UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 20F

|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

|

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

o

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report: Not Applicable

For the transition period from ______________ to ______________

Commission File Number 001-32670

MINCO GOLD CORPORATION

(Exact name of registrant as specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, V6E 3R5

(Address of principal executive offices)

Jennifer Trevitt, (604) 688-8002 Ext. 107 , (604) 688-8030, Suite 2772, 1055 West Georgia Street, PO Box 11176,

Vancouver, British Columbia, Canada, V6E 3R5

(Name, Telephone, Facsimile number and/or E-mail, and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Common Shares

|

|

NYSE MKT Equities, Toronto Stock Exchange

|

|

Title of each class

|

|

Name of each exchange on which registered

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2014: 50,514,881 common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o N/A

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "Accelerated filer and large accelerated file" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer: |

o |

Accelerated file: |

o |

Non-accelerated filer: |

x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP o

|

International Financial Reporting Standards as issued

|

Other o

|

| |

By the International Accounting Standards Board x

|

|

If "other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

TABLE OF CONTENTS

|

INTRODUCTION AND USE OF CERTAIN TERMS

|

|

|

|

3 |

|

| |

|

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

|

|

|

|

3 |

|

| |

|

|

|

|

|

|

CAUTIONARY NOTE ON RESOURCE AND RESERVE ESTIMATES

|

|

|

|

4 |

|

| |

|

|

|

|

|

|

TECHNICAL INFORMATION

|

|

|

|

4 |

|

| |

|

|

|

|

|

|

CURRENCY

|

|

|

|

4 |

|

| |

|

|

|

|

|

|

PRESENTATION OF FINANCIAL INFORMATION

|

|

|

|

4 |

|

| |

|

|

|

|

|

|

PART I

|

|

|

|

5 |

|

|

Item 1.

|

|

Identity of Directors, Senior Management and Advisers

|

|

|

|

5 |

|

|

Item 2.

|

|

Offer Statistics and Expected Timetable

|

|

|

|

5 |

|

|

Item 3.

|

|

Key Information

|

|

|

|

6 |

|

|

Item 4.

|

|

Information on the company

|

|

|

|

12 |

|

|

Item 4A

|

|

Unresolved Staff Comments

|

|

|

|

43 |

|

|

Item 5

|

|

Operating and Financial Review and Prospects

|

|

|

|

43 |

|

|

Item 6.

|

|

Directors, Senior Management and Employees

|

|

|

|

54 |

|

|

Item 7.

|

|

Major Shareholders and Related Party Transactions

|

|

|

|

59 |

|

|

Item 8.

|

|

Financial Information

|

|

|

|

61 |

|

|

Item 9.

|

|

The Offer and Listing

|

|

|

|

61 |

|

|

Item 10.

|

|

Additional Information

|

|

|

|

62 |

|

|

Item 11.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

|

69 |

|

|

Item 12.

|

|

Description of Securities Other than Equity Securities

|

|

|

|

69 |

|

| |

|

|

|

|

|

|

PART II

|

|

|

|

70 |

|

|

Item 13.

|

|

Defaults, Dividend Arrearages and Delinquencies

|

|

|

|

70 |

|

|

Item 14.

|

|

Material Modifications to the Rights of Security Holder and Use of Proceeds

|

|

|

|

70 |

|

|

Item 15.

|

|

Controls and Procedures

|

|

|

|

70 |

|

|

Item 16A

|

|

Audit Committee Financial Expert

|

|

|

|

71 |

|

|

Item 16B

|

|

Code of Ethics - Board of Directors and officers

|

|

|

|

71 |

|

|

Item 16C

|

|

Principal Accountant Fees and Services

|

|

|

|

71 |

|

|

Item 16D

|

|

Exemptions from the Listing Standards

|

|

|

|

71 |

|

|

Item 16E

|

|

Purchases of Equity Securities by the Issuer and Affiliate Purchasers

|

|

|

|

71 |

|

|

Item 16F

|

|

Change in Registrant’s certifying accountant

|

|

|

|

71 |

|

|

Item 16G

|

|

Corporate Governance

|

|

|

|

71 |

|

|

Item 16H

|

|

Mine Safety

|

|

|

|

71 |

|

| |

|

|

|

|

|

|

PART III

|

|

|

|

72 |

|

|

Item 17.

|

|

Financial Statements

|

|

|

|

72 |

|

|

Item 18.

|

|

Financial Statements

|

|

|

|

72 |

|

|

Item 19.

|

|

Exhibits

|

|

|

|

73 |

|

INTRODUCTION AND USE OF CERTAIN TERMS

Minco Gold Corporation (formerly "Minco Mining & Metals Corporation") is incorporated under the laws of the province of British Columbia, Canada. In this document, the terms "the Company", "we" our" and "us" refer to Minco Gold Corporation and its consolidated subsidiaries. Where required, the term "Minco Gold" refers to Minco Gold Corporation as a standalone entity. The Company’s consolidated financial statements are prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board ("IFRS"), and are presented in Canadian dollars. The Company files reports and other information with the Securities and Exchange Commission ("SEC"), located at 100 F St. NE, Washington, D.C. 20549. Copies of the Company’s filings with the SEC may be obtained by accessing the SEC’s website located at www.sec.gov. Further, the Company also files reports under Canadian securities regulatory requirements on the System for Electronic Data Analysis and Retrieval ("SEDAR"). Copies of the Company’s reports filed on SEDAR can be obtained by accessing SEDAR’s website at www.sedar.com. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, V6E 3R5, Tel: 604-688-8002, Fax: 604-688-8030, email address info@mincomining.ca and website www.mincomining.ca.

FORWARD-LOOKING STATEMENTS

This document contains certain forward-looking information and statements, including statements relating to matters that are not historical facts and statements of our beliefs, intentions and expectations about developments, results and events which will or may occur in the future, which constitute "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, collectively referred to as "forward-looking statements". Forward-looking statements are typically identified by words such as "anticipate", "could", "should", "expect", "seek", "may", "intend", "likely", "will", "plan", "estimate", "believe" and similar expressions suggesting future outcomes or statements regarding an outlook.

