TIDMAOR

RNS Number : 3249P

AorTech International PLC

18 August 2014

AorTech International plc

("AorTech", "the Company" or "the Group")

Preliminary audited results for the year ended 31 March 2014

AorTech International plc (AIM: AOR), the biomaterials and

medical device IP company, today announces its preliminary results

for the year ended 31 March 2014.

Financial summary

-- Group revenue from continuing operations US$0.4m (2013

US$0.3m)

-- Operating loss from continuing operations US$764k (2013:

US$1,205k loss from continuing operations)

-- Cash reserves decreased from US$987k to US$642k

Other developments

-- Business completed transition to exploiting its IP and

outsourcing its polymer manufacture

-- Significantly lower cost base going forward, following exit

from US

-- Board restructured following exit of former CEO

For further information contact:

AorTech International plc

Eddie McDaid, Chief Executive Tel: +44 (0)7802 920869

AorTech International plc

Bill Brown, Chairman Tel: +44 20 3206 7335

finnCap Limited

Stuart Andrews / James Thompson Tel: +44 20 7220 0500

A copy of this announcement will be available at

aortech.com/investor/announcements. The content of the website

referred to in this announcement is not incorporated into and does

not form part of this announcement.

About AorTech:

AorTech has developed biostable, implantable polymers, including

Elast-Eon(TM) and ECSil(TM) the world's leading long-term

implantable co-polymers, now manufactured on their behalf by

Biomerics LLC in Utah, USA. With several million implants and seven

years of successful clinical use, AorTech polymers are being

developed and used in cardiology and urological applications,

including pacing leads, cardiac cannulae, stents and implantable

sensor technology. Devices manufactured from AorTech polymers have

numerous US FDA PMA approvals, 510k's, CE Marks, Australian TGA and

Japanese Ministry of Health approvals.

Elast-Eon(TM) and ECSil(TM)'s biostability is comparable to

silicone while exhibiting excellent mechanical, blood contacting

and flex-fatigue properties. These polymers can be processed using

conventional thermoplastic extrusion and moulding techniques. A

range of materials in a variety of application-specific

formulations for use in medical devices and components are

available.

CHAIRMAN'S STATEMENT

I set out below my report to the shareholders of AorTech for the

year ended 31 March 2014.

Audited results for the year

During the year, the Group discontinued its manufacturing

operations as part of the transition to an IP-focused business. The

accounts have therefore been presented on the basis of the

continuing operations with a charge shown for the losses from the

discontinued activities. The references to financial performance

below are based on continuing operations only.

Group revenue for the year was $418,000 (2013, $313,000).

Operating loss after exceptional items was $764,000 (2013:

$1,205,000). The net loss for the year was $823,000 (2013:

$3,258,000) after exceptional finance costs of $59,000 (2013:

$2,048,000). These finance costs relate to a provision in respect

of potential additional redemption premium due to loan note

holders.

The Group's administrative expenditure before exceptional items

was $859,000 (2013: $1,091,000). The reduction in this expenditure

arises as a direct consequence of the closure of the US

manufacturing facility and the transition of the business to an IP

company. The exceptional administrative expenses of $83,000 relate

to legal fees incurred in the dispute with the Group's former Chief

Executive, Mr Maguire, of which further details are set out

below.

The Group's cash position at 31 March 2014 was $642,000. This

shows a decrease of approximately $345,000 from the corresponding

date last year. As previously disclosed, the cash position has been

reduced by the additional investment required to establish the

manufacturing license with Biomerics LLC together with the legal

fees referred to above.

Business Model

The exit from polymer manufacture provided the opportunity to

develop a more attractive business model, on a significantly lower

cost base, of exploiting the IP held by the Group. This process has

now been completed with the exit from manufacturing during the year

and the transfer of manufacturing know-how under license to

Biomerics. The process to ensure Biomerics were able to validate

our manufacturing suffered delays but is now nearing

completion.

