BT Group plc 2Q 2017 -- Forecast

October 25 2016 - 5:28AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

BT Group plc (BT) second-quarter results, based on a poll of four

analysts conducted by Dow Jones Newswires (figures in million

pounds, dividend and target price in pence, according to IFRS).

Earnings figures are scheduled to be released October 27.

===

EBITDA Net

2nd Quarter Revenue adj. PBT income

AVERAGE 5,923 1,868 709 567

Prev. Year 4,381 1,442 642 525

+/- in % +35 +30 +10 +8.0

MEDIAN 5,922 1,871 714 567

Maximum 5,953 1,886 720 582

Minimum 5,895 1,842 693 551

Amount 4 4 3 4

Barclays 5,953 1,842 693 551

Deutsche Bank 5,895 1,886 714 582

Goldman Sachs 5,924 1,873 720 572

Morgan Stanley 5,920 1,869 -- 562

Target price Rating DPS 2017

AVERAGE 464 positive 2 AVERAGE 15.6

Prev. Quarter 425 neutral 2 Prev. Year 14.0

+/- in % +9.1 negative 1 +/- in % +12

MEDIAN 475 MEDIAN 15.7

Maximum 560 Maximum 15.8

Minimum 345 Minimum 15.4

Amount 4 Amount 3

Barclays 550 Overweight --

Deutsche Bank 345 Sell 15.8

Goldman Sachs 560 Buy 15.4

Morgan Stanley -- Equalweight --

UBS 400 Neutral 15.7

===

Year-earlier figures are as reported by the company.

DJG/voi

(END) Dow Jones Newswires

October 25, 2016 05:13 ET (09:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

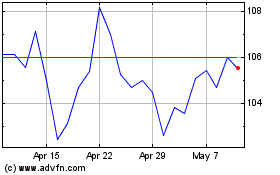

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

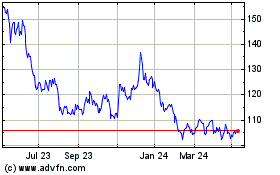

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024