Australian Dollar Falls Amid Risk Aversion

April 25 2016 - 9:44PM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Tuesday following the negative

cues from Wall Street and as oil prices eased overnight. Investors

preferred to stay on the sidelines ahead of central bank policy

decisions due for the week.

Crude oil futures turned lower Monday on a private estimate that

showed that supplies in Cushing, Oklahoma storage facilities

continued to rise. This is the main delivery hub in the U.S.

Investors also remain cautious ahead of the U.S. Federal

Reserve's two-day policy meeting starting later today.

The Federal Reserve is not expected to lift rates at this

meeting, but the markets will be looking for clues on whether a

June rate hike is on the table.

The Bank of Japan also meets this week and expectations that it

would help banks lend by offering a negative rate on some loans are

rising.

Monday, the Australian dollar showed mixed performance against

its major rivals. While the aussie fell against the U.S. dollar,

the euro and the Canadian dollar, it rose against the NZ dollar.

Meanwhile, the aussie held steady against the yen.

In the Asian trading, the Australian dollar fell to an 8-day low

of 1.4624 against the euro, from yesterday's closing value of

1.4600. The aussie may test support near the 1.51 region.

Against the yen and the NZ dollar, the aussie dropped to 4-day

lows of 85.44 and 1.1199 from yesterday's closing quotes of 85.77

and 1.1248, respectively. If the aussie extends its downtrend, it

is likely to find support around 82.00 against the yen and 1.10

against the kiwi.

Against the U.S. and the Canadian dollars, the aussie edged down

to 0.7706 and 0.9763 from yesterday's closing quotes of 0.7714 and

0.9776, respectively. On the downside, 0.74 against the greenback

and 0.95 against the loonie are seen as the next support levels for

the aussie.

Looking ahead, U.K. BBA mortgage approvals for March is due to

be released later in the day.

In the New York session, U.S. durable goods orders for March,

S&P/Case-Shiller U.S. house price index for February, the

Conference Board's U.S. consumer confidence index for April and the

Richmond Fed's regional manufacturing index for April are due. At

8:55 am ET, Bank of Canada Governor Stephen Poloz is expected to

speak at the Canada-US Securities Summit in New York.

At 1:00 pm ET, Bank of England Deputy Governor Jon Cunliffe will

speak at the Ross Goobey Memorial Lecture in London.

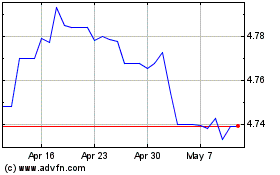

US Dollar vs MYR (FX:USDMYR)

Forex Chart

From Aug 2024 to Sep 2024

US Dollar vs MYR (FX:USDMYR)

Forex Chart

From Sep 2023 to Sep 2024