BP Adds $1.7 Billion To Cover Costs of Deepwater Horizon -- WSJ

January 17 2018 - 3:02AM

Dow Jones News

By Sarah Kent

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 17, 2018).

LONDON -- BP PLC's bill for the Deepwater Horizon disaster keeps

getting bigger.

The British oil giant said Tuesday it would take a $1.7 billion

charge to its fourth-quarter earnings because of settlement claims

related to the 2010 Gulf of Mexico blowout. The explosion killed 11

people and unleashed the worst offshore oil spill in American

history.

The charge adds to a disaster bill that BP last estimated at

over $63 billion, a toll that continues to mount since the

company's $20 billion settlement with the U.S. government in 2015.

That agreement marked the biggest environmental-damages settlement

in U.S. history, but it didn't deal with claims for economic losses

related to the oil spill.

BP said a separate U.S. court-supervised settlement program --

which deals with such losses for Gulf residents and businesses, and

is the source of the latest charge -- is nearing its close.

An overall profit for the fourth quarter is under threat because

the company has already announced a $1.5 billion accounting charge

related to the U.S. tax overhaul. BP will publish the quarter's

results on Feb. 6.

The company was expected to report net income of $2.1 billion

for the fourth quarter, according to a consensus of analyst

estimates compiled by S&P Global Market Intelligence. That

figure, now in jeopardy, represents what would be the company's

strongest quarterly profit since 2015.

BP's share price fell 2.7% in London to close at GBP5.18. The

stock still trades around 20% below its level before the accident

and a severe slump in oil prices.

BP remains handicapped by its Gulf of Mexico liabilities even as

the oil industry returns to profitability as crude prices recover

from the slump dating back to 2014. Prices have risen to about $70

a barrel in recent days, giving energy investors and executives a

sense of optimism for the first time in years.

The Gulf of Mexico bill imperils BP's progress in driving down

its break-even oil price, said BMO Capital Markets, referring to

the price level needed to cover capital spending and shareholder

payouts with cash.

BP said in October it had pushed its break-even oil price below

$50 a barrel, from $60 in February. Now, BMO sees BP's break-even

price rising by $5 a barrel in 2018, though it also expects the

company to manage and continue a share-buyback program announced in

2017.

BMO said Deepwater Horizon payments remain a concern. "There

might be further provisions in the next few quarters, as the

remaining claims might prove to exceed BP's expectations," the bank

said.

BP is contending with the fallout from nearly 400,000 claims

from Gulf Mexico residents and businesses for damages from the oil

spill. A court-supervised program was established in 2012 to

process the claims, the vast majority of which have been

settled.

The exact value of the company's liability within the program

remains unknown. In the fourth quarter, the court awarded a

significantly higher amount per claimant than in the previous 12

months. That, combined with a ruling in May that included more

cases in the process, forced BP to take the fourth-quarter

charge.

The company said the charge is fully manageable within its

financial framework and now that the claims process is nearly over

it has a better idea of its remaining liabilities. In addition to

flagging the fourth-quarter charge, the company raised its estimate

of cash payments related to the disaster in 2018 to about $3

billion, up from its previous estimate of $2 billion.

The new Gulf of Mexico charge will be compounded by the recent

changes to the American tax code. While the tax overhaul -- which

reduces corporate income tax to 21% from 35% -- will likely benefit

BP in the long term, the oil giant is among companies that have

warned of sizable one-time accounting charges because the changes

reduce the value of deferred tax assets.

Companies can log such assets during unprofitable periods and

use them as credits toward future tax payments. Lowering the

overall corporate tax rate makes those assets worth less on

paper.

Corrections & Amplifications BP expects cash payments

related to the Gulf of Mexico disaster to amount to $3 billion in

2018. An earlier version of this story said the amount was for the

fourth quarter. (Jan. 16, 2018)

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

January 17, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

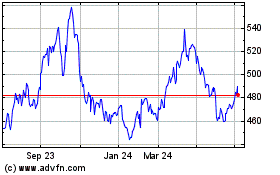

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

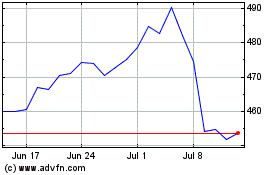

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024