Forward-looking statements are included throughout this document and include, but are not limited to, statements with respect to: our plans for future exploration programs for our mineral properties; our ability to generate working capital; markets; economic conditions; performance; business prospects; results of operations; capital expenditures; and foreign exchange rates. All such forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors we believe are relevant in the circumstances. These statements are, however, subject to known and unknown risks and uncertainties and other factors. As a result, our actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits will be derived therefrom. These risks, uncertainties and other factors include, among others: our interest in our mineral properties may be challenged or impugned by third parties or governmental authorities; economic, political and social changes in China; uncertainties relating to the Chinese legal system; failure or delays in obtaining necessary approvals; exploration and development is a speculative business; the Company's inability to obtain additional funding for the Company's projects on satisfactory terms, or at all; hazardous risks incidental to exploration and test mining; the Company has limited experience in placing resource properties into production; government regulation; high levels of volatility in market prices; environmental hazards; currency exchange rates; the Company's ability to obtain mining licenses and permits in China; and the other risks and uncertainties set forth in more detail in the section of this Annual Report entitled "Item 3: Key Information – D. Risk Factors".

Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that could cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements containing forward looking information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. All of the forward-looking statements contained in this document are expressly qualified, in their entirety, by this cautionary statement. The various risks to which we are exposed are described in additional detail in this document under the section entitled "Item 3: Key Information – D. Risk Factors". The forward-looking statements are made as of the date of this document and the Company undertakes no obligation to update forward looking statements if circumstances or management’s estimates or opinions should change except as required by law. Users of this Annual Report are cautioned not to place undue reliance on forward looking statements.

CAUTIONARY NOTE ON RESOURCE AND RESERVE ESTIMATES

As a reporting issuer in Canada, the Company is required by Canadian law to provide disclosure respecting its mineral interests in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Accordingly, readers are cautioned that the information contained in this Annual Report may not be comparable to similar information made public by U.S. companies under the United States federal securities laws and the rules and regulations thereunder. In particular, the terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" as may be used herein are not defined in SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Readers are cautioned not to assume that any part of or all mineral deposits in these categories will ever be converted into mineral reserves with demonstrated economic viability. In addition, the estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. readers are cautioned not to assume that part of or all of an inferred mineral resource exists, or is economically or legally minable.

Further, the terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms, the definitions of which differ from the definitions of the SEC. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

TECHNICAL INFORMATION

This Annual Report contains information of a technical or scientific nature respecting the Company's mineral properties ("Technical Information"). Technical Information respecting the Company's properties is primarily derived from the documents referenced herein. All other Technical Information which appears in this Annual Report has been reviewed and approved by Thomas Wayne Spilsbury, an independent director of Minco Silver Corporation (“Minco Silver”), a company in which the Company owned an 18.45% equity interest as at December 31, 2014. Mr. Spilsbury is a Member of the Association of Professional Engineers and Geoscientists of British Columbia (P Geo), a Member of the Australian Institute of Geoscientists and a Fellow of the Australasian Institute of Mining and Metallurgy CP (Geo) and is a "qualified person", as defined in NI 43-101. The Company operates quality assurance and quality control of sampling and analytical procedures.

CURRENCY

Unless otherwise indicated, all references in this document to "$" and "dollars" are to Canadian dollars, all references to "US$" and "US dollars" are to United States dollars and all references to "RMB" are to the Chinese Renminbi.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise stated, all financial information presented herein has been prepared in accordance with IFRS as issued by the IASB.

Due to rounding, numbers presented throughout this document may not add up precisely to the totals we provide and percentages may not precisely reflect the absolute figures.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

|

A.

|

SELECTED FINANCIAL DATA

|

The following selected financial information for the fiscal years ended December 31, 2014, 2013, 2012, 2011, and 2010 is derived from the audited financial statements of the Company and the notes thereto, which are prepared in accordance with IFRS as issued by the IASB, and should be read in conjunction with such financial statements and with the information appearing under the heading "Item 5: Operating and Financial Review and Prospects".

| |

|

|

|

|

Fiscal Year ended December 31,

|

|

|

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration expense

|

|

|

1,177,817 |

|

|

|

1,550,251 |

|

|

|

1,617,289 |

|

|

|

1,963,874 |

|

|

|

1,467,641 |

|

|

Exploration recovery

|

|

|

- |

|

|

|

(622,293 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Operating loss

|

|

|

3,026,755 |

|

|

|

3,662,049 |

|

|

|

4,444,854 |

|

|

|

6,275,689 |

|

|

|

3,691,505 |

|

|

Finance and other income (expense)

|

|

|

(4,471,039 |

) |

|

|

1,452,290 |

|

|

|

614,636 |

|

|

|

(128,474 |

) |

|

|

34,006 |

|

|

Income (Loss) from continuing operations

|

|

|

(7,497,794 |

) |

|

|

(2,943,305 |

) |

|

|

(4,871,432 |

) |

|

|

862,446 |

|

|

|

(2,058,649 |

) |

|

Income from discontinued operations

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,607,301 |

|

|

Net Income (loss)

|

|

|

(7,497,794 |

) |

|

|

(2,943,305 |

) |

|

|

(4,871,432 |

) |

|

|

862,446 |

|

|

|

(451,348 |

) |

|

Income (Loss) per Common share from continuing operations-basic and diluted

|

|

|

(0.15 |

) |

|

|

(0.06 |

) |

|

|

(0.10 |

) |

|

|

0.02 |

|

|

|

(0.04 |

) |

|

Net Income (Loss) per Common share (basic and diluted)

|

|

|

(0.15 |

) |

|

|

(0.06 |

) |

|

|

(0.10 |

) |

|

|

0.02 |

|

|

|

(0.01 |

) |

|

Common shares used in calculations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

50,488,078 |

|

|

|

50,348,215 |

|

|

|

50,348,215 |

|

|

|

50,228,592 |

|

|

|

48,582,347 |

|

|

Diluted

|

|

|

50,488,078 |

|

|

|

50,348,215 |

|

|

|

50,348,215 |

|

|

|

51,580,329 |

|

|

|

48,582,347 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

9,405,439 |

|

|

|

16,246,355 |

|

|

|

19,171,997 |

|

|

|

22,176,773 |

|

|

|

23,700,260 |

|

|

Total liabilities

|

|

|

4,502,225 |

|

|

|

4,304,484 |

|

|

|

8,707,332 |

|

|

|

7,715,102 |

|

|

|

13,469,839 |

|

|

Non-controlling interest

|

|

|

4,988,512 |

|

|

|

5,124,196 |

|

|

|

2,425,368 |

|

|

|

2,415,029 |

|

|

|

2,444,005 |

|

|

Net assets

|

|

|

4,903,214 |

|

|

|

11,941,871 |

|

|

|

10,464,665 |

|

|

|

14,461,671 |

|

|

|

10,230421 |

|

|

Share capital

|

|

|

41,882,757 |

|

|

|

41,758,037 |

|

|

|

41,758,037 |

|

|

|

41,758,037 |

|

|

|

40,335,033 |

|

|

Dividends

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

Exchange Rates

The following table sets forth information as to the average, period end, high and low exchange rate for Canadian dollars and US dollars for the periods indicated based on the Bank of Canada nominal noon exchange rates (USD to CAD) in Canadian dollars (US$1.00 = $1.2511 as at March 31, 2015).

