Basel Committee Chief Says New Capital Rules Are on Track

October 12 2016 - 12:50PM

Dow Jones News

BRUSSELS—The head of the Basel Committee on Banking Supervision

said Wednesday his organization won't yield to pressures from

European lenders to water down proposed new standards which could

increase capital requirements.

William Coen, Secretary-General of the Swiss-based standards

setter, spoke at the European Parliament on Wednesday and said that

the committee would forge ahead with the controversial plans to

revise postcrisis capital rules which are still under

negotiation.

"We are well on track to complete these reforms by the end of

the year," said Mr. Coen. "The weaknesses in the banking sector

were transmitted to the rest of the financial system and the real

economy…. Nine years after the start of the crisis, the global

economy is still recovering from its effects."

Mr. Coen's appearance in Brussels comes as European Union

officials and the bloc's biggest lenders have scaled up their

warnings about the damage the new bank-safety rules could inflict

on the banking sector.

Europe's largest banks have come out saying the reforms, dubbed

"Basel IV", would impose costly new burdens on banks' finances and

hinder lending at a time when Europe is struggling with growth.

Philippe Bordenave, chief operating officer of France's BNP

Paribas SA stressed in September that current proposals would

increase the overall level of capital requirements "to an extent

that would damage financial stability."

Sylvie Goulard, a French member of the European Parliament,

pointed out that the Basel reforms can no longer be detached from

politics, given Europe's weak economic situation and the delicate

state of its banking sector.

"The mood in the public opinion has changed, and we see it in

the American presidential election and we see it in Europe," said

Ms. Goulard. "What is at stake is much more than financial

stability, it is the stability of our political systems. We need to

explain to voters and citizens where the rules are coming from and

who is doing what."

Ms. Goulard added that Basel's decisions, even though they bear

no legal force, ultimately impact how the banking sector

behaves.

While the Basel Committee introduced fresh rules after the 2008

financial crisis that bolstered the amount of capital banks must

hold to withstand moments of economic crisis, it has since said

tighter rules are required to bolster the framework. The committee

said some banks could still be undercapitalized because of the

varying methods banks use to calculate capital, also known as

"internal models."

To rectify this, the Basel Committee has proposed five different

rules since the end of last year that would require banks to use

industrywide calculations instead of their own when assessing risk.

U.S. regulators argue European banks currently have an advantage

because of their freedom to make risk calculations on their own.

They say this allows European banks to underestimate their capitals

needs.

The plans have provoked fierce reactions on the continent.

Germany and France, whose leading lenders include Deutsche Bank and

BNP Paribas, have been the most outspoken against the proposed

rules.

"It must be clear that this package must be balanced and that it

must provide the same level playing field," said German finance

minister Wolfgang Schä uble on Tuesday at a meeting of EU finance

ministers in Luxembourg. "And that there mustn't be a

discrimination of European banks regarding capital requirements,"

he added.

EU officials and politicians argue the rules would put the

region's banks at a disadvantage to U.S. counterparts because,

unlike American firms, European banks generally hold mortgage loans

on their balance sheets. As a result, they have to offset more

capital against those loans.

Mr. Coen firmly denies that there is a trans-Atlantic spat

unfolding in the Basel Committee. "Let me point out that this isn't

debate between the European Union and the United States" he said.

"There are other countries on the Basel Committee. I don't see this

as a level playing field issue," he told lawmakers.

EU regulators, including the bloc's financial services chief

Valdis Dombrovskis, have spoken out against the plan though,

specifically citing the risk of a competitive disadvantage for the

EU. The European Commission, the EU's executive arm, has no direct

say in the Basel Committee. But it decides how to implement the

agreed Basel standards into EU legislation.

--Andrea Thomas in Berlin contributed to this article

Write to Julia-Ambra Verlaine at julia.verlaine@wsj.com

(END) Dow Jones Newswires

October 12, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

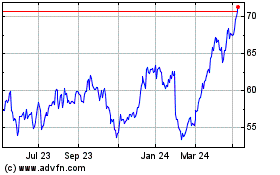

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

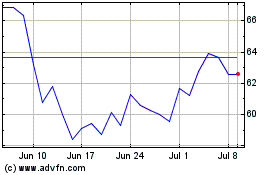

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024