TIDMAOR

RNS Number : 0839O

AorTech International PLC

16 August 2017

AorTech International plc

("AorTech", "the Company" or "the Group")

Audited results for the year ended 31 March 2017

AorTech International plc (AIM: AOR), the biomaterials and

medical device IP company, today announces its results for the year

ended 31 March 2017.

Financial summary

-- Trading Profit Achieved: Adding back amortisation of

goodwill, an operating profit of $55k was achieved compared to a

loss of $263k in the previous year.

-- Loss for year down 65%: Loss from continuing operations reduced from $604k to $237k.

-- Costs Reduced: Administrative expenses before exceptional

items and bad debt provisions reduced from US$715k in previous year

to US$523k in 2017.

-- High quality of Revenues: Despite a reduction in income, the

revenues recognised in the current year are recurring and supported

by contracts.

For further information contact:

AorTech International plc

Bill Brown, Chairman & Chief Executive Tel: +44 (0)7730

718296

finnCap Limited

Giles Rolls / Jonny Franklin-Adams Tel: +44 20 7220 0500

A copy of this announcement will be available at

www.aortech.net/investor-relations/rns-and-insider-information/.

The content of the website referred to in this announcement is not

incorporated into and does not form part of this announcement.

About AorTech:

AorTech has developed biostable, implantable polymers, including

Elast-Eon(TM) and ECSil(TM) the world's leading long-term

implantable co-polymers, now manufactured on their behalf by

Biomerics LLC in Utah, USA. With several million implants and seven

years of successful clinical use, AorTech polymers are being

developed and used in cardiology and urological applications,

including pacing leads, cardiac cannulae, stents and neuro

stimulation devices. Devices manufactured from AorTech polymers

have numerous US FDA PMA approvals, 510k's, CE Marks, Australian

TGA and Japanese Ministry of Health approvals.

Elast-Eon(TM) and ECSil(TM)'s biostability is comparable to

silicone while exhibiting excellent mechanical, blood contacting

and flex-fatigue properties. These polymers can be processed using

conventional thermoplastic extrusion and moulding techniques. A

range of materials in a variety of application-specific

formulations for use in medical devices and components are

available.

CHAIRMAN'S STATEMENT

In the year to 31 March 2017, AorTech's revenues were reduced to

$614,000 (2016: $901,000) over the full year; however the second

half year witnessed sales which were approximately 50% higher than

those achieved at the interim stage. AorTech generated a profit of

$55,000 before the amortisation of intangible assets (2016: loss of

$263,000). After amortisation of intangible assets (depreciation of

Intellectual Property) of $292,000, the Company incurred an

operating loss of $237,000 - less than half that incurred during

the previous year (2016: $575,000). The Board continued to maintain

a close control over costs with administration expenses for the

year being less than half those incurred during the previous year,

although the change in the Sterling/US Dollar exchange rate

contributed to that reduction.

The net current assets (total current assets less total current

liabilities) remained relatively stable at $404,000 compared to

$392,000 last year. Within this figure however there was a fall of

$200,000 in the cash position which stood at $114,000 at the year

end. The fall in cash was mostly offset by an increase in

receivables and as expected, the cash position has increased since

the year end.

Licensees

Over the years, AorTech has signed a number of licences to allow

AorTech polymer intellectual property to be incorporated into

medical devices. A number of devices are marketed which utilise the

benefits of Elast-Eon(TM) polymers; these include cardiac rhythm

management pacing leads, coronary artery stents, neuro stimulation

devices, catheters and urology stents. In all applications, the

material is performing well and delivering the bio-stability of

silicone together with the mechanical properties of urethane. Our

manufacturing licensee, Biomerics concluded a licence for

Elast-Eon(TM) earlier this year together with a long term supply

agreement. There are currently a number of companies evaluating

Elast-Eon(TM) which if succesful may lead to other licences.

Biomerics adopts a different approach to licensing to that which

AorTech has historically pursued. AorTech signed a number of

licences with very small/development companies long before products

were ready for market launch. As a result, other than annual

maintenance fees, the revenues from those licences depended upon

future product launches. By contrast, Biomerics is focussed on

volume supply and near term success.

Some historic licences signed by the Company have not generated

value for AorTech and have only resulted in the Elast-Eon(TM)

material not being exploited in the field of the licence. An

example of this was the licence for breast implants signed in 2011.