| Year Ended December 31 |

|

Average |

|

|

Period End |

|

|

High |

|

|

Low |

|

|

2014

|

|

|

1.1045 |

|

|

|

1.1601 |

|

|

|

1.1643 |

|

|

|

1.0614 |

|

|

2013

|

|

|

1.0299 |

|

|

|

1.0636 |

|

|

|

1.0697 |

|

|

|

0.9839 |

|

|

2012

|

|

|

0.9996 |

|

|

|

0.9949 |

|

|

|

1.0418 |

|

|

|

0.9710 |

|

|

2011

|

|

|

0.9891 |

|

|

|

1.0162 |

|

|

|

1.0604 |

|

|

|

0.9449 |

|

|

2010

|

|

|

1.0299 |

|

|

|

0.9931 |

|

|

|

1.0778 |

|

|

|

0.9946 |

|

|

Month

|

|

Average

|

|

|

Period End

|

|

|

High

|

|

|

Low

|

|

|

February 2015

|

|

|

1.2500 |

|

|

|

1.2508 |

|

|

|

1.2635 |

|

|

|

1.2403 |

|

|

January 2015

|

|

|

1.2115 |

|

|

|

1.2717 |

|

|

|

1.2717 |

|

|

|

1.1728 |

|

|

December 2014

|

|

|

1.1533 |

|

|

|

1.1601 |

|

|

|

1.1643 |

|

|

|

1.1344 |

|

|

November 2014

|

|

|

1.326 |

|

|

|

1.1427 |

|

|

|

1.1427 |

|

|

|

1.1236 |

|

|

October 2014

|

|

|

1.1213 |

|

|

|

1.1275 |

|

|

|

1.1289 |

|

|

|

1.1136 |

|

|

B.

|

CAPITALIZATION AND INDEBTEDNESS

|

Not Applicable.

|

C.

|

REASONS FOR THE OFFER AND USE OF PROCEEDS

|

Not Applicable.

An investment in our securities should be considered highly speculative and involves a high degree of financial risk due to the nature of our activities and the current status of our operations. Readers and prospective investors should carefully consider the risks summarized below and all other information contained in this Annual Report before making an investment decision relating to our shares. Some statements in this Annual Report (including some of the following risk factors) are forward-looking statements. Please refer to the discussion of forward-looking statements in the introduction to this Annual Report. Any one or more of these risks could have a material adverse effect on the value of any investment in our Company and the business, financial position or operating results of our Company and should be taken into account in assessing our activities. The risks noted below do not necessarily comprise all those faced by us.

Risks Relating to the Company

Title to Properties

To the knowledge of the Company, none of its property interests have been surveyed to establish boundaries. There can be no assurance that any governmental authority in China could not significantly alter the conditions of or revoke the applicable exploration or mining authorizations held by the Company or that the Company's interest in such properties will not be challenged or impugned by third parties or governmental authorities.

In addition, there can be no assurance that the properties or other assets in which the Company has an interest are not subject to prior unregistered agreements, transfers, pledges, mortgages or claims and title may be affected by undetected defects as it is difficult to verify that no agreements, transfers, claims, mortgages, pledges or other encumbrances exist given the state of the legal and administrative systems in China.

China Political and Economic Considerations

The business operations of the Company will be located in, and the revenues of the Company derived from activities in, China. Likewise, the Company's operations in China are currently conducted through and with the assistance of Minco Mining (China) Co., Ltd. ("Minco China"), a Wholly Foreign-Owned Enterprise ("WFOE"). Accordingly, the business, financial condition and results of operations of the Company could be significantly and adversely affected by economic, political and social changes in China. The economy of China has traditionally been a planned economy, subject to five-year and annual plans adopted by the state, which set national economic development goals. Since 1978, China has been moving the economy from a planned economy to a more open, market-oriented system. The economic development of China is following a model of market economy under socialism. Under this direction, it is expected that China will continue to strengthen its economic and trading relationships with foreign countries and that business development in China will follow market forces and the rules of market economics.

However, the Chinese government continues to play a significant role in regulating industry by imposing industrial policies. In addition, there is no guarantee that a major turnover of senior political decision makers will not occur, or that the existing economic policy of China will not be changed. A change in policies by China could adversely affect the Company's interests in China by changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports and sources of supplies, or the expropriation of private enterprises. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of companies engaged in mineral resource exploration and development, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties. Companies with a foreign ownership component operating in China may be required to work within a framework which is different to that imposed on domestic Chinese companies. The Chinese government is opening up opportunities for foreign investment in mining projects and this process is expected to continue. However, if the Chinese government should reverse this trend and impose greater restrictions on foreign companies, the Company's business and future earnings could be negatively affected.

Chinese Legal System and Enforcement

Most of the material agreements to which the Company or its affiliates are party or will be party in the future with respect to mining assets in China are expected to be governed by Chinese law and some may be with Chinese governmental entities. The Chinese legal system embodies uncertainties that could limit the legal protection available to the Company and its shareholders. The outcome of any litigation may be more uncertain than usual because: (i) the experience of Chinese judiciary in the industry in which we operate is relatively limited, and (ii) the interpretation of Chinese laws may be subject to policy changes reflecting domestic political changes. The laws that do exist are relatively recent and their interpretation and enforcement involve uncertainties, which could limit the available legal protections. Even where adequate laws exist in China, it may be impossible to obtain swift and equitable enforcement of such laws or to obtain enforcement of judgments by a court of another jurisdiction, which could have a material adverse impact on the Company. Many tax rules are not published in China, and those that are published can be ambiguous and contradictory, leaving a considerable amount of discretion to local tax authorities. China currently offers tax and other preferential incentives to encourage foreign investment. However, the tax regime of China is undergoing review and there is no assurance that such tax and other incentives will continue to be available. There is also no guarantee that the pursuit of economic reforms by the Government will be consistent or effective and as a result, changes in the rate or method of taxation, reduction in tariff protection and other import restrictions and changes in state policies affecting the mining industry may have a negative effect on our operating results and financial condition.

