TIDMAUR

RNS Number : 5359R

Aurum Mining PLC

30 June 2015

News Release

30 June 2015

AURUM MINING PLC

("Aurum" or "the Company")

Final Results for the year ended 31 March 2015

Aurum Mining plc (AIM: AUR), the Spanish focused gold and

tungsten explorer, is pleased to report its preliminary audited

financial results for the year ended 31 March 2015.

The Company is pleased to announce that in accordance with AIM

Rules 20 and 26, the Annual Report and Financial Statements for the

year ended 31 March 2015 and the Notice of Annual General Meeting

will be posted to shareholders shortly and will be available on the

Company's website www.aurummining.net. The Annual General Meeting

will be held at 12 noon on 6 August 2015 at the offices of the

Company's solicitors, Wragge Lawrence Graham & Co LLP, 4 More

London Riverside, London SE1 2AU.

Contacts:

Aurum Mining plc www.aurummining.net

Sean Finlay +44 (0) 20 7499 4000

WH Ireland Limited Nominated Adviser &

Broker

Mike Coe, Ed Allsopp +44 (0) 117 945 3470

Notes to Editors:

Aurum Mining is an AIM listed exploration and development

company focused on its highly prospective portfolio of gold and

tungsten assets in North West Spain.

Gold

Through its joint venture agreement with Ormonde Mining plc

(AIM: ORM), Aurum currently has a 58% interest in the Pino de Oro

project in Zamora Province and a 53% interest in the Peralonso and

Cabeza projects in Salamanca Province.

Tungsten

Aurum's 20% owned Morille Tungsten project is located

approximately 15km south west of Salamanca in North West Spain and

covers an area of 5,796 hectares. The permit area is a 'brownfield'

site with historical data indicating production from the site of

high quality tungsten concentrates.

Review of Activities

The Company's 2014 Interim Results, which were published on 6

November 2014, outlined that the Board was in the process of

transforming the Company and changing the Company's strategy and

direction in response to the very challenging market conditions

that continue to blight the junior natural resource sector. The

announcement went on to say that the Board would be working closely

in conjunction with the Company's major Shareholder to identify and

complete a transformational deal that will enhance the future of

the Company.

Since November, the evolution of the Company has continued and

this has been evidenced by Board changes, a fundraise to put the

Company on a sound financial footing and during this period the

Board has looked at a number of potential opportunities for the

Company. The key is to find a deal that will give the Company a

sustainable and long-term future, freeing the Company from being a

victim of the structural change occurring in the junior mining

market.

Most significantly, in April 2015, the Company announced that

David Williams, the Company's major shareholder with over 29% of

the issued share capital of the Company had agreed to join the

Board as Chairman. Not only has David been a highly supportive

major Shareholder in recent years, he also has a huge amount of

business experience, and this experience will be instrumental in

helping the Company achieve its objectives.

Shareholders in AIM listed junior mining companies have faced a

long period of falling valuations and increased dilution, and with

no end in sight for the ongoing downturn, the Board feels that this

change in strategy is unquestionably the right thing for the

Company to do, and with David at the helm, the Company will

continue to review and appraise opportunities that have the

potential to help Aurum complete its transformation.

The Board is looking forward to keeping the market up to date

with progress.

Gold projects

In tandem with the new strategic approach, the Company will be

looking to drive value from the successful exploration work done on

the gold projects to date. Aurum is working closely with its joint

arrangement partner Ormonde Mining plc ("Ormonde") (AIM: ORM) to

achieve this. There have been a number of discussions with

interested parties during the period around structuring a deal for

the gold projects and a number of these discussions are on-going.

There is currently a very low level of activity taking place on the

gold projects, and during this transitional period Aurum will not

be funding the projects - this has led to a small dilution on its

interest on the gold projects, albeit an immaterial dilution.

Morille tungsten project

Following the completion of the deal with Plymouth Minerals

Limited ("Plymouth") (ASX:PLH) in which Plymouth became Aurum's

partner on the Morille tungsten project, significant exploration

work has been carried out on the project. The Board has been

impressed by the energy and enthusiasm of Plymouth and the work

done to date has yielded some very promising results. The Board

looks forward to updating the market with further exploration

updates in the near future.

Key financials

For the twelve months to 31 March 2105, the Company is reporting

a loss of GBP317,000 compared to a loss of GBP530,000 for the same

period in 2014.

During this period of transition, cash management and cost

control have remained key priorities for the Company.

Administrative costs have been materially reduced over recent

months.