The structure of the Board has changed to reflect the new

business structure. Eddie McDaid was appointed as Chief Executive

Officer of the Group in December 2013 and Roy Mitchell took over

the role of Finance Director which was previously performed by

Eddie.

Maguire Dispute

We announced in June that AorTech is in dispute with Mr Frank

Maguire, the Company's previous CEO who resigned in November 2013.

Following Mr Maguire's resignation several matters arose which

created serious concerns for your Board.

We have found evidence showing that during his employment with

AorTech Mr Maguire sought to undertake business transactions,

unbeknown to the Board, with existing and potential licensees. Upon

his resignation from AorTech, Mr Maguire took up a senior

appointment with a company called Foldax which is involved in the

development of a TAVI heart valve.

Our investigations discovered that Mr Maguire had during the

previous two years been negotiating a potential heart valve deal

between AorTech and a company and individuals connected to Foldax.

In addition our investigations revealed that, during his period of

employment with AorTech, Mr Maguire had been negotiating with

another of AorTech's licensees for a transaction between himself

and the licensee to the exclusion of AorTech. AorTech's Board had

not been informed of these meetings and discussions.

As a result of these investigations, AorTech has taken legal

action against Mr Maguire for amongst other matters breach of his

contract, breach of his fiduciary duties, misappropriation of trade

secrets and the retaining of confidential documents, files and

assets which are the property of AorTech International.

At an initial court hearing on 1 August 2014, the Court

indicated it would deny motions in which Mr Maguire asked the Court

to dismiss AorTech's claims identified above.

It is the Board's present intention to vigorously pursue Mr

Maguire through the appropriate legal processes in order to protect

AorTech's know-how and trade secrets and, in doing so, protect the

Company and its shareholders' interests. This may include seeking,

as appropriate, damages from Mr Maguire and his co-venturers.

At the initial court hearing on 1 August Mr Maguire was

instructed to return all of AorTech's property including all data

and confidential information relating to AorTech's know-how and

trade secrets.

A substantial amount of time, effort and work has been incurred,

in particular by both our Chief Executive Eddie McDaid and our

Finance Director Roy Mitchell, in not only investigating these

matters but also in implementing the appropriate legal processes.

However such work has been necessary in view of the serious

allegations which arose from Mr Maguire's actions.

AorTech is taking advice from our US attorneys on the

possibility of taking further action against Mr Maguire and indeed

against Foldax, particularly where it relates to our IP, know-how

and trade secrets.

AorTech has over many years maintained appropriate insurance

cover to protect our IP, know-how and trade secrets. I am pleased

to confirm that AorTech has recently received confirmation that

insurance coverage, in accordance with the policy terms, will be

available to meet the ongoing costs of its action against Mr

Maguire.

Heart Valve

We have not made the progress with the Heart Valve project we

would have wished, but the Board are now trying to get some

indications of interest back up to speed and restore momentum to

the project.

Biomerics

One of the key objectives of your Board during 2013 was to

ensure that we were in a position to benefit from developments

being carried out by existing licensees and to assure their ongoing

supply of polymer, as well as creating a model for bringing our

polymers to a much wider medical market. On 1 October 2013 we

announced a licence with Biomerics LLC for the manufacture and

distribution of our Elast-Eon(TM) materials.

This licence required a process of transferring our

manufacturing know-how to Biomerics. It became clear a few months

into the relationship that the former CEO had significantly

underestimated both the costs and time scale required to complete

the technology transfer in a professional manner. The contract

called for AorTech to contribute up to $100,000 towards the

technology transfer process, of which $50,000 was paid on signing

the contract. In addition to this, a further $110,000 has had to be

invested. Biomerics have also incurred $155,000 in costs relating

to labour costs for the validation process. Biomerics are

effectively reimbursed these costs out of gross margin made on

polymer and material sales. By the year end, we had reimbursed

$47,000 of these costs.

The validation and technology transfer is now in its final phase

and we are pleased that the first shipments of Elast-Eon(TM) were

made by Biomerics to AorTech's licensees at the end of July 2014.