Government Regulation of Mineral Resources and Ownership

Ownership of land in China remains with the State, and the State, at the national, regional and local levels, is extensively involved in the regulation of exploration and mining activities. Transfers and issuances of exploration and mining rights are also subject to governmental approval. Failure or delays in obtaining necessary approvals could have a materially adverse effect on the financial condition and results of operations of the Company. Nearly all mining projects in China require government approval. There can be no certainty that any such approvals will be granted (directly or indirectly) to the Company in a timely manner, or at all.

Exploration and Development is a Speculative Business

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, the availability of mining equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital. The long-term profitability of the Company's operations will in part be directly related to the costs and success of its exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. If our exploration costs are greater than anticipated, we will have fewer funds for our exploration activities and for our general and administrative expenses, which in turn will adversely affect our financial condition and ability to pursue our exploration programs. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations, that commercially viable mineral deposits exist on our properties or that funds required for development can be obtained on a timely basis.

Future Financing

The Company currently has limited financial resources and there is no assurance that additional funding will be available to it for further exploration and development of its projects. There can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of the Company's projects with the possible loss of such properties.

Joint Venture Agreement

There is no guarantee that Minco Gold and its other partners will be able to fund the Changkeng project owned by Guangzhou Mingzhong Mining Co. Ltd (“Mingzhong”). Mingzhong, the entity that holds the Changkeng Permit (as defined below), is owned in part by certain state-owned entities which require government approvals before they are able to increase their investment in Mingzhong. It is unclear when these approvals will be granted, if at all.

Industry Specific Risks

The exploration, development, and production of minerals are capital-intensive businesses, subject to the normal risks and capital expenditure requirements associated with mining operations, which even a combination of experience, knowledge and careful evaluation may not be able to overcome.

Operations that we undertake will be subject to hazardous risks incidental to exploration and test mining, including, but not limited to work stoppages, equipment failure and possible environmental damage. Liabilities resulting from such events may result in us being forced to incur significant costs that could have a material adverse effect on our financial condition and business prospects.

Limited Experience with Development-Stage Mining Operations

The Company has limited experience in placing resource properties into production, and its ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that the Company will have available to it the necessary expertise if the Company places its resource properties into production.

Factors Beyond Company's Control

Discovery, location and development of mineral deposits depend upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The exploration and development of mineral properties and the marketability of any minerals contained in such properties will also be affected by numerous factors beyond the control of the Company. These factors include government regulation, high levels of volatility in market prices, availability of markets, availability of adequate transportation and refining facilities and the imposition of new, or amendments to existing, taxes and royalties. The effect of these factors cannot be accurately predicted.

Potential Conflicts of Interest

Certain members of the Company's board of directors (the “Board”) and officers of the Company also serve as officers or directors of other companies involved in natural resource exploration and development. Consequently, there exists the possibility that those directors and officers may be in a position of conflict. In particular, Ken Z. Cai is a director of and serves in management in each of the Company, Minco Silver and Minco Base Metals Corporation ("Minco Base Metals").

In addition, Samson Siu serves as Interim Chief Financial Officer and Jennifer Trevitt serves as Corporate Secretary for each of the Company, Minco Silver and Minco Base Metals. Any decision made by such directors and officers will be made in accordance with their duties and obligations to deal fairly and in good faith with the Company and such other companies. In addition, such directors and officers will declare, and refrain from voting on, any matter in which such directors or officers may have a conflict of interest. Nevertheless, there remains the possibility that the best interests of the Company will not be served because its directors and officers have other commitments. Matters between the Company and Minco Silver which put any of the directors or officers of the Company in a position of conflict are approved by the audit committee of the Board which comprises of solely independent directors.

In addition to the potential conflicts described above, some of the directors and officers of the Company are also directors or officers of other reporting and non-reporting issuers who are engaged in other industry sectors. Accordingly, conflicts of interest may arise which could influence the decisions or actions of directors or officers acting on behalf of the Company.

Scope of Business

In China, companies are granted a business license which specifies the scope of activities that they are permitted to undertake. Although Minco China has taken steps to ensure that all of its business activities are within the scope of its business license, there is no assurance that the relevant Chinese authorities will agree with such assessment. If Minco China is determined to have exceeded the scope of its business license, it could be subject to penalties or other sanctions.

Uninsured Risks

The Company's mining activities are subject to the risks normally inherent in mineral exploration, including, but not limited to, environmental hazards, industrial accidents, flooding, periodic or seasonal interruptions due to climate and hazardous weather conditions, and unusual or unexpected formations. Such risks could result in damage to or destruction of mineral properties or production facilities, personal injury, environmental damage, delay in mining and possible legal liability. The Company may become subject to liability for pollution and other hazards against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. The payment for such liabilities would reduce the funds available for exploration and mining activities and may have a material impact on the Company's financial position.

Currency Exchange Rates

The Company maintains its accounts in Canadian dollar and RMB denominations. Given that most of Minco Gold's expenditures are currently, and are anticipated to be, incurred in RMB, Minco Gold is subject to foreign currency fluctuations which may affect its financial position and operating results. The Company does not currently have a formal hedging program to mitigate foreign currency exchange risks.

Repatriation of Capital Located in China

The Company may face delays repatriating funds held in China if at any time the Company needs additional resources to enable it to undertake projects elsewhere in the world. There are certain restrictions on the repatriation of funds held in China, as more particularly described below.

Under Chinese law, repatriation of funds from China falls under several categories: (1) profit and capital repatriation; (2) liquidation; and (3) overseas loan repayment. The major requirements for each of the repatriation methods are as follows:

|

1.

|

Profit repatriation – A WFOE may repatriate its after-tax profits out of China with few restrictions. Minco China is classified as a WFOE. Profit repatriation can only be undertaken once a year.

|

| |

(a)

|

Capital Repatriation – Under Chinese law, capital repatriation can only be made under the following circumstances: Share/Equity Interest Sale – In the event that a foreign investor, as an assignor, intends to sell its equity interest in the WFOE to any other foreign or domestic entities/individuals, as an assignee, the approval from the original approving authority, such as the local Department of Commerce ("DOC") is required. Such governmental approval for an equity sale is not difficult to obtain in normal circumstances and it would normally take one to two months after all of the required documents have been submitted, subject to local practice.

Once the governmental approval is obtained, the assignee is obliged to apply to the local State Administration for Foreign Exchange ("SAFE"), for the approval of mailing the payment of the transfer price to the assignor, which can normally be done within 20 business days after all of the required documents have been submitted.

|

| |

(b)

|

Capital Decrease – Generally, a WFOE must not decrease its registered capital during its operating term. However, if its registered capital needs to be decreased due to the change of the total investment amount or operation scale or for other reasons, such decrease could be done after approval from the original approval authority has been obtained.