On 21 August 2014, the Company announced that it had raised

GBP60,000 (before expenses) through a placing of 4,800,000 new

Ordinary Shares.

On 15 April 2015 the Company announced that it had completed a

subscription of 25,758,356 new Ordinary Shares to new and existing

Shareholders at a price of 1 pence per share to raise approximately

GBP257,500 before expenses.

The funds raised are being used to fund working capital

requirements to enable the business to advance its

transformation.

Corporate

The Board would like to thank its Shareholders and advisers for

their input during this transitional period.

To facilitate the transformation process and to reduce costs,

the Company also announced various Directorate changes during the

first half of 2015. In addition to David Williams being appointed

to the Board as Chairman, Chris Eadie and Mark Jones have stepped

down from the Board. Sean Finlay stepped down as Chairman on

David's appointment but remains on the Board as a Non-Executive

Director along with Haresh Kanabar who also remains on the Board as

a Non-Executive Director.

Chris Eadie continues to assist the Company as a consultant on a

part-time basis and in order to keep operating costs to a minimum,

David Williams has agreed to take no salary until a

transformational deal is completed.

Qualified Person

Sean Finlay, Professional Geologist, Chartered Engineer,

Non-Executive Director of Aurum Mining plc, and a qualified person

as defined in the Guidance Note for Mining, Oil and Gas Companies,

June 2009, of the London Stock Exchange, has reviewed and approved

the technical information contained in this report.

On behalf of the Board

David Williams

Chairman

30 June 2015

STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME

year ended 31 march 2015

2015 2014

Notes GBP'000 GBP'000

Impairment charge (27) -

Administrative expenses (290) (479)

-------- ----------------

Operating loss (317) (479)

Finance income - 1

-------- ----------------

Loss for the year before taxation (317) (478)

Taxation - -

-------- ----------------

Loss for the year from continuing

operations (317) (478)

Loss for the year from discontinued

operations, net of tax - (52)

-------- ----------------

Loss and total comprehensive

loss for the year (317) (530)

-------- ----------------

Loss and total comprehensive

loss per share expressed in

pence per share

From continuing operations

Basic and Diluted 2 (0.22)p (0.34)p

From discontinued operations

Basic and Diluted 2 - (0.03)p

Total operations

Basic and Diluted 2 (0.22)p (0.37)p

Statement of financial position

as at 31 march 2015

Company number: 05059457 2015 2014

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 899 899

Investments 79 64

Amounts owed by subsidiaries - -

--------- ---------

Total non-current assets 978 963

--------- ---------

Current assets

Receivables 13 62

Cash and cash equivalents 106 214

--------- ---------

Total current assets 119 276

--------- ---------

Total assets 1,097 1,239

--------- ---------

Liabilities

Current liabilities

Trade and other payables 89 113

--------- ---------

Total current liabilities 89 113

--------- ---------

Total liabilities 89 113

--------- ---------

Net assets 1,008 1,126

--------- ---------

Capital and reserves attributable

to the equity holders of the

company

Share capital 1,461 1,413

Shares to be issued 140 -

Share premium 11,596 11,585

Retained deficit (12,189) (11,872)

--------- ---------

Total Equity 1,008 1,126

--------- ---------

statement of Changes in equity

year ended 31 march 2015

Shares Share

Share to be premium Retained Total

capital issued deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2013 1,413 - 11,585 (11,342) 1,656

Total comprehensive

expense for the

year - - - (530) (530)

At 31 March 2014 1,413 - 11,585 (11,872) 1,126

--------- -------- ----------------- --------------- ----------------

Total comprehensive

expense for the

year - - - (317) (317)

Issue of shares

net of issue costs 48 - 11 - 59

Shares to be issued - 140 - - 140

At 31 March 2015 1,461 140 11,596 (12,189) 1,008

------ ---- ------- --------- ------

STATEMENT of cash flows

year ended 31 march 2015

2015 2014

GBP'000 GBP'000

Cash flows from operating activities

Loss for the year before tax (317) (530)

Adjustments for:

Impairment charge 27 -

Finance income - (1)

Disposal of subsidiaries - 52

Exchange differences - 1

-------- --------------------

Cash flow from operating activities

before changes in working capital (290) (478)

Decrease in other receivables 7 13

(Decrease) / increase in trade and

other payables (24) 18

-------- --------------------

Net cash flow used in operating

activities (307) (447)

-------- --------------------

Investing activities

Ormonde joint arrangement payments - (159)

Disposal of subsidiary net of cash - 186

Increase in loans to subsidiaries - (60)

Net cash flow used in investing

activities - (33)

