Base Metals Plunge

August 24 2015 - 9:00AM

Dow Jones News

LONDON—Base metals slid to multiyear lows in London on Monday,

as a sharp decline in Chinese equities, and growing concerns about

the country's economic health, triggered a broad-based commodities

rout.

The London Metal Exchange's three-month copper contract was down

2.3% at $4,936.50 a metric ton in midmorning European trade, having

tumbled to its lowest level since 2009 earlier in trading at $4,903

a ton. It fell below the key $5,000 level for the fifth session in

a row.

The Shanghai Composite Index declined more than 8% at the start

of the week, bringing its losses since a mid-June peak to about

37%.

"Base metals are deeply in the red, amid a commodity selloff as

Chinese equities tumbled overnight," said Dee Perera, a base metals

analyst at Marex Spectron.

Aluminum also hit a six-year low during trading at $1,521 a ton,

while zinc hit a five-year low at $1,709 a ton and lead hit a

five-year low at $1,635 a ton.

Concerns about China have reignited recently, following the

devaluation of the yuan two weeks ago and the release of a string

of underwhelming economic data. China consumes over 45% of the

supply of major base metals, and as a result, metal prices tend to

follow its economic trajectory closely. When it is seen to be in

trouble, market participants anticipate demand declines and price

falls.

Investors remain cautious about the outlook for the base metals,

given a series of multiyear lows in the past month and the

continued bad news coming out of Chinese markets.

However, some analysts view the price falls as exaggerated given

what they say is continued Chinese buying of metals.

"In our opinion, the latest price slump is driven not so much by

fundamentals as by speculation," said Commerzbank in a note.

Commerzbank quoted the example of Chinese imports of refined

copper, which, in July, climbed by 2% month-on-month and 6%

year-over-year to 260,000 metric tons.

The "world-wide copper market thus remains tight," the bank

said.

Among the other base metals, aluminum was down 1.4% at $1,526 a

ton, zinc was down 2.3% at $1,726 a ton, nickel was down 6.4% at

$9,550 a ton, lead was down 3.1% at $1,649 a ton and tin was down

2.8% at $14,490 a ton.

Write to Ese Erheriene at ese.erheriene@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 24, 2015 08:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

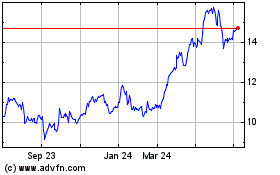

Commerzbank (TG:CBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

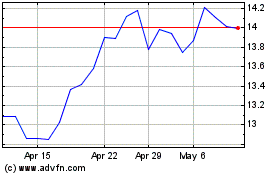

Commerzbank (TG:CBK)

Historical Stock Chart

From Apr 2023 to Apr 2024