The procedures for capital decrease are as follows:

|

| |

(i)

|

The WFOE would apply to the local DOC for a preliminary approval of a capital decrease;

|

| |

(ii)

|

After receiving the preliminary reply, the WFOE would notify all of its creditors in writing for such capital decrease and the WFOE would publically disclose such capital decrease in provincial newspapers at least three times;

|

| |

(iii)

|

The creditors may require the WFOE to pay off all debts or provide corresponding guarantees to pay any outstanding debts;

|

| |

(iv)

|

After the WFOE has made at least three public notices in provincial newspapers, it would apply to the local DOC for formal approval of the capital decrease;

|

| |

(v)

|

Once the DOC has approved the decrease of the registered capital, the WFOE would conduct the registration change at the local Administration for Industry and Commerce ("AIC"); and

|

| |

(vi)

|

Upon completion of the above procedures, if the then contributed capital of the WFOE exceeds the registered capital after the decrease; the WFOE would apply for the capital repatriation approval of the decreased capital to its investor(s) at the local SAFE. Once approval is received, the bank can remit the exceeded capital.

|

| |

|

The above process takes approximately six months to complete.

|

|

2.

|

Liquidation – The investor may also voluntarily liquidate the WFOE in accordance with relevant Chinese law and the articles of association of the WFOE. The procedures for the liquidation of a foreign investment are as follows:

|

| |

(a)

|

A resolution to liquidate the WFOE is adopted;

|

| |

(b)

|

The WFOE applies to the local DOC for approval of the liquidation;

|

| |

(c)

|

The WFOE sets up a liquidation committee to conduct the liquidation;

|

| |

(d)

|

Notices to creditors and public announcements about the liquidation must be made;

|

| |

(e)

|

The liquidation committee would handle the sale of the assets of the WFOE and the distribution of the liquidation proceeds and submit a distribution report to the local DOC;

|

| |

(f)

|

The deregistration of the WFOE must be conducted with the local AIC and local tax, customs, foreign exchange and other authorities; and

|

| |

(g)

|

Upon completion of the above procedures, the investor would apply to the local SAFE for repatriation of the liquidated proceeds. Once approval is received, the bank can remit the liquidated proceeds.

|

| |

|

The above process takes approximately six months to complete.

|

|

3.

|

Overseas Loan Repayment - Under Chinese law, a WFOE may borrow overseas loans from its investors or other overseas companies or financial institutions, provided that the overseas loan amount shall not exceed the balance between the total investment amount and the registered capital of the WFOE. The procedures for registration and repayment of such overseas loans are as follows:

|

| |

(a)

|

The WFOE would register the overseas loan with the local SAFE and obtain loan registration certificates issued by the local SAFE;

|

| |

(b)

|

After registration, the WFOE would open a special foreign exchange cash account with domestic banks to receive the overseas loan;

|

| |

(c)

|

When the WFOE repays the overseas loan, it would apply to the local SAFE for the repayment approval; and

|

| |

(d)

|

Upon the issuance of the repayment approval of the local SAFE, the WFOE would submit the overseas loan registration certificate and the repayment approval issued by the local SAFE to the banks and the banks would conduct payment operations through the WFOE's special foreign exchange cash account for the overseas loan or the special foreign exchange cash account for the overseas loan repayment.

|

Competition

The precious metal minerals exploration industry and mining business are intensely competitive. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mining properties. Many of these competitors have substantially greater technical and financial resources than the Company. Competition could adversely affect the Company's ability to acquire suitable properties or prospects in the future.

Uncertainty of Estimates

Resource and reserve estimates of minerals are inherently imprecise and depend to some extent on statistical inferences drawn from limited drilling, which may prove unreliable. Although estimated recoveries are based upon test results, actual recovery may vary with different rock types or formations in a way which could adversely affect operations.

Reliance on Management and Directors

The success of the Company is currently largely dependent on the performance of its officers. The loss of the services of these persons could have a materially adverse effect on the Company's business, prospects, and financial position. There is no assurance that the Company can maintain the services of its officers or other qualified personnel required to operate its business. Failure to do so could have a material adverse effect on the Company and its prospects. The Company has not purchased any "key-man" insurance with respect to any of its directors or officers as of the date hereof.

Fluctuating Mineral Prices

Factors beyond the control of the Company may affect the marketability of metals discovered, if any. Metal prices have fluctuated widely, particularly in recent years. The effect of these factors cannot be predicted. Fluctuations in the price of gold may also adversely affect our ability to obtain future financing to fund our planned exploration programs.

The Mining Industry Is Highly Speculative

The Company is engaged in the exploration for minerals, which involves a high degree of geological, technical and economic uncertainty because of the inability to predict future mineral prices, as well as the difficulty of determining the extent of a mineral deposit and the feasibility of its extraction without incurring considerable expenditures.

Environmental Considerations

Although China has enacted environmental protection legislation to regulate the mining industry, due to the very short history of this legislation, national and local environmental protection standards are still in the process of being formulated and implemented. The legislation provides for penalties and other liabilities for the violation of such standards and establishes, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are being or have been conducted.

Although the Company intends to fully comply with all environmental regulations, there is a risk that permission to conduct exploration and development activities could be withdrawn temporarily or permanently where there is evidence of serious breaches of such standards.

The operation of the Fuwan Project and the underlying property is generally determined by Minco Silver and we have no decision making power as to how the property is operated.

We have a material interest in the Fuwan Project held by Minco Silver through its subsidiary. Minco Silver generally has the power to determine the manner in which the Fuwan Project is or will be operated, including decisions to explore the property and put it into production. The interests of Minco Silver and our Company may not always be aligned. Our inability to control the operations of the Fuwan Project may adversely affect our profitability, results of operations and financial condition. Similar adverse effects may result from any other interests we may acquire that are primarily operated by another company. In addition, we have no or very limited access to technical, geological data relating to the mine, including data as to resources or reserves, and we have not received a NI 43-101 compliant technical report in respect of the Fuwan Project addressed to us. As such, we cannot independently determine reserve or resource amounts and are instead wholly dependent on the determination of the reserves and resources by Minco Silver. We can provide no assurances as to the level of reserves or resources on the property. If Minco Silver determines there are insufficient reserves to economically operate a mine, it may determine not to commence mining operations on the property, which could have a material adverse effect on our profitability, results of operations and financial condition. Minco Silver's failure to perform or other decisions made by Minco Silver, including as to scaling back or ceasing operations, could have a material adverse effect on our revenue, results of operations and financial condition.

