By Christopher Alessi and Jacob Bunge

Executives presented Bayer AG's deal to buy Monsanto Co. as a

win for both companies, but shareholders in the two camps weren't

ready to declare victory at the $57 billion price tag.

Bayer shareholders appeared cautiously optimistic after worrying

that the German drugs and chemicals giant could overpay, while some

Monsanto shareholders said they had envisioned a higher price for

the world's largest developer of high-tech crop seeds, though they

acknowledged a deep trough facing the agriculture sector.

"No one's exactly thrilled, which probably means it ended up in

a good compromise situation," said Andy Murray, portfolio manager

at Becker Capital Management, a Portland, Ore. firm that owns

Monsanto shares.

Bayer, which had been pursuing Monsanto for four months,

Wednesday struck a deal to acquire the U.S. firm at $128 a share in

cash. If successful, it will rank as Bayer's largest-ever

acquisition, joining its broad range of pesticide products with

Monsanto's industry-leading capabilities in seeds and biotechnology

to create the world's largest supplier of farm inputs.

The price was welcomed by initially skeptical Bayer investors,

some of whom had predicted Bayer would need to raise its bid to

between $130 and $135 a share to satisfy Monsanto's board. After

unveiling the initial bid for Monsanto in May, Bayer officials

including Chief Executive Werner Baumann hit the road for several

weeks to meet with shareholders and explain what many investors

regarded as an abrupt shift in strategy, potentially at a steep

cost.

"I was surprised that the price was cheaper than I thought,"

said Markus Manns, fund manager at Bayer shareholder Union

Investment. Monsanto's bargaining position may have been weakened

due to the continued slump in the farm economy, he said. Futures

prices for corn -- Monsanto's biggest product line -- hit a

seven-year low in late August as a record U.S. harvest looms.

Some Monsanto shareholders, however, said that shorter-term

challenges shouldn't diminish the value of the world's largest

biotech seed developer, where advances in technology can take

longer than a decade to bring to market, spanning any number of ups

and downs in commodity markets. A survey by Sanford C. Bernstein

analysts conducted prior to the deal's announcement showed that the

largest number of respondents anticipated a price between $129 and

$130 a share.

"The strategic sense of [the deal] is right," said Kelly

Wiesbrock, managing director at Harvest Capital Strategies LLC, a

San Francisco-based investment firm that owns Monsanto shares. "The

price is a little disappointing."

Mr. Baumann told analysts on a conference call Wednesday that

the deal would allow Bayer to deliver value to its shareholders

from an upswing in agricultural markets and longer-term growth in

the global population. Hugh Grant, Monsanto's CEO and chairman,

said Bayer represented a good strategic fit, and Monsanto's board

approved the deal after exploring alternative paths, including

staying independent.

Bayer's shares fell 2.3% to settle at EUR91.37 Thursday, while

Monsanto's stock fell 2.4% to $104.22. Investors said the prices

reflected some disappointment on the deal price as well as

uncertainty due to the lengthy regulatory gauntlet facing the deal,

with approval required by dozens of regulators around the world.

The companies expect the transaction to close by the end of next

year.

The lower-than-expected price, combined with the current lending

environment, should allow Bayer to relatively quickly reduce its

debt, having already swelled from a string of acquisitions,

investors said. Bayer's net debt stood at EUR17.45 billion (about

$20 billion) in 2015, more than double the EUR7 billion it held in

2011.

Jim Nelson, a portfolio manager and Bayer investor Euro Pacific

Capital Inc. in New York, said the deal should benefit Bayer since

it is funded primarily with money borrowed at very low rates. "The

combined company would control 30% of the overall seeds market,

resulting in increased pricing power," he added.

Purchasing Monsanto may leave Bayer little flexibility to pursue

other acquisitions. To generate cash, it may need to divest its

majority stake in Covestro AG, a specialty-plastics business that

Bayer spun off last year, and its animal-health unit, some analysts

said.

Securing the deal would make agriculture roughly half of overall

group sales, compared with 30% in 2015. The health-care business

would then comprise roughly the other half of sales.

Some Bayer investors remain uncomfortable with the shift. Greg

Herbert, a fund manager at U.K.-based Jupiter Fund Management PLC,

said last week that after buying Monsanto, Bayer would "be left

with a highly geared balance sheet and the management effort to

integrate the two businesses could easily lead to the larger

pharmaceutical business being neglected." Mr. Herbert said Thursday

he had no further comment on the deal.

David Moss, head of European Equities for F&C Management

Ltd., which owns Bayer shares, said he sees long-term growth ahead

for agricultural companies as the global population expands and

grows more wealthy. "This will be the biggest play on that and it's

a cheap stock at the moment," he said. "The fear was, they might

pay an awful lot more."

Write to Christopher Alessi at christopher.alessi@wsj.com and

Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

September 15, 2016 19:09 ET (23:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

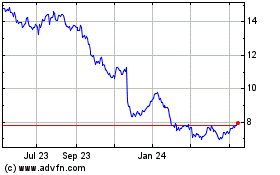

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

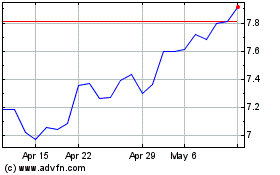

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024