-------- --------------------

Financing activities

Proceeds from issue of share capital 60 -

Expenses paid in connection with (1)

share issues -

Cash received in respect of shares 140

to be issued -

-------- --------------------

Net cash flow from financing activities 199 -

-------- --------------------

Net decrease in cash and cash equivalents (108) (480)

-------- --------------------

Cash and cash equivalents at the

beginning of the year 214 694

Effect of exchange rate changes

on cash and cash equivalents

-------- --------------------

Cash and cash equivalents at the

end of the year 106 214

-------- --------------------

NOTES

1. Basis of preparation

The financial information set out above, which was approved by

the Board on 29 June 2015 has been compiled in accordance with

International Financial Reporting Standards as adopted by the

European Union ("IFRS"), but does not contain sufficient

information to comply with IFRS. The Company expects to distribute

its full financial statements that comply with IFRS shortly. The

financial statements have been prepared on the historic cost basis

and on a consistent basis with the accounting policies adopted in

the prior year.

In the prior year, the Company sold 80% of its only wholly owned

subsidiary, leaving the Company with no subsidiaries to

consolidate. Consolidated accounts have therefore not been prepared

in 2015, and accordingly, Company financial statements have been

prepared for the current and the prior year.

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 March 2015 but

is extracted from those accounts. The Company's statutory accounts

for the year ended 31 March 2015 will be filed with the Registrar

of Companies following the Company's annual general meeting. The

independent auditors' report on those accounts was unqualified

although an emphasis of matter was included in the accounts to draw

attention to going concern. The financial statements have been

prepared on a going concern basis.

Following a review of the Company's operations, its current

financial position and cash flow forecasts, the Directors have

formed a view that the Company will have sufficient financial

resources available to it to continue in operational existence and

meet its financial commitments as they arise in the next twelve

months. The Directors have formed this view based on the amount of

available cash within the Company, the Company's historical track

record of raising funds from the AIM market, and the assets and

investments the Company holds which could be made available for

potential sale, should the need arise.

Based on the above the Directors have concluded that the Company

can continue as a going concern for a period of at least twelve

months from the date of signing these financial statements.

Accordingly, the Directors continue to adopt the going concern

basis for the preparation of these financial statements.

The forecasts prepared by the Directors reflect the requirement

for the Company to raise further funds over the next twelve months

or to dispose of at least one of the assets or investments of the

Company. Given that at the date of approval of the financial

statements there are no legally binding agreements in place

relating to either fundraising or to the sale of any of the

Company's assets or investments, there can be no certainty relating

to these potential causes of action, despite the Company's track

record of raising funds or completing asset transactions. This

position indicates the existence of a material uncertainty which

may cast significant doubt about the Company's ability to continue

as a going concern. The financial information / statements do not

include the adjustments that would result if the Company was unable

to continue as a going concern, which would principally relate to

the impairment of intangible assets and investments.

No statement was included under section 498(2) or (3) of the

Companies Act 2006. The Company's statutory accounts for the year

ended 31 March 2014 have been filed with the Registrar of

Companies. The independent auditors' report on those accounts was

unqualified, but an emphasis of matter was included in the accounts

to draw attention to going concern but did not contain any

statement under section 498(2) or (3) of the Companies Act

2006.

2. loss per share

Basic loss per share is calculated by dividing the loss

attributable to the ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted loss per share, the weighted average number of

shares in issue is adjusted to assume conversion of all the

dilutive potential ordinary shares. The potential dilutive shares

are anti-dilutive in 2014 and 2015 as the Company is loss

making.

At the reporting date there were 4,450,000 (2014: 4,450,000)

potentially dilutive ordinary shares. Dilutive potential ordinary

shares include share options and warrants.

2015 2014

GBP'000 GBP'000

Net loss attributable to equity

holders of the parent:

From continuing operations (317) (478)

From discontinued operations - (52)

From total operations (317) (530)

--------------------- --------

2015 2014

Number Number

Weighted average number of

shares:

Weighted average number of

shares 145,296,862 141,291,930

------------ ------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EADKNASESEFF

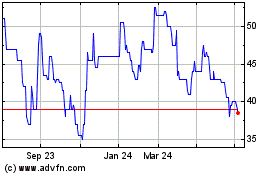

Shearwater (LSE:SWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

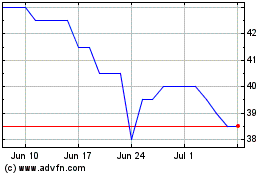

Shearwater (LSE:SWG)

Historical Stock Chart

From Apr 2023 to Apr 2024