BARCLAYS PLC Form 8.3 - LIBERTY GROUP PLC

February 09 2016 - 8:33AM

UK Regulatory

TIDMBARC

FORM 8.3

PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY

A PERSON WITH INTERESTS IN RELEVANT SECURITIES REPRESENTING 1%

OR MORE

Rule 8.3 of the Takeover Code (the "Code")

1. KEY INFORMATION

(a) Full name of discloser: Barclays PLC.

(b) Owner or controller of

interest and short

positions disclosed, if

different from 1(a):

(c) Name of offeror/offeree LIBERTY GLOBAL PLC

in relation to whose

relevant securities this form relates:

(d) If an exempt fund manager

connected with an

offeror/offeree, state this

and specify identity of

offeror/offeree:

(e) Date position held/dealing undertaken: 8 Feb 2016

(f) In addition to the company in 1(c) YES CABLE & WIRELESS

above, is the discloser making COMMUNICATIONS PLC

disclosures in respect of any

other party to the offer?

2. POSITIONS OF THE PERSON MAKING THE DISCLOSURE

If there are positions or rights to subscribe to disclose in

more than one class of relevant securities of the offeror or

offeree named in 1(c), copy table 2(a) or (b) (as appropriate) for

each additional class of relevant security.

(a) Interests and short positions in the relevant securities of

the offeror or offeree to which the disclosure relates following

the dealing (if any)

Class of USD 0.01 Class

relevant A ordinary

security:

Interests Short Positions

Number (%) Number (%)

(1) Relevant

securities

owned

and/or 265,752 0.11% 186,057 0.07%

controlled:

(2) Cash-settled

derivatives:

124,700 0.05% 0 0.00%

(3) Stock-settled

derivatives

(including

options)

and agreements 83,600 0.03% 294,300 0.12%

to

purchase/DEALING:

(4)

TOTAL: 474,052 0.19% 480,357 0.19%

Class of USD 0.01 Class

relevant C ordinary

security:

Interests Short Positions

Number (%) Number (%)

(1) Relevant

securities

owned

and/or 676,382 0.11% 77,495 0.01%

controlled:

(2) Cash-settled

derivatives:

0 0.00% 0 0.00%

(3) Stock-settled

derivatives

(including

options)

and agreements 0 0.00% 0 0.00%

to

purchase/DEALING:

(4)

TOTAL: 676,382 0.11% 77,495 0.01%

Class of USD 0.01 LiLAC

relevant Class

security: A ordinary

Interests Short Positions

Number (%) Number (%)

(1) Relevant

securities

owned

and/or 11,876 0.09% 8,235 0.07%

controlled:

(2) Cash-settled

derivatives:

8,235 0.07% 0 0.00%

(3) Stock-settled

derivatives

(including

options)

and agreements 0 0.00% 0 0.00%

to

purchase/DEALING:

(4)

TOTAL: 20,111 0.16% 8,235 0.07%

Class of USD 0.01 LiLAC

relevant Class

security: C ordinary

Interests Short Positions

Number (%) Number (%)

(1) Relevant

securities

owned

and/or 0 0.00% 56 0.00%

controlled:

(2) Cash-settled

derivatives:

0 0.00% 0 0.00%

(3) Stock-settled

derivatives

(including

options)

and agreements 0 0.00% 0 0.00%

to

purchase/DEALING:

(4)

TOTAL: 0 0.00% 56 0.00%

All interests and all short positions should be disclosed.

Details of any open stock-settled derivative positions

(including traded options), or agreements to purchase or sell

relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

(b) Rights to subscribe for new securities (including directors'

and other employee options)

Class of relevant security in relation

to which subscription right exists:

Details, including nature of the rights

concerned and relevant percentages:

3. DEALINGS (IF ANY) BY THE PERSON MAKING THE DISCLOSURE

Where there have been dealings in more than one class of

relevant securities of the offeror or offeree named in 1(c), copy

table 3(a), (b), (c) or (d) (as appropriate) for each additional

class of relevant security dealt in.

The currency of all prices and other monetary amounts should be

stated.

