ArcelorMittal, Marcegaglia Offer to Buy Italy's Largest Steel Plant Ilva -Update

June 30 2016 - 12:10PM

Dow Jones News

By Alex MacDonald and Razak Musah Baba

LONDON--A consortium made up of steel firms ArcelorMittal (MT)

and Marcegaglia have submitted an offer to buy Europe's largest

steel plant, Ilva.

The Italian government last year took control of the

administration of the loss-making plant in the southern Italian

city of Taranto, with a view to saving the plant's roughly 16,000

jobs and improve its pollution track record.

The acquisition of the flat steelmaking plant, if it goes ahead,

would mark ArcelorMittal's first major purchase since partnering

with Japan's Nippon Steel & Sumitomo Metal Corporation to buy

the Calvert, Alabama U.S. flat steel plant for $1.55 billion in

2014.

It comes at a time when European steelmakers are struggling to

cope with excess production capacity globally, shedding thousands

of jobs and selling loss-making plants in a bid to cope with anemic

steel demand growth and an influx of cheap steel into Europe from

China, the world's largest steelmaker.

"We believe Ilva represents a compelling investment opportunity

for ArcelorMittal, without compromising our balance sheet strength,

as it would extend our leadership position and increase our product

offering in Italy, Europe's second-largest steel manufacturing and

consuming market," said Geert Van Poelvoorde, CEO of

ArcelorMittal's Europe Flat Products unit.

The Luxembourg-based steelmaker, the world's largest by output,

plans to improve Ilva's product mix, quality and productivity in

order to return the plant to profitability. This would involve

boosting the plant's output to more than 6 million tons of steel

output annually by 2020 from the current 4.8 million tons produced

annually from three blast furnaces. The steelmaker said it's

committed to operating a minimum of three blast furnaces. "In the

longer term we will evaluate production volume increases based on

market demand and the performance of the asset," he added. Ilva is

capable of producing more than 9 million tons from five blast

furnaces, although two are currently idled.

Jefferies analyst Seth Rosenfeld believes ArcelorMittal's offer

may be a defensive move. "By acquiring Ilva, ArcelorMittal can

ensure that the plants are not run at higher utilization rates,"

thereby helping keep a lid on supplies while ensuring the

sustainability of recent flat steel price rises, he said.

Ilva is the E.U.'s fourth-largest flat steel producer after

ArcelorMittal, Germany's ThyssenKrupp AG, and India's Tata Steel

Ltd, accounting for 7% E.U. flat steel production. The offer is

structured in such a way that ArcelorMittal would likely own an 85%

stake in the plant, while Italy's Marcegaglia, a privately owned

finished steel manufacturer that is Ilva's largest customer, would

own a 15% stake, according to an ArcelorMittal spokesman. No

financial details were disclosed.

The Italian government will now spend the next 120 days

reviewing the environmental aspects of all offers submitted on

Thursday, before providing more clarity on the next steps of a

multi-stage process that doesn't have a formal end-date.

Write to Alex MacDonald and Razak Musah Baba

(END) Dow Jones Newswires

June 30, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

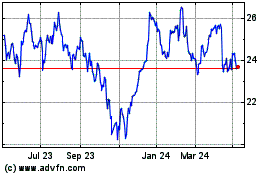

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

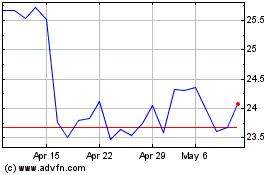

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024