Barclays Fined for Failing to Minimize Financial Crime Risk

November 26 2015 - 5:20AM

Dow Jones News

LONDON—The Financial Conduct Authority said Thursday it has

fined U.K. bank Barclays PLC £ 72.07 million ($108.89 million) for

failing to minimize the risk against financial crime, its largest

ever fine for such failings, but stopped short of saying if a crime

had been committed.

The U.K. regulator said the failings relate to a £ 1.88 billion

transaction that Barclays arranged and executed in 2011 and 2012

for a number of ultra-high-net-worth clients. The clients involved

were politically exposed persons and should therefore have been

subject to enhanced levels of due diligence and monitoring by

Barclays, the regulator said.

"Barclays ignored its own process designed to safeguard against

the risk of financial crime and overlooked obvious red flags to win

new business and generate significant revenue. This is wholly

unacceptable," said Mark Steward, director of enforcement and

market oversight at the FCA.

"Firms will be held to account if they fail to minimize

financial crime risks appropriately and for this reason the FCA has

required Barclays to disgorge its revenue from the transaction,"

Mr. Steward said.

The fine comprises £ 52.3 million representing the amount of

revenue Barclays generated from the transaction, and a penalty of £

19.77 million, the FCA said.

Barclays agreed to settle the fine quickly and therefore

received a 30% discount.

Write to Ian Walker at ian.walker@wsj.com

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0031348658

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US06738E2046

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 26, 2015 05:05 ET (10:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

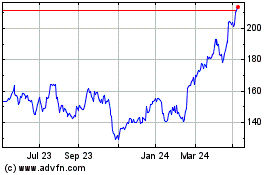

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

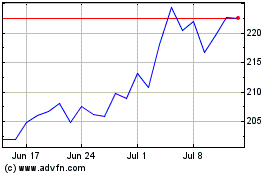

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024