The delays experienced by Biomerics in its validation processes has

inevitably resulted in delays in expected sales from the Biomerics

transaction. However Biomerics has already received enquiries from

several new potential customers who have shown an interest in

AorTech's Elast-Eon(TM) material.

Update on licensees

As announced in our trading and commercial update on 16 June

2014, our licensees are continuing to progress their products

through the development and regulatory phases, although some have

experienced delays during the past twelve months.

Conclusion

The last twelve months, in particular the last six months has

been a very difficult period for your Board in view of the

inordinate length of time that has been spent on the investigation

of the actions of Mr Maguire, our previous CEO. In addition, the

delays in both the validation process of Biomerics, our

manufacturing partner, and in the regulatory processes experienced

by several of our licensees have had an adverse effect on the

anticipated revenues both for this last financial year and the

current financial year.

On the positive side, AorTech together with it's manufacturing

partner Biomerics, has achieved a successful technology transfer to

enable and secure the continuation of future supply of

Elast-Eon(TM) material to not only our present customers but also

to future potential customers. Biomerics has already, at this early

stage, received a number of enquiries from several companies

regarding the potential use of AorTech's Elast-Eon(TM) material in

various medical devices.

The restructuring of AorTech is now complete resulting in

substantial cost savings going forward into the future.

I take this opportunity to recognise on behalf of the

shareholders the time, effort and hard work which has been carried

out by the Board. This past twelve months has demonstrated the

determination and commitment of your Board to continue to protect

the interests of its shareholders and the Company and to enhance

shareholder value in future years.

This current year will be one of continuing change and hopefully

result in resolution of some of the matters raised in this

report.

Bill Brown

Chairman

15 August 2014

Consolidated income statement

Year ended 31 March Year ended 31 March

2014 2013

Pre-exceptional Pre-exceptional

items Exceptional items Exceptional

items Total items Total

US$000 US$000 US$000 US$000 US$000 US$000

Revenue 418 - 418 313 - 313

Other income 1 - 1 62 - 62

Cost of sales - - - - - -

Administrative

expenses (859) (83) (942) (1,091) - (1,091)

Other expenses

-

development

expenditure - - - (239) - (239)

Other expenses

-

amortisation

of intangible

assets (241) - (241) (250) - (250)

-------------

Operating

(loss)

/ profit (681) (83) (764) (1,205) - (1,205)

Finance

expense - (59) (59) (5) (2,048) (2,053)

----------------- ----------------- ---------- ---------------- ------------- ------------------

Loss from

continuing

operations

attributable

to owners of

the

parent

company (681) (142) (823) (1,210) (2,048) (3,258)

(Loss) /

profit from

discontinued

operations (486) - (486) (782) 3,193 2,411

----------------- ----------------- ---------- ---------------- ------------- ------------------

(Loss) /

profit

attributable

to owners of

the

parent

company (1,167) (142) (1,309) (1,992) 1,145 (847)

Loss per share

Basic and

diluted

(US cents per

share) (27.09) (17.53)

Consolidated statement of comprehensive income

Year Year

ended ended

31 31

March March

2014 2013

US$000 US$000

Loss for the year (1,309) (847)

Other comprehensive income:

Exchange differences on

translating foreign operations (51) (130)

Income tax relating to other

comprehensive income - -

------------ ----------------

Other comprehensive income

for the year, net of tax (51) (130)

------------ ----------------

Total comprehensive income

for the year, attributable

to owners of the parent

company (1,360) (977)

No items of other comprehensive income can be subsequently

reclassified to profit and loss.