Since that time, AorTech's technology has not been incorporated

into any new device nor generated any revenue for AorTech despite

maintaining an IP portfolio in this arena. Your Board still

believes there to be substantial benefits in utilising

Elast-Eon(TM) technology in cosmetic and reconstructive surgery and

as a result recently terminated this licence in order to pursue

other opportunities in the field.

In a similar manner, we have sought to withdraw from

non-performing licences. We recently served notice of termination

on CardioSolutions, Inc which had licenced polymer for use in heart

valve repair, as two annual minimum payments had been missed.

Ongoing Litigation

As shareholders are aware, AorTech has been embroiled in

long-running litigation against its former CEO and related parties.

The Court recently heard four motions for partial summary

judgement. One of these motions was brought by AorTech against Mr

Frank Maguire seeking judgement on Mr Maguire's breach of his

service agreement. The other three motions for partial summary

judgement were brought by defendants after the AorTech motion was

briefed. These motions included a cross motion seeking denial of

AorTech's motion on Mr Maguire's breach of contract; a motion

seeking summary judgement on an alleged breach by AorTech of a

consulting agreement with Mr Maguire, and a motion seeking summary

judgement on alleged non-payment of travel expenses incurred by Mr

Maguire a number of years prior to his resignation. At the time of

writing, the Court has still to issue its rulings on these motions

together with two other motions for partial summary judgement heard

nearly two years ago.

A significant amount of work has been undertaken, yet due to the

confidentiality of the process and the materials shared with the

Court, very little detail can be reported to shareholders.

AorTech remains confident in its position and is committed to

pursuing justice on behalf of shareholders.

Board Changes

Mr Eddie McDaid retired as Chief Executive Officer and a

Director last October. Your Board wishes to express its gratitude

to Mr McDaid for his dedication and hard work and to wish him a

long and happy retirement.

The vacancy on the Board created by Eddie's retirement was

filled by the appointment of John McKenna as a Non-executive

Director.

Conclusion

Despite the fall in revenue over the year, the overall quality

and maintainability of sales is much better year on year. A new

revenue-generating licence has been signed and enquiries have

increased markedly. We have taken back control of our breast

implant IP and are actively pursuing opportunities to exploit this

alongside our other intellectual property, including heart valves

and polymers.

W Brown

Chairman and Chief Executive Officer

15 August 2017

Consolidated income statement

Year ended 31 March Year ended 31 March

2017 2016

Pre-exceptional Pre-exceptional

items Exceptional items Exceptional

items Total items Total

Notes US$000 US$000 US$000 US$000 US$000 US$000

Revenue 3 614 - 614 751 - 751

Other income - - - 150 - 150

Administrative

expenses (571) 12 (559) (1,084) (80) (1,164)

Other expenses

- amortisation

of intangible

assets 11 (292) - (292) (312) - (312)

--------------

Operating loss 3 (249) 12 (237) (495) (80) (575)

Finance (expense)

/ income 8 - - - - (29) (29)

---------------- -------------- --------- ---------------- -------------- ----------

Loss from

continuing

operations

attributable

to owners of

the parent

company 5 (249) 12 (237) (495) (109) (604)

Loss attributable

to owners of

the parent

company (249) 12 (237) (495) (109) (604)

Loss per share

Basic and diluted

(US cents per

share) 10 (4.27) (12.00)

Consolidated statement of comprehensive income

Year

ended Year

31 ended

March 31 March

2017 2016

US$000 US$000

Loss for the year (237) (604)

Other comprehensive income:

I Items that will not be reclassified

subsequently to profit and loss

Exchange differences (2,329) (586)

Items that will be reclassified

subsequently to profit and loss

Exchange differences 2,125 551

-------- ----------

Other comprehensive income for

the year, net of tax (204) (35)

-------- ----------

Total comprehensive income for

the year, attributable

to owners of the parent company (441) (639)

Consolidated balance sheet

31 March 31 March

2017 2016

US$000 US$000

Notes

Assets

Non current assets

Intangible assets 11 914 1,367

Total non current assets 914 1,367

---------- ---------------------

Current assets

Trade and other receivables 13 392 243

Cash and cash equivalents 14 114 314

Total current assets 506 557

---------- ---------------------

Total assets 1,420 1,924

---------- ---------------------

Liabilities

Current liabilities

Trade and other payables 15 (102) (165)

Total current liabilities (102) (165)

---------- ---------------------

Total liabilities (102) (165)

Net assets 1,318 1,759

========== =====================

Equity

Issued capital 17 15,189 17,426

Share premium 17 3,133 3,595

Other reserve (2,511) (2,881)

Foreign exchange reserve 8,752 6,627

Profit and loss account (23,245) (23,008)