(a) Purchases and sales

Class of relevant Purchase/DEALING Number of Price per unit

security securities

USD 0.01 Class A ordinary Purchase 1 32.2600 USD

USD 0.01 LiLAC Class Purchase 1 37.6700 USD

C ordinary

USD 0.01 Class C ordinary Purchase 3 31.5800 USD

USD 0.01 Class C ordinary Purchase 3 31.5400 USD

USD 0.01 Class C ordinary Purchase 4 31.5900 USD

USD 0.01 Class C ordinary Purchase 93 31.6325 USD

USD 0.01 Class C ordinary Purchase 93 31.6177 USD

USD 0.01 Class C ordinary Purchase 100 30.9800 USD

USD 0.01 Class C ordinary Purchase 100 31.2350 USD

USD 0.01 Class A ordinary Purchase 100 32.1700 USD

USD 0.01 LiLAC Class Purchase 100 35.0200 USD

A ordinary

USD 0.01 Class C ordinary Purchase 100 32.0499 USD

USD 0.01 Class A ordinary Purchase 100 31.8600 USD

USD 0.01 Class A ordinary Purchase 100 31.0200 USD

USD 0.01 LiLAC Class Purchase 100 33.5000 USD

A ordinary

USD 0.01 LiLAC Class Purchase 100 33.5500 USD

A ordinary

USD 0.01 Class C ordinary Purchase 100 30.9300 USD

USD 0.01 Class A ordinary Purchase 100 30.8800 USD

USD 0.01 LiLAC Class Purchase 100 33.6900 USD

A ordinary

USD 0.01 LiLAC Class Purchase 100 33.7300 USD

A ordinary

USD 0.01 Class A ordinary Purchase 100 30.6800 USD

USD 0.01 LiLAC Class Purchase 100 36.0600 USD

C ordinary

USD 0.01 Class A ordinary Purchase 119 32.0757 USD

USD 0.01 Class A ordinary Purchase 123 31.0300 USD

USD 0.01 Class C ordinary Purchase 127 31.5100 USD

USD 0.01 Class C ordinary Purchase 144 31.0085 USD

USD 0.01 Class C ordinary Purchase 144 31.1100 USD

USD 0.01 LiLAC Class Purchase 200 35.9775 USD

C ordinary

USD 0.01 Class A ordinary Purchase 200 30.9975 USD

USD 0.01 LiLAC Class Purchase 200 33.7850 USD

A ordinary

USD 0.01 Class A ordinary Purchase 200 31.0400 USD

USD 0.01 Class C ordinary Purchase 200 31.5850 USD

USD 0.01 Class A ordinary Purchase 200 33.5900 USD

USD 0.01 LiLAC Class Purchase 299 33.6600 USD

A ordinary

USD 0.01 Class A ordinary Purchase 299 32.2570 USD

USD 0.01 Class A ordinary Purchase 300 31.0066 USD

USD 0.01 LiLAC Class Purchase 300 33.7900 USD

A ordinary

USD 0.01 Class A ordinary Purchase 300 31.4299 USD

USD 0.01 LiLAC Class Purchase 300 33.6466 USD

A ordinary

USD 0.01 Class A ordinary Purchase 345 32.1682 USD

USD 0.01 Class A ordinary Purchase 400 32.0650 USD

USD 0.01 LiLAC Class Purchase 400 36.0050 USD

C ordinary

USD 0.01 Class A ordinary Purchase 453 32.8230 USD

USD 0.01 Class C ordinary Purchase 493 31.6216 USD

USD 0.01 Class C ordinary Purchase 500 32.3660 USD

USD 0.01 LiLAC Class Purchase 500 33.4800 USD

A ordinary

USD 0.01 LiLAC Class Purchase 500 33.8260 USD

A ordinary

USD 0.01 Class A ordinary Purchase 500 31.4110 USD

USD 0.01 Class C ordinary Purchase 600 30.8599 USD

USD 0.01 Class A ordinary Purchase 600 32.5950 USD

USD 0.01 Class A ordinary Purchase 600 32.6915 USD

USD 0.01 Class A ordinary Purchase 601 31.2157 USD

USD 0.01 Class A ordinary Purchase 682 30.9200 USD

USD 0.01 Class C ordinary Purchase 700 31.2385 USD

USD 0.01 Class A ordinary Purchase 700 30.9350 USD

USD 0.01 LiLAC Class Purchase 700 33.8407 USD

A ordinary

USD 0.01 Class C ordinary Purchase 704 31.2494 USD

USD 0.01 Class C ordinary Purchase 800 31.7612 USD

USD 0.01 Class C ordinary Purchase 800 31.2806 USD

USD 0.01 LiLAC Class Purchase 800 34.0150 USD

A ordinary

USD 0.01 LiLAC Class Purchase 900 35.7811 USD

C ordinary

February 09, 2016 08:33 ET (13:33 GMT)

Class Options 2016

A

ordinary

USD 0.01 Call Written -10,700 37.5000 American Apr 15,

Class Options 2016

A

ordinary

USD 0.01 Call Written -400 32.5000 American Apr 15,

Class Options 2016

A

ordinary

USD 0.01 Call Written -17,700 45.0000 American Apr 15,

Class Options 2016

A

ordinary

USD 0.01 Call Written -9,800 40.0000 American Jul 15,

Class Options 2016

A

ordinary

USD 0.01 Put Purchased -1,000 17.5000 American Jul 15,

Class Options 2016

A

ordinary

3. AGREEMENTS TO PURCHASE OR SELL ETC.

Full details should be given so that the nature of the

interest or position can be fully understood:

It is not necessary to provide details on a Supplemental Form

(Open Positions) with regard to cash-settled derivatives.

The currency of all prices and other monetary amounts should be

stated.

The Panel's Market Surveillance Unit is available for

consultation in relation to the Code's disclosure requirements on

+44 (0)20 7638 0129.

The Code can be viewed on the Panel's website at

www.thetakeoverpanel.org.uk.

View source version on businesswire.com:

http://www.businesswire.com/news/home/DEALING/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

February 09, 2016 08:33 ET (13:33 GMT)

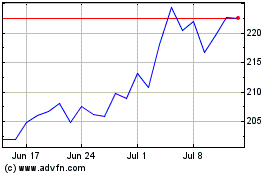

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

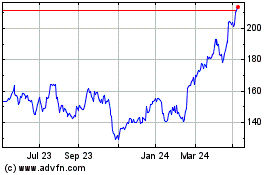

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024