Consolidated balance sheet

31

March 31 March

2014 2013

US$000 US$000

Assets

Non current assets

Intangible assets 1,861 1,840

Property, plant and equipment - 4

Trade and other receivables 300 -

Total non current assets 2,161 1,844

------------- --------------

Current assets

Inventories 46 -

Trade and other receivables 401 1,820

Cash and cash equivalents 642 987

Total current assets 1,089 2,807

------------- --------------

Total assets 3,250 4,651

------------- --------------

Liabilities

Current liabilities

Trade and other payables (306) (406)

Total current liabilities (306) (406)

------------- --------------

Non current liabilities

Change of control redemption

premium (193) (134)

------------- --------------

Total non current liabilities (193) (134)

Total liabilities (499) (540)

Net assets 2,751 4,111

============= ==============

Equity

Issued capital 20,144 18,351

Share premium 3,901 3,555

Other reserve (3,340) (3,043)

Foreign exchange reserve 3,791 5,684

Profit and loss account (21,745) (20,436)

Total equity attributable

to equity holders of the

parent 2,751 4,111

============= ==============

The Group financial statements were approved by the Board on 15

August 2014.

Consolidated cash flow statement

Year Year

ended ended

31 31

March March

2014 2013

US$000 US$000

Cash flows from operating activities

Group loss after tax (823) (3,258)

Adjustments for:

Amortisation of intangible assets 241 250

Finance expense 59 2,053

(Decrease) / increase in trade

and other receivables 102 (754)

Increase in trade and other

payables 69 8

------------------ --------

Net cash flow from continuing

operations (352) (1,701)

Net cash flow from discontinued

operations 312 2,227

------------------ --------

Net cash flow from operating

activities (40) 526

Cash flows from investing activities

Purchase of intangible assets (439) (72)

------------------ --------

Net cash flow from continuing

operations (439) (72)

Net cash flow from discontinued

operations - 671

Net cash flow from investing

activities (439) 599

------------------ --------

Cash flows from financing activities

Interest paid - (5)

Proceeds from issue of loan

notes - 1,914

Repayment of loan notes - (1,914)

Redemption premium paid to loan

note holders - (1,914)

------------------ --------

Net cash flow from financing

activities - (1,919)

------------------ --------

Net decrease in cash and cash

equivalents (479) (794)

Foreign exchange movements on

cash held in foreign currencies 134 (136)

Cash and cash equivalents at

beginning of year 987 1,917

Cash and cash equivalents at

end of year 642 987

================== ========

Consolidated statement of changes

in equity

Profit

Issued Foreign and

Share Share Other exchange loss Total

capital premium reserve reserve account equity

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 31 March

2012 19,319 3,742 (3,203) 4,819 (19,589) 5,088

Transactions with owners - - - - - -

Loss for the year - - - - (847) (847)

Other comprehensive

income

Exchange difference

on translating foreign

operations (968) (187) 160 865 - (130)

Total comprehensive

income for the year (968) (187) 160 865 (847) (977)

--------- --------- --------- ---------- --------- --------

Balance at 31 March

2013 18,351 3,555 (3,043) 5,684 (20,436) 4,111

Transactions with owners - - - - - -

Loss for the year - - - - (1,309) (1,309)

Other comprehensive

income

Exchange difference

on translating foreign

operations 1,793 346 (297) (1,893) - (51)

Total comprehensive

income for the year 1,793 346 (297) (1,893) (1,309) (1,360)

------- ------ -------- -------- --------- ----------

Balance at 31 March

2014 20,144 3,901 (3,340) 3,791 (21,745) 2,751

======= ====== ======== ======== ========= ==========

Notes:

1. Basis of preparation

The Group financial statements are for the year ended 31 March

2014. They have been prepared in compliance with International

Financial Reporting Standards (IFRS) and IFRS Interpretations

Committee (IFRIC) interpretations as adopted by the European Union

as at 31 March 2014.

The Group financial statements have been prepared under the

historical cost convention.

The accounting policies remain unchanged from the previous

year.

2. Going concern

After considering the year end cash position, making appropriate

enquiries and reviewing budgets and profit and cash flow forecasts

for a period of at least twelve months from the date of signing

these financial statements, the Directors have formed a judgement

at the time of approving the financial statements that there is a

reasonable expectation that the Group has sufficient resources to

continue in operational existence for the foreseeable future. For

this reason the Directors consider the adoption of the going

concern basis in preparing the Group financial statements is

appropriate.