Total equity attributable

to equity holders of the

parent 1,318 1,759

========== =====================

The Consolidated financial statements were approved by the Board

on 15 August 2017 and were signed on its behalf by W Brown,

Chairman and CEO, and G Wright, Director

Company number SC170071

Consolidated cash flow statement

Year

ended Year ended

31 March 31 March

2017 2016

US$000 US$000

Cash flows from operating activities

Group loss after tax (237) (604)

Adjustments for:

Amortisation of intangible assets 292 312

Finance expense / (income) - 29

(Increase) / decrease in trade

and other receivables (149) 494

Decrease in trade and other

payables (106) (109)

----------- -----------------------

Net cash flow from continuing

operations (200) 122

Net cash flow from operating

activities (200) 122

Cash flows from investing activities

Purchase of intangible assets - (168)

----------- -----------------------

Net cash flow from continuing

operations - (168)

Net cash flow from investing

activities - (168)

----------- -----------------------

Net cash flow from financing

activities - -

----------- -----------------------

Net decrease in cash and cash

equivalents (200) (46)

Cash and cash equivalents at

beginning of year 314 360

Cash and cash equivalents at

end of year 114 314

=========== =======================

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of preparation

The Consolidated financial statements are for the year ended 31

March 2017. They have been prepared in compliance with

International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee (IFRIC) interpretations as adopted by the

European Union as at 31 March 2017.

The Consolidated financial statements have been prepared under

the historical cost convention.

The accounting policies remain unchanged from the previous

year.

2. Going concern

After considering the year end cash position, making appropriate

enquiries and reviewing budgets and profit and cash flow forecasts

to 31 March 2023, the Directors have formed a judgement at the time

of approving the financial statements that there is a reasonable

expectation that the Group has sufficient resources to continue in

operational existence for the foreseeable future. For this reason

the Directors consider the adoption of the going concern basis in

preparing the Consolidated financial statements is appropriate.

3. Preliminary announcement

The summary accounts set out above do not constitute statutory

accounts as defined by Section 434 of the UK Companies Act 2006.

The summarised consolidated balance sheet at 31 March 2017, the

summarised consolidated income statement, the summarised

consolidated statement of comprehensive income, the summarised

consolidated statement of changes in equity and the summarised

consolidated cash flow statement for the year then ended have been

extracted from the Group's statutory financial statements for the

year ended 31 March 2017 upon which the auditor's opinion is

unqualified and did not contain a statement under either sections

498(2) or 498(3) of the Companies Act 2006. The audit report for

the year ended 31 March 2016 did not contain statements under

Section 498(2) or Section 498(3) of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2016

have been delivered to the Registrar of Companies. The 31 March

2017 accounts were approved by the Directors on 15 August 2017, but

have not yet been delivered to the Registrar of Companies.

4. Earnings per share

The basic loss per ordinary share of 4.27 US cents (2016: loss

of 12.00 US cents) is calculated on the loss of the Group of

US$237,000 (2016: loss of US$604,000) and on 5,557,695 (2016:

5,032,823) equity shares, being the weighted average number of

shares in issue during the year.

The diluted loss per share does not differ from the basic loss

per share as the exercise of share options would have the effect of

reducing the loss per share and is therefore not dilutive under the

terms of IAS 33.

5. Current operations

On 1 October 2013, the Group signed an agreement with Biomerics

LLC for the manufacture and distribution of our patented materials,

including to our existing licensees. In the opinion of the

Directors, the Biomerics transaction transformed the Group into a

pure intellectual property company.

Notice of Annual General Meeting

Notice of the twentieth Annual General Meeting of AorTech

International Plc will be posted with the Annual

Report and Accounts and will be held in the offices of Kergan

Stewart LLP, 163 Bath Street, Glasgow G2 4SQ

on Wednesday, 27 September 2017 at 11:00am.

Posting and availability of accounts

The annual report and accounts for the year ended 31 March 2017

will be sent by post or electronically to all registered

shareholders on 1 September 2017. Additional copies will be

available for a month thereafter from the Company's Weybridge

office. Alternatively, the document may be viewed on, or downloaded

from, the Company's website: www.aortech.net.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PAMATMBJBBPR

(END) Dow Jones Newswires

August 16, 2017 02:00 ET (06:00 GMT)

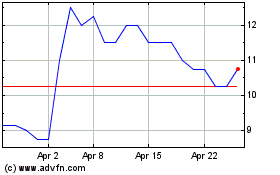

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024