Terrorist or Cyber-Attacks

Terrorist attacks and threats, cyber-attacks, escalation of military activity or acts of war may have significant effects on general economic conditions and market liquidity, each of which could materially and adversely affect the Company’s business. Future terrorist or cyber-attacks, rumors or threats of war, actual conflicts involving the U.S., Canada or their respective allies, or military or trade disruptions may significantly affect the Company’s operations. The Company does not maintain specialized insurance for possible liability resulting from a cyber-attack on its assets that may impact the Company’s business. It is possible that any of these occurrences, or a combination of them, could have a material adverse effect on the Company’s business, financial condition and results of operations.

ITEM 4. INFORMATION ON THE COMPANY

|

A.

|

HISTORY AND DEVELOPMENT OF THE COMPANY

|

Name, Address and Incorporation

Minco Gold was incorporated under the Business Corporations Act (British Columbia) on November 5, 1982, under the name "Caprock Energy Ltd." The Company changed its name to "Minco Gold Corporation" on January 29, 2007. The Company has subsidiaries which are also engaged in the acquisition and exploration of mineral projects in China. See "Item 4: Organizational Structure".

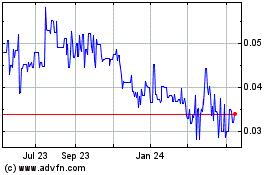

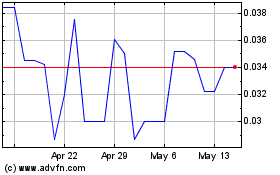

The principal executive office and registered office of the Company is located at Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3R5, telephone number 604-688-8002, fax number 604-688-8030 and email address info@mincomining.ca. The Company's shares trade on the Toronto Stock Exchange (the "TSX") under the trading symbol "MMM". The Company began trading on the NYSE MKT on November 22, 2005 under the trading symbol "MMK". On February 1, 2007, the trading symbol on the NYSE MKT was changed from "MMK" to "MGH".

The Company is in the exploration stage and had no operating revenue during the years ended December 31, 2014, 2013 and 2012. Since the signing of the Company's first co-operation agreement in China in 1995, the Company has been active in mineral exploration, property evaluation and acquisition in China. Over the years, the Company has established strong ties with Chinese governmental bureaus and also with Chinese mining enterprises. The Company's senior management has in-depth experience with the intricacies of Chinese mining laws, permitting and licensing procedures.

At present, the Company is an exploration-stage company and further exploration will be required on its properties before final evaluations as to commercial feasibility can be determined. Other than the Company's interest in the Fuwan Silver Project owned by Minco Silver discussed below, none of the mineral properties owned by the Company have known reserves, and none of such properties are the commercial development or production stage. No assurance can be given that any of the Company's properties will become commercially viable. Further, the Company's interest in joint ventures that own properties will be subject to dilution if the Company fails to expend further funds on the project. The Company has not generated cash flows from operations. These facts increase the uncertainty and risks faced by investors in the Company. See "Item 3: Key Information – D. Risk Factors".

Overview for 2014

Longnan Project - the Company has compiled and analyzed the exploration data from last year’s exploration program on the Baimashi area of the Yejiaba project, which is located in the Wudu district of Gansu Province, China. Four drilling targets were identified, and the Company’s drilling program on the Baimashi area began in early July 2014 and was completed in the fourth quarter of 2014. In 2014, the Company drilled 870.35 meters over four targets. See the discussion of drilling results under “Description of Properties.”

In its continuing efforts to dispose of its non-core assets, Minco China entered into a sale agreement on December 26, 2014 to dispose of four exploration permits in the Yangshan area of the Longnan Project for RMB 3.2 million ($604,618). As at December 31, 2014, the process of transferring the titles to the four permits was pending approval by Gansu Province and the proceeds had not been received.

Changkeng Gold Project - The Company did not conduct any exploration activities in the past three years for the Changkeng Gold Project except for maintaining the exploration permit. The renewed Changkeng Exploration Permit expires on September 10, 2015.

Gold Bull Mountain Project – Minco China also entered into a sale agreement on June 28, 2014 to dispose of its interest in Yuanling Minco Mining Co. Ltd. (“Yuanling Minco”) for RMB 7 million ($1.2 million). Yuanling Minco’s wholly owned subsidiary, Huaihua Tiancheng Mining Ltd. ("Huaihua Tiancheng"), owns the Gold Bull Mountain exploration permit. As at December 31, 2014, the Company issued a notice of termination, as the buyer failed to make the remaining payments within the specified period, resulting in a breach in the sale agreement. The deposit of RMB 2,100,000 ($376,937) received by the Company will be non-refundable in accordance with the sale agreement. During the year ended December 31, 2014, the Company recorded a gain from sale of exploration permit of RMB 2,100,000 ($376,937).

Equity Investment in Minco Silver - as at December 31, 2014, the Company owned a 18.45% equity interest in Minco Silver, a publicly traded company listed on the TSX under the symbol “MSV”, which indirectly holds the title to the Fuwan Silver Project in Guangdong Province, China. In the fourth quarter of 2014, the Company determined that due to a significant decline in the market value of Minco Silver’s common shares, the recoverable amount of its investment was less than its carrying amount. As a result, the Company recognized an impairment loss of $4,205,816, which represents the difference between the carrying value of the investment and its recoverable amount, which was based on the quoted market price of Minco Silver’s shares at December 31, 2014.

In this Annual Report, the discussion respecting the Fuwan Silver Project held by Minco Silver is based on Minco Silver's public disclosure record available on SEDAR at www.sedar.com.

Chinese Mining Regulations

Government Regulations of Mineral Resources and Ownership

Exploration for and exploitation of mineral resources in China are governed by the Mineral Resources Law of China of 1986, amended effective January 1, 1997, and the Implementation Rules for the Mineral Resources Law of China, effective March 26, 1994. In order to further implement these laws, on February 12, 1998, the State Council issued three sets of regulations: (i) Regulation for Registering to Explore Mineral Resources Using the Block System, (ii) Regulation for Registering to Mine Mineral Resources, and (iii) Regulation for Transferring Exploration and Mining Rights (together with the mineral resources law and implementation rules, referred to herein as the "Mineral Resources Law"). Under the Mineral Resources Law, Ministry of Land and Resources (“MOLAR”) is charged with supervision nationwide of mineral resources prospecting and development.