3. Preliminary announcement

The summary accounts set out above do not constitute statutory

accounts as defined by Section 434 of the UK Companies Act 2006.

The summarised consolidated balance sheet at 31 March 2014, the

summarised consolidated income statement, the summarised

consolidated statement of comprehensive income, the summarised

consolidated statement of changes in equity and the summarised

consolidated cash flow statement for the year then ended have been

extracted from the Group's statutory financial statements for the

year ended 31 March 2014 upon which the auditor's opinion is

unqualified and did not contain a statement under either sections

498(2) or 498(3) of the Companies Act 2006. The audit report for

the year ended 31 March 2013 did not contain statements under

Section 498(2) or Section 498(3) of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2013

have been delivered to the Registrar of Companies. The 31 March

2014 accounts were approved by the Directors on 15 August 2014, but

have not yet been delivered to the Registrar of Companies.

4. Earnings per share

The basic loss per Ordinary share of 27.09 US cents (2013: loss

of 17.53 US cents) is calculated on the loss of the Group of

US$1,309,000 (2013: loss of US$847,000) and on 4,832,778 (2013:

4,832,778) equity shares, being the number of shares in issue

during the year. Of this, 17.03 US cents (2013: 67.43 US cents) is

calculated on the loss from continuing operations, whilst a loss of

10.06 US cents (2013: earnings of 49.90 US cents) results from

discontinued operations.

The diluted earnings per share is not materially different from

the basic earnings per share. The diluted loss per share does not

differ from the basic loss per share as the exercise of share

options would have the effect of reducing the loss per share and is

therefore not dilutive under the terms of IAS 33.

5. Discontinued operations

During the year ended 31 March 2013, the Group settled a dispute

with St Jude Medical, a key US customer. A consequence of that

settlement was the effective transfer of the US manufacturing

facility to St Jude Medical. The Directors considered, at that

time, that the St Jude transaction and related asset disposal did

not constitute a discontinued operation under the definition in

IFRS 5.

On 1 October 2013, the Group signed an agreement with Biomerics

LLC for the manufacture and distribution of our patented materials,

including to our existing licensees. In the opinion of the

Directors, the Biomerics transaction transformed the Group into a

pure intellectual property company. As a consequence, results

attributable to manufacturing activity constitute a discontinued

operation, and have been presented as such in the Income Statement.

Comparative figures have been adjusted accordingly.

The results of the discontinued manufacturing operations are

shown in more detail below.

Pre-exceptional Pre-exceptional

items Exceptional items items Exceptional items

Total Total

2014 2014 2014 2013 2013 2013

$000 $000 $000 $000 $000 $000

Revenue 245 - 245 1,492 1,990 3,482

Other income 13 - 13 227 2.271 2,498

Cost of sales (211) - (211) (1,268) (786) (2,054)

Administrative

expenses (537) - (537) (1,233) (420) (1,653)

Profit on

disposal of

property,

plant and

equipment 4 - 4 - 138 138

------------------ ------------------ ------- ------------------ ------------------- -------

Operating

(loss) /

profit (486) - (486) (782) 3,193 2,411

------------------ ------------------ ------- ------------------ ------------------- -------

Notice of Annual General Meeting

Notice of the seventeenth Annual General Meeting of AorTech

International Plc will be posted with the Annual Report and

Accounts and will be held in the offices of Kergan Stewart LLP, 163

Bath Street, Glasgow G2 4SQ on Monday, 29 September 2014 at

11:00am.

Posting and availability of accounts

The annual report and accounts for the year ended 31 March 2014

will be sent by post to all registered shareholders on 26 August

2014. Additional copies will be available for a month thereafter

from the Company's Weybridge office. Alternatively, the document

may be viewed on, or downloaded from, the Company's website:

www.aortech.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLGDICGBBGSU

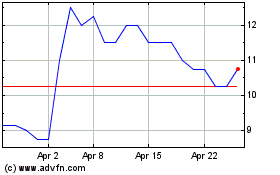

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024