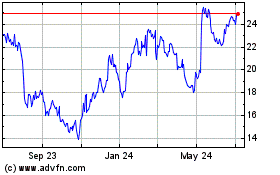

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024