The Mineral Resources Law provides for equal legal status for domestic enterprises and enterprises with foreign investment, security and transferability of mineral titles as well as the exclusivity of mining rights. The right to explore and exploit minerals is granted by way of exploration and mining rights. The holder of an exploration right has the privileged priority to obtain the mining right to the mineral resources in the exploration area, provided the holder meets the conditions and requirements specified in the law.

Foreign Investment

Direct foreign investment in China usually takes the form of equity joint ventures ("EJVs"), cooperative joint ventures ("CJVs") and WFOEs. These investment vehicles are collectively referred to as foreign investment enterprises ("FIEs"). An EJV is a Chinese legal person and consists of at least one foreign party and at least one Chinese party. An EJV generally takes the form of a limited liability company. It is required to have registered capital, to which each party to the EJV subscribes. Each party to the EJV is liable to the EJV up to the amount of the registered capital subscribed by it.

Mineral Resources Permits

The Provisions in Guiding Foreign Investment and the Industrial Catalogue in Guiding Foreign Investment, which was updated on April 1, 2002, January 1, 2005, October 31, 2007 and December 2011 (the "Investment Guiding Regulations"), govern foreign investment in China and categorize industries into three types where foreign investment is: (i) encouraged, (ii) restricted, or (iii) prohibited. Industries not listed in any of the three categories are deemed permitted.

In mining industries, "encouraged" projects include the exploration and mining of coal (and its derived resources), iron, manganese, copper and zinc minerals, etc. "Restricted" projects include the exploration and mining of the minerals of tin, antimony and other noble metals including gold and silver, etc. "Prohibited" projects include the exploration and mining of radioactive minerals and rare earth. Foreign investment is "permitted" if the exploration and mining of the minerals is not included in one of these three categories. Subject to the Investment Guiding Regulations, foreign investment in the exploration and mining of minerals is generally encouraged, in particular in relation to minerals in the western region of China.

Until January 2000, the production, purchasing, distributing, manufacturing, using, recycling, import and export of silver was strictly regulated by the Regulations of the People's Republic of China on the Control of Gold and Silver. Since then, China's silver market has been fully opened and silver is now treated as a commodity not subject to any special control or restrictive regulation by the state. However, foreign investment in the exploration and mining of silver remains restricted. China has adopted, under the Mineral Resources Law, a licensing system for the exploration and exploitation of mineral resources. MOLAR and its authorized provincial or local departments are responsible for approving applications for exploration permits and mining permits. The approval of MOLAR is also required to transfer those rights.

Applicants must meet certain conditions for qualification set by the state. Pursuant to the Mineral Resources Law, the applicant for a mining right must present stated documents, including a plan for development and use of the mineral resources and an evaluation report of the environmental impact thereof. The Mineral Resources Law allows individuals to excavate sporadic resources, sand, rocks and clay for use as materials for construction and a small quantity of mineral resources for sustenance. However, individuals are prohibited from mining mineral resources that are more appropriate to be mined in scale by an enterprise, the specified minerals that are subject to protective mining by the state and certain other designated mineral resources, as may be determined by MOLAR. Once granted, all exploration and mining rights are protected by the state from encroachment or disruption under the Mineral Resources Law. It is a criminal offence to steal, seize or damage exploration facilities, or disrupt the working order of exploration areas.

Exploration Rights

Exploration permits are registered and issued to "licensees". The period of validity of an exploration permit can have a maximum term of three years. The exploration permit is described by a "basic block". An exploration permit for metallic and non-metallic minerals has a maximum of 40 basic blocks.

When a mineral that is capable of economic development is discovered, the licensee may apply for the right to develop such mineral. The period of validity of an exploration permit can be extended by application and each extension can be no more than two years in duration. During the term of an exploration permit, the licensee has the privileged priority to obtain the mining right to the mineral resources in the exploration area covered by the exploration permit, provided it meets the conditions of qualification for mining rights holders. Further, the licensee has the rights to, among other things: (i) explore without interference within the area under permit during the permit term, (ii) construct exploration facilities, and (iii) pass through other exploration areas and adjacent ground to access the permitted area. After the licensee acquires an exploration permit, the licensee is obliged to, among other things: (i) start exploration within the prescribed term, (ii) explore according to a prescribed exploration work scheme, (iii) comply with state laws and regulations regarding labor safety, water and soil conservation, land reclamation and environmental protection, (iv) make detailed reports to local and other licensing authorities, (v) close and occlude the wells arising from prospect work, (vi) take other measures to protect against safety concerns after the prospect work is completed, and (vii) complete minimum exploration expenditures as required by the Regulations for Registering to Explore or Mineral Resources Using the Block System.

Transferring Exploration and Mining Rights

A mining enterprise may transfer its exploration or mining rights to others, subject to the approval of MOLAR or its authorized departments at the provincial or local level, as the case may be. An exploration permit may only be transferred if the transferor has: (i) held the exploration permit for two years as of the issue date, or discovered minerals in the exploration block, which are able to be explored or mined further, (ii) a valid and subsisting exploration permit, (iii) completed the stipulated minimum exploration expenditure, (iv) paid the user fees and the price for prospect rights pursuant to the relevant regulations, and (v) obtained the necessary approval from the authorized department in charge of the minerals. Mining rights may only be transferred if the transferor needs to change the ownership of such mining rights because it is: (i) engaging in a merger or split, (ii) entering into equity or cooperative joint ventures with others, (iii) selling its enterprise assets, or (iv) engaging in a similar transaction that will lead to the alteration of the property ownership of the enterprise. A mining permit may only be transferred if the transferor has: (i) commenced production for no less than one year, (ii) a valid and subsisting mining permit without title dispute, and (iii) paid the user fees, the price for the mining right, any applicable resource tax and any mineral resource compensation required pursuant to applicable laws.

The laws and policies for environmental protection in China have moved towards stricter compliance and stronger enforcement. The basic laws in China governing environmental protection in the mineral industry sector of the economy are the Environmental Protection Law, the Environment Impact Assessment Law and the Mineral Resources Law. The State Administration of Environmental Protection and its provincial counterparts are responsible for the supervision of implementation and enforcement of environmental protection laws and regulations. Provincial governments also have the power to issue implementing rules and policies in relation to environmental protection in their respective jurisdictions. Applicants for mining rights must submit environmental impact assessments and those projects that fail to meet environmental protection standards will not be granted licenses.

