Australian Dollar Strengthens on GDP Growth

December 01 2015 - 9:20PM

Dow Jones News

The Australian dollar reached its highest levels in nearly seven

weeks Wednesday on news of strong economic expansion, while

regional stock markets slipped after sharp gains the day

before.

The Aussie dollar touched 0.7342 against its U.S. counterpart

earlier, its highest level since Oct. 15, after the Australian

Bureau of Statistics said gross domestic product in the third

quarter grew 0.9% quarter over quarter and 2.5% from a year

earlier. The Aussie dollar had been trading at US$0.7321 late

Tuesday.

The expansion was due to a surge in commodity exports and was in

line with economists' forecasts.

"The Australian dollar was probably one of the most shorted

[Asian] currencies around and now a lot of short positions have

been taken out over the past month," said Steven Leung, a director

at UOB Kay Hian in Hong Kong.

The GDP data and the fact that the Reserve Bank of Australia

seems far from cutting interest rates have buoyed the Aussie

dollar, he explained.

Elsewhere, shares in the region slipped after a sharp gains

Tuesday, when disappointing Chinese manufacturing data spurred

hopes from stimulus from Beijing.

Japan's Nikkei Stock Average slipped 0.2%, Australia's fell 0.4%

and South Korea's Kospi shed 0.3%.

China's official reading on factory activity slipped in November

for the fourth straight month in a row.

Mr. Leung said he expected shares in Hong Kong to step back when

the market opens, after the Hang Seng Index's 1.8% rise

Tuesday.

"The gain was pretty staggering yesterday so a bit of a

correction today would not be surprising," he said, adding that the

market is [also] a little bit over worried about the interest rate

hike in the U.S."

In the U.S., investors snapped up stocks Tuesday ahead of key

economic data and the prospect of additional stimulus from the

European Central Bank. Major U.S. indexes have stuck to narrow

ranges in recent weeks ahead of meetings of the ECB this week and

the Federal Reserve later in December.

Friday's U.S. payrolls data could offer further clues on the

Fed's course.

Shares in Australia fell after iron ore prices reached a new

decade low of $42.27 a ton overnight. The utilities sector on the

S&P/ASX 200 was down 0.8%, while material shares were roughly

flat.

Brent oil prices were off 0.4% at $44.28 a barrel. U.S. crude

oil rose 0.3% to $41.74 a barrel overnight.

Gold prices rose 0.6% to $1,069.30 a troy ounce.

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 21:05 ET (02:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

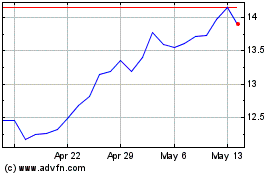

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

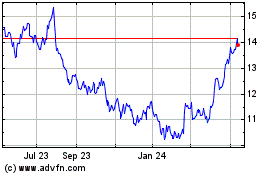

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Apr 2023 to Apr 2024