In addition, after exploration the licensee must perform water and soil maintenance and take steps towards environmental protection. After the mining rights have expired or the concessionaire stops mining during the permit period and the mineral resources have not been fully developed, the concessionaire shall perform water and soil maintenance, land recovery and environmental protection in compliance with the original development scheme, or must pay the costs of land recovery and environmental protection. After closing, the mining enterprises shall perform water and soil maintenance, land recovery and environmental protection in compliance with mine closure approval reports, or must pay the costs of land recovery and environmental protection.

|

C.

|

ORGANIZATIONAL STRUCTURE

|

The following chart sets forth the Company's corporate structure, including its significant subsidiaries, related parties and their jurisdictions of incorporation along with the various mineral properties held by each of them, as at the date of this Annual Report:

The Company has wholly-owned and less than wholly-owned subsidiaries as follows: Wholly-owned subsidiaries - Minco China, Yuanling Minco, Huaihua Tiancheng, and Minco Resource Limited ("Minco Resources"). The Company, through Minco China, established Tibet Minco Mining Co Ltd (“Tibet Minco”) on January 29, 2013 for the purpose of potential future transactions.

Less than wholly-owned subsidiaries – the Company through Minco China and Tibet Minco owns 51% of a company formed and known as "Guangzhou Mingzhong Mining Co., Ltd." - the holding company for the Changkeng Gold Property and the Changkeng Exploration Permit.

During 2013, Minco Gold transferred its interest in Minco China to Minco Resources, a 100% subsidiary of Minco Gold, that resulted in Minco China becoming a wholly-owned subsidiary of Minco Resources.

Minco Silver, incorporated on August 20, 2004, is a related party to the Company through common management. This company was incorporated to acquire and develop silver projects in China and is currently involved with the development of the Fuwan Silver Project in Guangdong Province, China.

The Company assigned its 51% interest in the Silver Mineralization to Minco Silver. The remaining 49% interest in the silver mineralization on the Changkeng Property remains with the other minority shareholders of Mingzhong.

Foshan Minco Fuwan Mining Co. Ltd. ("Foshan Minco"), a subsidiary of Minco China and the Company, is beneficially owned by Minco Investment Holdings HK Limited (“Minco HK”), a subsidiary of Minco Silver pursuant to a confirmation agreement between Minco Silver, Minco Gold and Minco China dated August 24, 2006 (the "Confirmation Agreement") and subsequent assignments and transfers to Minco HK. Foshan Minco is subject to a 10% beneficial interest held by Guangdong Geological Bureau, a Chinese government owned entity. Pursuant to the agreements between Minco Gold and its subsidiaries and Minco Silver and its subsidiary, Minco Gold and Minco China agreed to hold all licenses, permits and other assets held by Minco China in respect of the Fuwan Project and all licenses, permits and other assets acquired subsequent to the date of the Confirmation Agreement in trust for Foshan Minco. Foshan Minco is consolidated into Minco Silver for accounting purposes.

The legal structure described above reflects restrictions under Chinese law for foreign companies to invest in registered Chinese entities. Funding from Minco Silver to Foshan Minco must pass through Minco China. Minco China is a WFOE for the purposes of Chinese law and is the parent company of Foshan Minco under Chinese law. This transaction flow will be necessary until such time as Foshan Minco becomes Minco Silver's legal subsidiary in China when Minco Silver incorporates a WFOE to allow it to pass funds directly to Foshan Minco. As Foshan Minco is consolidated into Minco Silver for accounting purposes, loans or funds advanced from Minco Silver to Minco Gold or Minco China are discharged when such funds are advanced from Minco China to Foshan Minco as, at such time, the funds move back into the Minco Silver consolidated group. Minco Gold and Minco China are used by Minco Silver as conduits to transfer funds to Foshan Minco; however, they have no ongoing obligation with respect to funds advanced through to Foshan Minco and are not subject to repayment obligations in respect of such funds.

|

D.

|

DESCRIPTION OF PROPERTIES

|

The following consists of a discussion of the properties that Minco Gold holds through its subsidiaries and its investment in Minco Silver, which owns the Fuwan Silver Project.

|

I.

|

CHANGKENG GOLD PROJECT

|

The following is a brief description of the Company's Changkeng Gold Project. Technical Information respecting the Changkeng Gold Project is primarily derived from the NI 43-101 technical report entitled "Technical Report and Updated Resource Estimate on the Changkeng Gold Project Guangdong Province, China", dated effective February 21, 2009 and prepared by Tracy Armstrong, P. Geo Ontario, Eugene Puritch, P. Eng. Ontario and Antoine Yassa, P.Geo. Québec, all of P&E Mining Consultants Inc. of Brampton, Ontario ("P&E"), and all qualified persons for the purposes of NI 43-101. This technical report includes relevant information regarding the data, data validation and the assumptions, parameters and methods of the mineral resource estimates on the Changkeng Project.

LOCATION

The Changkeng gold deposit is located approximately 45 km southwest of Guangzhou, the fourth largest city in China with 13 million people and the capital city of Guangdong Province. The project is adjacent to Minco Silver's Fuwan Silver Deposit and situated close to well established water, power, and transportation infrastructure.

OWNERSHIP

The Company signed a 30-year joint venture contract with four Chinese companies for the exploration and development of the Changkeng Gold Project in late 2004. A business license was granted on March 30, 2007 to Mingzhong, a joint venture company established for pursuing the Changkeng Gold Project and a subsidiary of the Company.

Mingzhong, a cooperative joint-venture established among Minco China, Guangdong Geological Bureau, Guangdong Gold Corporation and two private Chinese companies to jointly explore and develop the Changkeng Property, signed a purchase agreement in January 2008 to acquire a 100% interest in the Changkeng Exploration Permit on the Changkeng Project from 757 Exploration Team.

The transfer of the Changkeng Exploration Permit from 757 Exploration Team to Mingzhong was approved by MOLAR in 2009. This exploration permit was renewed for a two-year period ending on September 10, 2015. The purchase price of the Changkeng Exploration Permit was set at RMB 48 million (approximately $7.6 million). As of December 31, 2008, the Company paid the first payment of RMB 19 million (approximately $3.22 million) for the Changkeng Exploration Permit to 757 Exploration Team. The remaining balance of RMB 29 million ($4.92 million) was settled in May 2013.

Pursuant to the terms of an agreement with Minco Silver, the Company has assigned its right to earn a 51% interest in the Changkeng Silver Mineralization to Minco Silver. As a result, Minco Silver is responsible for 51% of the total costs in relation to the Changkeng Silver Mineralization.

EXPLORATION ACTIVITIES

The Company has not conducted any exploration activities on the Changkeng gold project in the past three years, except for maintaining the exploration permits in respect of the project.